In this day and age where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add an element of personalization to your area, Tax Rebate Under Different Sections have become an invaluable source. Here, we'll take a dive deep into the realm of "Tax Rebate Under Different Sections," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Tax Rebate Under Different Sections Below

Tax Rebate Under Different Sections

Tax Rebate Under Different Sections -

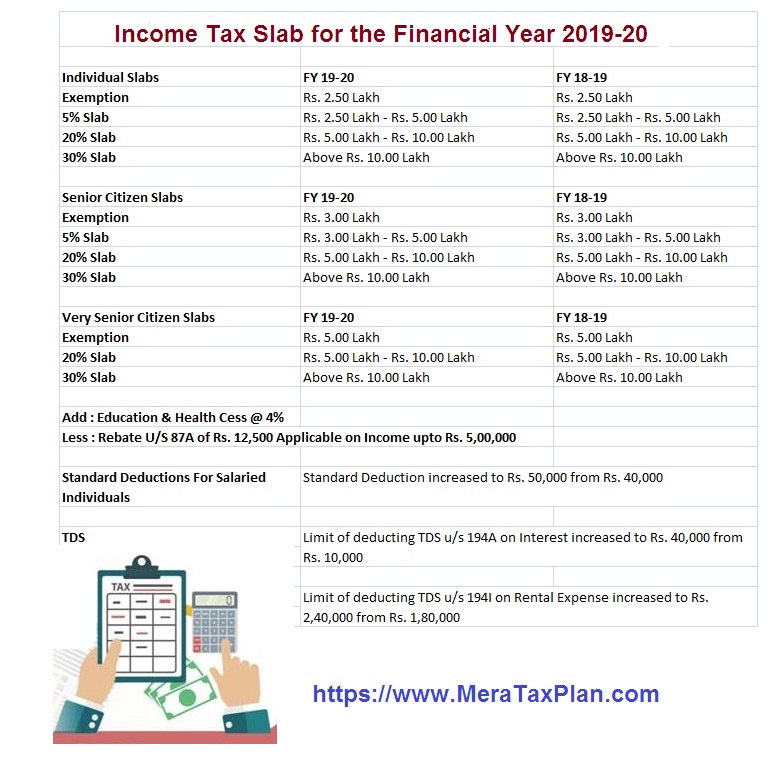

A tax rebate is a refund that you are eligible for if the taxes paid by you exceed your tax liability For example if your tax liability is amounting to Rs 20 000 but if the bank pays the Government a TDS that amounts to Rs 30 000 on your

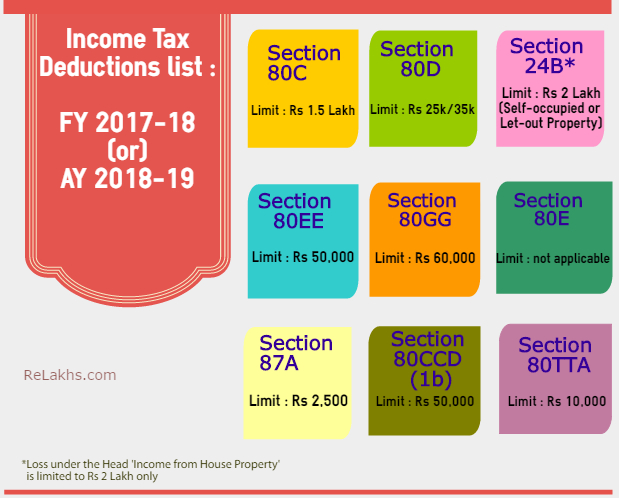

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

Tax Rebate Under Different Sections cover a large array of printable materials available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. One of the advantages of Tax Rebate Under Different Sections is in their variety and accessibility.

More of Tax Rebate Under Different Sections

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax relief and tax benefit under Sections 80C 80D 87A 10 and 24 Tax relief is any provision that reduces the tax owed by a taxpayer may it be an individual or a business entity Similarly the tax benefit is a deduction or a tax credit that reduces the tax liability of a taxpayer

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to

Tax Rebate Under Different Sections have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization You can tailor the templates to meet your individual needs such as designing invitations planning your schedule or decorating your home.

-

Education Value Downloads of educational content for free cater to learners of all ages. This makes them a great source for educators and parents.

-

Easy to use: You have instant access a myriad of designs as well as templates can save you time and energy.

Where to Find more Tax Rebate Under Different Sections

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

If your income is more than Rs 5 00 lakhs then investments and expenses that fall under various Sections like 80C 80D 80CCD etc can reduce your tax liability Individuals with a gross income of up to Rs 5 00 lakhs are

What are the rebates in the new tax regime in 2024 Under the new tax regime if your taxable income is upto Rs 7 lakh you are eligible for a tax rebate and do not have to pay any tax The maximum tax rebate under

Now that we've piqued your interest in Tax Rebate Under Different Sections and other printables, let's discover where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Rebate Under Different Sections to suit a variety of reasons.

- Explore categories like home decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Tax Rebate Under Different Sections

Here are some unique ways that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Rebate Under Different Sections are a treasure trove of practical and imaginative resources designed to meet a range of needs and desires. Their accessibility and flexibility make them a great addition to both professional and personal lives. Explore the vast array of Tax Rebate Under Different Sections to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial purposes?

- It's based on the conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright rights issues with Tax Rebate Under Different Sections?

- Some printables may contain restrictions in their usage. Make sure you read the terms and conditions set forth by the author.

-

How can I print Tax Rebate Under Different Sections?

- Print them at home using either a printer at home or in a local print shop for the highest quality prints.

-

What program do I need in order to open Tax Rebate Under Different Sections?

- Many printables are offered in the format PDF. This can be opened with free software like Adobe Reader.

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Check more sample of Tax Rebate Under Different Sections below

TDS Rates Chart With Sections FY 2022 23 In Bangladesh

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

What Is Income Tax Limit For Property Tax And Insurance

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

https://tax2win.in/guide/deductions

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

https://cleartax.in/s/income-tax-allowances-and-deductions

With the help of these deductions and exemptions one could reduce their tax substantially In this article we try to list some of the major deductions and allowances available to the salaried persons using which one can reduce their income tax liability

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

With the help of these deductions and exemptions one could reduce their tax substantially In this article we try to list some of the major deductions and allowances available to the salaried persons using which one can reduce their income tax liability

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Allowances Or Exemptions Available For Salaried For A Y 2018 19 All

What Will Be The Tax Allowance For 2020 21 Tutorial Pics

What Will Be The Tax Allowance For 2020 21 Tutorial Pics

Top NGO In Bihar Who Is Providing A Better Society