In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply adding the personal touch to your home, printables for free are a great resource. In this article, we'll take a dive deep into the realm of "Tax Rebate On Joint Housing Loan," exploring the different types of printables, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Rebate On Joint Housing Loan Below

Tax Rebate On Joint Housing Loan

Tax Rebate On Joint Housing Loan - Tax Exemption On Joint Housing Loan, Joint Home Loan Tax Benefits, Who Can Claim Tax Benefit On Housing Loan, Income Tax Rebate On Second Housing Loan Interest, How To Claim Joint Home Loan In Income Tax

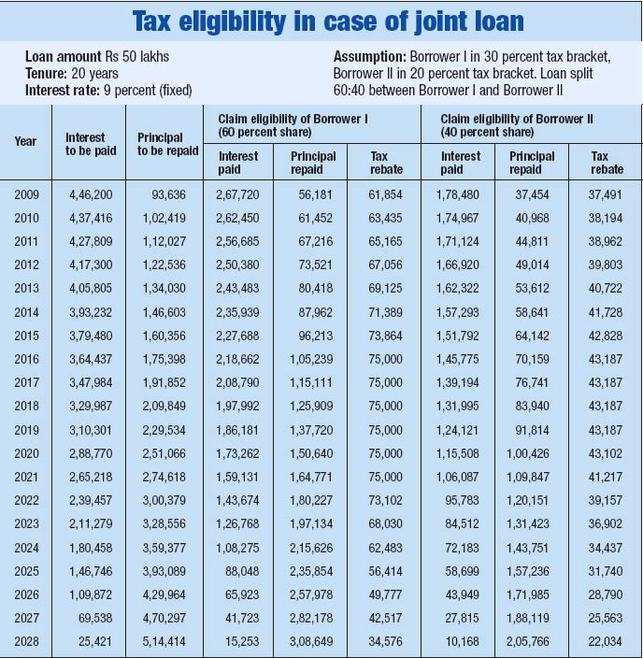

Web 31 mai 2022 nbsp 0183 32 Also borrowers with a joint loan who are also co owners of a property can claim tax rebates on housing credit Property must be fully constructed to claim tax deductions In case the house is not built it

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Printables for free include a vast collection of printable materials that are accessible online for free cost. They come in many designs, including worksheets templates, coloring pages and many more. The beauty of Tax Rebate On Joint Housing Loan lies in their versatility and accessibility.

More of Tax Rebate On Joint Housing Loan

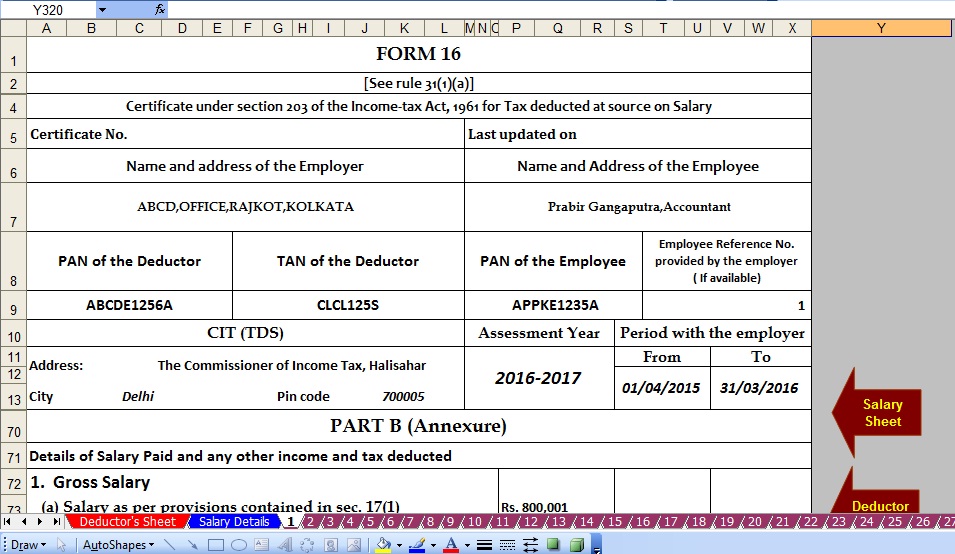

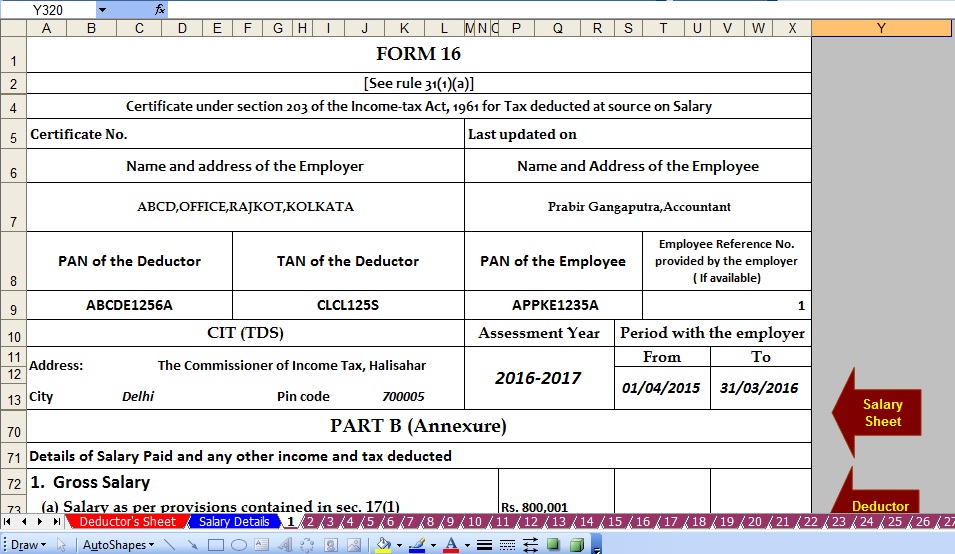

Housing Loans Joint Declaration Form For Housing Loan

Housing Loans Joint Declaration Form For Housing Loan

Web 10 juil 2020 nbsp 0183 32 Both you and your wife will qualify for a rebate on home loan interest rates as well as higher tax benefits with registration fees as lenders offer reduced interest rates to female borrowers If you want to

Web 16 oct 2012 nbsp 0183 32 A maximum of 4 to 6 joint applicants are eligible for tax rebate under this clause Thus availing a joint home loan is certainly a lucrative financial option to buy a

Tax Rebate On Joint Housing Loan have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements for invitations, whether that's creating them to organize your schedule or even decorating your house.

-

Educational Impact: These Tax Rebate On Joint Housing Loan cater to learners from all ages, making them a useful tool for teachers and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates reduces time and effort.

Where to Find more Tax Rebate On Joint Housing Loan

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Web if you have taken a home loan but continue to reside in a rented property you can claim tax benefits against HRA as well in the case of a joint home loan both borrowers can claim

Web 11 avr 2023 nbsp 0183 32 In the case of a joint home loan both co borrowers can claim a deduction of up to Rs 50 000 each provided they are both first time home buyers and the loan

We hope we've stimulated your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Tax Rebate On Joint Housing Loan designed for a variety objectives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide range of topics, from DIY projects to planning a party.

Maximizing Tax Rebate On Joint Housing Loan

Here are some inventive ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Rebate On Joint Housing Loan are a treasure trove with useful and creative ideas for a variety of needs and interests. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the endless world of Tax Rebate On Joint Housing Loan today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can print and download these materials for free.

-

Are there any free printables for commercial uses?

- It's all dependent on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to review the terms and conditions offered by the creator.

-

How can I print Tax Rebate On Joint Housing Loan?

- Print them at home with the printer, or go to the local print shop for top quality prints.

-

What software do I need to open printables that are free?

- The majority of printed documents are in PDF format. These is open with no cost software like Adobe Reader.

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Check more sample of Tax Rebate On Joint Housing Loan below

How To Calculate Tax Rebate On Home Loan Grizzbye

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Tax Benefit Calculator FrankiSoumya

FREE 8 Loan Receipt Templates Examples In MS Word PDF

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

FREE 8 Loan Receipt Templates Examples In MS Word PDF

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

GST HST New Housing Rebate Rebates House With Land Home Construction