Today, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. For educational purposes project ideas, artistic or simply adding an individual touch to your area, Tertiary Education Tax Deductions Trinidad are a great source. This article will dive deep into the realm of "Tertiary Education Tax Deductions Trinidad," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tertiary Education Tax Deductions Trinidad Below

Tertiary Education Tax Deductions Trinidad

Tertiary Education Tax Deductions Trinidad -

You can file a TD1 form if you have one or more of the items below These items form part of approved deductible before the calculation of your income tax These allowable expenses are Tertiary Education Expenses Institution situated outside of Trinidad Tobago First Time Home Owner Deduction Approved Deferred Annuity Contributions

These deductions are current as of tax year 2014 except where otherwise stated Tertiary Education Expenses limited to 72 000 as of 01 01 2019 Acceptance Letter Proof of Payment Statement of Expenses Only fees payments made to a foreign Tertiary Institution will be allowed as an expense First Time Home Owner limited to 30 000 as of

Tertiary Education Tax Deductions Trinidad cover a large range of printable, free materials available online at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and much more. The appeal of printables for free is in their variety and accessibility.

More of Tertiary Education Tax Deductions Trinidad

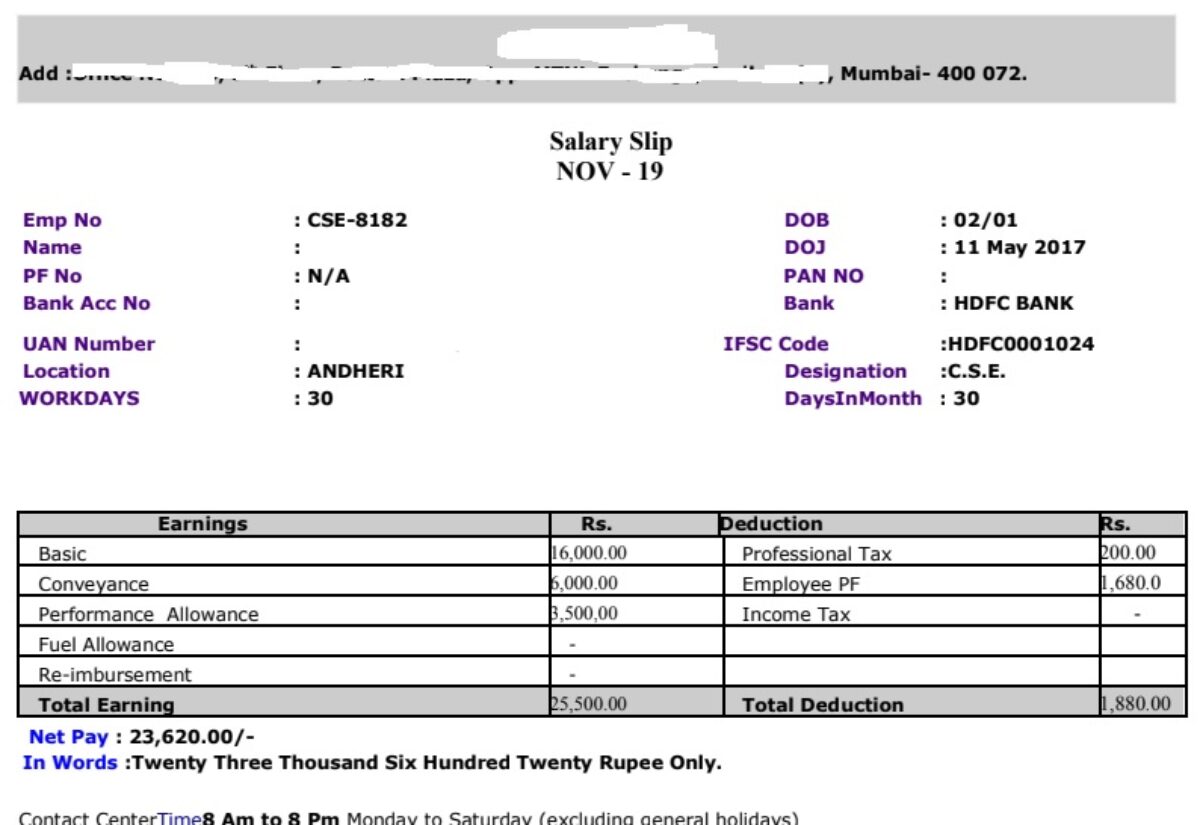

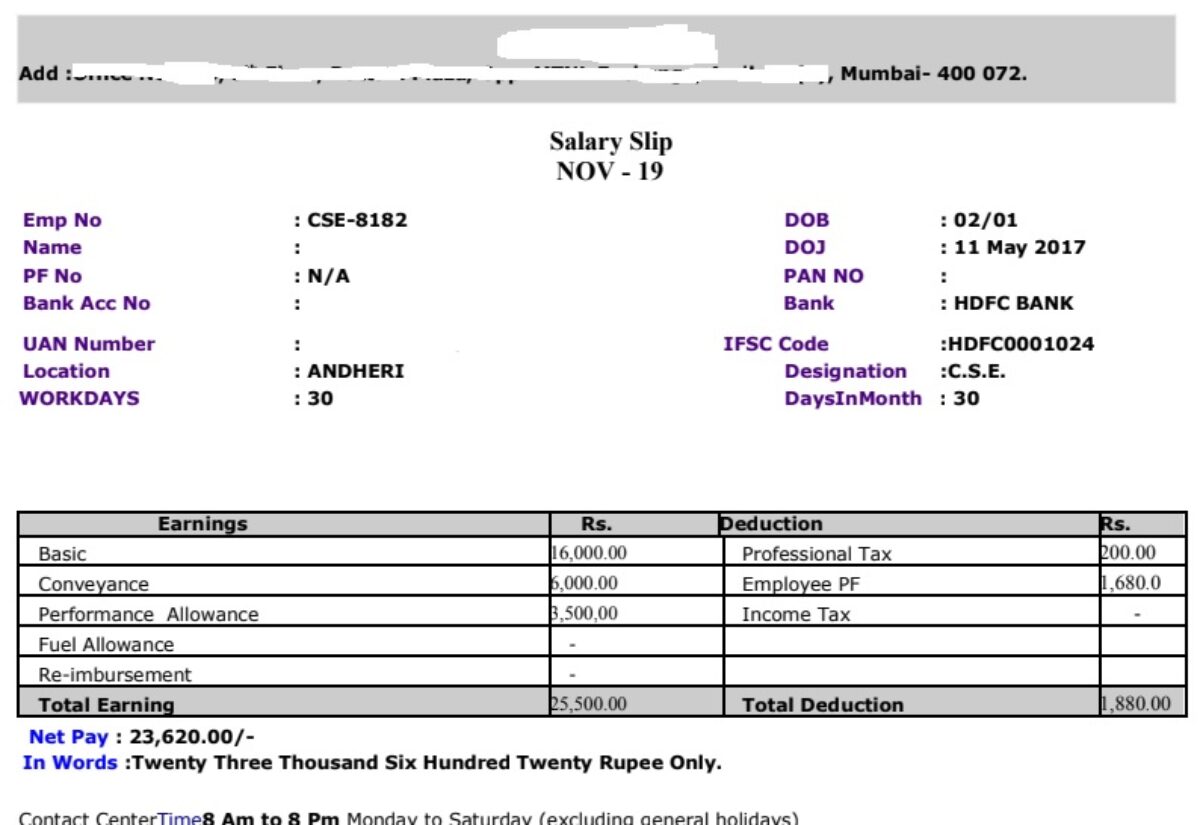

Payslip Format Word Azgardwee

Payslip Format Word Azgardwee

Individual Income Tax Deductions Allowances by Income Year 2016 to 2021 Only payments made to the foreign person or institution are allowed You are allowed only one return travel per year Claims are not allowed for Institutions within the Region apart from St George s University which is considered a US Institution

Tertiary Education Deduction A deduction is granted in respect of expenses incurred on tertiary education at institutions other than local and regional public institutions situated within or outside of Trinidad and Tobago and approved by the Ministry of Education for the taxpayer or his spouse or the children of both spouses The

Tertiary Education Tax Deductions Trinidad have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize designs to suit your personal needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Printables for education that are free offer a wide range of educational content for learners from all ages, making them an invaluable source for educators and parents.

-

The convenience of You have instant access various designs and templates saves time and effort.

Where to Find more Tertiary Education Tax Deductions Trinidad

Education Tax Credits And Deductions Regal Financial Group

Education Tax Credits And Deductions Regal Financial Group

Tertiary Education This deduction is primarily for the parents whose children are attending full time university outside of Trinidad and Tobago Expenses are limited to TT 72 000 per household so if you have more than one child

Allowance of TT 60 000 8860 for tertiary education completed at a foreign institution Pension deferred annuity aggregated with NIS of TT 50 000 7390 70 of NIS contributions First time homeowner allowance of TT 25 000 3690 per household for

If we've already piqued your interest in Tertiary Education Tax Deductions Trinidad Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of uses.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing Tertiary Education Tax Deductions Trinidad

Here are some unique ways create the maximum value use of Tertiary Education Tax Deductions Trinidad:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free for teaching at-home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tertiary Education Tax Deductions Trinidad are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and passions. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the many options of Tertiary Education Tax Deductions Trinidad to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can download and print the resources for free.

-

Can I utilize free templates for commercial use?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright issues with Tertiary Education Tax Deductions Trinidad?

- Certain printables could be restricted regarding their use. Be sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home with an printer, or go to a local print shop for better quality prints.

-

What program will I need to access printables at no cost?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software like Adobe Reader.

IRD Am I Self Employed Or A Sole Trader

.png)

Elon Musk Loses World s Richest Spot To Louis Vuitton Owner Bernard

Check more sample of Tertiary Education Tax Deductions Trinidad below

GATE Downsizing Linked To precipitous Fall In Tertiary Education

IRD Am I Self Employed Or A Sole Trader

.png)

Tax And Financial Enviorment Of Trinidad And Tobago Insights For 2022

The Three Most Important Education Tax Deductions And Credits For 2015

Special Education Tax Deductions Tax Strategies For Parents

Tag Archive For withholding Tax On Rental Expense Philippines Tax

https://www.ird.gov.tt › individual › deductions-and...

These deductions are current as of tax year 2014 except where otherwise stated Tertiary Education Expenses limited to 72 000 as of 01 01 2019 Acceptance Letter Proof of Payment Statement of Expenses Only fees payments made to a foreign Tertiary Institution will be allowed as an expense First Time Home Owner limited to 30 000 as of

https://taxsummaries.pwc.com › Trinidad-and-Tobago › ...

A resident individual is entitled to a deduction in respect of the following Tertiary education expenses up to a maximum of TTD 72 000 Aggregation of contributions to approved pension funds annuity plans and National Insurance up to a maximum sum of TTD 60 000

These deductions are current as of tax year 2014 except where otherwise stated Tertiary Education Expenses limited to 72 000 as of 01 01 2019 Acceptance Letter Proof of Payment Statement of Expenses Only fees payments made to a foreign Tertiary Institution will be allowed as an expense First Time Home Owner limited to 30 000 as of

A resident individual is entitled to a deduction in respect of the following Tertiary education expenses up to a maximum of TTD 72 000 Aggregation of contributions to approved pension funds annuity plans and National Insurance up to a maximum sum of TTD 60 000

The Three Most Important Education Tax Deductions And Credits For 2015

.png)

IRD Am I Self Employed Or A Sole Trader

Special Education Tax Deductions Tax Strategies For Parents

Tag Archive For withholding Tax On Rental Expense Philippines Tax

Trinidad And Tobago Population Of The Official Age For Tertiary

Education Tax Credits And Deductions Guide Nj

Education Tax Credits And Deductions Guide Nj

THA To Attend Conference On Improving Tertiary Education Trinidad And