Today, where screens rule our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education, creative projects, or simply to add some personal flair to your space, Tax Rebate On Plug In Hybrid can be an excellent resource. Here, we'll take a dive to the depths of "Tax Rebate On Plug In Hybrid," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Tax Rebate On Plug In Hybrid Below

Tax Rebate On Plug In Hybrid

Tax Rebate On Plug In Hybrid -

Web 5 mai 2023 nbsp 0183 32 The Inflation Reduction Act passed in August 2022 changed the eligibility criteria for plug in hybrid electric vehicles PHEVs to qualify for the clean vehicle tax credit As of August 16 th 2022 only PHEVs

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Tax Rebate On Plug In Hybrid cover a large array of printable materials available online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages, and more. The great thing about Tax Rebate On Plug In Hybrid is in their variety and accessibility.

More of Tax Rebate On Plug In Hybrid

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S

Web 18 avr 2023 nbsp 0183 32 The only exception is compact Plug In Hybrid Electric Vehicles PHEVs which would have the tax credit capped at 7 000 The IRS issued a safe harbor notice for 2023 that all EVs have an incremental cost of at least 7 500 except compact PHEVs which have an incremental cost of 7 000

Tax Rebate On Plug In Hybrid have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify printables to fit your particular needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational value: The free educational worksheets can be used by students from all ages, making the perfect device for teachers and parents.

-

The convenience of Access to an array of designs and templates, which saves time as well as effort.

Where to Find more Tax Rebate On Plug In Hybrid

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a

Since we've got your curiosity about Tax Rebate On Plug In Hybrid Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Tax Rebate On Plug In Hybrid suitable for many needs.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets as well as flashcards and other learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Tax Rebate On Plug In Hybrid

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Tax Rebate On Plug In Hybrid are a treasure trove of practical and innovative resources catering to different needs and preferences. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print these materials for free.

-

Can I use free printables for commercial use?

- It's all dependent on the usage guidelines. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright violations with Tax Rebate On Plug In Hybrid?

- Certain printables may be subject to restrictions concerning their use. Make sure to read these terms and conditions as set out by the author.

-

How can I print Tax Rebate On Plug In Hybrid?

- You can print them at home using your printer or visit an in-store print shop to get top quality prints.

-

What software do I require to view printables at no cost?

- The majority of printed documents are in PDF format, which is open with no cost software such as Adobe Reader.

Boulder Hybrids Bouldering Prius Repair

Table 1 From Characterizing Plug In Hybrid Electric Vehicle Consumers

Check more sample of Tax Rebate On Plug In Hybrid below

California Rebates For Hybrid Cars 2023 Carrebate

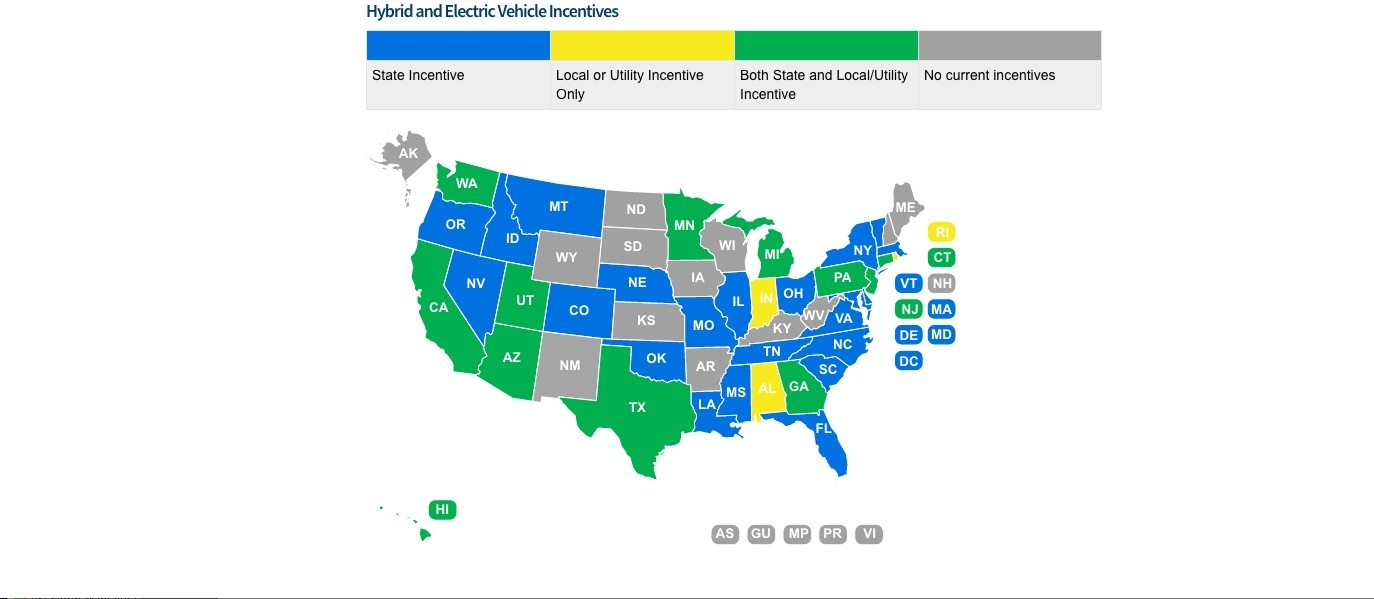

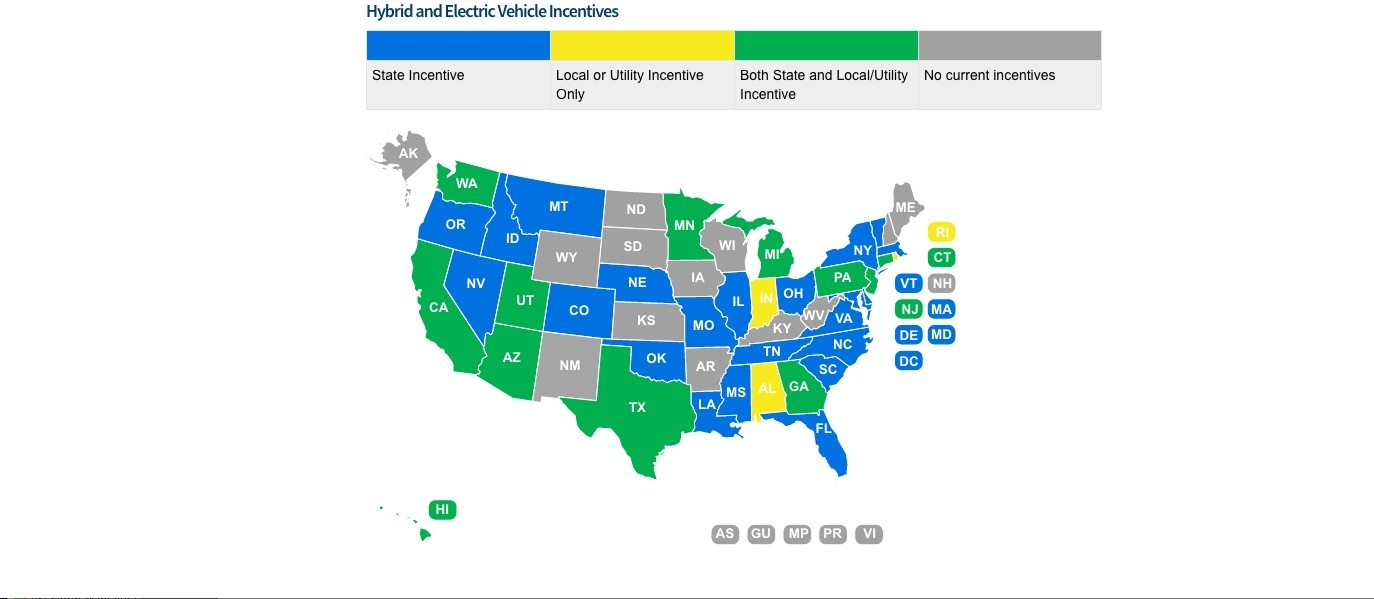

Electric Car Rebates By State ElectricRebate

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

The Florida Hybrid Car Rebate Save Money And Help The Environment

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

The Florida Hybrid Car Rebate Save Money And Help The Environment

Electric Car Rebates By State ElectricRebate

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Federal Rebate Hybrid Car 2023 Carrebate