In this age of technology, where screens dominate our lives but the value of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons such as creative projects or just adding an individual touch to your area, Tax Refund Formula are now an essential resource. Here, we'll dive through the vast world of "Tax Refund Formula," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Tax Refund Formula Below

Tax Refund Formula

Tax Refund Formula -

1 Refunds under GST are of the below kinds Export of goods under LUT Letter of undertaking Export of goods on payment of IGST under the claim of rebate Inverted duty refund Other claims Sec 54 3 of CGST Act 2017 states a Zero rated supplies made without payment of tax

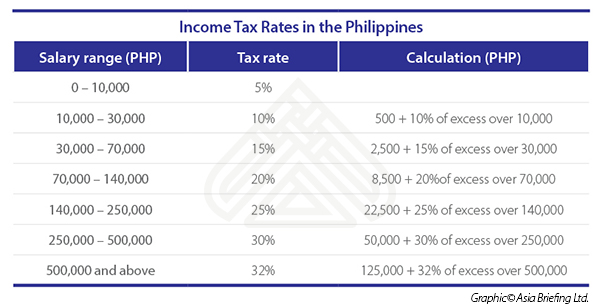

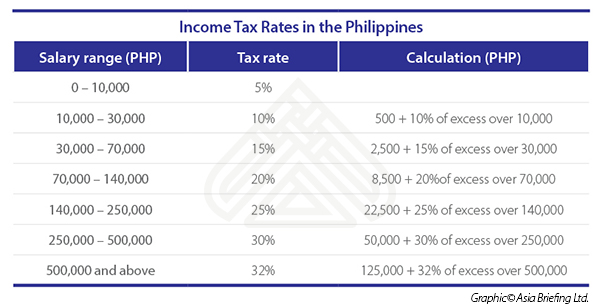

Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually

Tax Refund Formula include a broad assortment of printable content that can be downloaded from the internet at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and much more. The benefit of Tax Refund Formula is their flexibility and accessibility.

More of Tax Refund Formula

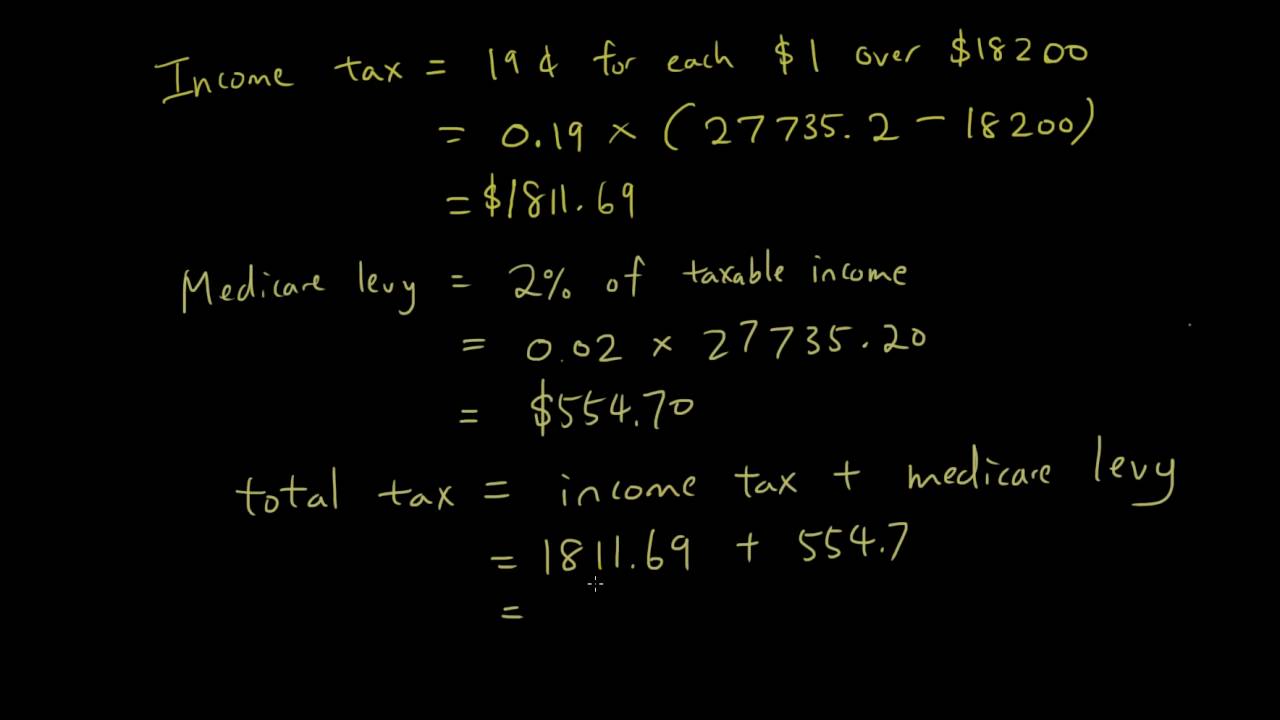

Maths A Tax Lesson 4 Calculate Medicare Levy Tax Refund YouTube

Maths A Tax Lesson 4 Calculate Medicare Levy Tax Refund YouTube

Subtract line 24 from line 33 If the amount on line 33 is larger than the amount on line 24 that s what you overpaid In theory you should get this amount back as a refund Enter this overpayment on line 34 If the total tax owed line 24 is more than the tax you paid line 33 you ll owe taxes

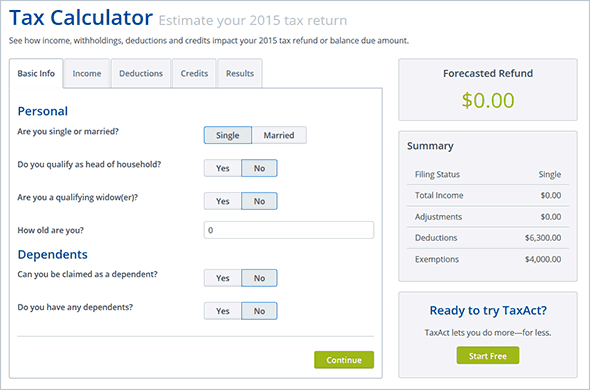

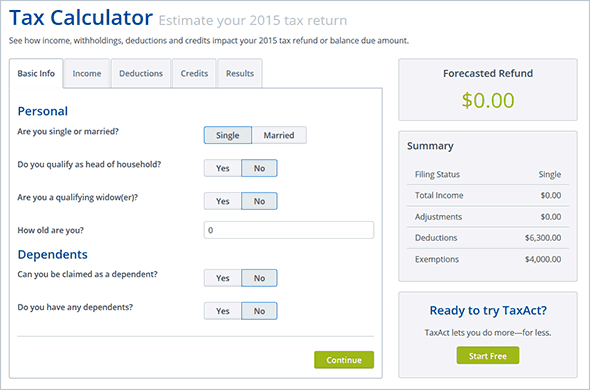

Start TurboTax for free The tax calculator estimates that I owe money How do I lower the amount The simplest way to lower the amount you owe is to adjust your tax withholdings on your W 4 Our W 4 Calculator can help you determine how to update your W 4 to get your desired tax outcome

The Tax Refund Formula have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: We can customize the design to meet your needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free cater to learners from all ages, making the perfect source for educators and parents.

-

Convenience: Access to numerous designs and templates is time-saving and saves effort.

Where to Find more Tax Refund Formula

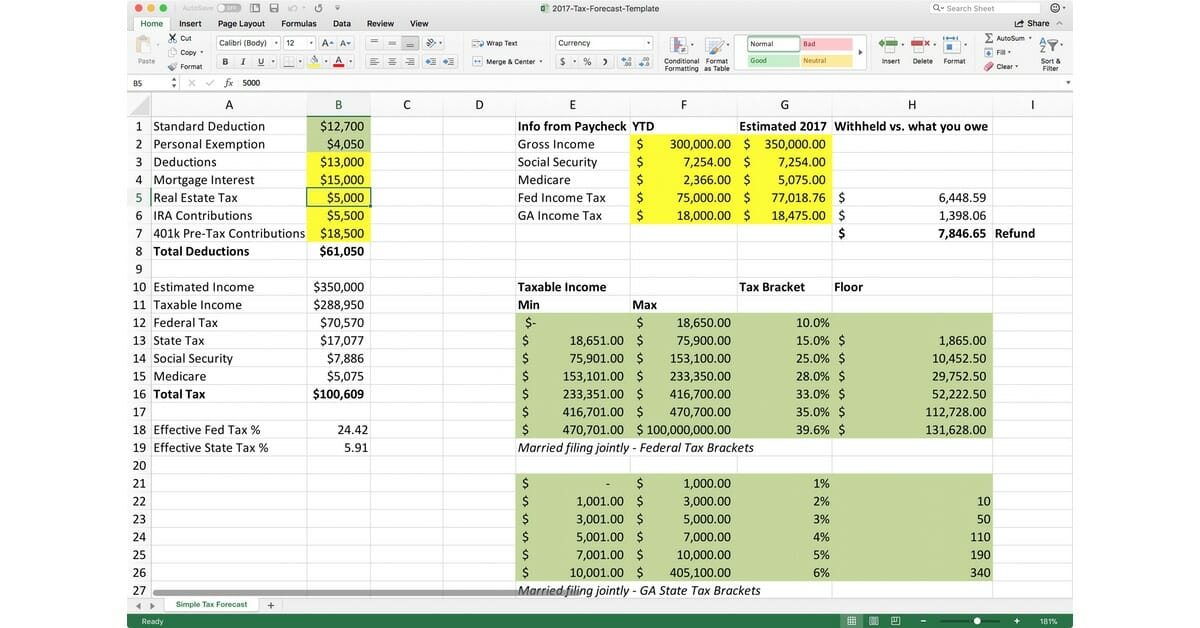

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

Generally your refund is calculated by how much money is withheld for federal income tax minus your total federal income tax for the year There are other factors too like deductions

Commissioner for Revenue Individuals Refunds Refunds Last Updated 06 04 2022 There are cases where the CFR needs to issue a refund to the taxpayer whether an individual a company a partnership or an organisation due to overpaid tax or a tax credit deduction resulting in a refund

Now that we've piqued your interest in Tax Refund Formula We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Tax Refund Formula for all uses.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide range of topics, all the way from DIY projects to party planning.

Maximizing Tax Refund Formula

Here are some fresh ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets for teaching at-home as well as in the class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Refund Formula are a treasure trove of practical and imaginative resources catering to different needs and desires. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the world that is Tax Refund Formula today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can print and download these tools for free.

-

Does it allow me to use free printables for commercial use?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with Tax Refund Formula?

- Some printables may have restrictions in use. Make sure you read these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in an in-store print shop to get high-quality prints.

-

What software do I require to view printables free of charge?

- The majority of printed documents are as PDF files, which can be opened with free software, such as Adobe Reader.

Calculate Income Tax Malaysia Amy Lyman

How To Calculate Tax Refund

Check more sample of Tax Refund Formula below

2022 Tax Brackets Calculator SabinaPriya

How To Calculate Real Rate Of Return With Inflation Forex Education

![]()

Looking Good Deferred Tax Calculation Format In Excel Llp Balance Sheet

Gross Payroll Calculator Canada Erwin Salary

Standard Deduction Tax Exemption And Deduction TaxAct Blog

Types Of Income Tax In The Philippines Bovenmen Shop

https://filipiknow.net/tax-refund-philippines

Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually

https://www.learntocalculate.com/calculate-tax-refund

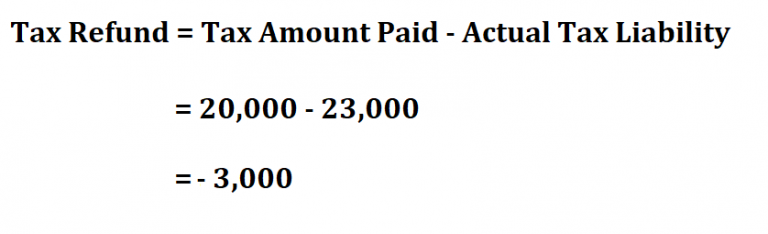

Formula to calculate tax refund To calculate your tax return you first need to know your tax liability Then find the difference of the amount you paid for tax and your actual tax liability Example If for instance your company paid 20 000 as tax calculate your tax refund if your actual tax liability was 23 000

Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually

Formula to calculate tax refund To calculate your tax return you first need to know your tax liability Then find the difference of the amount you paid for tax and your actual tax liability Example If for instance your company paid 20 000 as tax calculate your tax refund if your actual tax liability was 23 000

Gross Payroll Calculator Canada Erwin Salary

How To Calculate Real Rate Of Return With Inflation Forex Education

Standard Deduction Tax Exemption And Deduction TaxAct Blog

Types Of Income Tax In The Philippines Bovenmen Shop

Refund Formula For Export Without Payment Of Tax YouTube

How To Estimate Your Tax Refund Or Balance Due TaxAct Blog

How To Estimate Your Tax Refund Or Balance Due TaxAct Blog

Refund Formula TaxDose