In the digital age, in which screens are the norm but the value of tangible printed items hasn't gone away. Whatever the reason, whether for education, creative projects, or just adding an element of personalization to your area, Tax Rebate Under Section 87a For Senior Citizens are now an essential resource. This article will take a dive deep into the realm of "Tax Rebate Under Section 87a For Senior Citizens," exploring their purpose, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Tax Rebate Under Section 87a For Senior Citizens Below

Tax Rebate Under Section 87a For Senior Citizens

Tax Rebate Under Section 87a For Senior Citizens -

Senior citizens For tax liability on income other than equity fund long term gains you fully get a rebate under Section 87A

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Tax Rebate Under Section 87a For Senior Citizens provide a diverse range of downloadable, printable materials available online at no cost. They come in many designs, including worksheets templates, coloring pages and more. The beauty of Tax Rebate Under Section 87a For Senior Citizens lies in their versatility as well as accessibility.

More of Tax Rebate Under Section 87a For Senior Citizens

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided Family HUF and firms are not eligible for the rebate under Section 87A

The Income Tax Rebate under Section 87A offers tax relief to eligible resident Indians For FY 2023 24 the new tax regime allows a rebate of up to Rs 25 000 for taxable incomes up to Rs 7 lakhs The old regime maintains a Rs 12 500 rebate for incomes up to Rs 5 lakhs

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: We can customize the design to meet your needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Use: Printables for education that are free cater to learners of all ages, which makes them an essential aid for parents as well as educators.

-

Simple: instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Tax Rebate Under Section 87a For Senior Citizens

Section 87A What Is The Income Tax Rebate Available Under Section 87A

Section 87A What Is The Income Tax Rebate Available Under Section 87A

Under the old tax regime super senior citizens those who are 80 years of age or older are not eligible since their basic threshold limit is INR 5 00 000 Illustration Of Tax Rebate Under Section 87A For FY 2024 25 AY 2025 26 Let us consider a number of scenarios assuming the taxpayer is an individual who is less than 60 years of age

Income Tax Rebate under section 87A helps reduce tax liability for individuals meeting specific income criteria The rebate amount differs based on income levels It is only applicable for resident individuals and not HUFs or firms

If we've already piqued your curiosity about Tax Rebate Under Section 87a For Senior Citizens we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Tax Rebate Under Section 87a For Senior Citizens for various applications.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing Tax Rebate Under Section 87a For Senior Citizens

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Rebate Under Section 87a For Senior Citizens are an abundance with useful and creative ideas which cater to a wide range of needs and needs and. Their access and versatility makes these printables a useful addition to both professional and personal life. Explore the vast world that is Tax Rebate Under Section 87a For Senior Citizens today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial purposes?

- It's determined by the specific conditions of use. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Tax Rebate Under Section 87a For Senior Citizens?

- Some printables may have restrictions in use. Be sure to read these terms and conditions as set out by the creator.

-

How do I print Tax Rebate Under Section 87a For Senior Citizens?

- You can print them at home with either a printer or go to the local print shop for top quality prints.

-

What software do I require to view printables for free?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate Under Section 87A

Check more sample of Tax Rebate Under Section 87a For Senior Citizens below

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

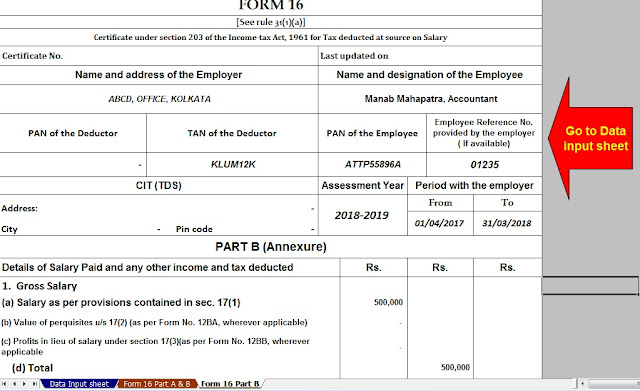

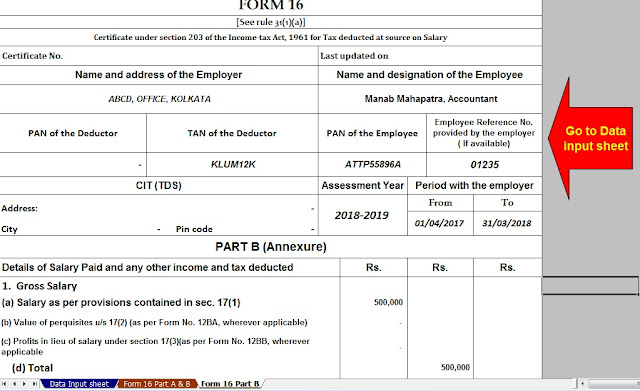

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Section 87A Tax Rebate Under Section 87A Paisabazaar

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A Of I Tax Act Income Tax

https://www.incometax.gov.in › iec › foportal › help › individual

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

https://greatsenioryears.com

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This applies to both the old and new tax regimes

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This applies to both the old and new tax regimes

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A Of I Tax Act Income Tax

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA