In a world with screens dominating our lives, the charm of tangible printed products hasn't decreased. Whatever the reason, whether for education as well as creative projects or just adding an extra personal touch to your space, Travel Expenses Tax Deduction 2023 are now a useful source. In this article, we'll take a dive into the sphere of "Travel Expenses Tax Deduction 2023," exploring what they are, where to find them, and how they can add value to various aspects of your life.

Get Latest Travel Expenses Tax Deduction 2023 Below

Travel Expenses Tax Deduction 2023

Travel Expenses Tax Deduction 2023 -

Car and travel expenses 2023 You may be able to claim deductions for work related car expenses and work related travel expenses

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related reason There must be an employee employer relationship between yourself and the company

Printables for free include a vast variety of printable, downloadable resources available online for download at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and many more. The appealingness of Travel Expenses Tax Deduction 2023 is in their versatility and accessibility.

More of Travel Expenses Tax Deduction 2023

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

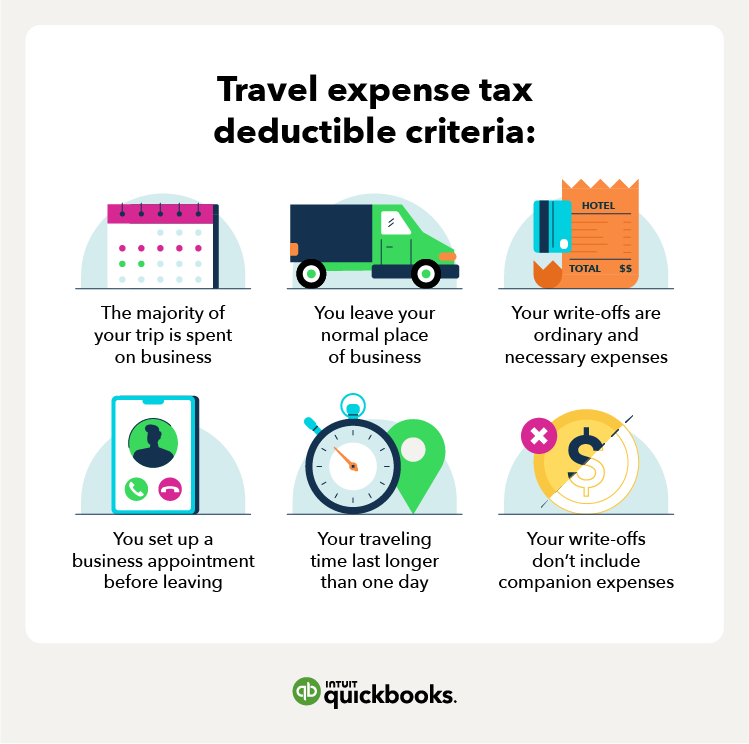

Tax Tip 2023 15 February 7 2023 Whether someone travels for work once a year or once a month figuring out travel expense tax write offs might seem confusing The IRS has information to help all business travelers properly claim these valuable deductions

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job You can t deduct expenses that are lavish or extravagant or that are for personal purposes

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring designs to suit your personal needs for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages. This makes them an invaluable source for educators and parents.

-

Convenience: You have instant access various designs and templates reduces time and effort.

Where to Find more Travel Expenses Tax Deduction 2023

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Here are some of the most common exceptions that may still be tax deductible in 2023 expenses for events like the company holiday party or rewards trip or costs tied to business meetings

If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent If you choose the simplified method claim in Canadian or US funds a flat rate of 23 per meal for the 2023 tax year to a maximum of 69 per day sales tax included per person without receipts Although you

In the event that we've stirred your curiosity about Travel Expenses Tax Deduction 2023 Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Travel Expenses Tax Deduction 2023 for different objectives.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Travel Expenses Tax Deduction 2023

Here are some ideas how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Travel Expenses Tax Deduction 2023 are an abundance of practical and innovative resources that meet a variety of needs and interests. Their access and versatility makes them a great addition to any professional or personal life. Explore the vast array of Travel Expenses Tax Deduction 2023 now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can print and download these tools for free.

-

Can I utilize free printables in commercial projects?

- It is contingent on the specific terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may come with restrictions in use. Make sure you read the terms of service and conditions provided by the designer.

-

How can I print Travel Expenses Tax Deduction 2023?

- You can print them at home with the printer, or go to any local print store for top quality prints.

-

What software do I need to run Travel Expenses Tax Deduction 2023?

- Most printables come in the format of PDF, which can be opened using free software like Adobe Reader.

How To Make The Most Out Of Your Business Travel Tax Tips With A CPA

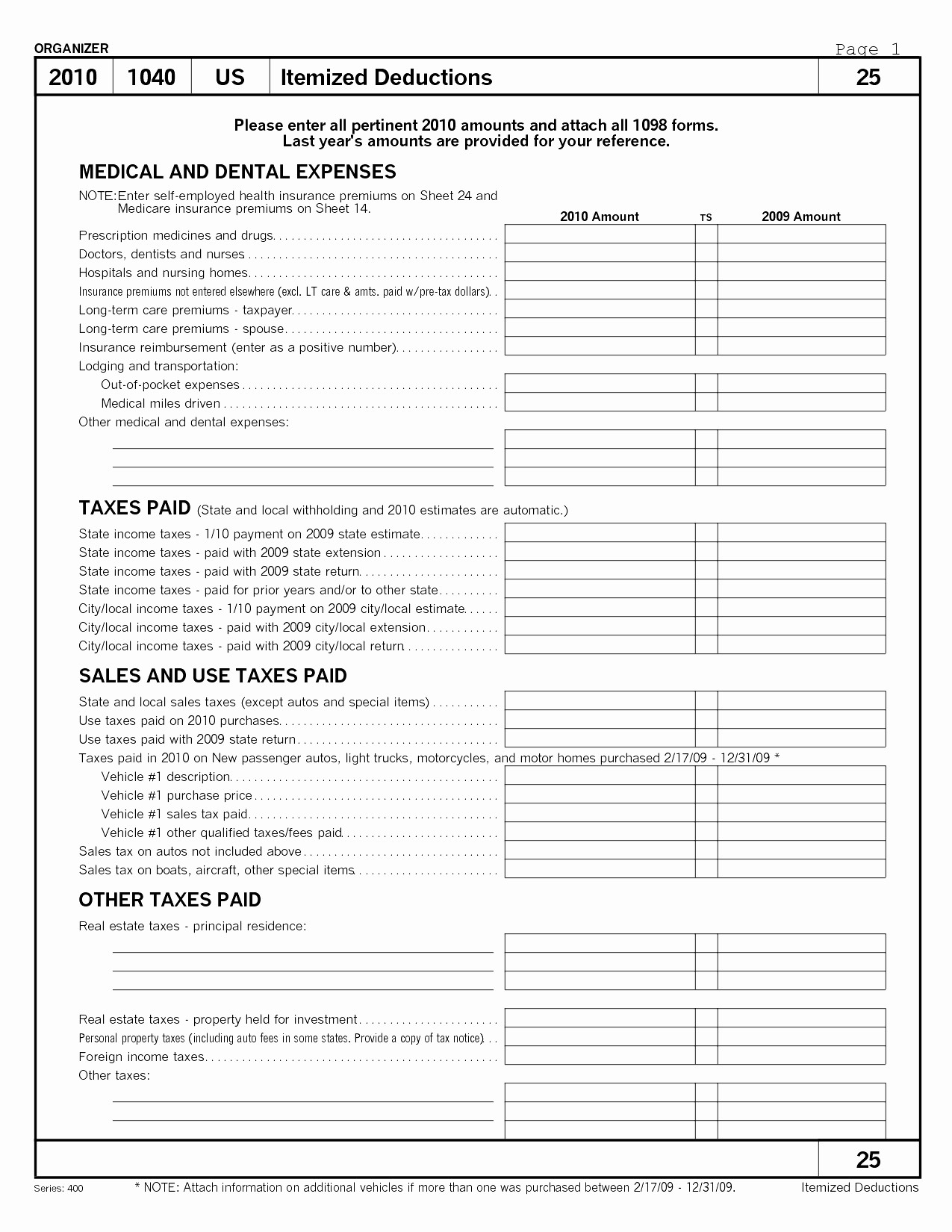

IRS Updates Medical Expenses Tax Deduction For 2023 U S Commodity

Check more sample of Travel Expenses Tax Deduction 2023 below

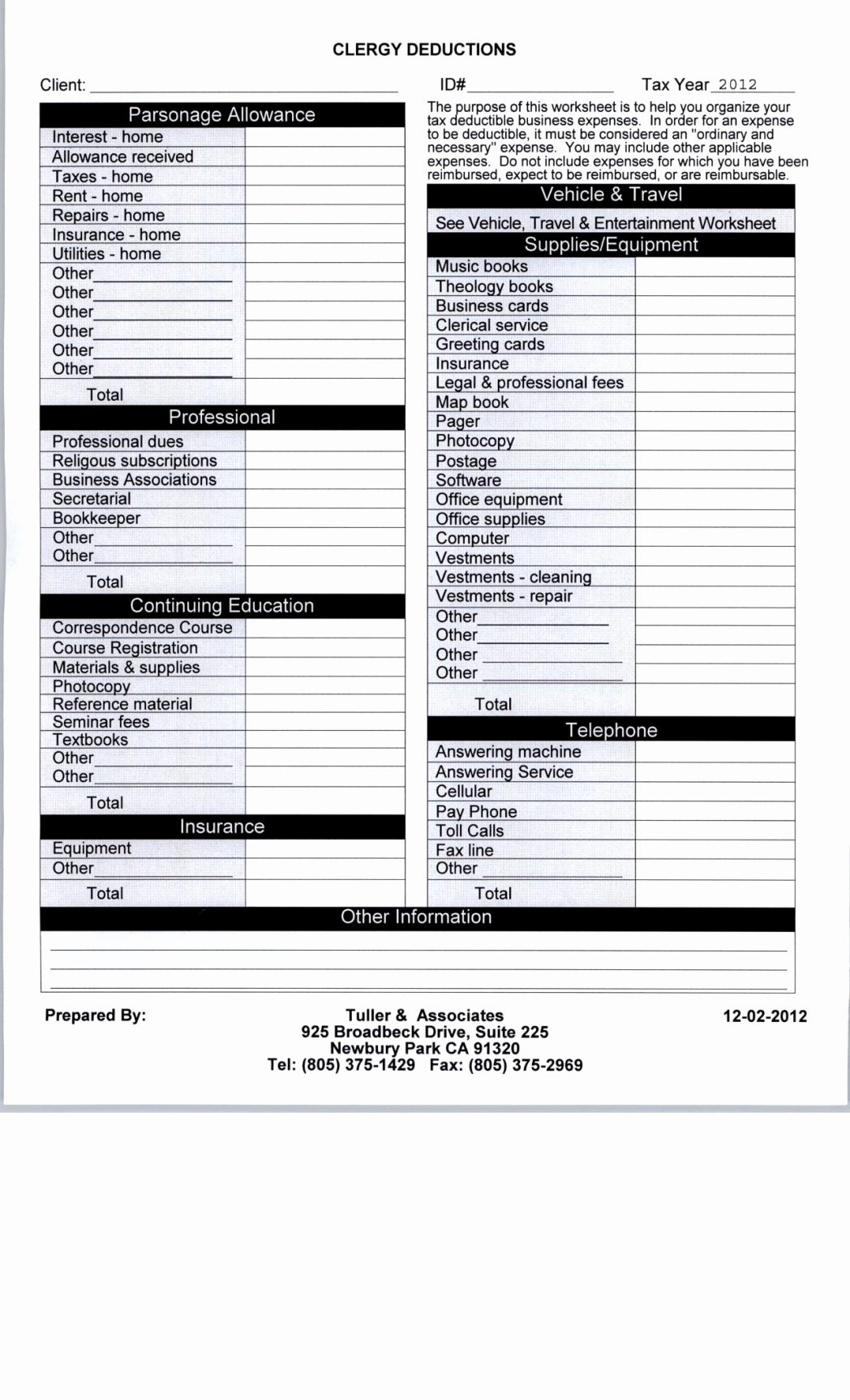

Printable Itemized Deductions Worksheet

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Realtors Tax Deductions Worksheet

Travel Nursing Cardiac Cath Lab Nursing RNNetwork Travel Nursing Blog

Small Business Tax Deductions Worksheet

Can You Claim Car Expenses As A Tax Deduction

https://www.vero.fi/en/individuals/deductions/...

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related reason There must be an employee employer relationship between yourself and the company

https://www.vero.fi/en/individuals/deductions/...

The deduction for travel expenses is calculated differently for commuting and for business trips Commuting refers to the travel between your home and your primary place of work You need to refer to the least expensive mode of transport and fare ticket prices when you claim the tax deduction for commuting

Reimbursements of expenses include kilometre and per diem allowances It is possible to receive these amounts tax free from your employer if you travel for work related reason There must be an employee employer relationship between yourself and the company

The deduction for travel expenses is calculated differently for commuting and for business trips Commuting refers to the travel between your home and your primary place of work You need to refer to the least expensive mode of transport and fare ticket prices when you claim the tax deduction for commuting

Travel Nursing Cardiac Cath Lab Nursing RNNetwork Travel Nursing Blog

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Small Business Tax Deductions Worksheet

Can You Claim Car Expenses As A Tax Deduction

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

Moving Expenses Tax Deduction Tax Square

Moving Expenses Tax Deduction Tax Square

A Singaporean s Guide How To Claim Income Tax Deduction For Work