In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or just adding some personal flair to your area, Tuition Fee Exemption In Income Tax are now an essential source. For this piece, we'll dive into the sphere of "Tuition Fee Exemption In Income Tax," exploring the benefits of them, where they are, and how they can enrich various aspects of your lives.

Get Latest Tuition Fee Exemption In Income Tax Below

Tuition Fee Exemption In Income Tax

Tuition Fee Exemption In Income Tax -

Tuition Fee The child is entitled to reimbursement for the usual tuition costs assessed by the school or other educational facility where they are enrolled The

Section 80C contains provisions for tax deduction incentives including tax incentives for tuition fees Learn more about tuition fees exemption in income tax in this article

Tuition Fee Exemption In Income Tax include a broad collection of printable documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. The great thing about Tuition Fee Exemption In Income Tax is in their variety and accessibility.

More of Tuition Fee Exemption In Income Tax

Tuition Fees Exemption In Income Tax 2023 Guide

Tuition Fees Exemption In Income Tax 2023 Guide

Deduction for tuition fees u s 80C of the Income Tax Act 1961 is available to Individual Assessee and is not available to HUF Maximum Child Deduction under this section is available for tuition fees

Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an

Tuition Fee Exemption In Income Tax have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: This allows you to modify print-ready templates to your specific requirements be it designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them an invaluable tool for teachers and parents.

-

Accessibility: Quick access to a plethora of designs and templates will save you time and effort.

Where to Find more Tuition Fee Exemption In Income Tax

KAIST International Student Scholarship

KAIST International Student Scholarship

As per Section 80C education fees deduction in income tax you can get a maximum of Rs 1 5 lakh as tuition fee tax exemption for expenses of up to two children

Salaried individuals can fill out the form 12BB to avail their tuition fee tax exemption For self employed or non salaried employees Section 6 of the Income Tax

Now that we've ignited your interest in Tuition Fee Exemption In Income Tax Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Tuition Fee Exemption In Income Tax for various uses.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad variety of topics, from DIY projects to party planning.

Maximizing Tuition Fee Exemption In Income Tax

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tuition Fee Exemption In Income Tax are a treasure trove of practical and imaginative resources which cater to a wide range of needs and pursuits. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the many options of Tuition Fee Exemption In Income Tax today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes they are! You can download and print these materials for free.

-

Can I use free printables for commercial purposes?

- It's all dependent on the rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Tuition Fee Exemption In Income Tax?

- Some printables may contain restrictions on usage. Be sure to check the conditions and terms of use provided by the designer.

-

How can I print Tuition Fee Exemption In Income Tax?

- You can print them at home with the printer, or go to the local print shop for top quality prints.

-

What program is required to open Tuition Fee Exemption In Income Tax?

- The majority of printed documents are in PDF format. These can be opened with free software, such as Adobe Reader.

Printable Free Professional Fee Receipt Templates At

Sabanci University Turkey Fully Funded Scholarship 2023 Apply By 2 Dec

Check more sample of Tuition Fee Exemption In Income Tax below

Tuition Fees Exemption In Income Tax 2023 Guide

Sabanci University Scholarships 2023 Study In Turkey

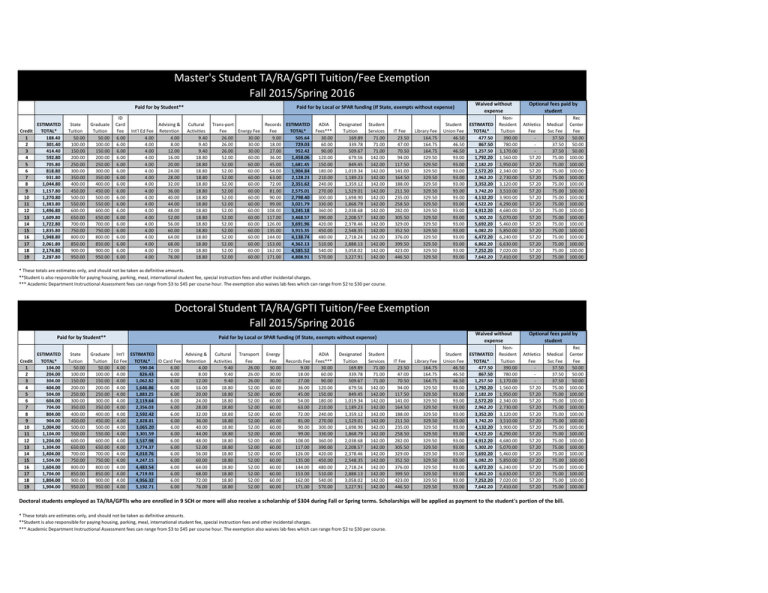

ESTIMATED ID Non Rec

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Get FD Done In These 5 Government Banks Getting The Highest Interest

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

https://instafiling.com/tuition-fees-exemptio…

Section 80C contains provisions for tax deduction incentives including tax incentives for tuition fees Learn more about tuition fees exemption in income tax in this article

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

Section 80C contains provisions for tax deduction incentives including tax incentives for tuition fees Learn more about tuition fees exemption in income tax in this article

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Sabanci University Scholarships 2023 Study In Turkey

Get FD Done In These 5 Government Banks Getting The Highest Interest

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

Exemption Applications Doc Template PdfFiller

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

ITR Filing Exemption Know Before Filing Income Tax Return What Are The