In this age of technology, where screens dominate our lives and the appeal of physical printed materials hasn't faded away. Whether it's for educational purposes project ideas, artistic or simply adding an extra personal touch to your space, Tax Rebate Period are now a vital resource. For this piece, we'll take a dive through the vast world of "Tax Rebate Period," exploring what they are, where to get them, as well as what they can do to improve different aspects of your life.

Get Latest Tax Rebate Period Below

Tax Rebate Period

Tax Rebate Period -

Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three consecutive YAs

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs

Printables for free include a vast variety of printable, downloadable material that is available online at no cost. These printables come in different types, like worksheets, coloring pages, templates and many more. One of the advantages of Tax Rebate Period is their versatility and accessibility.

More of Tax Rebate Period

Period Panty Cashback Rebate RebateKey

Period Panty Cashback Rebate RebateKey

A deduction in five equal instalments starting from the year the property is acquired or construction is completed is allowed over and above the deduction you are

It will run until 14 September Here Which explains the kinds of tax can you get a refund on and how you can make a claim Get a firmer grip on your finances with

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor the templates to meet your individual needs such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Value These Tax Rebate Period can be used by students of all ages, making them an invaluable aid for parents as well as educators.

-

It's easy: The instant accessibility to various designs and templates saves time and effort.

Where to Find more Tax Rebate Period

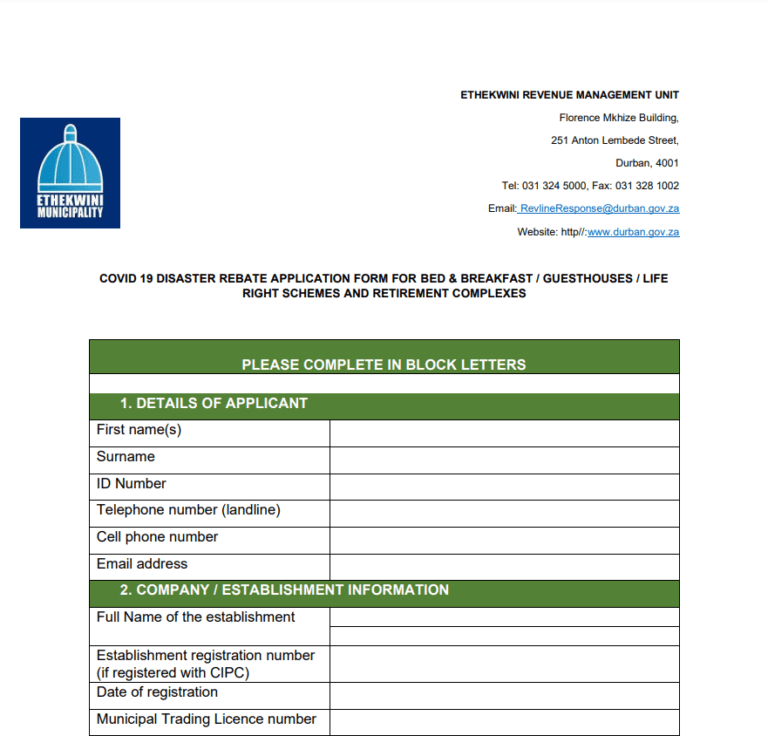

Ethekwini Rates Printable Rebate Form

Ethekwini Rates Printable Rebate Form

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money

RM35 000 S 6A 2 tax rebate for departure levy S 6A 2A and tax rebate for zakat or fitrah S 6A 3 IRBM s Feedback The phrase rebate may be granted is preferred as

Now that we've ignited your interest in Tax Rebate Period Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Tax Rebate Period designed for a variety purposes.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast selection of subjects, all the way from DIY projects to planning a party.

Maximizing Tax Rebate Period

Here are some unique ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to aid in learning at your home for the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Rebate Period are a treasure trove of useful and creative resources catering to different needs and preferences. Their accessibility and versatility make them an essential part of any professional or personal life. Explore the vast world of Tax Rebate Period and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print these materials for free.

-

Can I use free printables for commercial purposes?

- It's contingent upon the specific usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Tax Rebate Period?

- Some printables may come with restrictions on usage. Be sure to check the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to any local print store for more high-quality prints.

-

What software do I need to open printables at no cost?

- A majority of printed materials are with PDF formats, which can be opened using free software like Adobe Reader.

BBMP Property Tax 2023 Bangalore House Tax Calculator

HFM HF Markets Rebate Cashback 100 Up To 60 Of Pip Value

Check more sample of Tax Rebate Period below

My GM Partner Perks GM Parts

Section 87A Tax Rebate Under Section 87A Rebates Financial

Period Panty Cashback Rebate RebateKey

KSLSA To Hold Meeting Today To Consider Recommending Extension Of 50

Deferred Tax And Temporary Differences The Footnotes Analyst

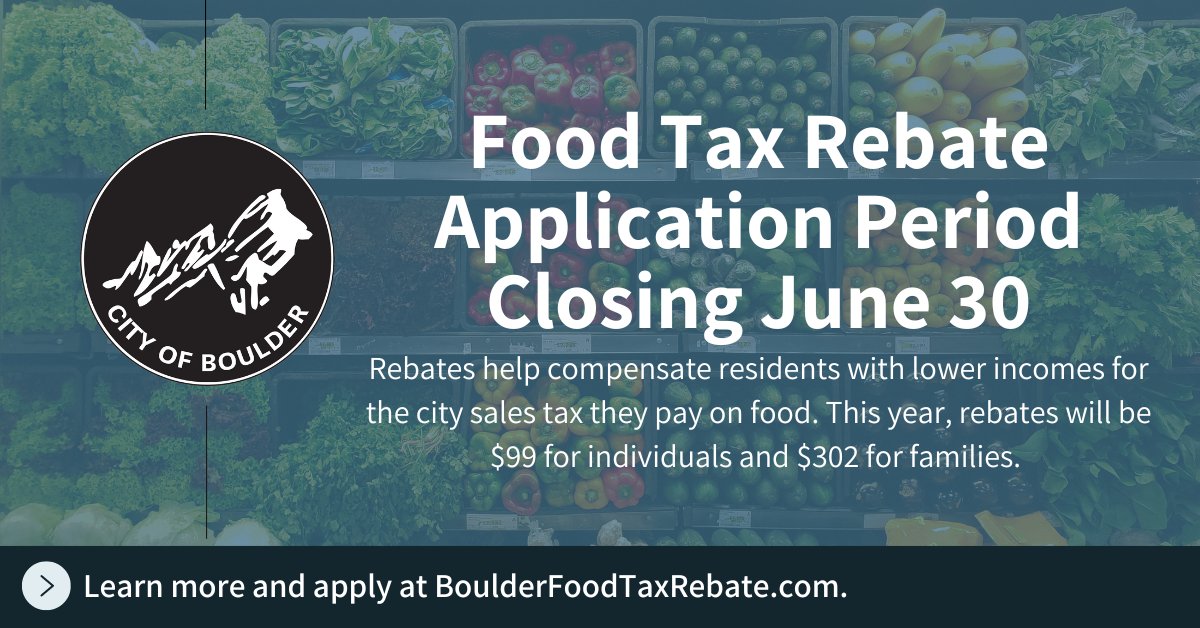

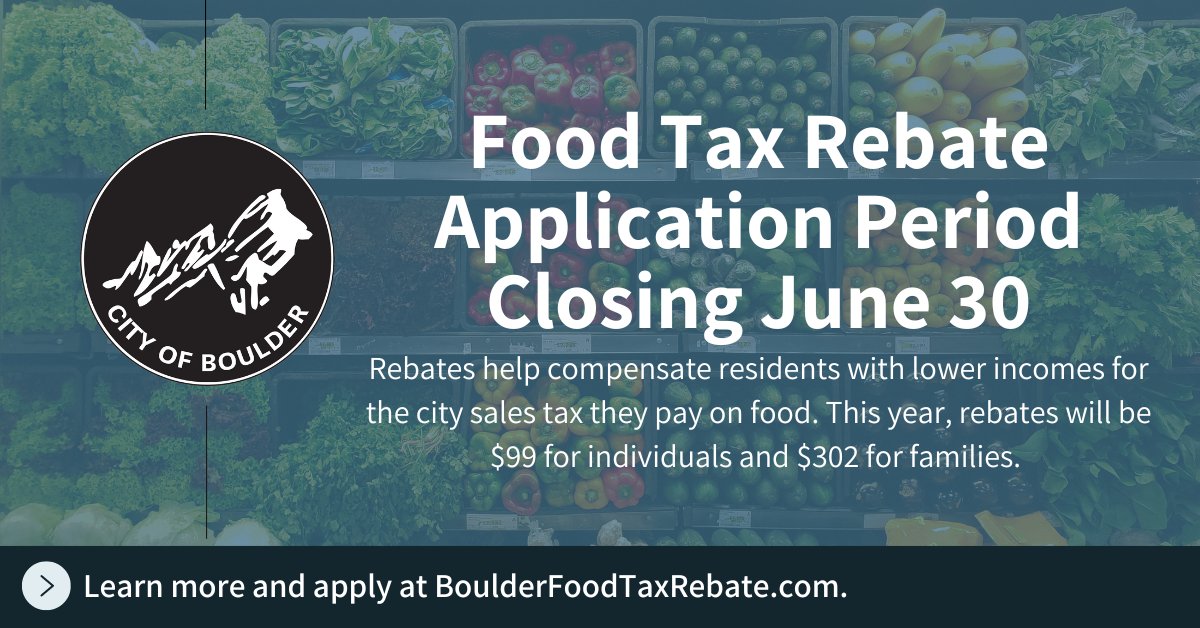

City Of Boulder On Twitter Submit Your Application For The Annual

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs

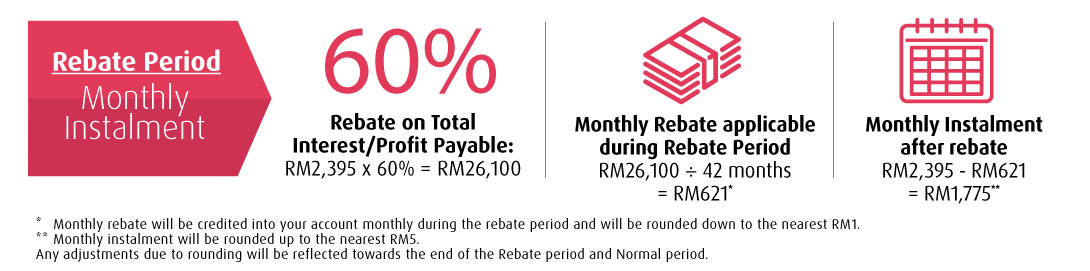

https://www.stanleyco.com.my/post/tax-rebat…

An income tax rebate up to RM20 000 per year for 3 years of assessment was given to newly established small and medium enterprises SMEs between 1 July 2020 to 31 December 2021

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs

An income tax rebate up to RM20 000 per year for 3 years of assessment was given to newly established small and medium enterprises SMEs between 1 July 2020 to 31 December 2021

KSLSA To Hold Meeting Today To Consider Recommending Extension Of 50

Section 87A Tax Rebate Under Section 87A Rebates Financial

Deferred Tax And Temporary Differences The Footnotes Analyst

City Of Boulder On Twitter Submit Your Application For The Annual

.png)

Windrose Consulting Group s Response To Medicaid s Proposed Changes To

Audio Technica

Audio Technica

Promotion Personal Loan Financing i Consolidation