In the digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. For educational purposes or creative projects, or simply adding some personal flair to your home, printables for free have proven to be a valuable resource. With this guide, you'll dive deep into the realm of "Tax Rebate On Two Home Loans," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Rebate On Two Home Loans Below

Tax Rebate On Two Home Loans

Tax Rebate On Two Home Loans - Tax Benefit On Two Home Loans, Tax Exemption On Two Home Loans, Tax Exemption On Second Home Loan, Tax Benefit On Second Home Loan Under Construction, Can I Get Tax Benefit On Two Home Loans, Can I Claim Tax Benefit On Two Home Loans, Can I Claim Tax Benefit On The Second House, Can I Get Tax Benefit On Second Home Loan, Is Second Home Mortgage Tax Deductible, Is Second Home Loan Tax Benefit

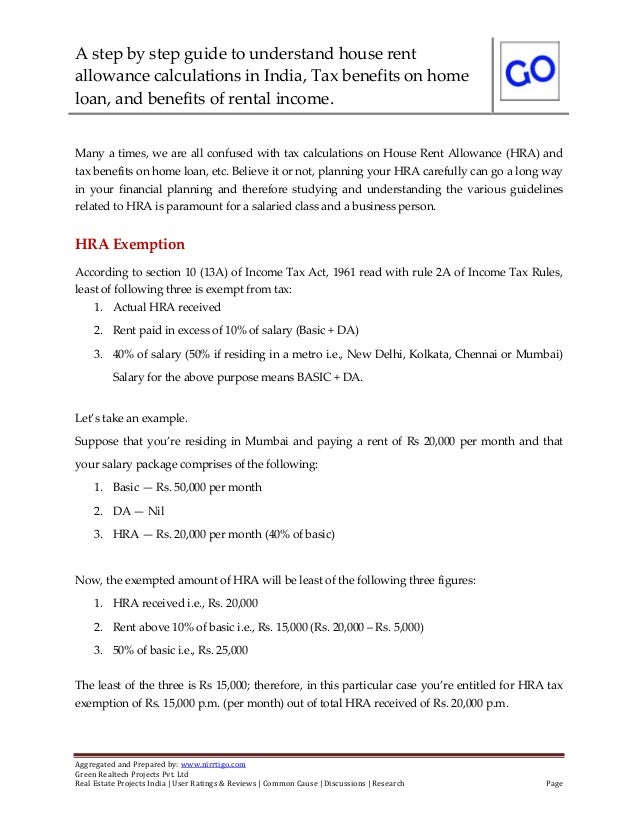

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan amount repayment you may claim tax benefit on stamp duty

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted

The Tax Rebate On Two Home Loans are a huge range of downloadable, printable resources available online for download at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and many more. The benefit of Tax Rebate On Two Home Loans lies in their versatility and accessibility.

More of Tax Rebate On Two Home Loans

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under either under Section 80EE or 80EEA For your second home no deduction is available on the principal payment

Web 24 d 233 c 2019 nbsp 0183 32 Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self occupied properties can be claimed under

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Impact: These Tax Rebate On Two Home Loans can be used by students of all ages, making them a great tool for parents and educators.

-

Easy to use: The instant accessibility to many designs and templates, which saves time as well as effort.

Where to Find more Tax Rebate On Two Home Loans

How To Get A Second Home Loan For Rental Income

How To Get A Second Home Loan For Rental Income

Web You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources of income Home Loan Eligibility Calculator Home First Finance Company Watch on Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks

Web 13 janv 2021 nbsp 0183 32 Under Section 24B of the Income Tax I T Act you can claim deduction for interest payable on a loan repair renovation or construction But if you own only one house which is self occupied the

After we've peaked your interest in Tax Rebate On Two Home Loans and other printables, let's discover where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Rebate On Two Home Loans designed for a variety goals.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Tax Rebate On Two Home Loans

Here are some unique ways to make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Tax Rebate On Two Home Loans are a treasure trove of fun and practical tools for a variety of needs and needs and. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the vast array of Tax Rebate On Two Home Loans right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use the free printing templates for commercial purposes?

- It's based on the rules of usage. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with Tax Rebate On Two Home Loans?

- Certain printables might have limitations in use. Be sure to read the terms and regulations provided by the designer.

-

How can I print Tax Rebate On Two Home Loans?

- Print them at home using any printer or head to an in-store print shop to get better quality prints.

-

What software is required to open printables free of charge?

- A majority of printed materials are in the format of PDF, which is open with no cost software, such as Adobe Reader.

DEDUCTION UNDER SECTION 80C TO 80U PDF

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Check more sample of Tax Rebate On Two Home Loans below

How To Calculate Tax Rebate On Home Loan Grizzbye

What Does Rebate Lost Mean On Student Loans

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Illinois Tax Rebate Tracker Rebate2022

What Are The Best Ways To Manage Tax Rebates

Realtors Seek Tax Rebate On House Loans

https://www.livemint.com/money/personal-fina…

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Illinois Tax Rebate Tracker Rebate2022

What Does Rebate Lost Mean On Student Loans

What Are The Best Ways To Manage Tax Rebates

Realtors Seek Tax Rebate On House Loans

How To Calculate Tax Rebate On Home Loan Grizzbye

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Microfinance Loan Application Form