In a world where screens rule our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or simply adding the personal touch to your home, printables for free are a great source. The following article is a dive into the world "Tax Rebate In New Tax Regime," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your life.

Get Latest Tax Rebate In New Tax Regime Below

Tax Rebate In New Tax Regime

Tax Rebate In New Tax Regime -

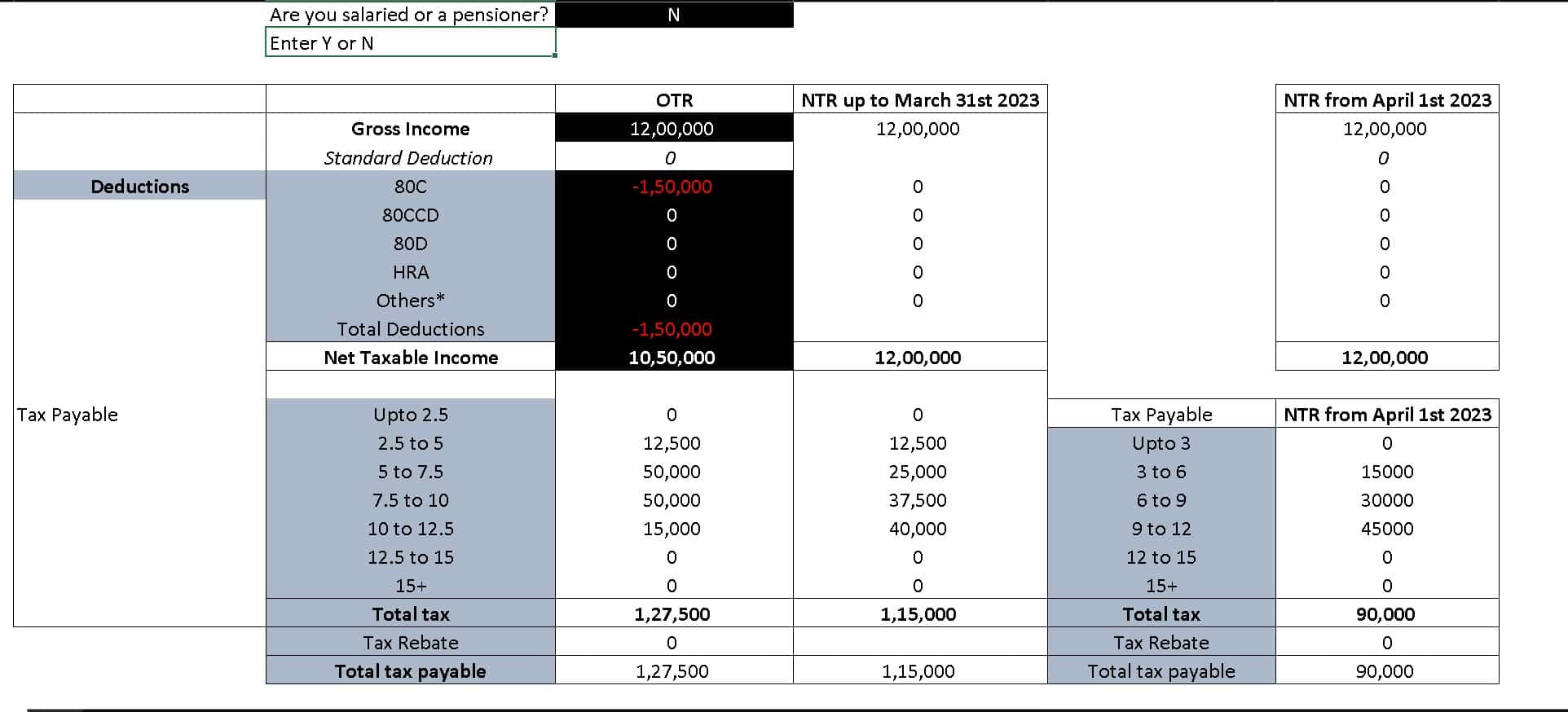

Everything about New regime for AY 2024 25 is answered Slide 1 TAX slabs for New vs Old for AY 2024 25 Slide 2 87A rebate for New regime Slide 3 New regime List of Deductions not allowed as compare to Old Slide 4 NEW vs Old colmparison for diff income level

In the new tax regime the rebate is increased to Rs 25 000 or 100 percent of income tax where the total income does not exceed Rs 7 00 000 While filing ITR for FY 2023 24 AY 2024 25 I want to opt for the old tax regime instead of the default new tax regime should I file Form 10 IEA before filing his income tax return ITR

Printables for free include a vast selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and many more. The attraction of printables that are free is their versatility and accessibility.

More of Tax Rebate In New Tax Regime

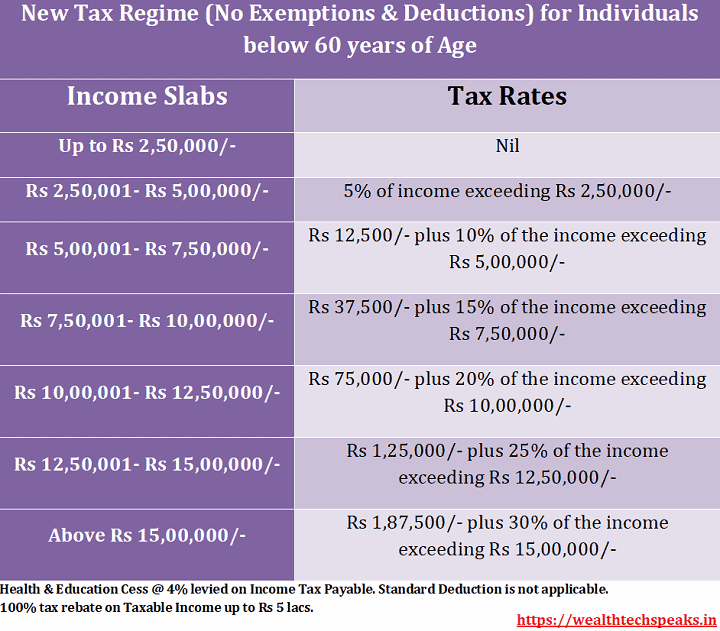

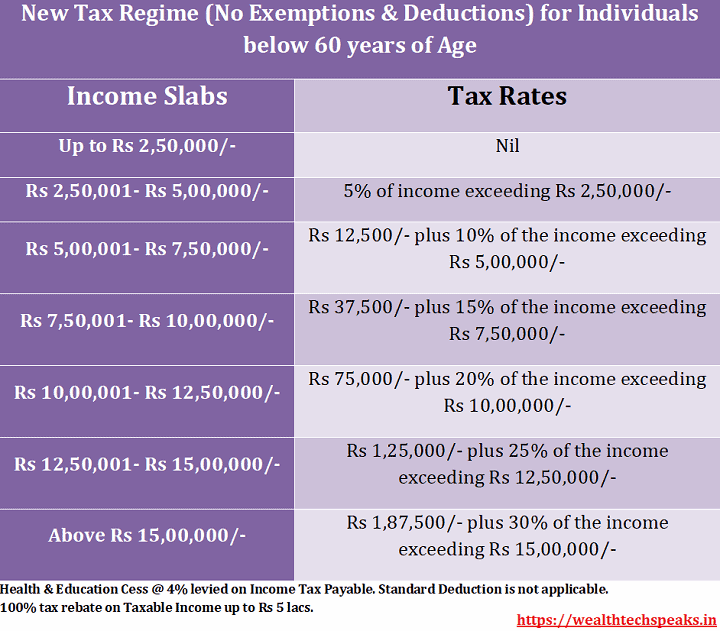

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Section 115BAC of the Income Tax Act introduced in the Union Budget 2020 offers a new tax regime with lower tax rates and reduced deductions Individuals and Hindu Undivided Families

Tax Rebate In New Tax Regime have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: This allows you to modify the design to meet your needs, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free cater to learners from all ages, making them a vital aid for parents as well as educators.

-

The convenience of instant access a plethora of designs and templates reduces time and effort.

Where to Find more Tax Rebate In New Tax Regime

Choosing The New Tax Regime You Can t Claim Tax Rebate For THESE 7

Choosing The New Tax Regime You Can t Claim Tax Rebate For THESE 7

What are the rebates in the new tax regime in 2024 Under the new tax regime if your taxable income is upto Rs 7 lakh you are eligible for a tax rebate and do not have to pay any tax The maximum tax rebate under

The Section 87A rebate has been increased under the new tax regime for taxable incomes up to Rs 7 lakh Individuals with taxable income of less than Rs 7 lakh will not have to pay any taxes if they choose the new tax regime in FY 2023 24 Any changes were made in the old tax regime for FY 2023 24

If we've already piqued your curiosity about Tax Rebate In New Tax Regime Let's see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of motives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Rebate In New Tax Regime

Here are some new ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to enhance your learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Rebate In New Tax Regime are an abundance with useful and creative ideas that meet a variety of needs and preferences. Their accessibility and versatility make them a wonderful addition to the professional and personal lives of both. Explore the wide world of Tax Rebate In New Tax Regime today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these resources at no cost.

-

Can I make use of free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright violations with Tax Rebate In New Tax Regime?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and conditions set forth by the creator.

-

How do I print Tax Rebate In New Tax Regime?

- Print them at home using your printer or visit an in-store print shop to get better quality prints.

-

What program must I use to open Tax Rebate In New Tax Regime?

- The majority are printed with PDF formats, which can be opened with free programs like Adobe Reader.

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

Check more sample of Tax Rebate In New Tax Regime below

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Rebate In New Tax Regime No Income Tax Up To Rs 7 Lakh Sher E Punjab

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

How To Choose Between The New And Old Income Tax Regimes Chandan

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Changes In New Tax Regime All You Need To Know

https://www.incometax.gov.in/iec/foportal/help/new...

In the new tax regime the rebate is increased to Rs 25 000 or 100 percent of income tax where the total income does not exceed Rs 7 00 000 While filing ITR for FY 2023 24 AY 2024 25 I want to opt for the old tax regime instead of the default new tax regime should I file Form 10 IEA before filing his income tax return ITR

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

In the new tax regime the rebate is increased to Rs 25 000 or 100 percent of income tax where the total income does not exceed Rs 7 00 000 While filing ITR for FY 2023 24 AY 2024 25 I want to opt for the old tax regime instead of the default new tax regime should I file Form 10 IEA before filing his income tax return ITR

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

How To Choose Between The New And Old Income Tax Regimes Chandan

Rebate In New Tax Regime No Income Tax Up To Rs 7 Lakh Sher E Punjab

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Changes In New Tax Regime All You Need To Know

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Income Tax Slab For The A Y 2024 25

Income Tax Slab For The A Y 2024 25

Additional Benefit In New Tax Regime For Those With Net Taxable Income