In the age of digital, with screens dominating our lives and the appeal of physical printed items hasn't gone away. In the case of educational materials for creative projects, just adding an element of personalization to your area, Travel Allowance Tax Deduction are now an essential resource. We'll take a dive into the sphere of "Travel Allowance Tax Deduction," exploring their purpose, where to find them, and how they can improve various aspects of your life.

Get Latest Travel Allowance Tax Deduction Below

Travel Allowance Tax Deduction

Travel Allowance Tax Deduction -

A travel allowance expense is a deductible travel expense you incur when you re travelling away from your home overnight to perform your employment duties that you

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related

Travel Allowance Tax Deduction offer a wide range of downloadable, printable materials available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages, and more. The beauty of Travel Allowance Tax Deduction is in their versatility and accessibility.

More of Travel Allowance Tax Deduction

Teacher voters Protest Against 20 Tax Deduction Of Travel Allowance

Teacher voters Protest Against 20 Tax Deduction Of Travel Allowance

It is important for both employers and employees to understand the tax rules and regulations governing travel allowances including exemption limits proof of travel taxation

Last updated 24 August 2021 Print or Download Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they

Travel Allowance Tax Deduction have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring designs to suit your personal needs in designing invitations planning your schedule or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them a vital instrument for parents and teachers.

-

An easy way to access HTML0: Quick access to a plethora of designs and templates saves time and effort.

Where to Find more Travel Allowance Tax Deduction

Why You Need Emigration Tax Clearance Tax Leaders

Why You Need Emigration Tax Clearance Tax Leaders

The Income tax Act 1961 offers various tax exemptions including Leave Travel Allowance LTA for salaried employees LTA can be claimed for domestic travel within India with valid proof of travel The exemption is limited to actual travel

The first year limit on the depreciation deduction special depreciation allowance and section 179 deduction for vehicles acquired before September 28 2017 and placed in service during

We've now piqued your curiosity about Travel Allowance Tax Deduction we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Travel Allowance Tax Deduction to suit a variety of purposes.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing Travel Allowance Tax Deduction

Here are some inventive ways how you could make the most use of Travel Allowance Tax Deduction:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Travel Allowance Tax Deduction are an abundance of innovative and useful resources that can meet the needs of a variety of people and passions. Their accessibility and versatility make they a beneficial addition to both professional and personal life. Explore the vast array of Travel Allowance Tax Deduction today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can print and download the resources for free.

-

Are there any free printouts for commercial usage?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Always read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to an in-store print shop to get premium prints.

-

What program do I need to open printables free of charge?

- Most printables come in PDF format, which can be opened with free software like Adobe Reader.

How To Claim HRA Allowance House Rent Allowance Exemption

Help Taxman Help You The Citizen

Check more sample of Travel Allowance Tax Deduction below

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

The Prescribed Travel Rate Per KM Increases And The Determined Travel

Income Tax Savings HRA

Reservists Eligible For Travel Tax Deduction 512th Airlift Wing

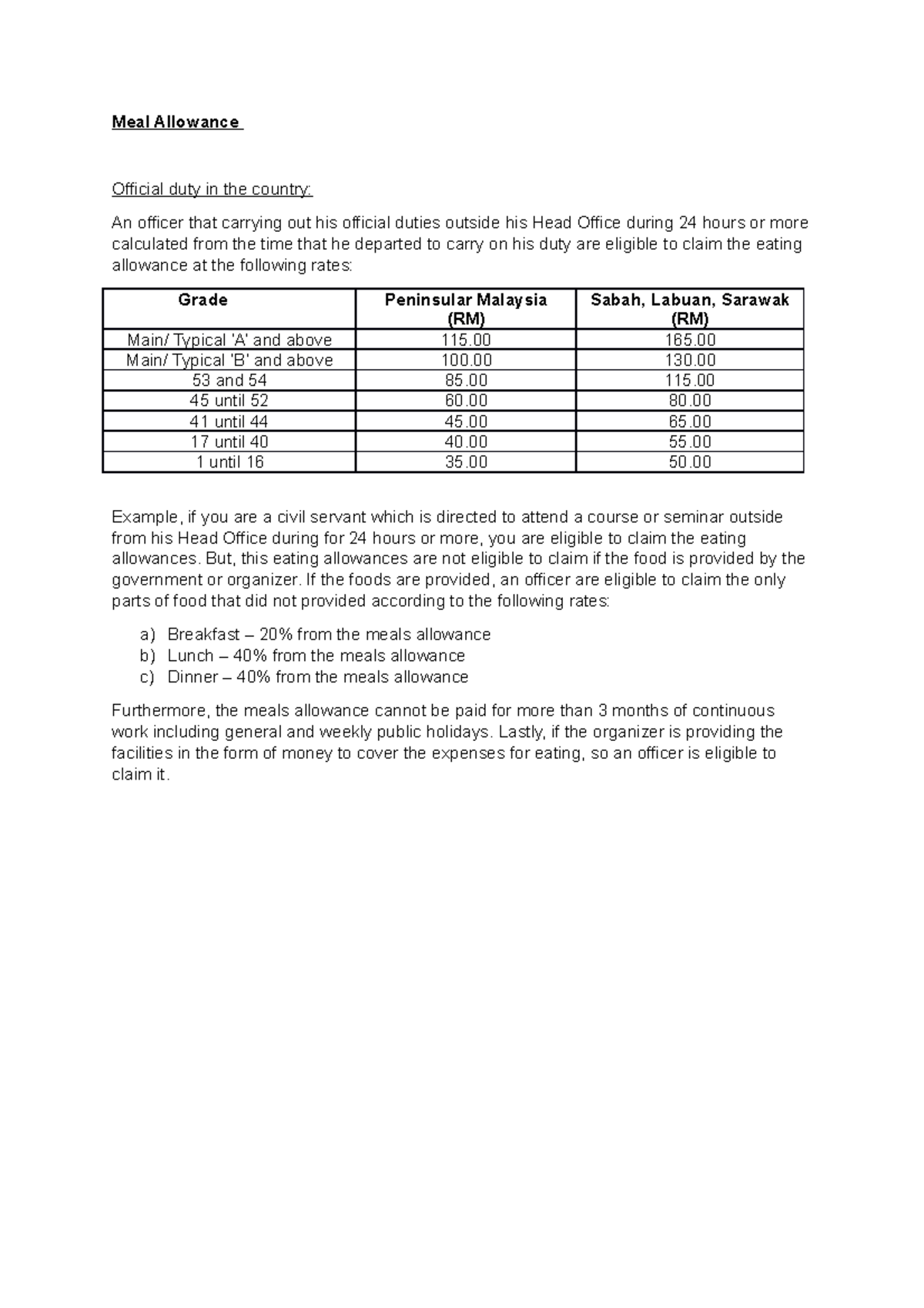

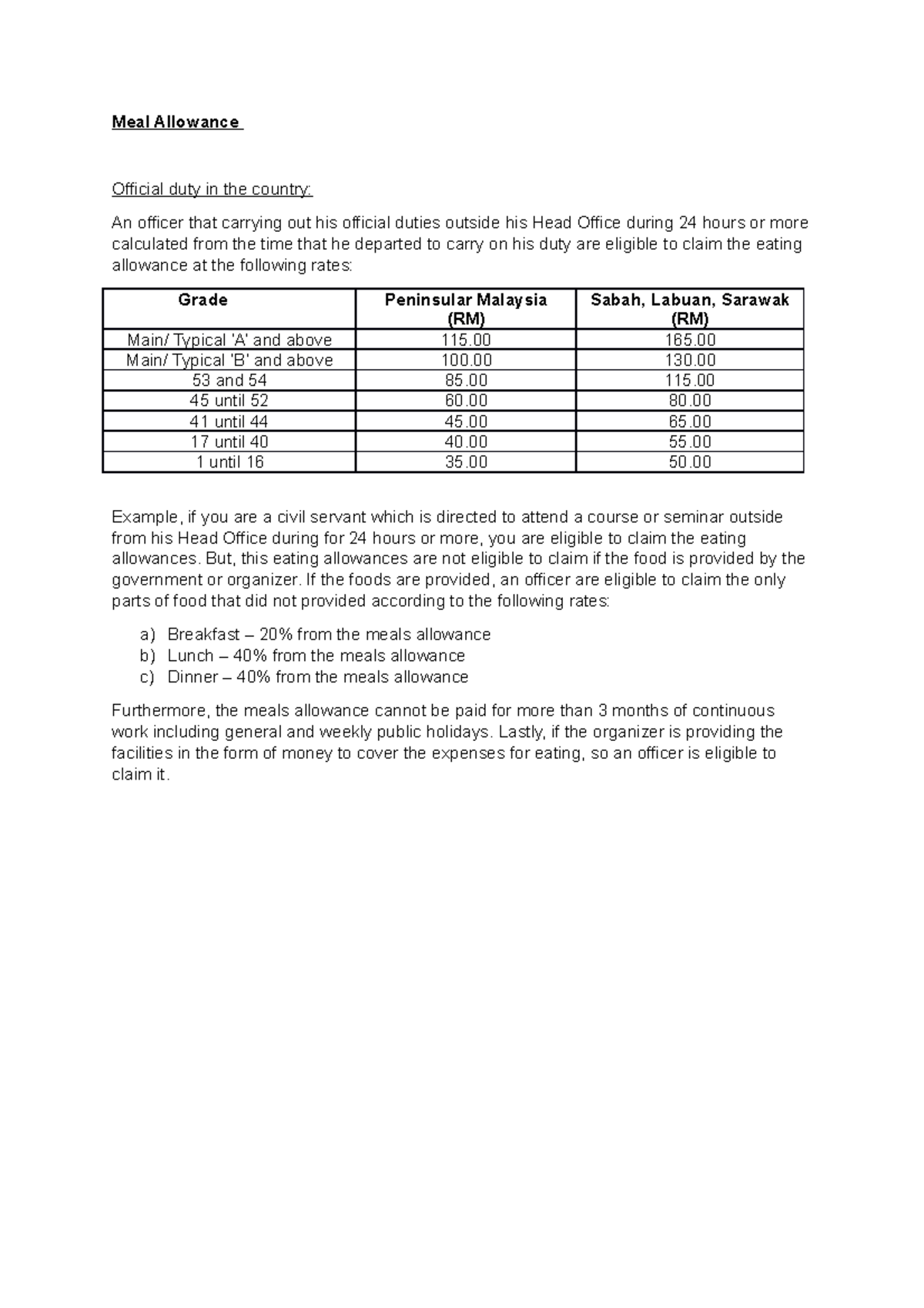

Meal Allowance General Order In Malaysia Meal Allowance Official Duty

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

https://www.vero.fi/en/individuals/deductions/...

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related

https://www.vero.fi/en/individuals/deductions/...

The personal liability threshold for commuting expenses is 900 The Tax Administration first subtracts the personal liability threshold of 900 750 in 2023 from your

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related

The personal liability threshold for commuting expenses is 900 The Tax Administration first subtracts the personal liability threshold of 900 750 in 2023 from your

Reservists Eligible For Travel Tax Deduction 512th Airlift Wing

The Prescribed Travel Rate Per KM Increases And The Determined Travel

Meal Allowance General Order In Malaysia Meal Allowance Official Duty

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

How To Make The Most Out Of Your Business Travel Tax Tips With A CPA

What Is Leave Travel Allowance Or LTA

What Is Leave Travel Allowance Or LTA

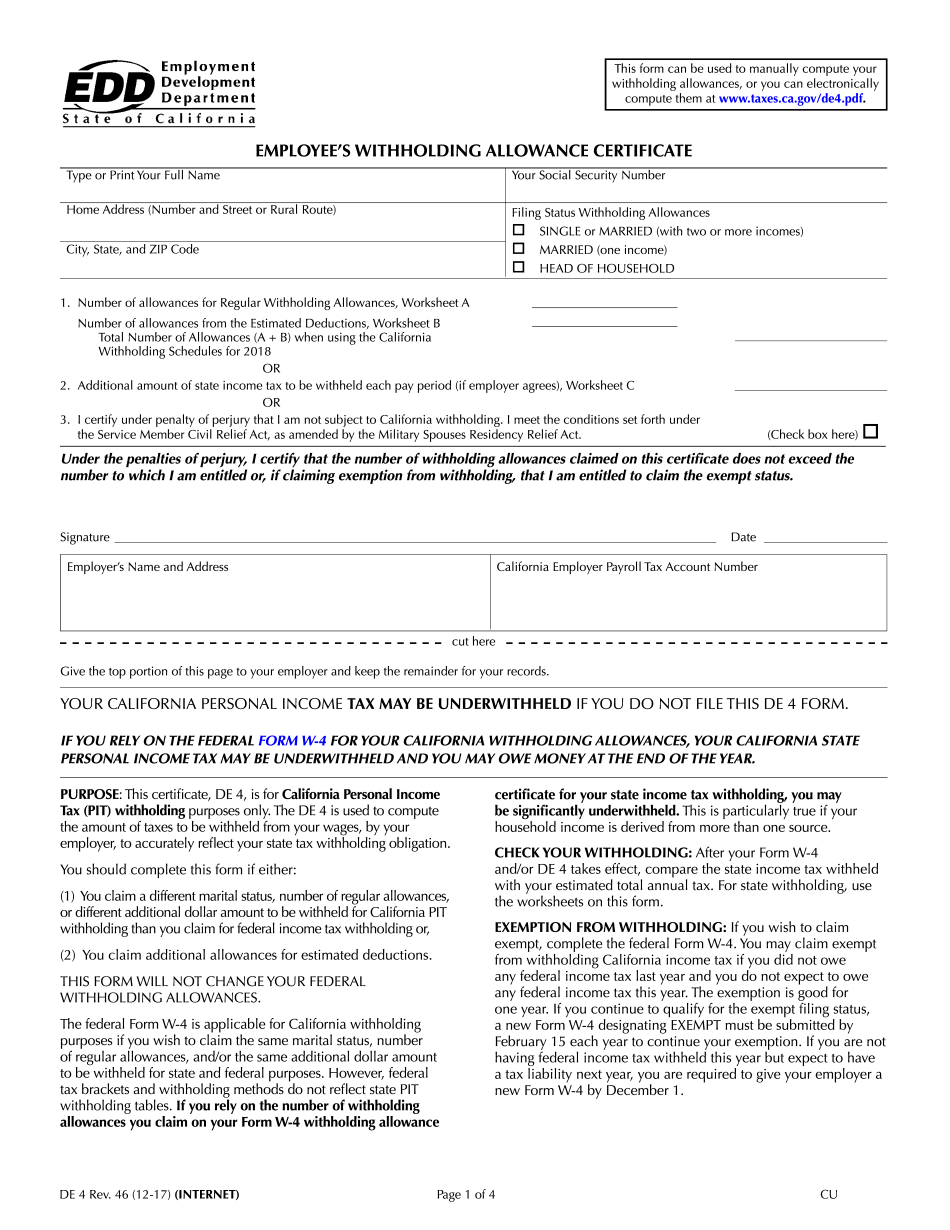

Ca W4 Allowances 2022 W4 Form