In this age of technology, in which screens are the norm yet the appeal of tangible printed material hasn't diminished. If it's to aid in education, creative projects, or just adding an extra personal touch to your space, Travel Expenses Tax Deduction can be an excellent source. We'll take a dive deep into the realm of "Travel Expenses Tax Deduction," exploring the benefits of them, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Travel Expenses Tax Deduction Below

Travel Expenses Tax Deduction

Travel Expenses Tax Deduction -

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job You can t deduct expenses that are lavish or extravagant or that are for personal purposes

What is the deduction for commuting expenses when you use other than public transportation Private car Own car If you drive your own car the deduction for commuting expenses is 0 30 km for 2023 On the 2024 tax card the deduction is 0 28 km

The Travel Expenses Tax Deduction are a huge collection of printable materials online, at no cost. They come in many designs, including worksheets coloring pages, templates and many more. The value of Travel Expenses Tax Deduction lies in their versatility and accessibility.

More of Travel Expenses Tax Deduction

Business Startup Expenses Tax Deduction Guide Picnic

Business Startup Expenses Tax Deduction Guide Picnic

Deductible travel expenses include Travel by airplane train bus or car between your home and your business destination Fares for taxis or other types of transportation between an airport or train station and a hotel or from a hotel to a work location

Key Takeaways Travel expenses are tax deductible only if they were incurred to conduct business related activities Only ordinary and necessary travel expenses are deductible expenses that

Travel Expenses Tax Deduction have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization We can customize print-ready templates to your specific requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: Printing educational materials for no cost can be used by students of all ages, which makes them a useful tool for teachers and parents.

-

Affordability: You have instant access the vast array of design and templates will save you time and effort.

Where to Find more Travel Expenses Tax Deduction

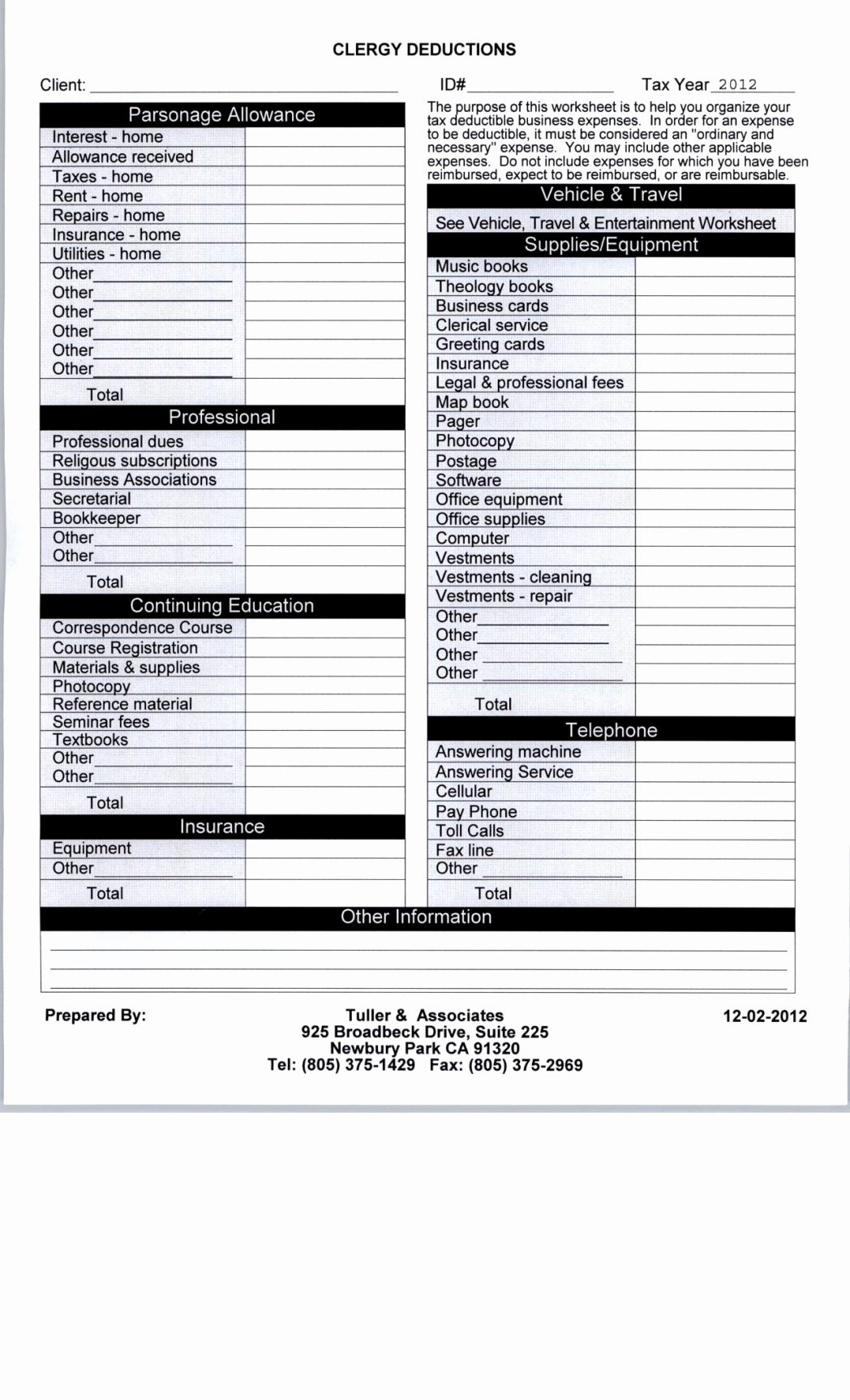

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

Your business can claim a deduction for travel expenses related to your business whether the travel is taken within a day overnight or for many nights Expenses you can claim include airfares

Good news most of the regular costs of business travel are tax deductible Even better news as long as the trip is primarily for business you can tack on a few vacation days and still deduct the trip from your taxes in good conscience

If we've already piqued your interest in printables for free Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Travel Expenses Tax Deduction for all applications.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast variety of topics, all the way from DIY projects to planning a party.

Maximizing Travel Expenses Tax Deduction

Here are some unique ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Travel Expenses Tax Deduction are a treasure trove of fun and practical tools that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Travel Expenses Tax Deduction truly available for download?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables to make commercial products?

- It's dependent on the particular conditions of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations concerning their use. Make sure you read the terms and condition of use as provided by the designer.

-

How do I print Travel Expenses Tax Deduction?

- Print them at home with an printer, or go to a local print shop for superior prints.

-

What software do I need to open printables at no cost?

- The majority of printables are in the PDF format, and can be opened using free software such as Adobe Reader.

ATO Travel Allowance What Are Work Related Travel Expenses MGI

Printable Small Business Tax Deductions Worksheet

Check more sample of Travel Expenses Tax Deduction below

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Benzema The only Candidate For The Ballon D Or Nobody Is At His

How Much Is The Medical Expenses Tax Deduction Https homebiztaxlady

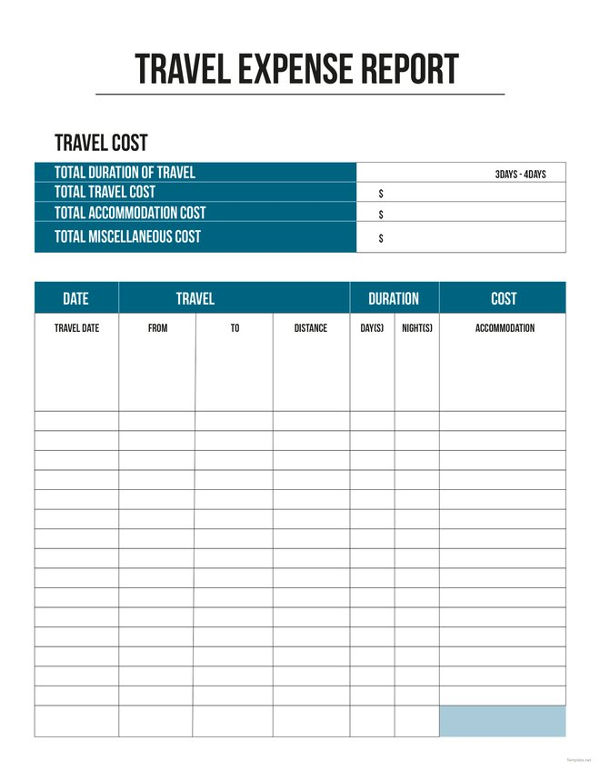

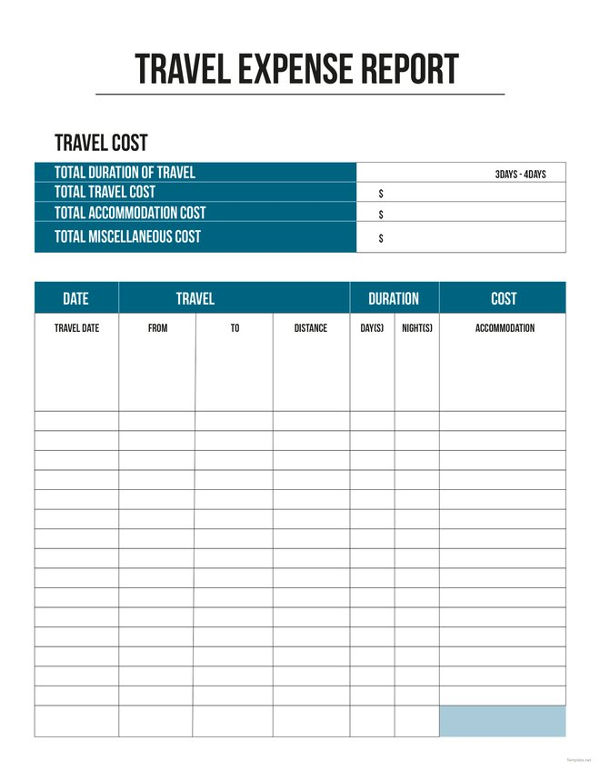

Business Travel Expense Template

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Travel Expense Tax Deduction Guide How To Maximize Write offs

https://www.vero.fi › en › individuals › deductions › ...

What is the deduction for commuting expenses when you use other than public transportation Private car Own car If you drive your own car the deduction for commuting expenses is 0 30 km for 2023 On the 2024 tax card the deduction is 0 28 km

https://www.vero.fi › en › individuals › deductions › ...

Depending on the purpose of your trip costs are tax deductible either As commuting meaning trips from home to work and back where the deductible amount is always based on the least expensive means of transportation or As expenses for the production of income which allows you to deduct the same amounts as you paid

What is the deduction for commuting expenses when you use other than public transportation Private car Own car If you drive your own car the deduction for commuting expenses is 0 30 km for 2023 On the 2024 tax card the deduction is 0 28 km

Depending on the purpose of your trip costs are tax deductible either As commuting meaning trips from home to work and back where the deductible amount is always based on the least expensive means of transportation or As expenses for the production of income which allows you to deduct the same amounts as you paid

Business Travel Expense Template

Benzema The only Candidate For The Ballon D Or Nobody Is At His

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Travel Expense Tax Deduction Guide How To Maximize Write offs

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Can You Claim A Tax Deduction For Medical Expenses OVLG

Can You Claim A Tax Deduction For Medical Expenses OVLG

How To Make The Most Out Of Your Business Travel Tax Tips With A CPA