In this digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. Be it for educational use and creative work, or just adding some personal flair to your home, printables for free are now a useful source. For this piece, we'll take a dive deep into the realm of "Tax Return Student Loan," exploring the benefits of them, where they are, and how they can enhance various aspects of your daily life.

Get Latest Tax Return Student Loan Below

Tax Return Student Loan

Tax Return Student Loan -

1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Tax Return Student Loan provide a diverse range of printable, free items that are available online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages, and many more. The beauty of Tax Return Student Loan is their flexibility and accessibility.

More of Tax Return Student Loan

Student Loan Interest Deduction For Individuals MiklosCPA

Student Loan Interest Deduction For Individuals MiklosCPA

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

Student loans can impact your federal income tax return in several ways from reducing your taxable income to losing your refund depending on your situation Here s what

Tax Return Student Loan have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Individualization This allows you to modify the templates to meet your individual needs when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: The free educational worksheets provide for students of all ages, making them a useful tool for parents and teachers.

-

It's easy: The instant accessibility to the vast array of design and templates reduces time and effort.

Where to Find more Tax Return Student Loan

Pin On Safety First On Garbage Day

Pin On Safety First On Garbage Day

Student loans aren t taxable because you ll eventually repay them Free money used for school is treated differently You don t pay taxes on scholarship or fellowship money used toward

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

If we've already piqued your interest in printables for free and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in Tax Return Student Loan for different applications.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Tax Return Student Loan

Here are some ideas for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free for teaching at-home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Return Student Loan are a treasure trove with useful and creative ideas that cater to various needs and passions. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the many options of Tax Return Student Loan now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free printables for commercial use?

- It depends on the specific rules of usage. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright violations with Tax Return Student Loan?

- Some printables could have limitations on usage. Make sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- You can print them at home with your printer or visit the local print shops for higher quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in the format PDF. This can be opened using free software such as Adobe Reader.

Here s Why You May Be Getting A Tax Break Tax Return Student Loan

To IRS Willful Means Penalties Or Jail Income Tax Tax Refund

Check more sample of Tax Return Student Loan below

Tax Return Student Loan Repayments Ppt Powerpoint Presentation Visual

Houston Bookkeepers Tip The 4 Ways To Pay For College And How They

The Important Tax Deduction Tip Every Parent Needs To Read Student

Student Loans 2023 What Borrowers Need To Know About Filing Taxes

1040Now Review Misses The Mark In 2021 Tax Software Income Tax

Pachuca Vs Atlas Incre ble Serenata De Pachuca Previo A La Final De La

https://www.forbes.com/advisor/taxes/…

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid

Student Loans 2023 What Borrowers Need To Know About Filing Taxes

Houston Bookkeepers Tip The 4 Ways To Pay For College And How They

1040Now Review Misses The Mark In 2021 Tax Software Income Tax

Pachuca Vs Atlas Incre ble Serenata De Pachuca Previo A La Final De La

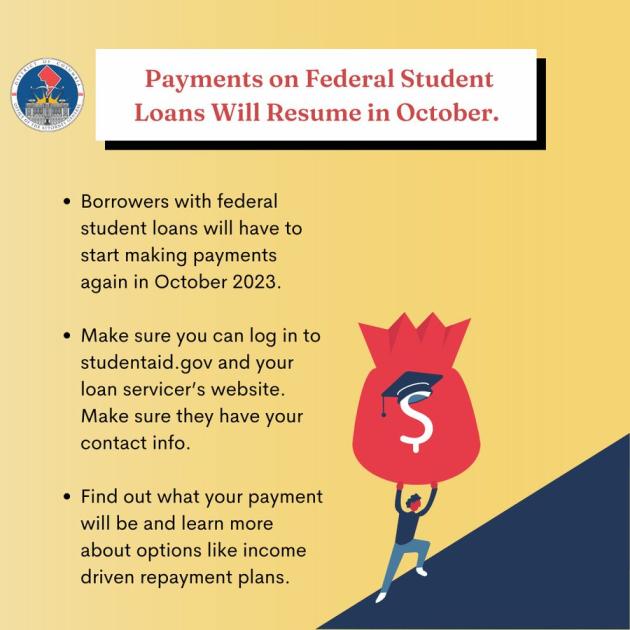

Consumer Alert Payments On Federal Student Loans Will Resume In October

How Student Loan Payments Are Changing From September

How Student Loan Payments Are Changing From September

Student Loan For Tax Returns New Scholars Hub