Today, where screens dominate our lives however, the attraction of tangible printed products hasn't decreased. Be it for educational use, creative projects, or simply adding an individual touch to your home, printables for free have become a valuable source. Here, we'll take a dive through the vast world of "Tax Rebate U S 87a For Huf," exploring the benefits of them, where they are available, and how they can enhance various aspects of your life.

Get Latest Tax Rebate U S 87a For Huf Below

Tax Rebate U S 87a For Huf

Tax Rebate U S 87a For Huf -

Income Tax Rebate under section 87A helps reduce tax liability for individuals meeting specific income criteria The rebate amount differs based on income levels It is only applicable for resident individuals and not HUFs or firms

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto Rs 5 lakhs then he will get the tax benefit of Rs 12 500 or the amount of tax

Tax Rebate U S 87a For Huf provide a diverse collection of printable documents that can be downloaded online at no cost. They come in many styles, from worksheets to templates, coloring pages and more. The appealingness of Tax Rebate U S 87a For Huf is in their variety and accessibility.

More of Tax Rebate U S 87a For Huf

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the new tax regime and 12 500 under the optional tax regime This rebate is applicable under section 87A of the Income Tax Act

You can claim rebate u s 87A if your taxable income is within Rs 5 00 lacs for the old tax regime and within Rs 7 00 lacs for the new tax regime The section 87A rebate will be the tax payable or Rs 12500 Rs 25000 whichever is lower

Tax Rebate U S 87a For Huf have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: It is possible to tailor designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes the perfect tool for parents and teachers.

-

Affordability: The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more Tax Rebate U S 87a For Huf

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Sec 87A Amendment Rebate YouTube

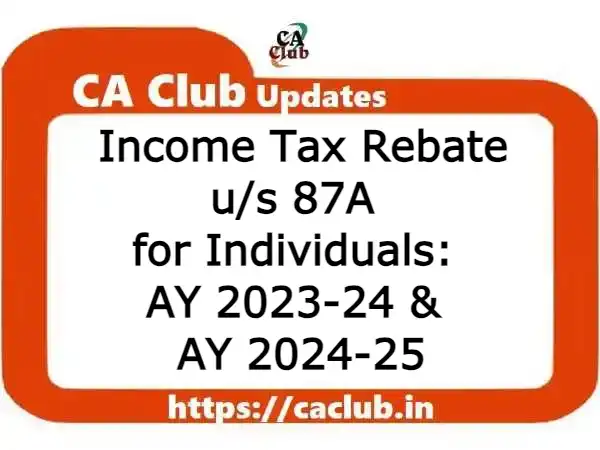

Non resident individual taxpayers are not eligible for rebate u s 87A Partnership firms LLP HUF Companies etc are not eligible under section 87A The tax rebate allowed u s87A shall be limited to a maximum amount up to 100 of tax or Rs 12 500 whichever is less

Section 87A of the Income Tax Act of 1961 provides a rebate on income tax to resident individual taxpayers This section is designed to provide relief to taxpayers with income lower than the specified threshold by reducing their tax liability

Now that we've ignited your curiosity about Tax Rebate U S 87a For Huf Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Tax Rebate U S 87a For Huf for all objectives.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing Tax Rebate U S 87a For Huf

Here are some fresh ways how you could make the most use of Tax Rebate U S 87a For Huf:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Rebate U S 87a For Huf are a treasure trove filled with creative and practical information for a variety of needs and pursuits. Their accessibility and flexibility make them an essential part of every aspect of your life, both professional and personal. Explore the vast collection of Tax Rebate U S 87a For Huf today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables in commercial projects?

- It's based on specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations on their use. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print Tax Rebate U S 87a For Huf?

- Print them at home using the printer, or go to the local print shops for better quality prints.

-

What software must I use to open printables that are free?

- The majority of printables are in the format PDF. This is open with no cost software, such as Adobe Reader.

Rebate U s 87A

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Check more sample of Tax Rebate U S 87a For Huf below

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

What Is Income Tax Rebate Under Section 87A HDFC Life

Income Tax Rebate Under Section 87A

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://tax2win.in › guide

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto Rs 5 lakhs then he will get the tax benefit of Rs 12 500 or the amount of tax

https://economictimes.indiatimes.com › wealth › tax › ...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto Rs 5 lakhs then he will get the tax benefit of Rs 12 500 or the amount of tax

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

What Is Income Tax Rebate Under Section 87A HDFC Life

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Breathtaking Income Tax Calculation Statement Two Types Of Financial