In this age of electronic devices, where screens dominate our lives yet the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or simply adding a personal touch to your home, printables for free have proven to be a valuable source. The following article is a take a dive deep into the realm of "Tax Rebate U S 89," exploring their purpose, where to find them and how they can enrich various aspects of your daily life.

Get Latest Tax Rebate U S 89 Below

Tax Rebate U S 89

Tax Rebate U S 89 -

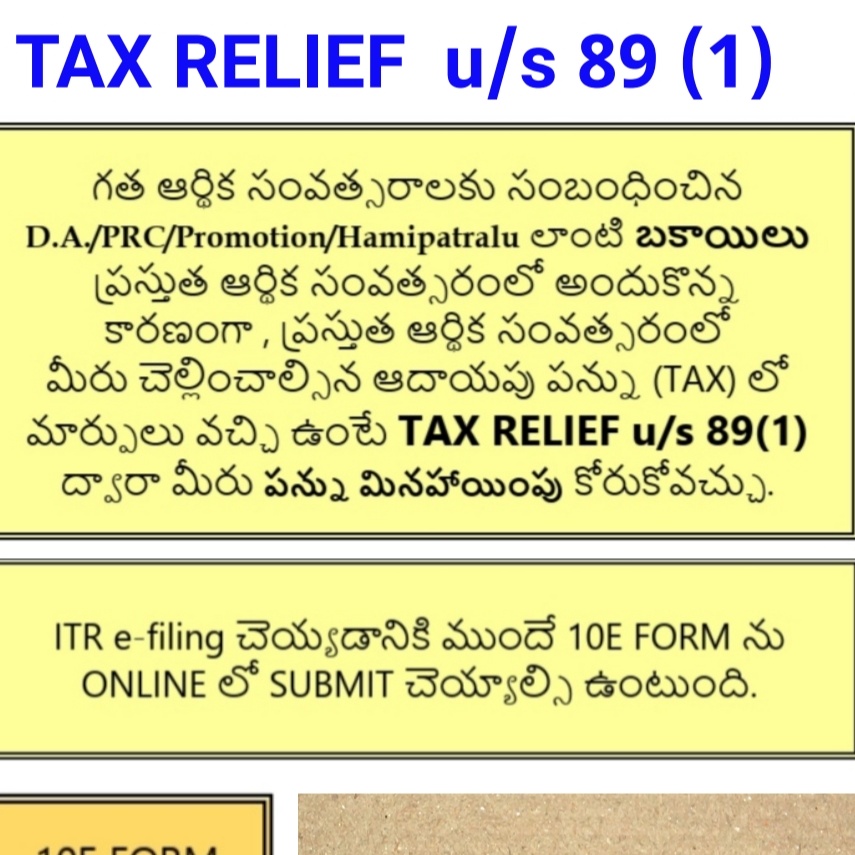

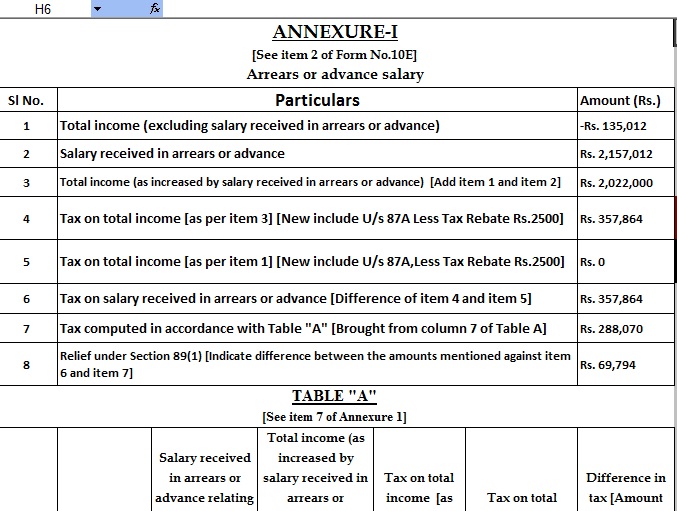

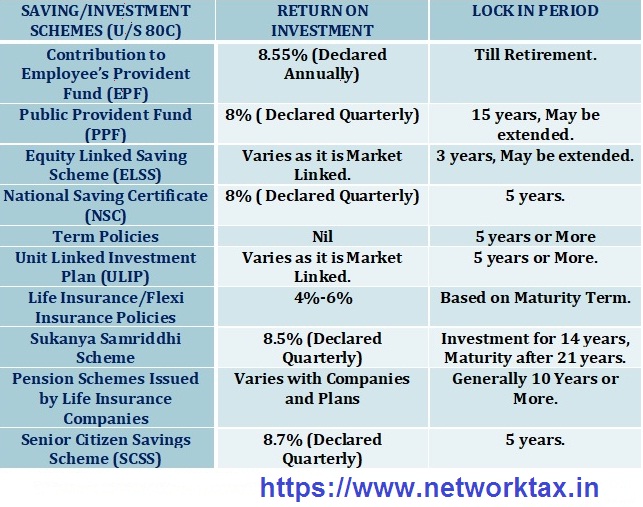

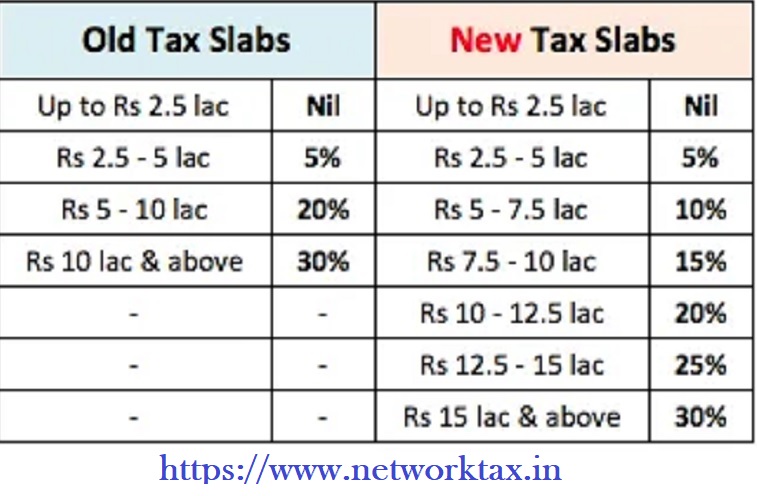

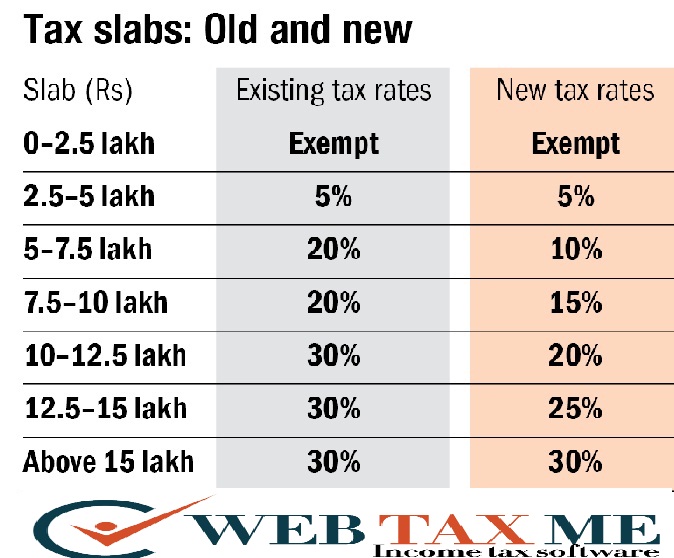

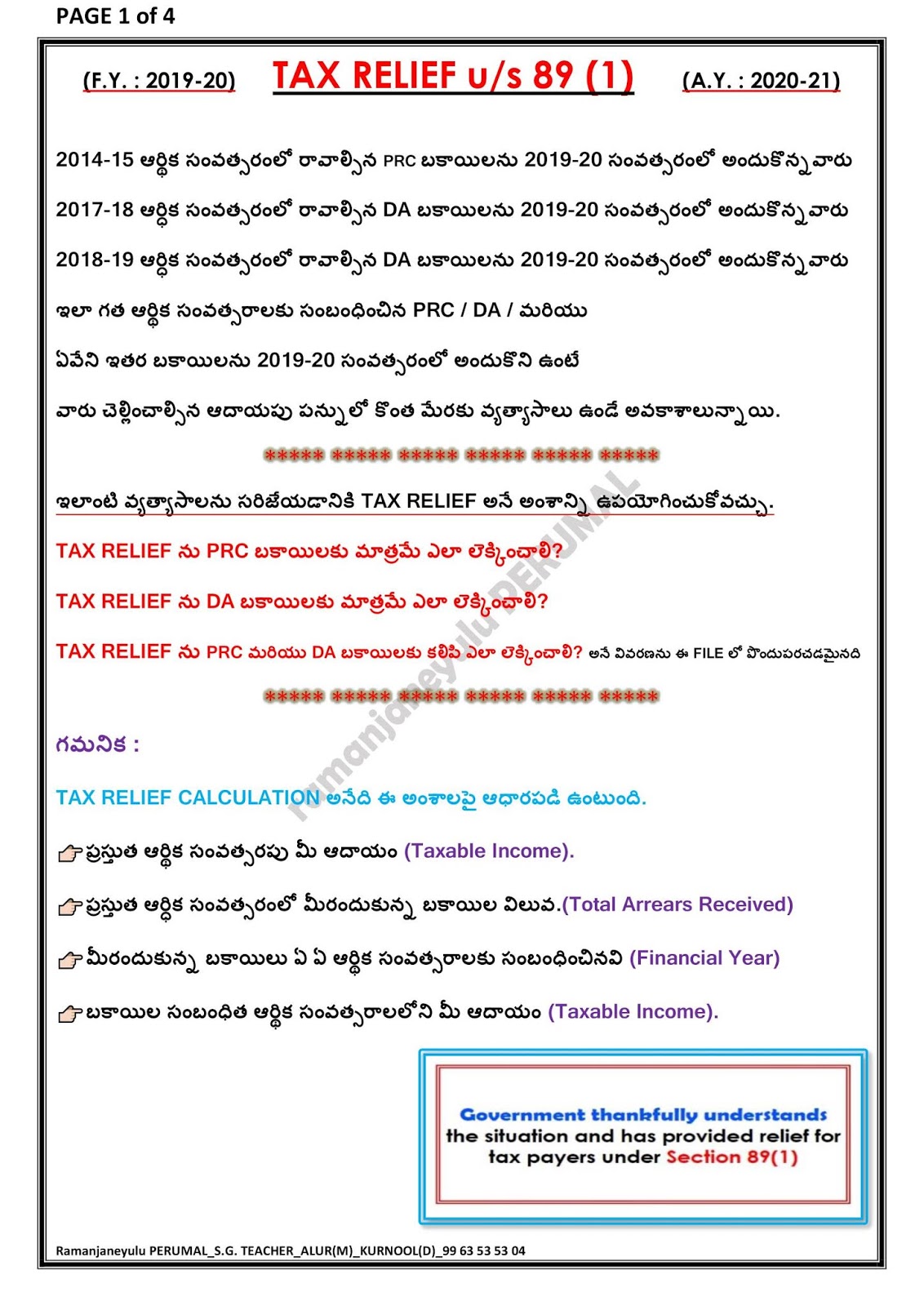

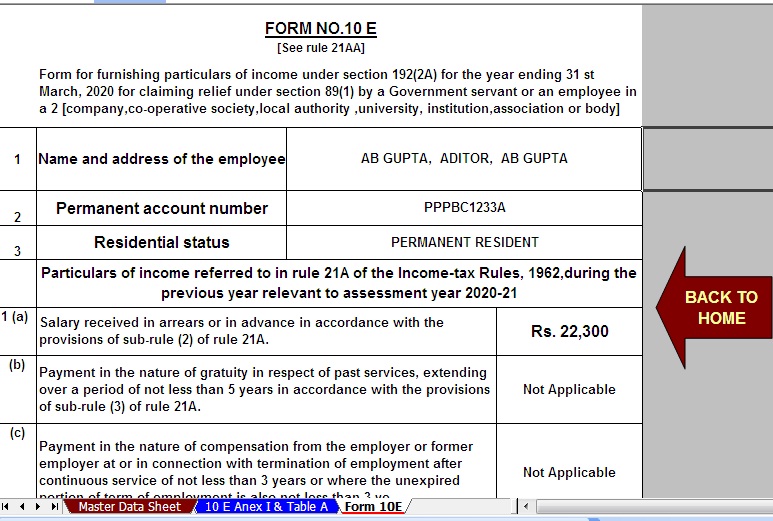

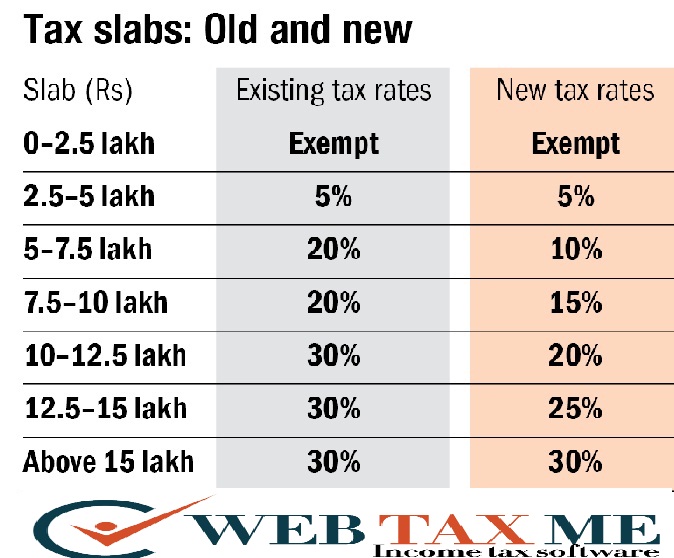

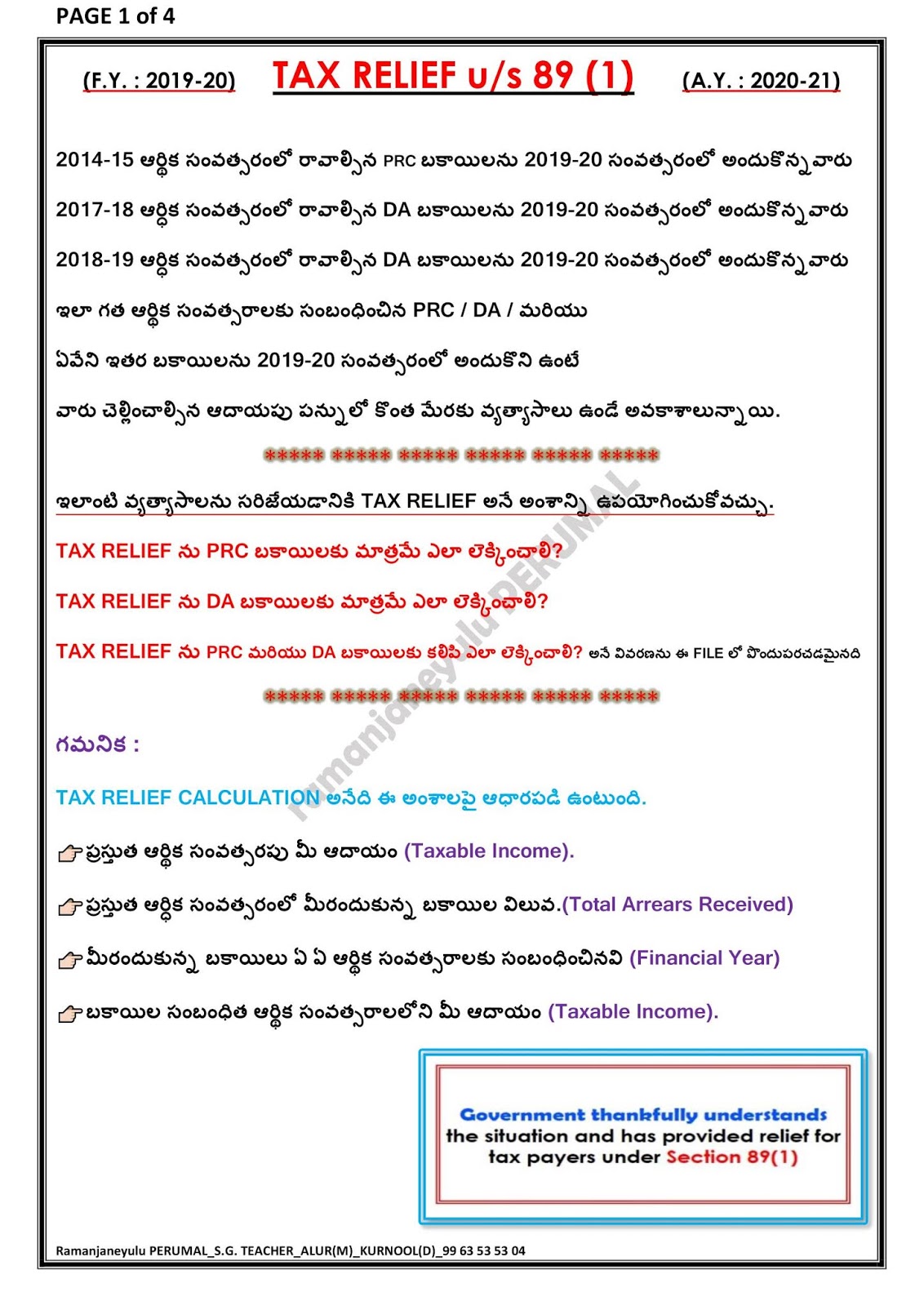

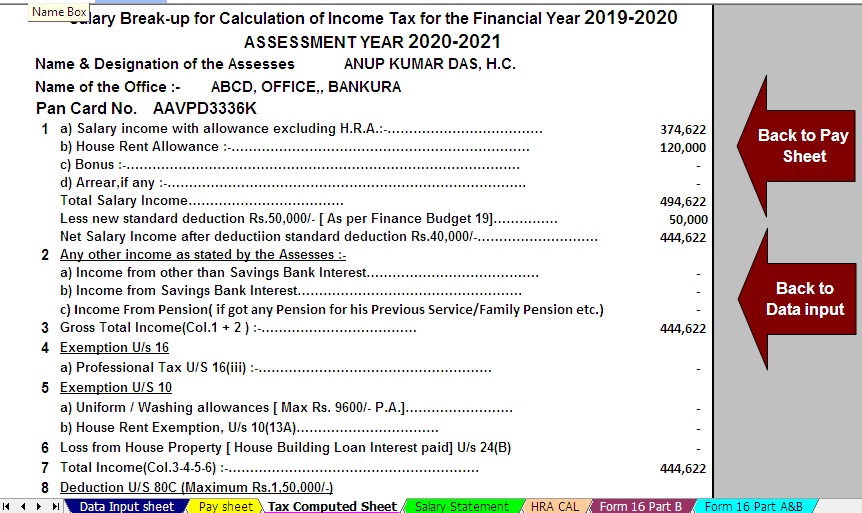

Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax payable on total income

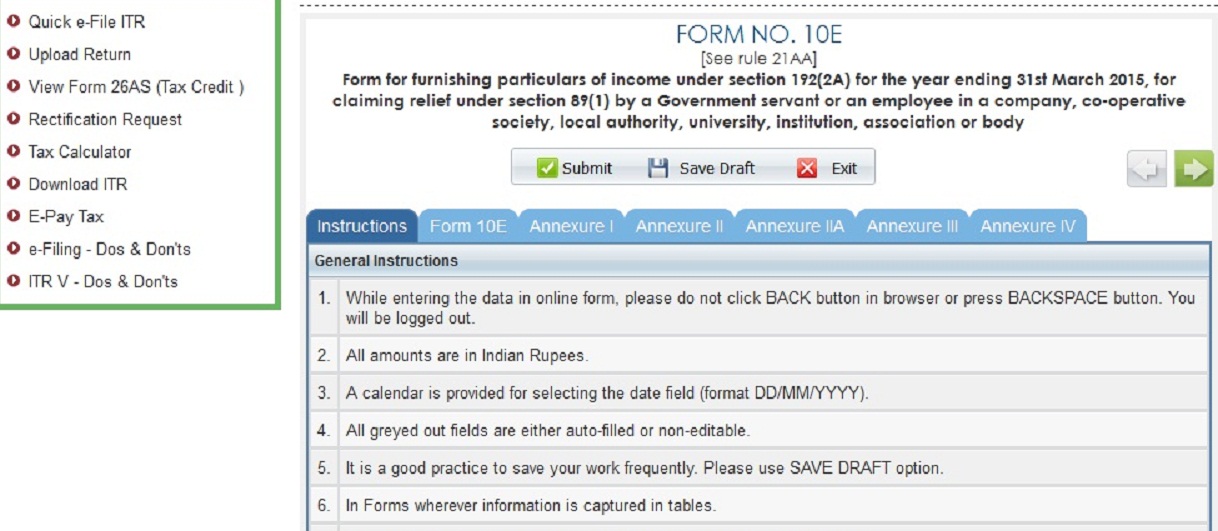

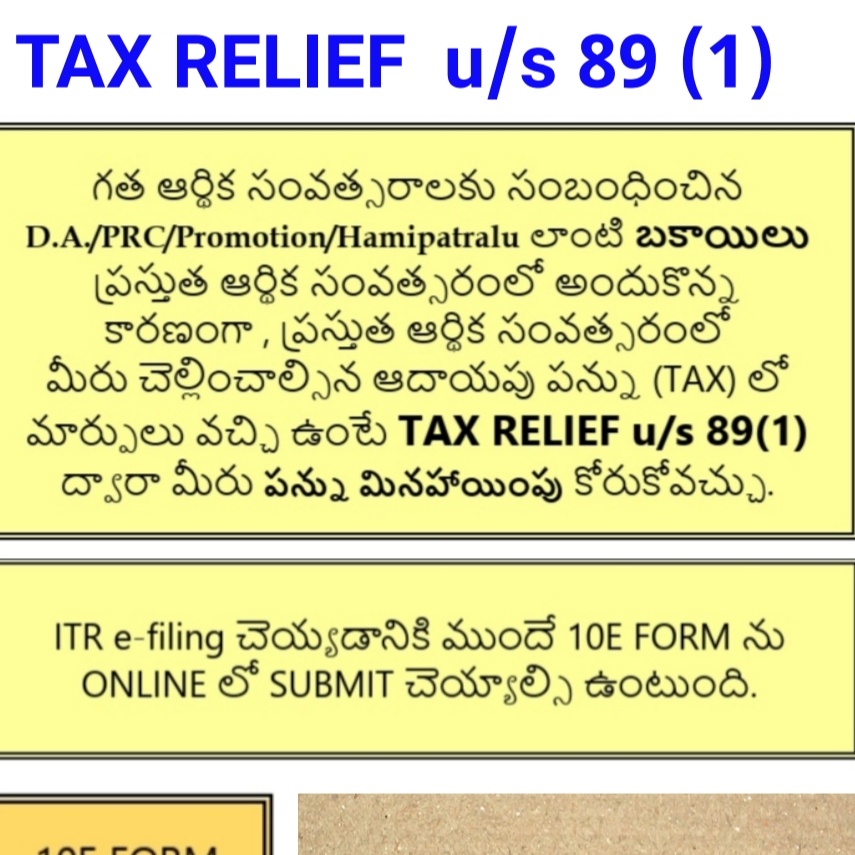

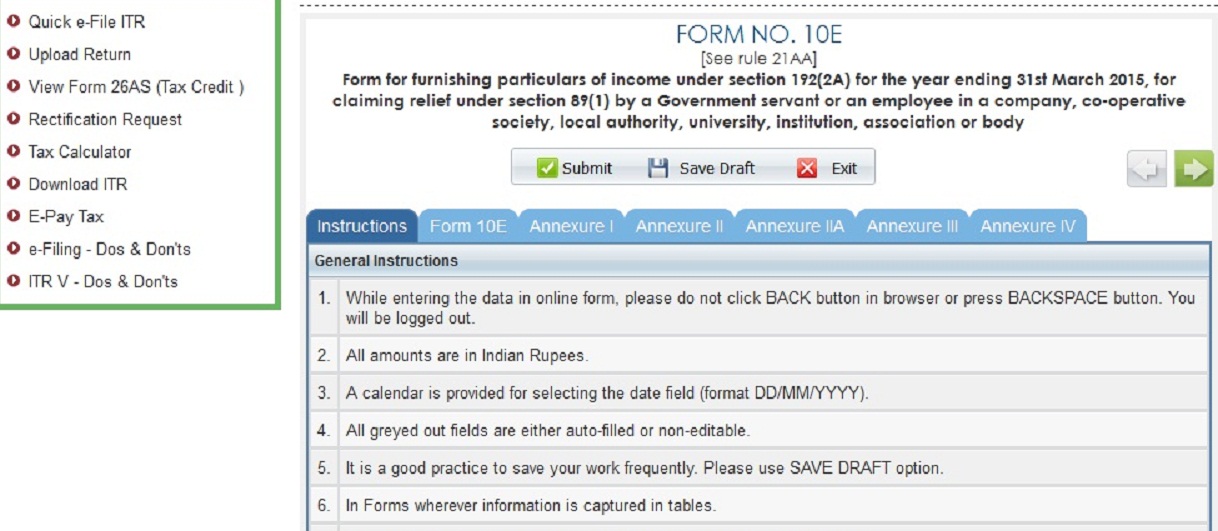

Web The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There can be times when you do not receive your

Tax Rebate U S 89 offer a wide variety of printable, downloadable materials online, at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and many more. The beauty of Tax Rebate U S 89 lies in their versatility as well as accessibility.

More of Tax Rebate U S 89

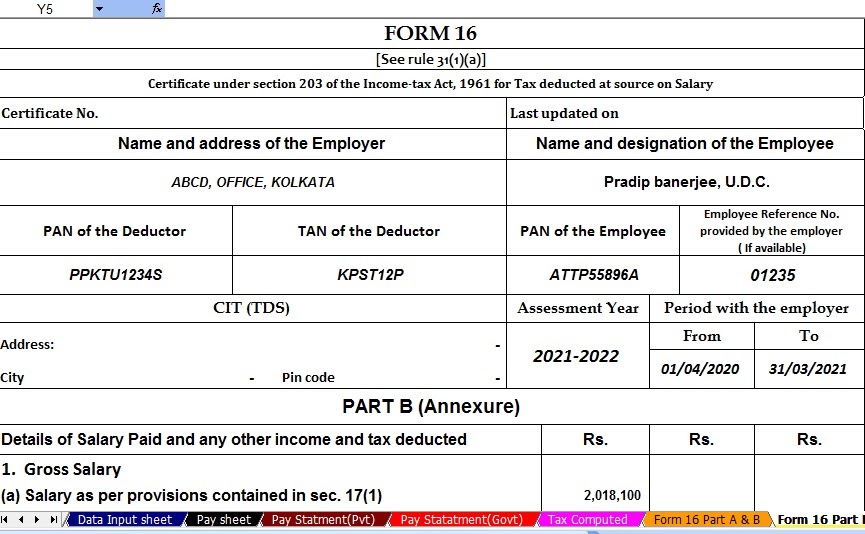

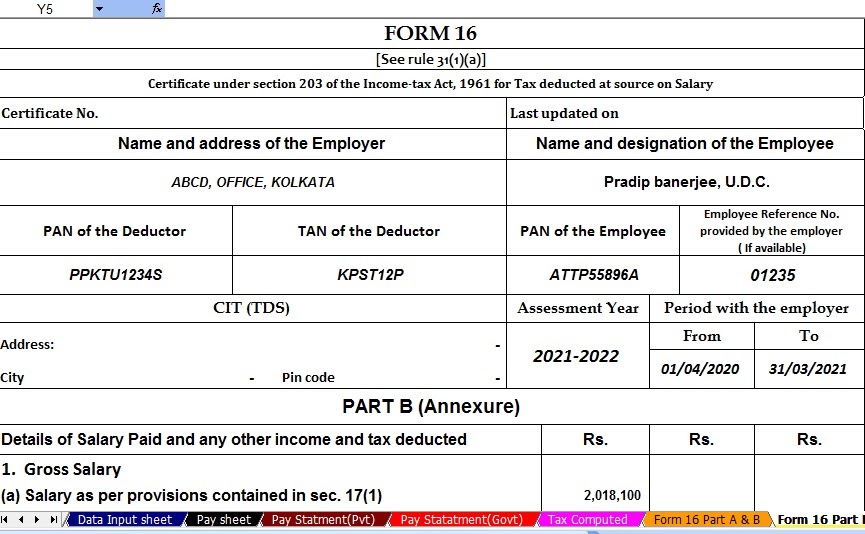

Relief Under Section 89 1 For Arrears Of Salary Itaxsoftware

Relief Under Section 89 1 For Arrears Of Salary Itaxsoftware

Web Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15 years Rule

Web 28 mai 2012 nbsp 0183 32 A Relief can be claimed u s 89 1 if gratuity is received in excess of limits specified The cases in which the relief is admissible is divided into three categories a 194

Tax Rebate U S 89 have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

customization: You can tailor designs to suit your personal needs such as designing invitations making your schedule, or even decorating your house.

-

Educational Value: Education-related printables at no charge can be used by students from all ages, making these printables a powerful tool for parents and teachers.

-

Affordability: Fast access an array of designs and templates reduces time and effort.

Where to Find more Tax Rebate U S 89

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Web 8 mai 2023 nbsp 0183 32 Section 89 1 of the Income Tax Act offers relief from receipt of past income in the current year for any change in taxation laws The relief is provided by recalculating

Web If in case of receipt of past salary salary in advance or receipt of family pension in arrears you are allowed some tax relief under section 89 1 Here s how you can calculate the

After we've peaked your interest in Tax Rebate U S 89 We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of goals.

- Explore categories like decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Tax Rebate U S 89

Here are some new ways for you to get the best of Tax Rebate U S 89:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to enhance learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Rebate U S 89 are an abundance of practical and imaginative resources for a variety of needs and needs and. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast array that is Tax Rebate U S 89 today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free templates for commercial use?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Tax Rebate U S 89?

- Some printables may have restrictions regarding their use. Make sure you read the terms and condition of use as provided by the author.

-

How can I print Tax Rebate U S 89?

- Print them at home with either a printer or go to a local print shop to purchase the highest quality prints.

-

What software do I need to run printables that are free?

- The majority of printed documents are in the format of PDF, which is open with no cost software such as Adobe Reader.

Now It Is Compulsory To Upload 10E Form For Claim Relief U s 89 1 To

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Check more sample of Tax Rebate U S 89 below

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

TAX RELIEF U s 89 1 Explination By Ramanjaneyulu Perumal MANNAMweb

https://www.canarahsbclife.com/tax-university…

Web The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There can be times when you do not receive your

https://maxutils.com/income/calculate-tax-relief-us89

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of

Web The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There can be times when you do not receive your

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

TAX RELIEF U s 89 1 Explination By Ramanjaneyulu Perumal MANNAMweb

Revised Tax Rebate Under Sec 87A After Budget 2019 With Automated

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

2 Relief U s 89 Income Tax Bcom Mcom Nta Net Jrf YouTube