In the digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. If it's to aid in education as well as creative projects or just adding an element of personalization to your space, Tax Rebate Under Section 80cce can be an excellent source. We'll take a dive into the sphere of "Tax Rebate Under Section 80cce," exploring what they are, how they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Tax Rebate Under Section 80cce Below

Tax Rebate Under Section 80cce

Tax Rebate Under Section 80cce -

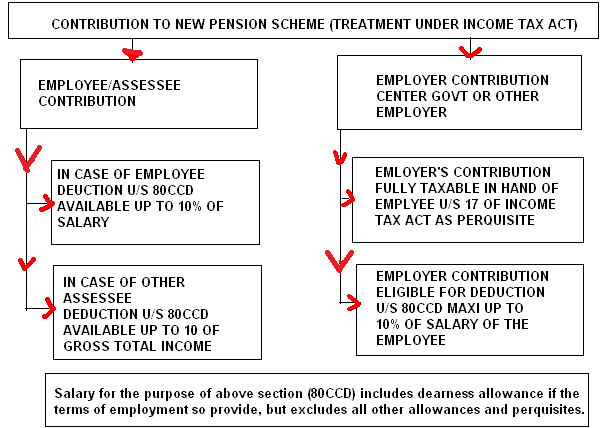

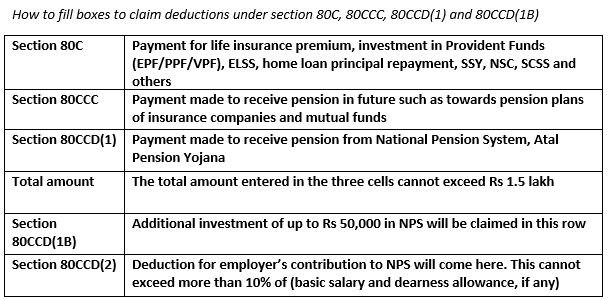

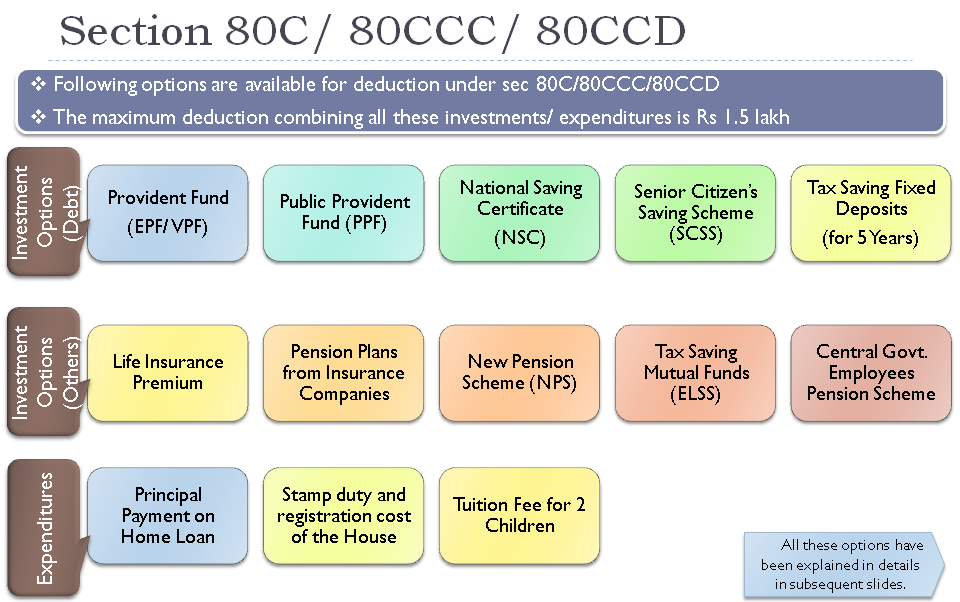

Web 29 juin 2018 nbsp 0183 32 Please note that Limit of deduction Under section 80CCC is enhanced to Rs 1 50 from One Lakh with effect from assessment year 2016 17 and for subsequent assessment years Limit of deduction

Web Deduction limit under sections 80C 80CCC amp 80CCD Amended and updated notes on section 80CCE of Income Tax Act 1961 as amended by the Finance Act 2022 and

Tax Rebate Under Section 80cce encompass a wide assortment of printable, downloadable material that is available online at no cost. They come in many types, such as worksheets coloring pages, templates and more. The great thing about Tax Rebate Under Section 80cce is in their variety and accessibility.

More of Tax Rebate Under Section 80cce

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Web 2 juil 2021 nbsp 0183 32 Section 80CCE permits individuals to deduct up to INR 1 5 lakh from their total gross income before calculating tax payable if this INR 1 5 lakh is perfused in

Web 19 oct 2012 nbsp 0183 32 Tax Rebate to your Pension Contribution The taxman will give following tax relief under Sections 80C 80CCC and 80CCD to your pension contribution The limit

Tax Rebate Under Section 80cce have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor print-ready templates to your specific requirements such as designing invitations and schedules, or even decorating your house.

-

Educational Value The free educational worksheets offer a wide range of educational content for learners of all ages, making these printables a powerful instrument for parents and teachers.

-

Accessibility: Instant access to the vast array of design and templates saves time and effort.

Where to Find more Tax Rebate Under Section 80cce

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Web 13 janv 2020 nbsp 0183 32 L article 15 de la loi de finances pour 2020 a prorog 233 et am 233 nag 233 le CITE cr 233 dit d imp 244 t transition 233 nerg 233 tique pour l ann 233 e 2020 Elle conditionne notamment

Web 3 mars 2023 nbsp 0183 32 Section 80E Tax Deductions for Interest on Education Loan Section 80E allows a deduction for interest paid on repayment of education loans taken for higher education The deduction u s 80E is not

After we've peaked your interest in Tax Rebate Under Section 80cce Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of motives.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Tax Rebate Under Section 80cce

Here are some ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Rebate Under Section 80cce are a treasure trove of useful and creative resources that can meet the needs of a variety of people and passions. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the world of Tax Rebate Under Section 80cce now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print the resources for free.

-

Can I download free printables for commercial purposes?

- It's based on the rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Tax Rebate Under Section 80cce?

- Certain printables may be subject to restrictions on use. Check the terms and regulations provided by the author.

-

How can I print Tax Rebate Under Section 80cce?

- Print them at home with either a printer or go to an area print shop for better quality prints.

-

What software do I need to open printables free of charge?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

Investing Can Be Interesting Financial Awareness Deduction Under

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

Check more sample of Tax Rebate Under Section 80cce below

Income Tax Deductions Available For The Financial Year 2017 18

Investing Can Be Interesting Financial Awareness Deduction Under

Deductions Under Section 80 Complete Guide Download Excel Sheet

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

https://www.aubsp.com/section-80cce-deduction-limit-80c-80ccc-80ccd

Web Deduction limit under sections 80C 80CCC amp 80CCD Amended and updated notes on section 80CCE of Income Tax Act 1961 as amended by the Finance Act 2022 and

https://bemoneyaware.com/tax-saving-options-80c-80d

Web 16 janv 2013 nbsp 0183 32 Section 80CCE Limit of deduction under section 80C 80CCC and 80CCD There are other tax saving options like Medical Insurance and Health Checkups

Web Deduction limit under sections 80C 80CCC amp 80CCD Amended and updated notes on section 80CCE of Income Tax Act 1961 as amended by the Finance Act 2022 and

Web 16 janv 2013 nbsp 0183 32 Section 80CCE Limit of deduction under section 80C 80CCC and 80CCD There are other tax saving options like Medical Insurance and Health Checkups

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Investing Can Be Interesting Financial Awareness Deduction Under

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Budget 2014 Impact On Money Taxes And Savings