In this digital age, where screens rule our lives it's no wonder that the appeal of tangible printed products hasn't decreased. For educational purposes project ideas, artistic or just adding an element of personalization to your space, Tax Rebate Vs Tax Credit have proven to be a valuable source. We'll dive into the world "Tax Rebate Vs Tax Credit," exploring what they are, how to find them and how they can add value to various aspects of your life.

Get Latest Tax Rebate Vs Tax Credit Below

Tax Rebate Vs Tax Credit

Tax Rebate Vs Tax Credit -

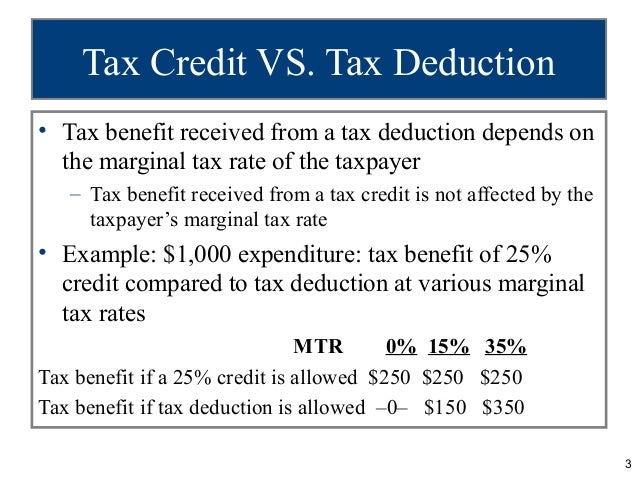

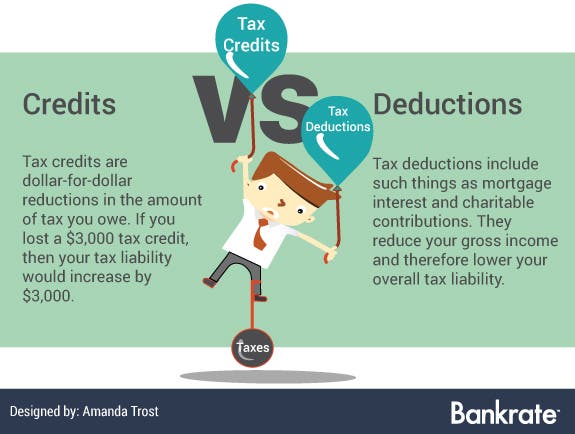

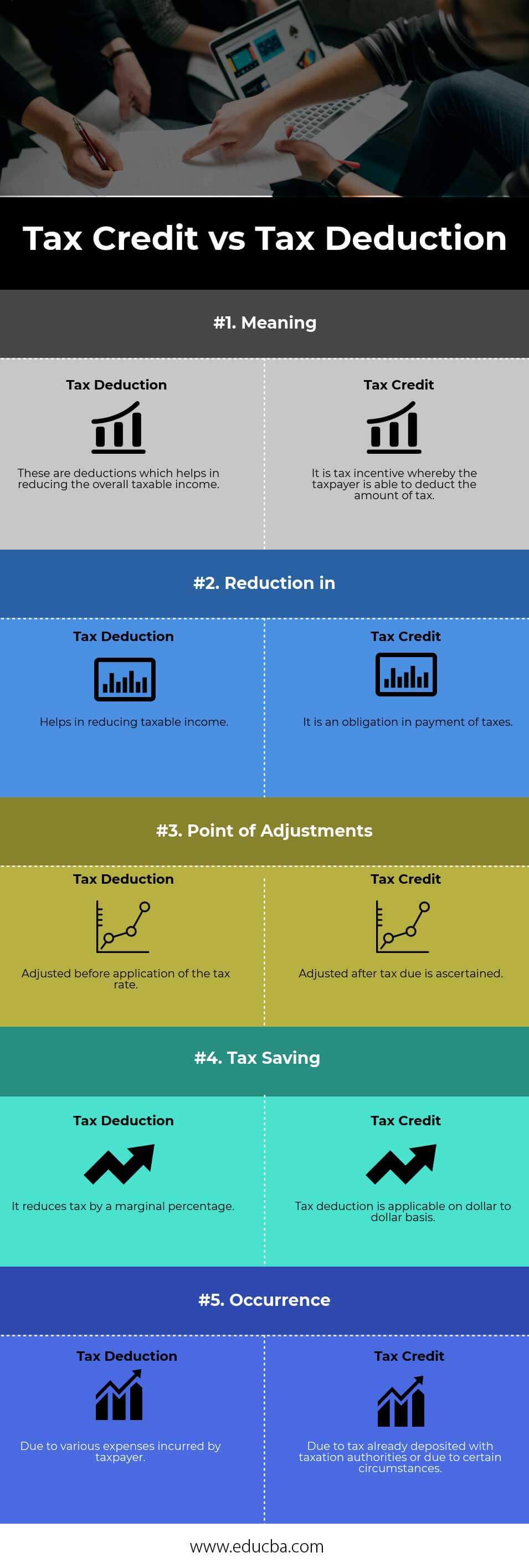

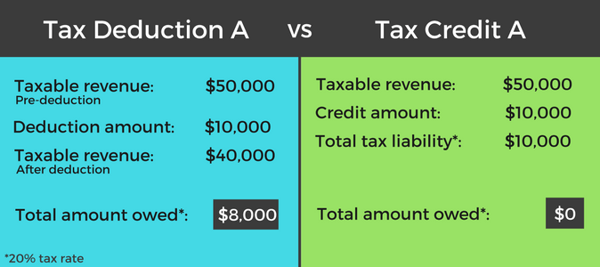

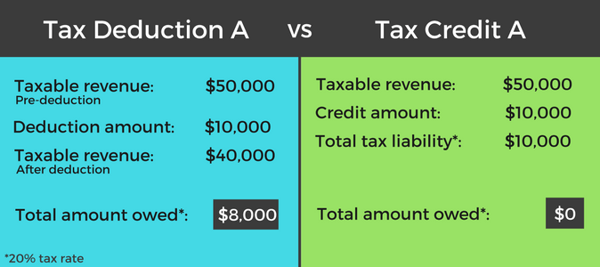

Web 12 f 233 vr 2023 nbsp 0183 32 Key Takeaways A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more

Web Tax Credit Vs Rebate Definitions A tax credit is a tax allowance that the federal or state government allows certain taxpayers who meet Timing Tax credits apply to a given tax

Printables for free cover a broad array of printable materials available online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages and much more. The attraction of printables that are free is in their variety and accessibility.

More of Tax Rebate Vs Tax Credit

What Is The Difference Between A Tax Credit And Tax Deduction

What Is The Difference Between A Tax Credit And Tax Deduction

Web 31 janv 2023 nbsp 0183 32 A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your

Web 5 mars 2009 nbsp 0183 32 Generally speaking tax credits only offset tax balances due meaning if you have low income and owe nothing in tax you get no benefit from a credit Whereas tax

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify printed materials to meet your requirements when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them a vital tool for parents and teachers.

-

Affordability: Access to various designs and templates can save you time and energy.

Where to Find more Tax Rebate Vs Tax Credit

Ppt Ch 13

Ppt Ch 13

Web Refundable vs Non refundable Tax Credits Tax credits come in two forms refundable and non refundable Refundable tax credits provide benefit even if you do not owe the IRS

Web 5 f 233 vr 2018 nbsp 0183 32 These are known as refundable tax credits Tax credits are always refundable or nonrefundable Nonrefundable tax credits can t increase your tax refund

We've now piqued your curiosity about Tax Rebate Vs Tax Credit Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Tax Rebate Vs Tax Credit for all needs.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast variety of topics, ranging from DIY projects to planning a party.

Maximizing Tax Rebate Vs Tax Credit

Here are some inventive ways ensure you get the very most of Tax Rebate Vs Tax Credit:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Rebate Vs Tax Credit are a treasure trove of practical and innovative resources which cater to a wide range of needs and passions. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the vast array of Tax Rebate Vs Tax Credit and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes, they are! You can print and download the resources for free.

-

Are there any free printables in commercial projects?

- It depends on the specific terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on their use. Be sure to check these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with an printer, or go to the local print shops for more high-quality prints.

-

What software do I require to view printables free of charge?

- Many printables are offered in the PDF format, and can be opened with free programs like Adobe Reader.

Used Capital Loss Carryover Will Taxes Go Up 3 000

Tax Credit Vs Tax Deduction

Check more sample of Tax Rebate Vs Tax Credit below

Tax Credit Vs Tax Deduction Top 5 Major Differences With Infographics

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

EV Rebate Vs Tax Credit What s The Difference Between EV Incentives

Credits Vs Deductions Carpenter Tax And Accounting

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.sapling.com/7884940/tax-credit-vs-rebate

Web Tax Credit Vs Rebate Definitions A tax credit is a tax allowance that the federal or state government allows certain taxpayers who meet Timing Tax credits apply to a given tax

https://www.britannica.com/money/tax-credit-deduction-refund

Web What is a tax credit Tax credits reduce the amount of tax you owe Taxes are calculated first then credits are applied to the taxes you have to pay Some credits called

Web Tax Credit Vs Rebate Definitions A tax credit is a tax allowance that the federal or state government allows certain taxpayers who meet Timing Tax credits apply to a given tax

Web What is a tax credit Tax credits reduce the amount of tax you owe Taxes are calculated first then credits are applied to the taxes you have to pay Some credits called

EV Rebate Vs Tax Credit What s The Difference Between EV Incentives

Credits Vs Deductions Carpenter Tax And Accounting

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Increase Your Tax Savings With These Tax Credits For Maryland Manufacturers

Increase Your Tax Savings With These Tax Credits For Maryland Manufacturers

Tax Deductions Vs Tax Credits And How To Use Both To Pay Less In