Today, where screens rule our lives, the charm of tangible printed material hasn't diminished. For educational purposes for creative projects, just adding an individual touch to your home, printables for free are now a vital source. Here, we'll dive deep into the realm of "Types Of Pension Tax Relief," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Types Of Pension Tax Relief Below

Types Of Pension Tax Relief

Types Of Pension Tax Relief -

The basic rules Contributing to a pension has always been a tax efficient method to save towards retirement If you are UK resident and under 75 you will be eligible for tax relief on contributions into your pension In order to get full tax relief the amount you can pay into your pension is restricted to the higher of 3 600 gross

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is always used

The Types Of Pension Tax Relief are a huge selection of printable and downloadable materials available online at no cost. They are available in a variety of types, like worksheets, coloring pages, templates and much more. The great thing about Types Of Pension Tax Relief is in their variety and accessibility.

More of Types Of Pension Tax Relief

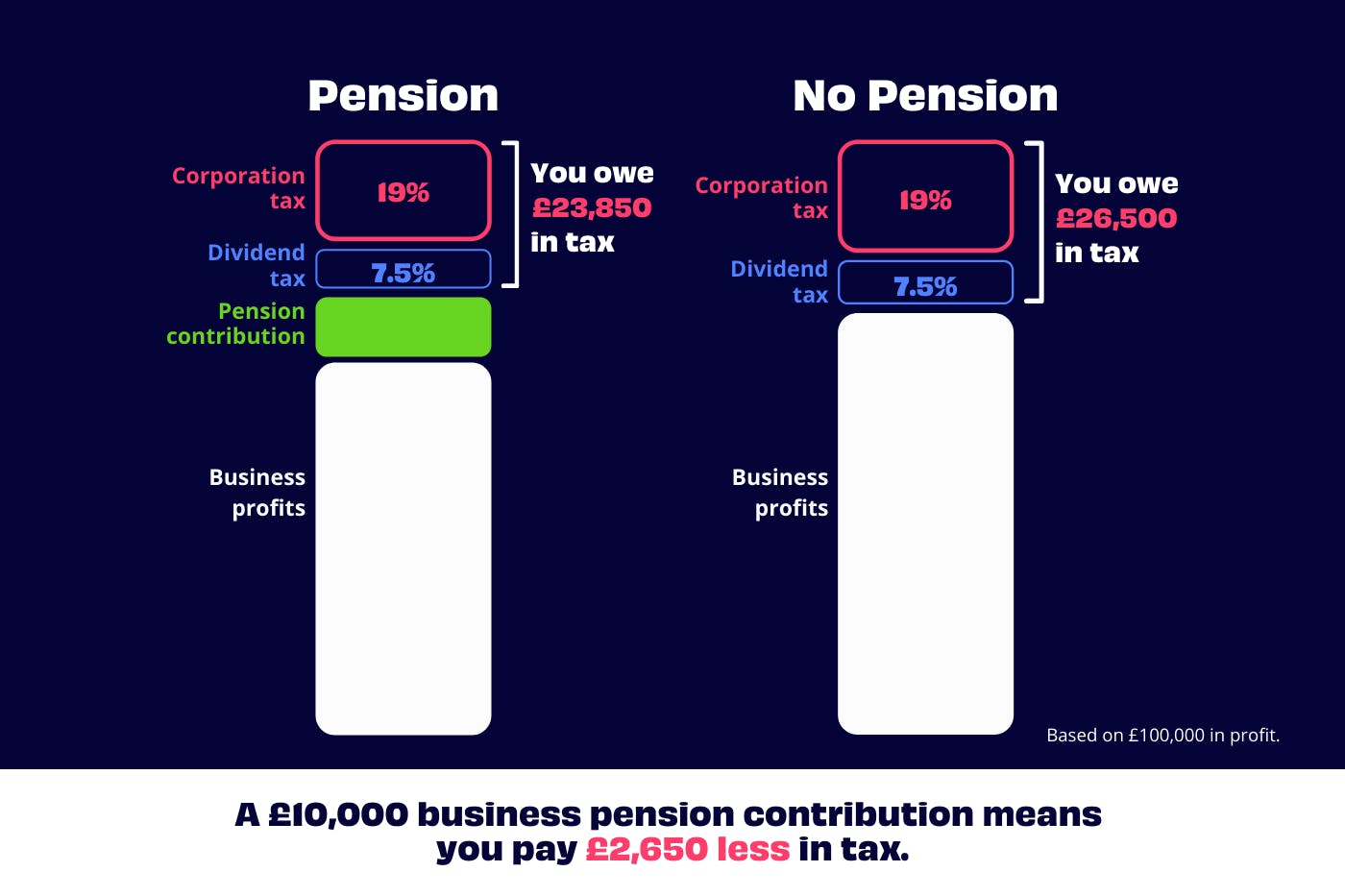

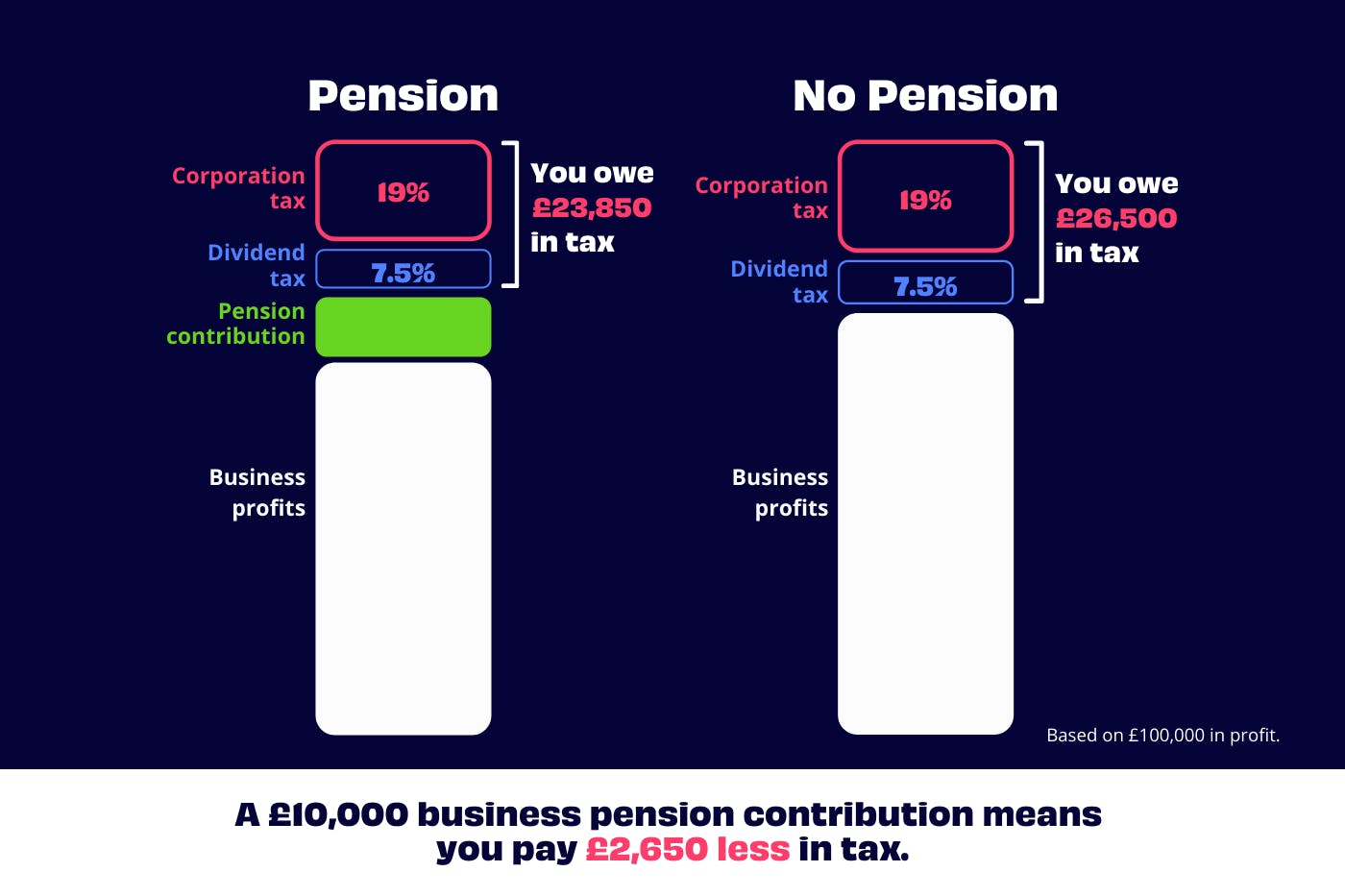

Pension Tax Relief How To Save 60 Tax 4 Financial Planning

Pension Tax Relief How To Save 60 Tax 4 Financial Planning

You can get pension tax relief on all pension types including workplace pensions personal pensions self invested personal pensions SIPPs and stakeholder pensions How you get this tax relief may differ depending on which of the above pensions you have

Contents Types of Pension Schemes in the UK State Pension Scheme Workplace Pension Scheme Personal Pension Scheme Income Tax You Pay on Pension Earnings How Does Relief on Pension Contributions Work Who Can Claim Tax Relief on Pension Contributions Do Pension Contributions

Types Of Pension Tax Relief have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: We can customize printed materials to meet your requirements whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Value: Educational printables that can be downloaded for free cater to learners of all ages. This makes them a great tool for parents and educators.

-

The convenience of Instant access to the vast array of design and templates saves time and effort.

Where to Find more Types Of Pension Tax Relief

Pension Tax Relief Banner Ward Goodman

Pension Tax Relief Banner Ward Goodman

A person can receive tax relief on pension contributions of up to 100 of their annual earnings Someone earning less than 3 600 a year can receive relief on contributions up to 3 600 An annual allowance which limits the amount someone can pay into a pension pot to 40 000 each year before they pay tax

This page provides more detail on the different ways that tax relief is given on pension contributions relief at source and net pay arrangements Note that personal pension schemes typically used by self employed are all

Since we've got your interest in Types Of Pension Tax Relief and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of applications.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing Types Of Pension Tax Relief

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Types Of Pension Tax Relief are an abundance of useful and creative resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make them an invaluable addition to both professional and personal life. Explore the plethora of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can download and print these tools for free.

-

Can I use free printouts for commercial usage?

- It's based on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright problems with Types Of Pension Tax Relief?

- Certain printables could be restricted regarding their use. Be sure to check the terms and conditions offered by the creator.

-

How can I print Types Of Pension Tax Relief?

- You can print them at home using either a printer or go to any local print store for high-quality prints.

-

What software is required to open printables that are free?

- The majority of printables are with PDF formats, which can be opened using free programs like Adobe Reader.

100 Years Of Pension Tax Relief Millions Of High Earners Are Still

What Is Pension Tax Relief

Check more sample of Types Of Pension Tax Relief below

Pension Tax Relief Pareto IFA

100 Years Of Pension Tax Relief Millions Of High Earners Are Still

Experts Discuss Pension Tax Relief

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

Self Employed Pension Tax Relief Explained Penfold Pension

Fairness Of Pension Tax Relief Called Into Question More Than Accountants

https://www.moneyhelper.org.uk/en/pensions-and...

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is always used

https://www.which.co.uk/money/pensions-and...

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is always used

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

100 Years Of Pension Tax Relief Millions Of High Earners Are Still

Self Employed Pension Tax Relief Explained Penfold Pension

Fairness Of Pension Tax Relief Called Into Question More Than Accountants

Pension Tax Relief Knowledge Gap

Pension Tax Raid Could Potentially Pay For The Pandemic Debt

Pension Tax Raid Could Potentially Pay For The Pandemic Debt

Pension Tax Relief Is Safe For Now Adcock Financial