In this age of technology, when screens dominate our lives but the value of tangible printed items hasn't gone away. If it's to aid in education for creative projects, simply adding some personal flair to your space, Tax Rebate For Salaried Person are now an essential source. In this article, we'll take a dive in the world of "Tax Rebate For Salaried Person," exploring their purpose, where to locate them, and how they can enhance various aspects of your daily life.

Get Latest Tax Rebate For Salaried Person Below

Tax Rebate For Salaried Person

Tax Rebate For Salaried Person - Tax Rebate For Salary Person, Tax Deduction For Salaried Person, Tax Return For Salaried Person, Tax Benefit For Salaried Person 2022-23, Tax Benefit For Salaried Person Budget 2023, Tax Deduction For Salaried Employees In India, Tax Credit For Salaried Employees, Tax Exemption For Salaried Employees In Budget 2023, Fbr Tax Return For Salaried Person, Tax Rebate For Salaried Employees

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Web 7 avr 2021 nbsp 0183 32 L employeur doit appliquer le pr 233 l 232 vement 224 la source PAS sur les revenus des salari 233 s Il doit respecter les taux transmis par les services des imp 244 ts au moyen

The Tax Rebate For Salaried Person are a huge range of downloadable, printable materials online, at no cost. They are available in numerous types, like worksheets, coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Rebate For Salaried Person

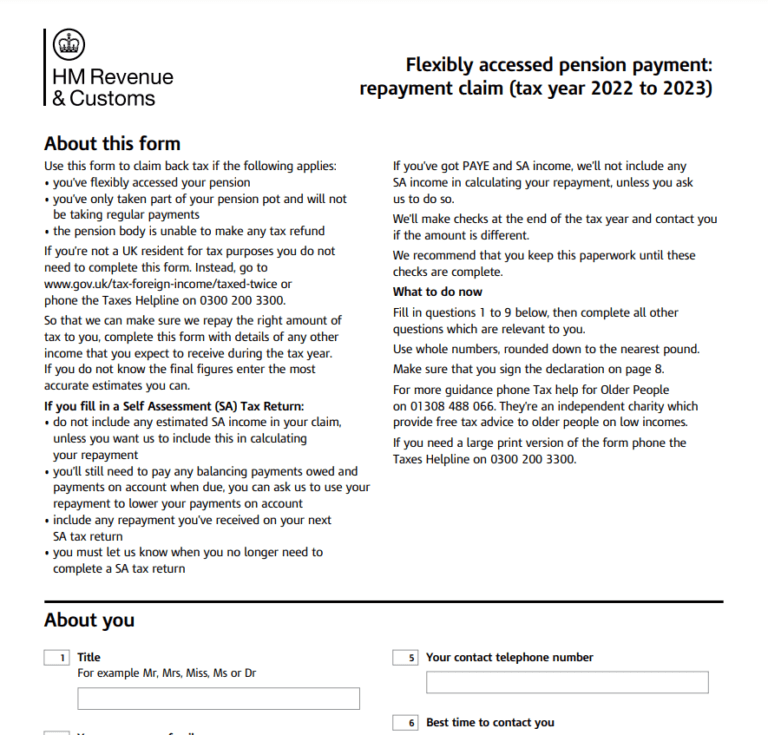

P55 Tax Rebate Form Business Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

Web 8 juin 2023 nbsp 0183 32 Vous avez des frais professionnels d 233 penses de transport du domicile au lieu de travail de v 234 tements sp 233 cifiques 224 l emploi exerc 233 etc et vous souhaitez les

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Tax Rebate For Salaried Person have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printables to fit your particular needs such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free provide for students of all ages, making them a useful tool for teachers and parents.

-

Accessibility: You have instant access many designs and templates helps save time and effort.

Where to Find more Tax Rebate For Salaried Person

Best Tax Saving Guide Complete Tax Planning For Salaried Persons

Best Tax Saving Guide Complete Tax Planning For Salaried Persons

Web 21 f 233 vr 2023 nbsp 0183 32 Employees incur expenses on books newspapers periodicals journals and so on The income tax law allows an employee to claim a tax free reimbursement of

Web 8 juin 2023 nbsp 0183 32 Le bar 232 me sert 224 calculer le montant de l imp 244 t Pour d 233 terminer le montant 224 payer il faut appliquer un taux 224 chaque tranche de revenu

After we've peaked your interest in printables for free We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in Tax Rebate For Salaried Person for different needs.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast variety of topics, that range from DIY projects to party planning.

Maximizing Tax Rebate For Salaried Person

Here are some fresh ways for you to get the best of Tax Rebate For Salaried Person:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Rebate For Salaried Person are a treasure trove of fun and practical tools that cater to various needs and desires. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the plethora that is Tax Rebate For Salaried Person today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate For Salaried Person truly free?

- Yes they are! You can download and print these materials for free.

-

Does it allow me to use free printables in commercial projects?

- It is contingent on the specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Tax Rebate For Salaried Person?

- Certain printables could be restricted in use. Make sure you read the terms and regulations provided by the designer.

-

How can I print Tax Rebate For Salaried Person?

- Print them at home with printing equipment or visit the local print shop for high-quality prints.

-

What program must I use to open printables free of charge?

- A majority of printed materials are in PDF format. These can be opened using free software such as Adobe Reader.

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

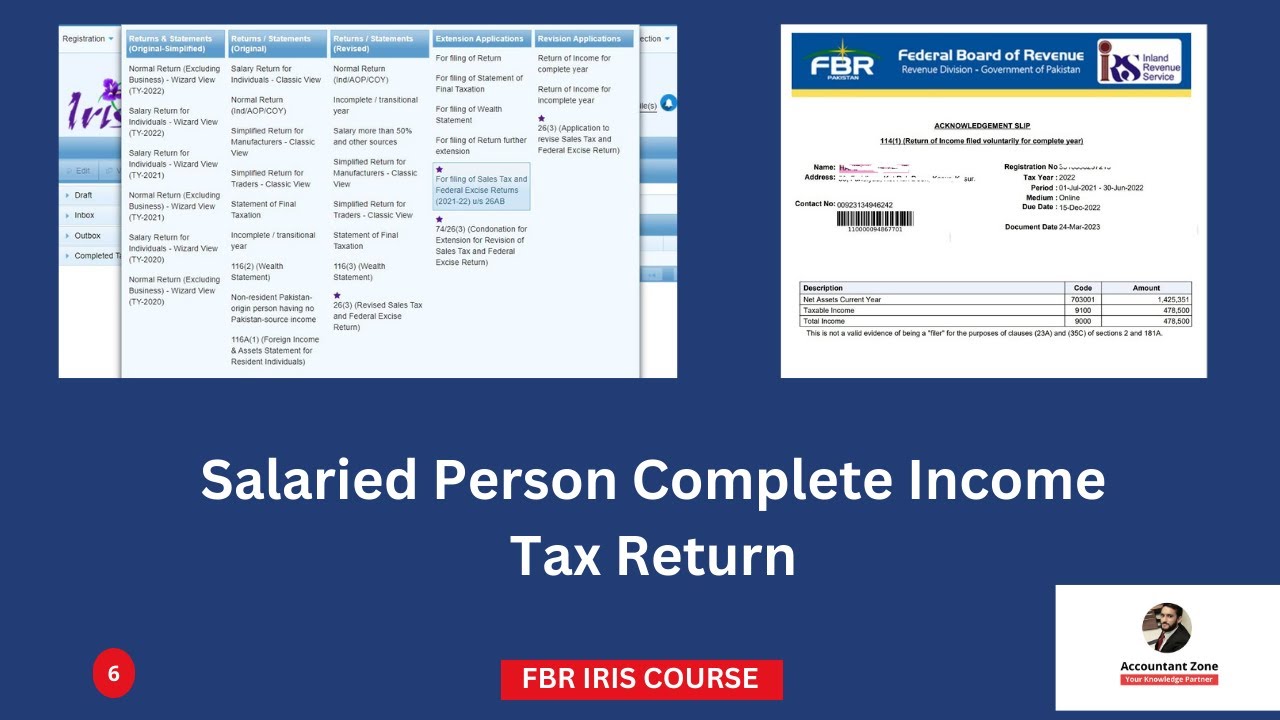

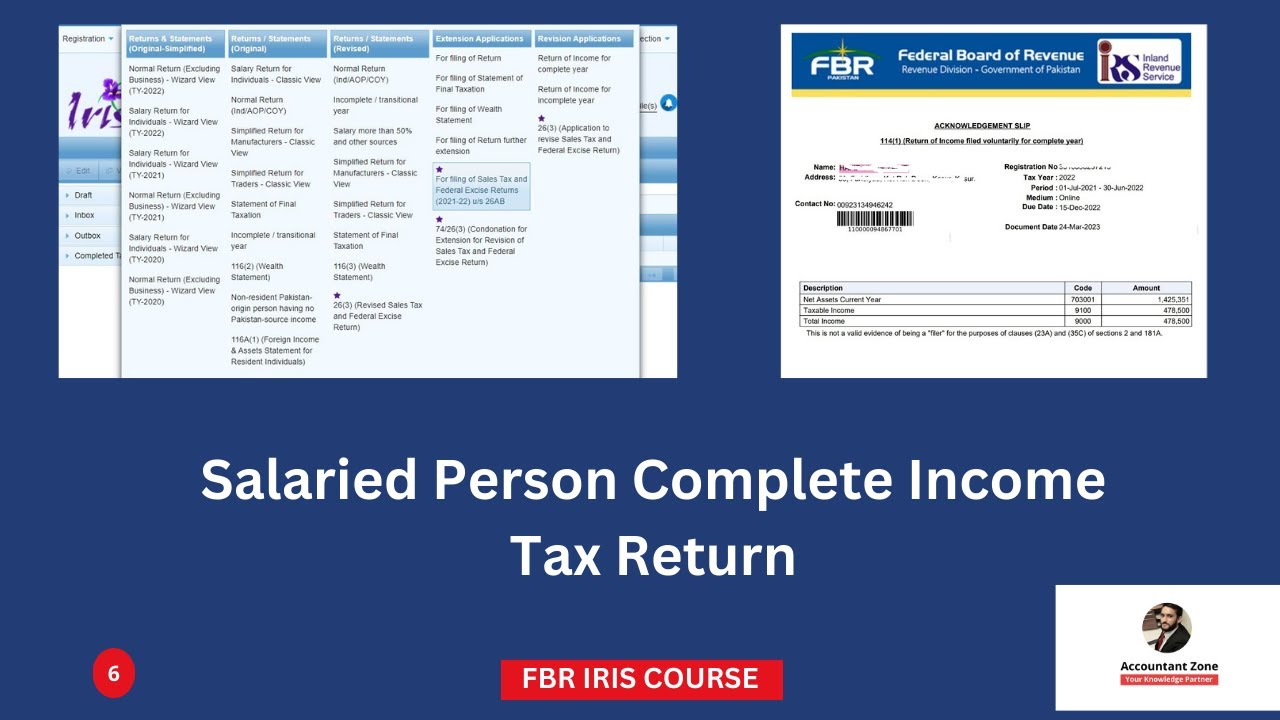

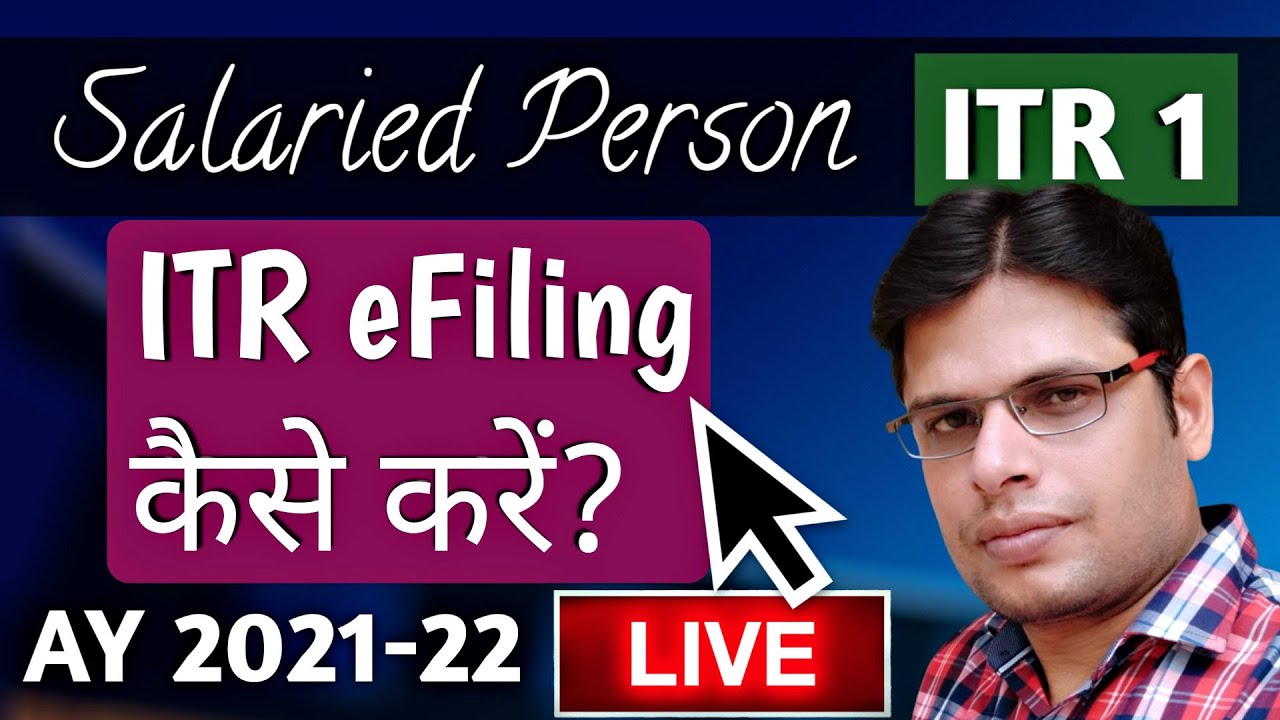

E Filing Of Income Tax Return For Salaried Persons YouTube

Check more sample of Tax Rebate For Salaried Person below

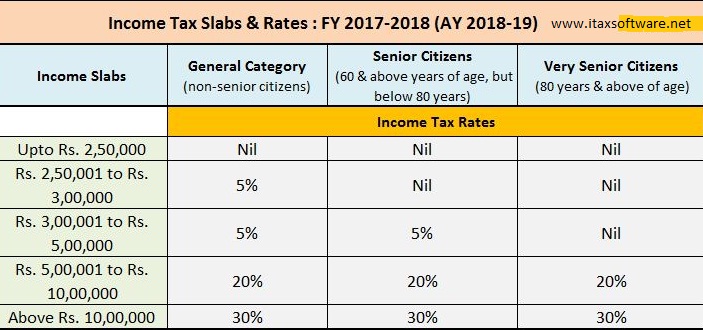

New Slabs Of Tax For Salaried Person Income Tax On Salary Tax On

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Download Automated All In One TDS On Salary For West Bengal Govt

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

How To File ITR 1 For AY 2021 22 Explained In Hindi Salaried Person

Standard Deduction For Salaried Employees Transport Medical Reimbursem

https://www.service-public.fr/particuliers/vosdroits/F34732

Web 7 avr 2021 nbsp 0183 32 L employeur doit appliquer le pr 233 l 232 vement 224 la source PAS sur les revenus des salari 233 s Il doit respecter les taux transmis par les services des imp 244 ts au moyen

https://entreprendre.service-public.fr/vosdroits/F22576

Web La taxe sur les salaires est due par les employeurs qui emploient des salari 233 s et qui ne sont pas soumis 224 la TVA Ils doivent 233 galement 234 tre 233 tablis en m 233 tropole ou dans un

Web 7 avr 2021 nbsp 0183 32 L employeur doit appliquer le pr 233 l 232 vement 224 la source PAS sur les revenus des salari 233 s Il doit respecter les taux transmis par les services des imp 244 ts au moyen

Web La taxe sur les salaires est due par les employeurs qui emploient des salari 233 s et qui ne sont pas soumis 224 la TVA Ils doivent 233 galement 234 tre 233 tablis en m 233 tropole ou dans un

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

How To File ITR 1 For AY 2021 22 Explained In Hindi Salaried Person

Standard Deduction For Salaried Employees Transport Medical Reimbursem

List Of Benefits Available To Salaried Persons AY 2023 24 S N

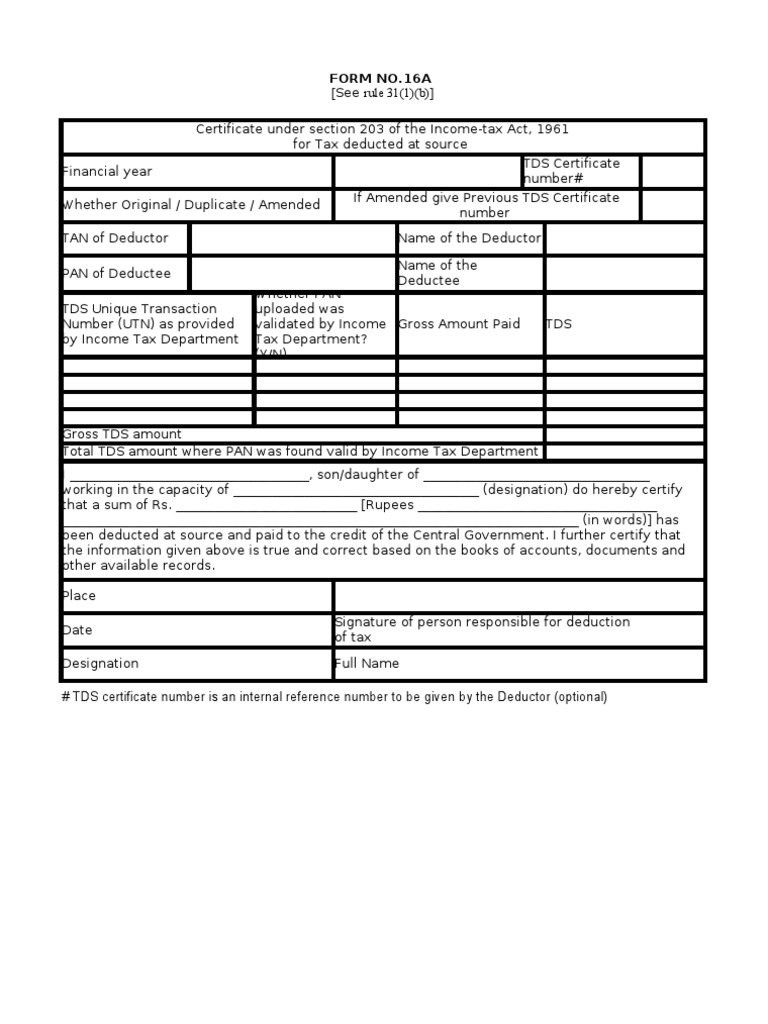

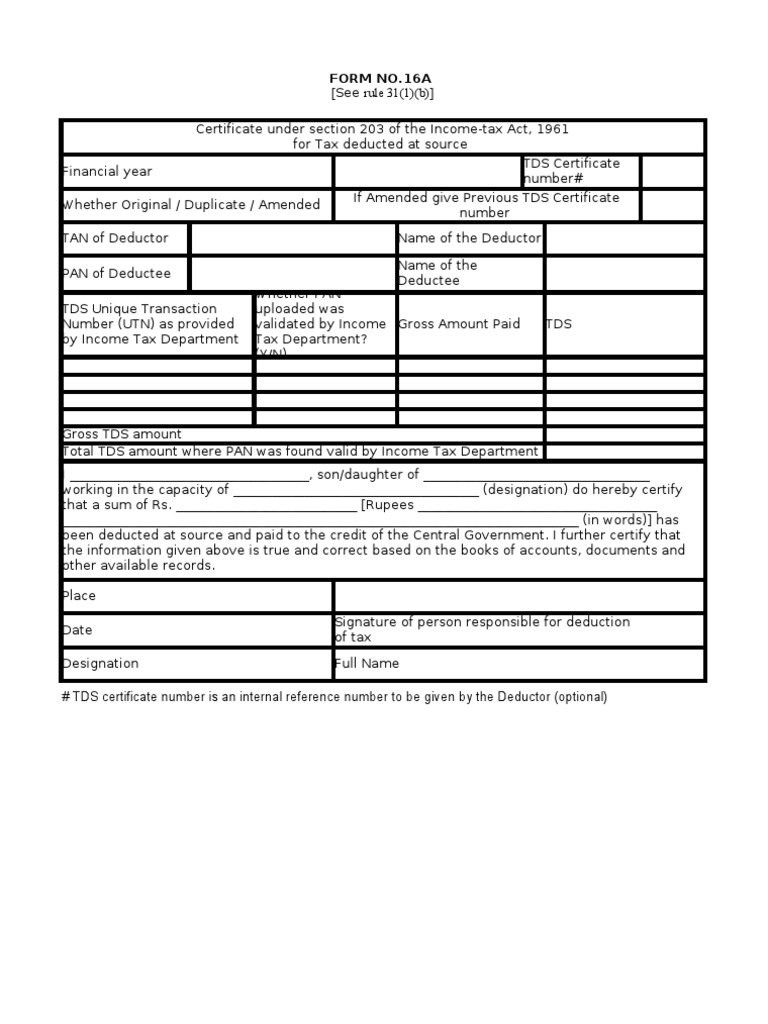

Form 16 For Salaried Person Tax Refund Income Tax In India

Form 16 For Salaried Person Tax Refund Income Tax In India

Tax Rate Card 2022 23 Icmap 2022 Tax Rates For Salaried Persons