In the age of digital, in which screens are the norm yet the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education as well as creative projects or simply to add an element of personalization to your area, Tax Return On Death Canada are now a vital source. We'll dive through the vast world of "Tax Return On Death Canada," exploring what they are, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Return On Death Canada Below

Tax Return On Death Canada

Tax Return On Death Canada -

2024 01 23 Learn what you ll need to do when someone has died such as how to report the date of death to the CRA access tax records as a representative file a Final Return and estate tax return and settling the estate

Prepare tax returns for someone who died Death benefits On this page CPP QPP death benefit Death benefit from an employer CPP QPP death benefit The CPP or QPP death benefit is a one time lump sum payment generally made to the estate upon the death of a CPP or QPP contributor

Printables for free cover a broad assortment of printable, downloadable materials available online at no cost. These resources come in many forms, like worksheets templates, coloring pages and more. The appealingness of Tax Return On Death Canada is their flexibility and accessibility.

More of Tax Return On Death Canada

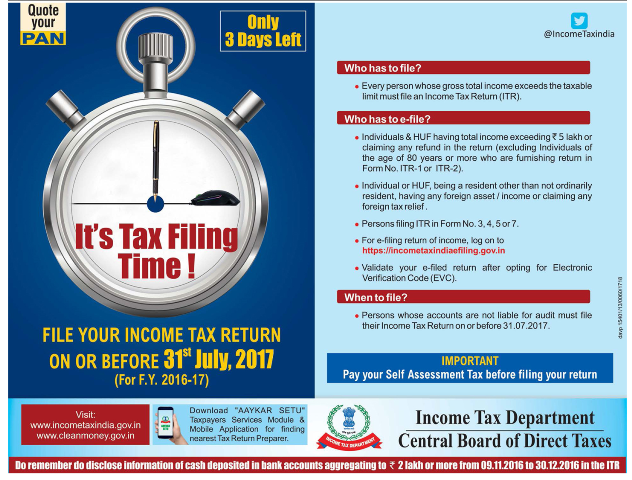

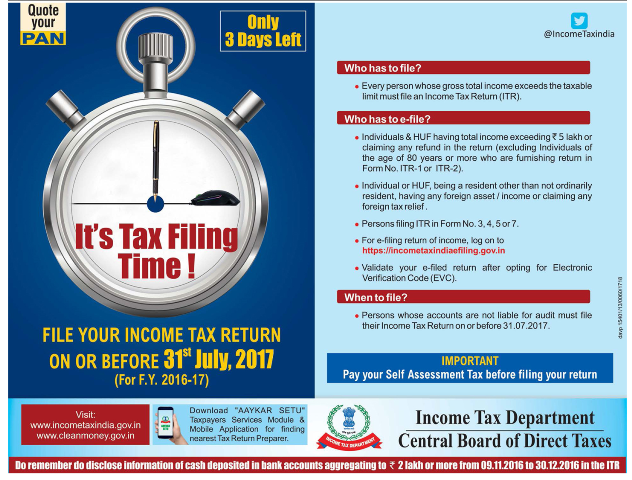

4 Days Left Penalty And Loss Of Benefits If You Miss Tax Return

4 Days Left Penalty And Loss Of Benefits If You Miss Tax Return

All deductions and tax credits can be claimed on the Final Return for the person who died However if you are filing one or more optional T1 returns you may also be able to split certain deductions or tax credits between the returns

Apart from legal costs a deceased person s assets may be subject to two main types of levies income taxes and probate taxes or fees As far as income tax is concerned a deceased individual is generally deemed to have disposed of their property at fair market value at the time of death

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring the templates to meet your individual needs, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Use: These Tax Return On Death Canada provide for students from all ages, making them a useful tool for parents and teachers.

-

Convenience: instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Return On Death Canada

When To Lodge A Date Of Death Tax Return Paris Financial Accounting

When To Lodge A Date Of Death Tax Return Paris Financial Accounting

Taxes By Debbie Stanley TEP MTI on January 12 2023 Estimated reading time 6 minutes The final tax return after death How it gets done in Canada Presented By Scotiabank What tax

File the returns Prepare tax returns for someone who died Canada ca Once you know what to report and claim on the final tax returns you can fill out and submit the returns On this page T1 Income Tax and Benefit Returns Final Return Optional T1 returns Labelling the tax returns T3 Trust Income Tax and Information Return

We hope we've stimulated your interest in Tax Return On Death Canada, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Tax Return On Death Canada for all objectives.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad spectrum of interests, everything from DIY projects to planning a party.

Maximizing Tax Return On Death Canada

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Return On Death Canada are an abundance of useful and creative resources for a variety of needs and interests. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of Tax Return On Death Canada and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial purposes?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in Tax Return On Death Canada?

- Certain printables might have limitations in their usage. Check the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home using any printer or head to a print shop in your area for high-quality prints.

-

What software do I require to view printables that are free?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

What Is Line 10100 On Tax Return Formerly Line 101

Michael Ryan Mousterpiece Death Canada Jordquest

Check more sample of Tax Return On Death Canada below

Why Should You File Your Income Tax Return On Time

Mesothelioma Death Canada

What Is Line 10100 On Tax Return formerly 101 Notice Of Assessment

T2 Short Form Fillable Printable Forms Free Online

Amending Your Income Tax Return TurboTax Tax Tips Videos

Society Annual Return Alberta Fill Out Sign Online DocHub

https://www.canada.ca/.../death-benefits.html

Prepare tax returns for someone who died Death benefits On this page CPP QPP death benefit Death benefit from an employer CPP QPP death benefit The CPP or QPP death benefit is a one time lump sum payment generally made to the estate upon the death of a CPP or QPP contributor

https://www.canada.ca/en/revenue-agency/services/...

If a person dies early in 2024 on or before the filing due date for their 2023 T1 Return and they have not filed that return the due date for filing that return and paying any balance owing is 6 months after the date of death on the same calendar day as the date of death

Prepare tax returns for someone who died Death benefits On this page CPP QPP death benefit Death benefit from an employer CPP QPP death benefit The CPP or QPP death benefit is a one time lump sum payment generally made to the estate upon the death of a CPP or QPP contributor

If a person dies early in 2024 on or before the filing due date for their 2023 T1 Return and they have not filed that return the due date for filing that return and paying any balance owing is 6 months after the date of death on the same calendar day as the date of death

T2 Short Form Fillable Printable Forms Free Online

Mesothelioma Death Canada

Amending Your Income Tax Return TurboTax Tax Tips Videos

Society Annual Return Alberta Fill Out Sign Online DocHub

Canadian Tax Return Basics For Newcomers To Canada IsMigration

Income Tax Department Only 3Days Left File Your Income Tax Return On Or

Income Tax Department Only 3Days Left File Your Income Tax Return On Or

Yaum E Pakistan Gift FREE TAX RETURN On March 24 2018 Pakistan