In this digital age, where screens dominate our lives, the charm of tangible printed products hasn't decreased. Be it for educational use for creative projects, simply adding an individual touch to the area, Truck Driver Tax Credits Canada are now an essential resource. Through this post, we'll take a dive to the depths of "Truck Driver Tax Credits Canada," exploring their purpose, where they are, and how they can add value to various aspects of your life.

Get Latest Truck Driver Tax Credits Canada Below

Truck Driver Tax Credits Canada

Truck Driver Tax Credits Canada -

Are you a transport employee or a long haul truck driver If so there are allowable employment expenses that you can claim for tax purposes

The payer Company A requires all the truck drivers to deliver the goods within a certain time frame and to report any traffic infraction they receive while driving their trucks The payer is responsible for paying the insurance on all trailers and cargo and therefore must approve of any passengers in the truck

The Truck Driver Tax Credits Canada are a huge range of downloadable, printable materials that are accessible online for free cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. The great thing about Truck Driver Tax Credits Canada is their flexibility and accessibility.

More of Truck Driver Tax Credits Canada

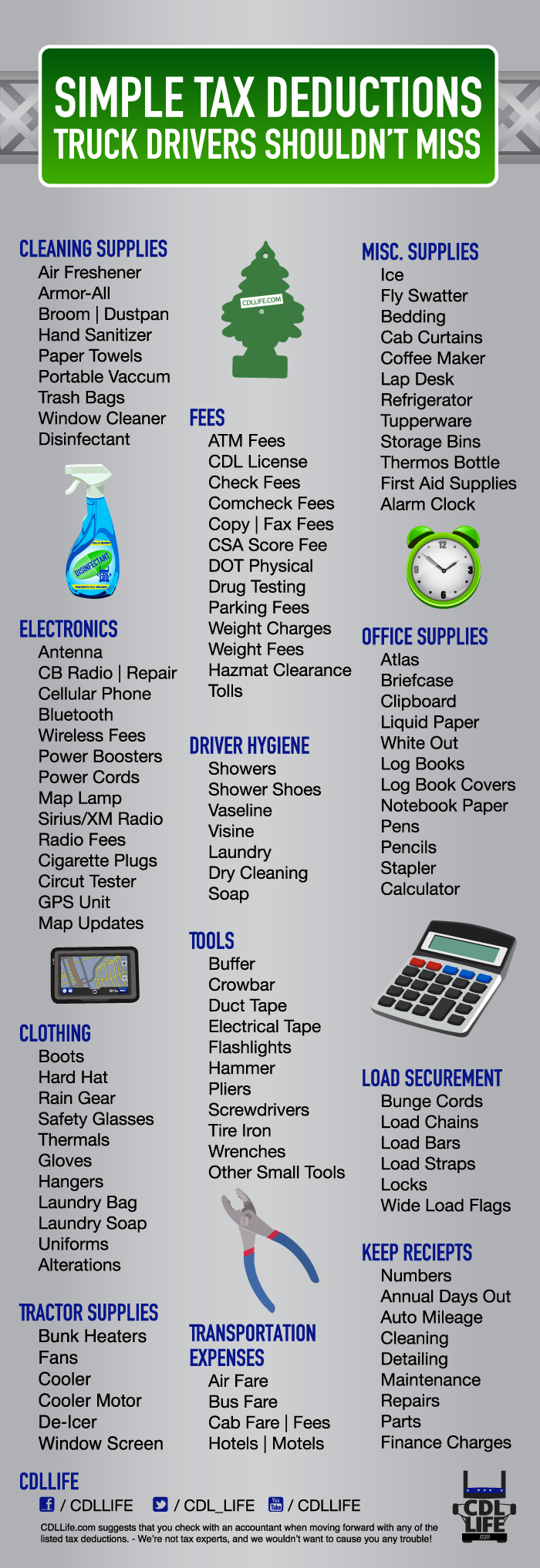

Truck Driver Tax Deductions The Basics AllTruckJobs

Truck Driver Tax Deductions The Basics AllTruckJobs

As a truck driver or trucking company in Canada understanding the tax deductions available to you is essential for optimizing your financial situation By taking advantage of these deductions you can significantly reduce your taxable income and keep more of your hard earned money

As an employee of a transport business such as a truck driver or railway employee you can claim the cost of meal lodging and or shower expenses you paid for while working away from home This cost includes any GST and provincial sales tax or HST you paid

Truck Driver Tax Credits Canada have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor designs to suit your personal needs for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational Use: The free educational worksheets are designed to appeal to students from all ages, making them a vital device for teachers and parents.

-

Simple: Instant access to a variety of designs and templates saves time and effort.

Where to Find more Truck Driver Tax Credits Canada

Comprehensive Truck Driver Tax Deduction List One Click Life

Comprehensive Truck Driver Tax Deduction List One Click Life

As a truck driver in Canada you can claim up to 50 percent of your meal expenses You might have a claim of up to 80 percent if you are a long haul driver who is away from your primary residence for at least 24 hours

Tax deductions on meal and lodging expenses are the most important means of tax savings for truck drivers Let s take a closer look at these deductible expenses Meal Expenses As a truck driver your meal expenses are tax deductible The maximum allowed deductible is 50 on your meal expenses

In the event that we've stirred your interest in Truck Driver Tax Credits Canada Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Truck Driver Tax Credits Canada for different objectives.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast range of topics, starting from DIY projects to party planning.

Maximizing Truck Driver Tax Credits Canada

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Truck Driver Tax Credits Canada are a treasure trove of creative and practical resources for a variety of needs and passions. Their availability and versatility make them an essential part of both professional and personal life. Explore the vast collection of Truck Driver Tax Credits Canada right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printables to make commercial products?

- It is contingent on the specific terms of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may have restrictions concerning their use. Make sure you read the terms and conditions provided by the creator.

-

How do I print Truck Driver Tax Credits Canada?

- Print them at home with printing equipment or visit an area print shop for the highest quality prints.

-

What software do I need to run printables that are free?

- The majority of printed documents are as PDF files, which can be opened using free programs like Adobe Reader.

Tax Credits In Canada Small Business Benefit

Tax Tips For Truck Drivers Liquid Trucking

Check more sample of Truck Driver Tax Credits Canada below

Tax Deduction List For Owner Operator Truck Drivers

Tax Deduction List For Owner Operator Truck Drivers

Tax Credits In Canada For Small Business Owners

New Tax Credits For 2022 In Canada

-1.png)

Smart Prosperity Institute For A Stronger Cleaner Economy

Truck Driver Tax Deductions

https://www.canada.ca/en/revenue-agency/services...

The payer Company A requires all the truck drivers to deliver the goods within a certain time frame and to report any traffic infraction they receive while driving their trucks The payer is responsible for paying the insurance on all trailers and cargo and therefore must approve of any passengers in the truck

https://www.canada.ca/en/revenue-agency/services/...

Employees of a transport business You can claim the cost of meals and lodging including showers on Form TL2 Claim for Meals and Lodging Expenses if you meet all of the following conditions You work for an airline railway bus or trucking company or for any other employer whose main business is transporting goods passengers or both

The payer Company A requires all the truck drivers to deliver the goods within a certain time frame and to report any traffic infraction they receive while driving their trucks The payer is responsible for paying the insurance on all trailers and cargo and therefore must approve of any passengers in the truck

Employees of a transport business You can claim the cost of meals and lodging including showers on Form TL2 Claim for Meals and Lodging Expenses if you meet all of the following conditions You work for an airline railway bus or trucking company or for any other employer whose main business is transporting goods passengers or both

-1.png)

New Tax Credits For 2022 In Canada

Tax Deduction List For Owner Operator Truck Drivers

Smart Prosperity Institute For A Stronger Cleaner Economy

Truck Driver Tax Deductions

Tax Credits How To Get A Bigger Tax Refund In Canada For 2021

Truck Driver Tax Deductions That Will Save You Money Truckstop

Truck Driver Tax Deductions That Will Save You Money Truckstop

Michener Awards Foundation Honours Outstanding Contributions To