Today, when screens dominate our lives yet the appeal of tangible printed products hasn't decreased. Whether it's for educational purposes or creative projects, or simply to add personal touches to your space, Tax Return On Student Loans are now a useful resource. With this guide, you'll dive deep into the realm of "Tax Return On Student Loans," exploring what they are, how to find them, and how they can improve various aspects of your daily life.

Get Latest Tax Return On Student Loans Below

Tax Return On Student Loans

Tax Return On Student Loans -

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Tax Return On Student Loans cover a large variety of printable, downloadable materials available online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and many more. The benefit of Tax Return On Student Loans lies in their versatility as well as accessibility.

More of Tax Return On Student Loans

Professional Development See The Light Bathing Revealing By Tucker

Professional Development See The Light Bathing Revealing By Tucker

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid

You ll need to complete the student or postgraduate loan repayment section of your Self Assessment tax return if the Student Loans Company SLC has said your

The Tax Return On Student Loans have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: You can tailor printed materials to meet your requirements, whether it's designing invitations planning your schedule or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them an invaluable instrument for parents and teachers.

-

An easy way to access HTML0: instant access a variety of designs and templates is time-saving and saves effort.

Where to Find more Tax Return On Student Loans

The IRS Wants Taxpayers To Know It Stands Ready To Help In The Event Of

The IRS Wants Taxpayers To Know It Stands Ready To Help In The Event Of

You may be eligible to deduct the interest you paid on your student loans on your taxes Note that the amount of your student loan interest tax deduction or whether you re eligible for one is

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You

If we've already piqued your interest in Tax Return On Student Loans Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of motives.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing Tax Return On Student Loans

Here are some new ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Return On Student Loans are an abundance with useful and creative ideas that cater to various needs and pursuits. Their access and versatility makes them an invaluable addition to the professional and personal lives of both. Explore the vast array of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printables for commercial use?

- It's all dependent on the conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may have restrictions on use. Be sure to review the terms and conditions provided by the designer.

-

How can I print Tax Return On Student Loans?

- Print them at home with printing equipment or visit an area print shop for top quality prints.

-

What program must I use to open printables that are free?

- The majority of PDF documents are provided in PDF format. These can be opened with free software, such as Adobe Reader.

Pin On BREAKING NEWS II

Tax Return Tax Return On Student Loans

Check more sample of Tax Return On Student Loans below

How To Answer FAFSA Question 30 31 Income Tax Return Details

How To Fill Out FAFSA Step By Step Guide Hey You Need A Plan

How Can You Find Out If You Paid Taxes On Student Loans

Student Loan Forgiveness Or Discharge Can Create A Huge Tax Bill Watch

Should I Use Tax Credits Or Deductions To Save On My Student Loans

How To Answer FAFSA Question 88 Parents Additional Financial Information

https://www.forbes.com › advisor › taxe…

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

https://www.forbes.com › advisor › taxes › student-loans-taxes

Paying or defaulting on student loans and having student loan debt forgiven can have an impact on your tax return Check out these tips before you file

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Paying or defaulting on student loans and having student loan debt forgiven can have an impact on your tax return Check out these tips before you file

Student Loan Forgiveness Or Discharge Can Create A Huge Tax Bill Watch

How To Fill Out FAFSA Step By Step Guide Hey You Need A Plan

Should I Use Tax Credits Or Deductions To Save On My Student Loans

How To Answer FAFSA Question 88 Parents Additional Financial Information

How To Avoid An IRS Audit Debt Relief Programs Irs Credit Card Relief

Irs Forms Tax Return Student Loans Car Buying Freedom Knowledge

Irs Forms Tax Return Student Loans Car Buying Freedom Knowledge

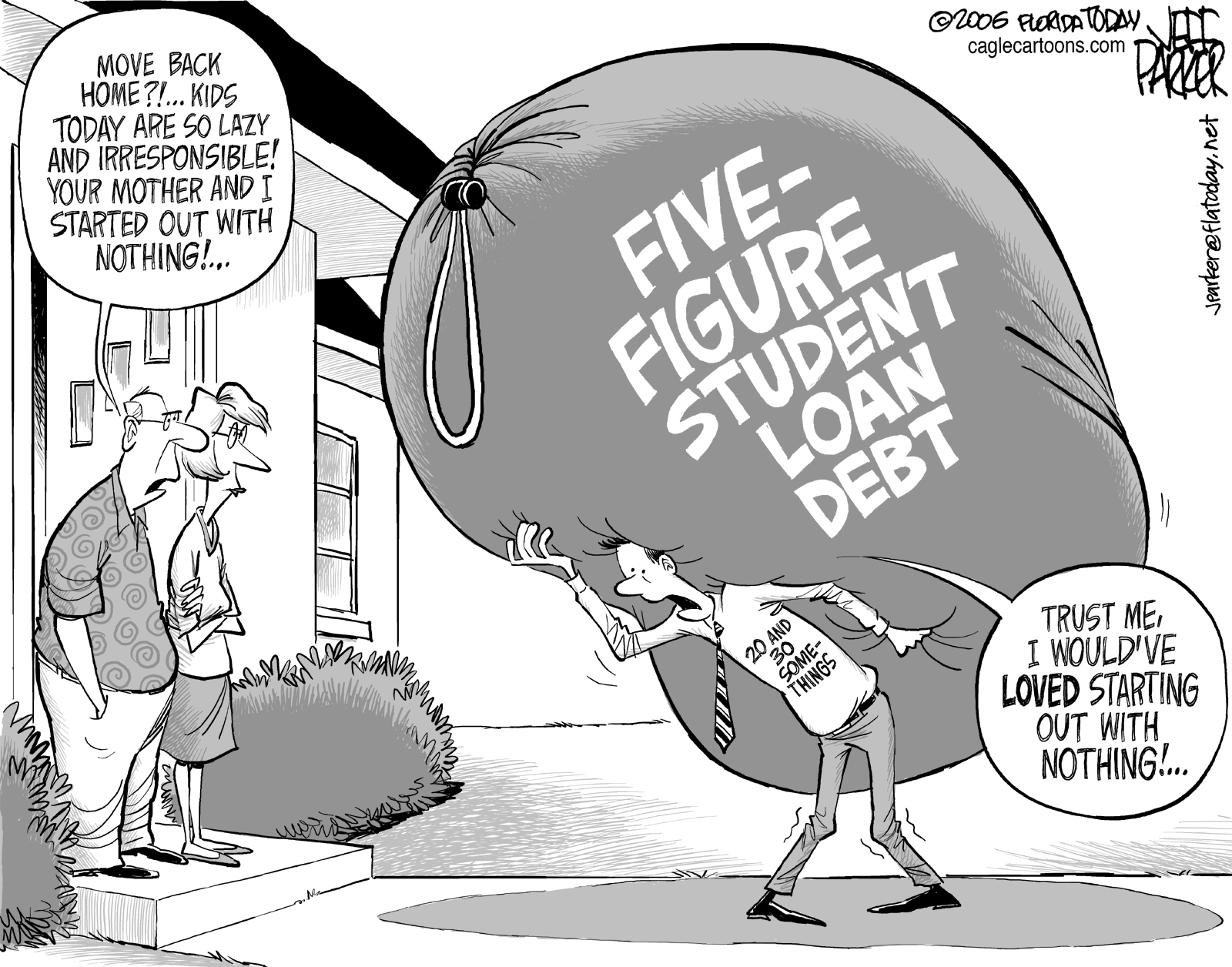

Jobsanger Deal On Student Loans Maybe