Today, with screens dominating our lives and the appeal of physical printed materials isn't diminishing. Be it for educational use such as creative projects or simply adding an element of personalization to your home, printables for free are a great source. With this guide, you'll take a dive deep into the realm of "Tax Rebate Under 80c," exploring the benefits of them, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest Tax Rebate Under 80c Below

Tax Rebate Under 80c

Tax Rebate Under 80c -

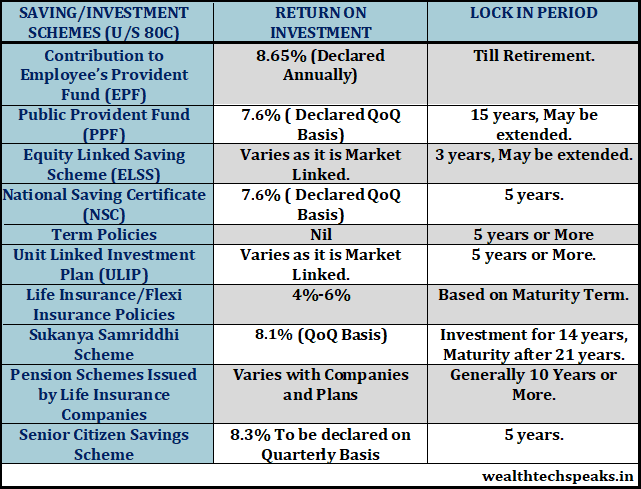

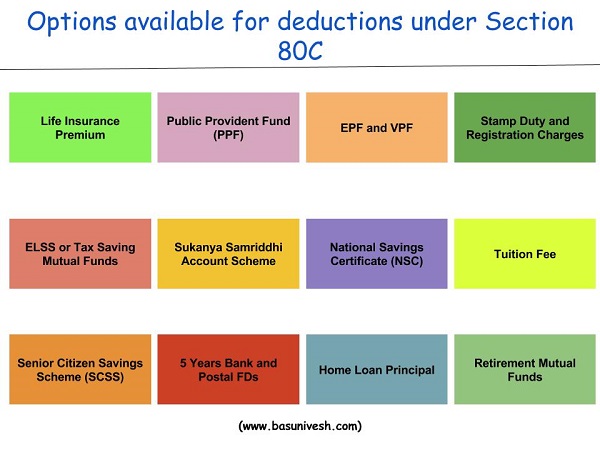

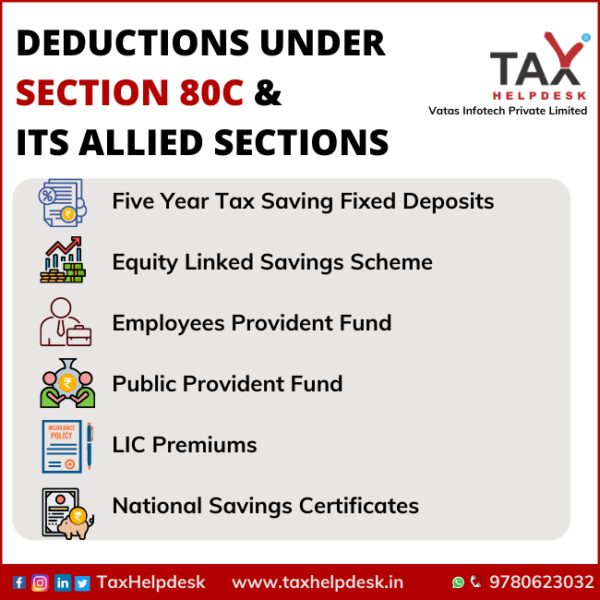

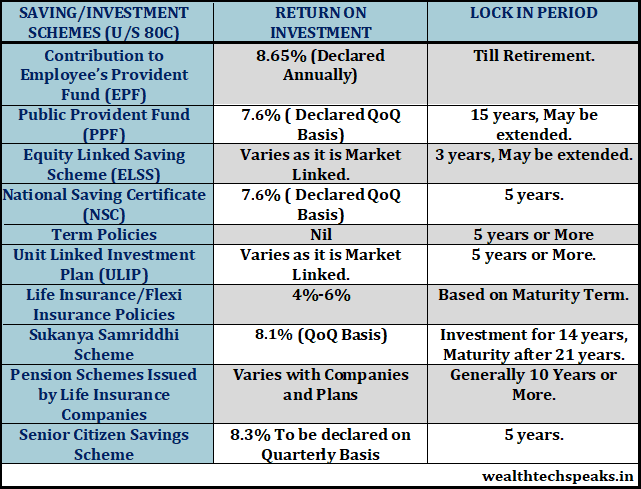

Web 4 janv 2020 nbsp 0183 32 04 Jan 2020 2 491 305 Views 839 comments Articles deals with deduction under Section 80C of the Income Tax Act and explains who is eligible for deduction Eligible Investments Limit for deduction who

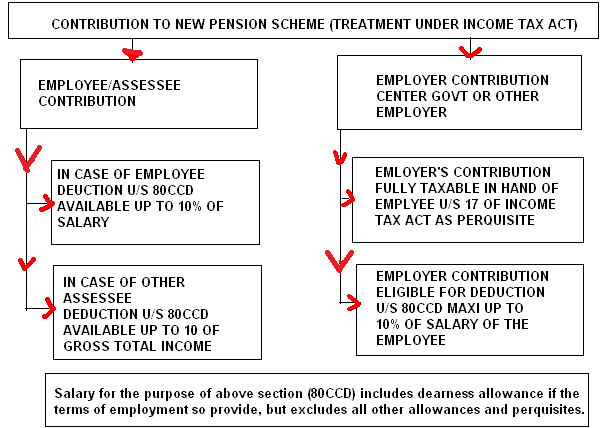

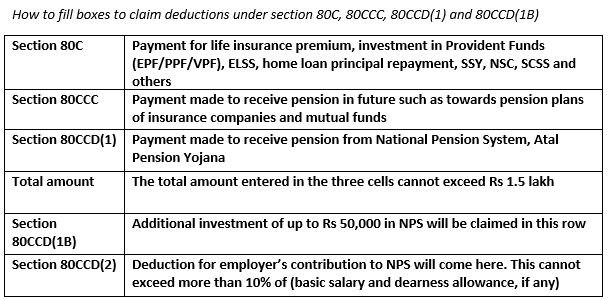

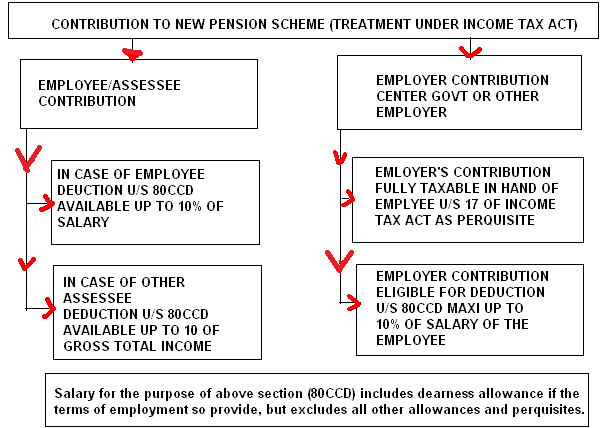

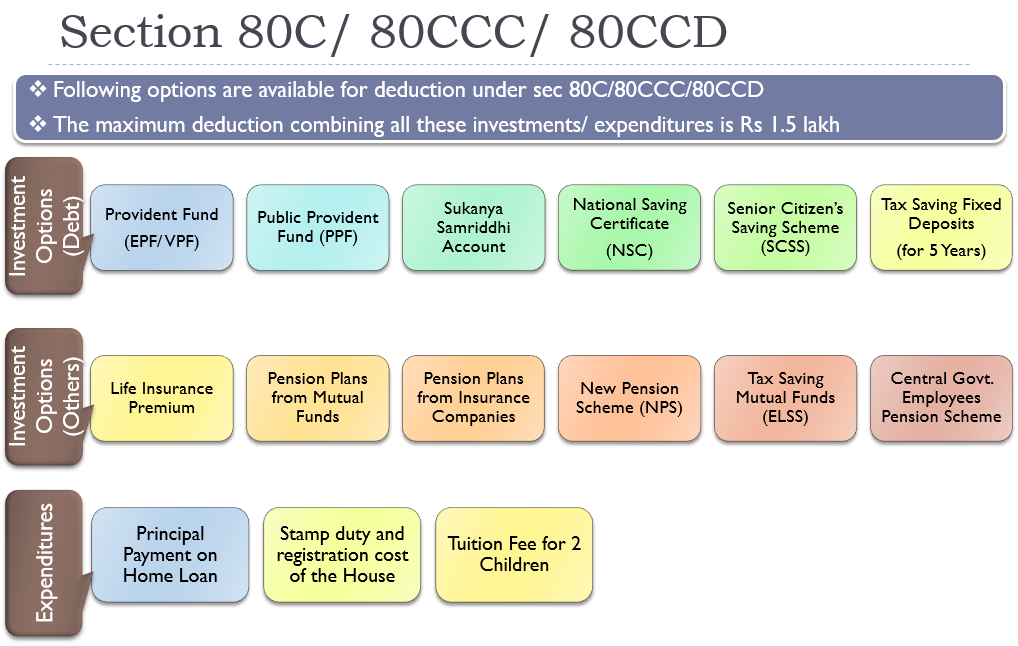

Web 21 juil 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income

Tax Rebate Under 80c provide a diverse array of printable items that are available online at no cost. These resources come in many kinds, including worksheets coloring pages, templates and many more. One of the advantages of Tax Rebate Under 80c lies in their versatility as well as accessibility.

More of Tax Rebate Under 80c

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Web Tax Saving Calculator Calculate Deductions under 80C Lower your tax liability through tax exemptions Section 80C allows you to be eligible for tax deduction up to Rs 1 5 lakh

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different

Tax Rebate Under 80c have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printables to fit your particular needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages, which makes them a valuable source for educators and parents.

-

Affordability: You have instant access various designs and templates can save you time and energy.

Where to Find more Tax Rebate Under 80c

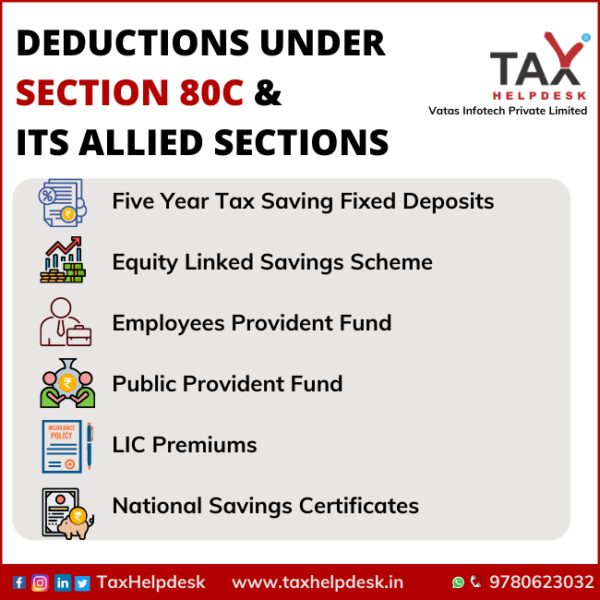

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C Its Allied Sections

Web 3 ao 251 t 2023 nbsp 0183 32 Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for current 2022 23 AY 2023 24 is Rs 1 50 000 For claiming the tax

Web 21 sept 2022 nbsp 0183 32 The Income Tax Act of 1961 allows a maximum deduction of 1 50 000 per annum under Section 80C which includes other tax deductibles like insurance premiums interest on education or housing

If we've already piqued your curiosity about Tax Rebate Under 80c Let's see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Tax Rebate Under 80c for various objectives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Tax Rebate Under 80c

Here are some new ways ensure you get the very most use of Tax Rebate Under 80c:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Rebate Under 80c are a treasure trove with useful and creative ideas designed to meet a range of needs and hobbies. Their access and versatility makes them a great addition to your professional and personal life. Explore the world of Tax Rebate Under 80c to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download these files for free.

-

Are there any free printouts for commercial usage?

- It's dependent on the particular terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with Tax Rebate Under 80c?

- Some printables may contain restrictions concerning their use. Be sure to check the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home with the printer, or go to any local print store for higher quality prints.

-

What software do I require to open printables for free?

- The majority are printed in PDF format, which is open with no cost programs like Adobe Reader.

DEDUCTION UNDER SECTION 80C TO 80U PDF

How To Claim Health Insurance Under Section 80D From 2018 19

Check more sample of Tax Rebate Under 80c below

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Section 80C Income Tax Deduction Under Section 80C Tax2win

Deduction Under Section 80C A Complete List BasuNivesh

Budget 2014 Impact On Money Taxes And Savings

Deduction Under Section 80C Its Allied Sections

Investing Can Be Interesting Financial Awareness Deduction Under

https://taxguru.in/income-tax/section-80c-80c…

Web 21 juil 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income

https://www.fincash.com/l/tax/tax-rebate

Web 3 janv 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section

Web 21 juil 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income

Web 3 janv 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section

Budget 2014 Impact On Money Taxes And Savings

Section 80C Income Tax Deduction Under Section 80C Tax2win

Deduction Under Section 80C Its Allied Sections

Investing Can Be Interesting Financial Awareness Deduction Under

Income Tax Deductions Under Section 80

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

Download Complete Tax Planning Guide In PDF For Salaried And Professionals