Today, where screens dominate our lives however, the attraction of tangible printed objects hasn't waned. If it's to aid in education such as creative projects or simply adding some personal flair to your area, Tax Relief For Course Fees have proven to be a valuable source. For this piece, we'll dive to the depths of "Tax Relief For Course Fees," exploring the different types of printables, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Tax Relief For Course Fees Below

Tax Relief For Course Fees

Tax Relief For Course Fees -

HMRC has identified a number of training courses specific to the medical profession where relief for training costs incurred will qualify for tax relief This list is not exhaustive and may

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment towards the fees you must include this information when claiming the relief

Tax Relief For Course Fees provide a diverse range of downloadable, printable material that is available online at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and more. The value of Tax Relief For Course Fees lies in their versatility as well as accessibility.

More of Tax Relief For Course Fees

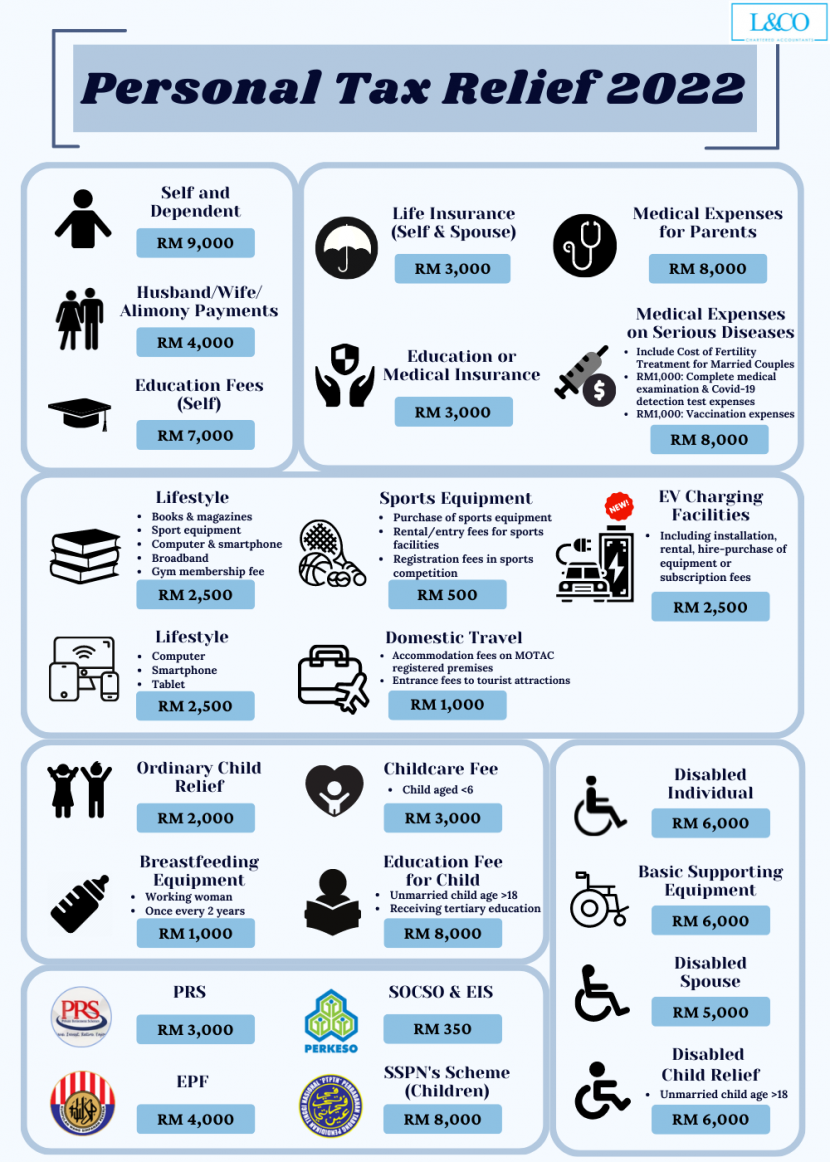

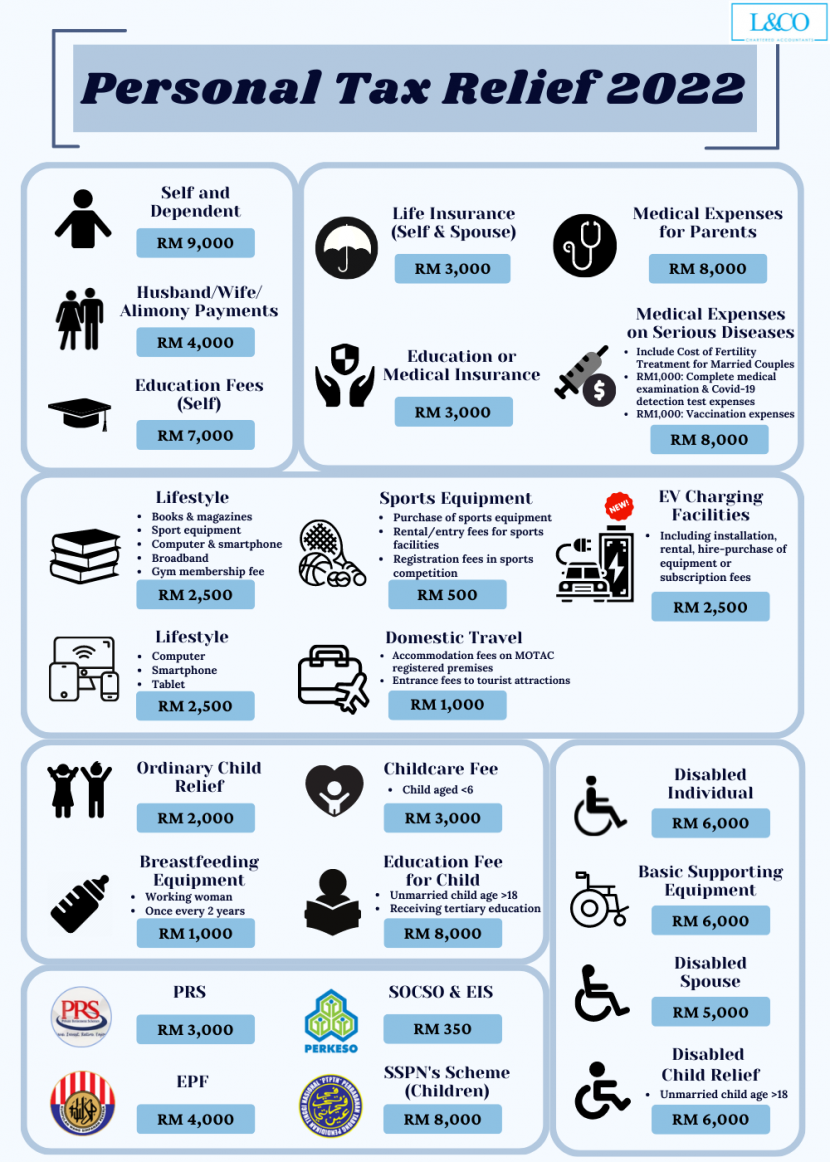

List Of Personal Tax Relief And Incentives In Malaysia 2023

List Of Personal Tax Relief And Incentives In Malaysia 2023

Under s776 ITTOIA 2005 employers can pay tax free scholarship or expenses of up to 15 000 pa I think to an employee in full time higher eduation No tax or National Insurance charge applies If the employee is the director s child it is a BIK on the director Thanks 1 By petersaxton

Page edited 11 October 2023 Tax relief is available in respect of tuition fees paid in private third level institutions in institutions abroad and by repeat students and part time students The Student Contribution may also qualify for relief

Tax Relief For Course Fees have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor printables to your specific needs for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Value: The free educational worksheets are designed to appeal to students of all ages, which makes them a valuable device for teachers and parents.

-

Accessibility: immediate access the vast array of design and templates will save you time and effort.

Where to Find more Tax Relief For Course Fees

California Franchise Tax Board Provides Tax Relief For Hurricane Ian

California Franchise Tax Board Provides Tax Relief For Hurricane Ian

Claiming this relief can result in a tax deduction of up to 1 100 depending on how much your course fees are the duration of your course full time vs part time and which tax year you make the claim This is one of the biggest and least known advantages of when financing your postgraduate education

The tax office recognize all costs for further education as income related expenses Werbungskosten without setting a limit These costs often come from seminars conferences or conventions Other typical further education costs can arise from Further education for your current job Retraining or re education

Now that we've ignited your interest in printables for free Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Tax Relief For Course Fees designed for a variety objectives.

- Explore categories such as home decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Tax Relief For Course Fees

Here are some unique ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Tax Relief For Course Fees are an abundance of practical and innovative resources that can meet the needs of a variety of people and passions. Their availability and versatility make them an essential part of both professional and personal life. Explore the plethora of Tax Relief For Course Fees right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Relief For Course Fees really available for download?

- Yes they are! You can download and print these items for free.

-

Can I utilize free templates for commercial use?

- It's based on specific conditions of use. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables could be restricted in use. Check the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit a local print shop to purchase the highest quality prints.

-

What program do I need to run printables free of charge?

- Most printables come in the format PDF. This is open with no cost software like Adobe Reader.

Tax Relief Announced For Homeowners Going Solar Flipboard

IRS Provides Tax Relief For Hurricane Ian Victims In Florida Tax

Check more sample of Tax Relief For Course Fees below

I Believe In You Quotes For Daughter

Personal Tax Relief 2022 L Co Accountants

List Of Personal Tax Relief And Incentives In Malaysia 2023

Malaysia Personal Income Tax Relief 2022

Flipboard QBiz No Corporate Tax Relief For Large Companies In Budget

Tax relief RateMuse

https://www.revenue.ie/en/personal-tax-credits...

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment towards the fees you must include this information when claiming the relief

https://www.revenue.ie/en/personal-tax-credits...

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college Other charges and levies do not qualify for relief such as administration fees student centre levy sports centre charge

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment towards the fees you must include this information when claiming the relief

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college Other charges and levies do not qualify for relief such as administration fees student centre levy sports centre charge

Malaysia Personal Income Tax Relief 2022

Personal Tax Relief 2022 L Co Accountants

Flipboard QBiz No Corporate Tax Relief For Large Companies In Budget

Tax relief RateMuse

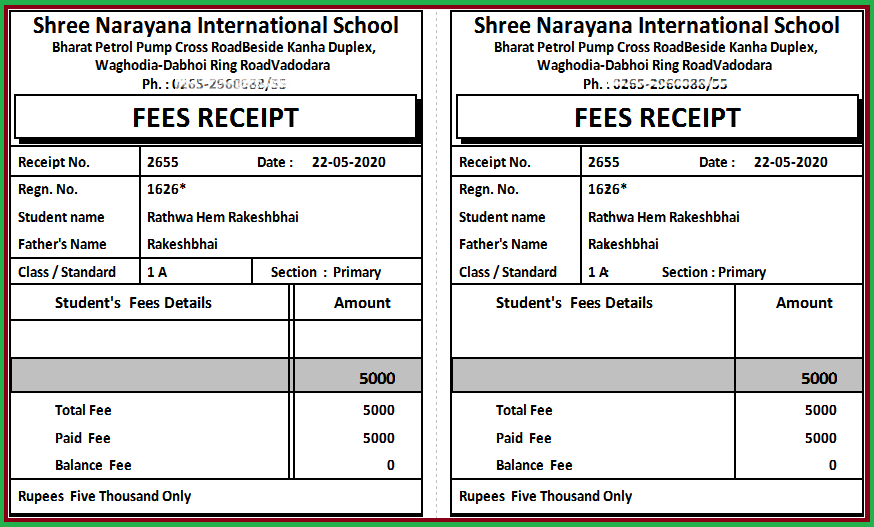

Fee Slip Format For School Toparhitecti ro

Tax Relief For 2023

Tax Relief For 2023

Tax Relief For Tuition Fees 2014 2015