In the age of digital, where screens have become the dominant feature of our lives however, the attraction of tangible printed items hasn't gone away. Whatever the reason, whether for education and creative work, or simply to add an individual touch to the space, Types Of Tax Incentives In Malaysia are a great source. We'll dive deeper into "Types Of Tax Incentives In Malaysia," exploring the benefits of them, where to find them and what they can do to improve different aspects of your life.

Get Latest Types Of Tax Incentives In Malaysia Below

Types Of Tax Incentives In Malaysia

Types Of Tax Incentives In Malaysia -

Types of government grants and incentives Standard incentive Conventional Pioneer Status PS and Investment Tax Allowance ITA are granted to prospecting investors

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and

Types Of Tax Incentives In Malaysia provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These resources come in many designs, including worksheets coloring pages, templates and more. The great thing about Types Of Tax Incentives In Malaysia is their flexibility and accessibility.

More of Types Of Tax Incentives In Malaysia

Tax Incentives In Malaysia The Star

Tax Incentives In Malaysia The Star

Tax 30 June 2021 Hits 8507 Tax Incentives by Legislation Labuan Offshore Business Activity Act LOBATA 1990 Free Zone Act 1990 Customs Act 1967 Customs Act

Available investment and tax incentives are described under 1 5 1 5 Tax incentives A broad range of incentives are available for companies seeking to invest in new projects or

Types Of Tax Incentives In Malaysia have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor the design to meet your needs such as designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners of all ages. This makes them a great resource for educators and parents.

-

The convenience of You have instant access numerous designs and templates can save you time and energy.

Where to Find more Types Of Tax Incentives In Malaysia

Film Industry Tax Incentives State by State 2022 Wrapbook

Film Industry Tax Incentives State by State 2022 Wrapbook

Malaysia has enacted a number of tax incentives to encourage particular forms of economic activity Many tax incentives simply remove part or of the burden of the tax

The direct tax incentives grant partial or total relief from income tax payment for a specified period while indirect tax incentives are in the form of

Now that we've piqued your interest in Types Of Tax Incentives In Malaysia Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Types Of Tax Incentives In Malaysia suitable for many uses.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad range of interests, that includes DIY projects to party planning.

Maximizing Types Of Tax Incentives In Malaysia

Here are some innovative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Types Of Tax Incentives In Malaysia are a treasure trove of practical and imaginative resources catering to different needs and hobbies. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It's all dependent on the conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues with Types Of Tax Incentives In Malaysia?

- Certain printables may be subject to restrictions regarding usage. You should read the conditions and terms of use provided by the designer.

-

How do I print Types Of Tax Incentives In Malaysia?

- Print them at home using a printer or visit a local print shop to purchase more high-quality prints.

-

What program must I use to open printables at no cost?

- Most printables come in the format of PDF, which can be opened with free software such as Adobe Reader.

Tax Incentives Under Malaysia s Budget 2023

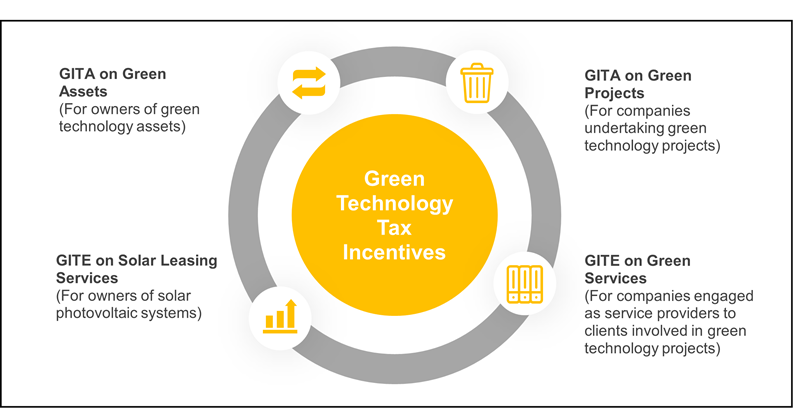

Tax Incentive For Green Initiatives Crowe Malaysia PLT

Check more sample of Types Of Tax Incentives In Malaysia below

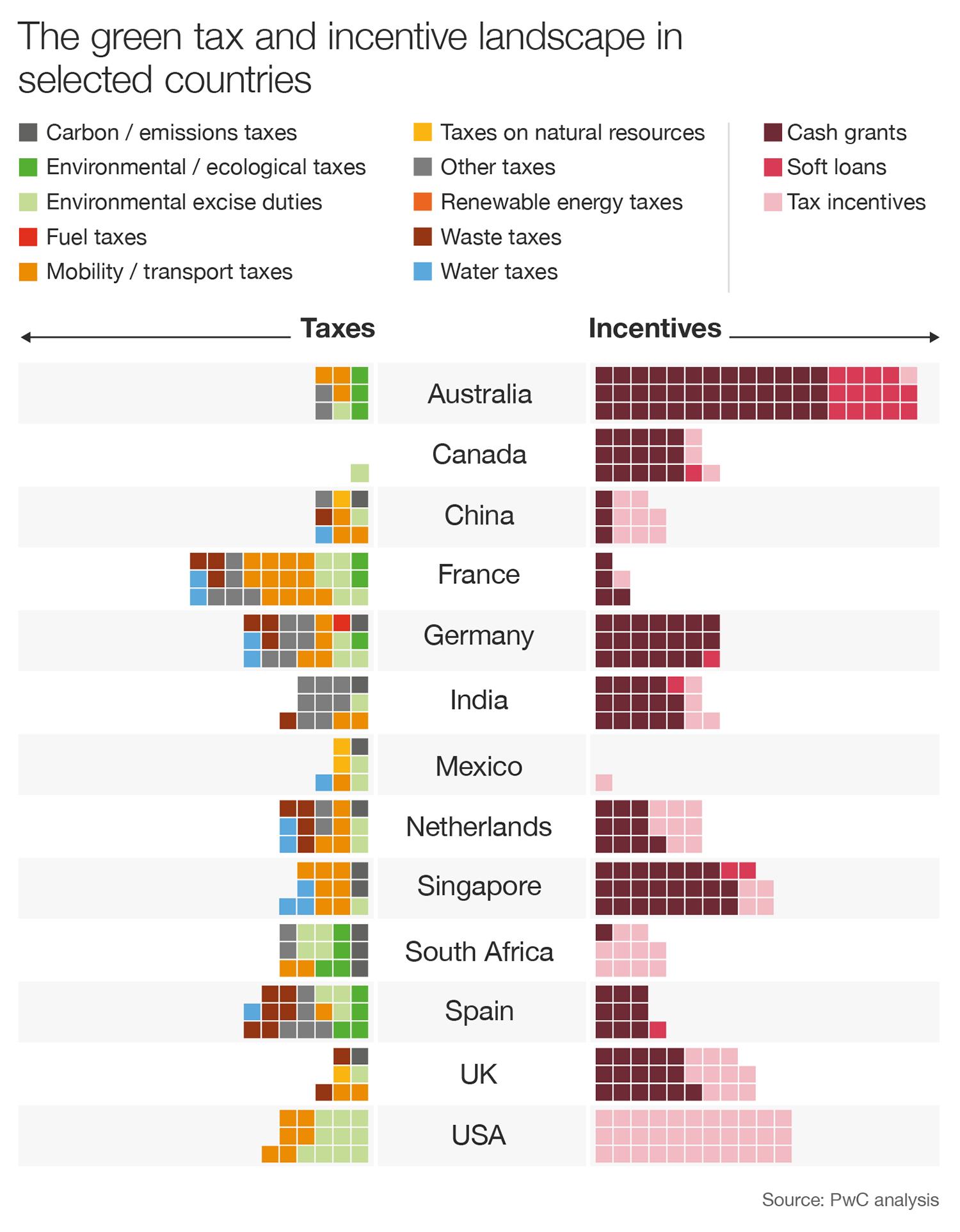

Green Taxes And Incentives Can Help Businesses Achieve ESG Goals

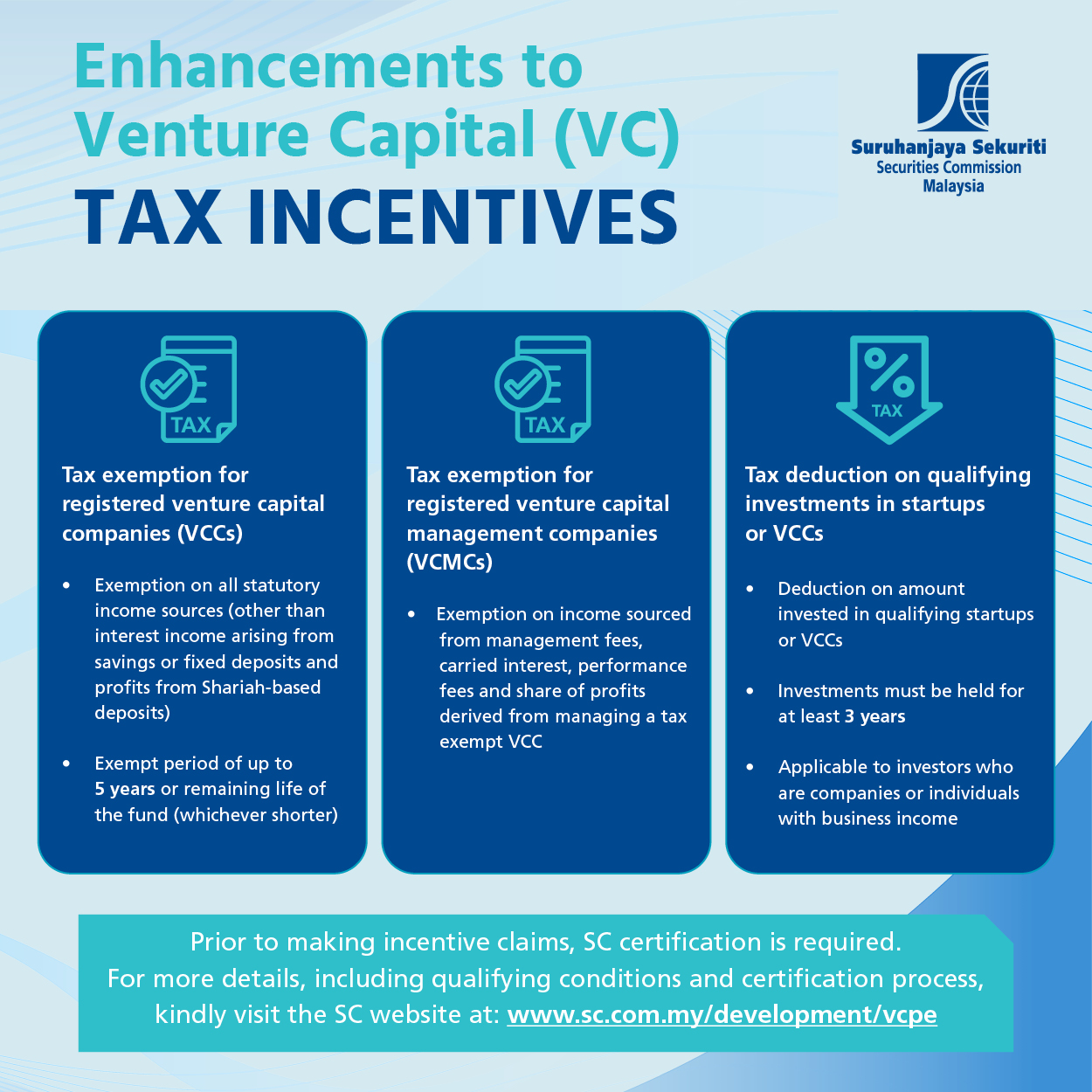

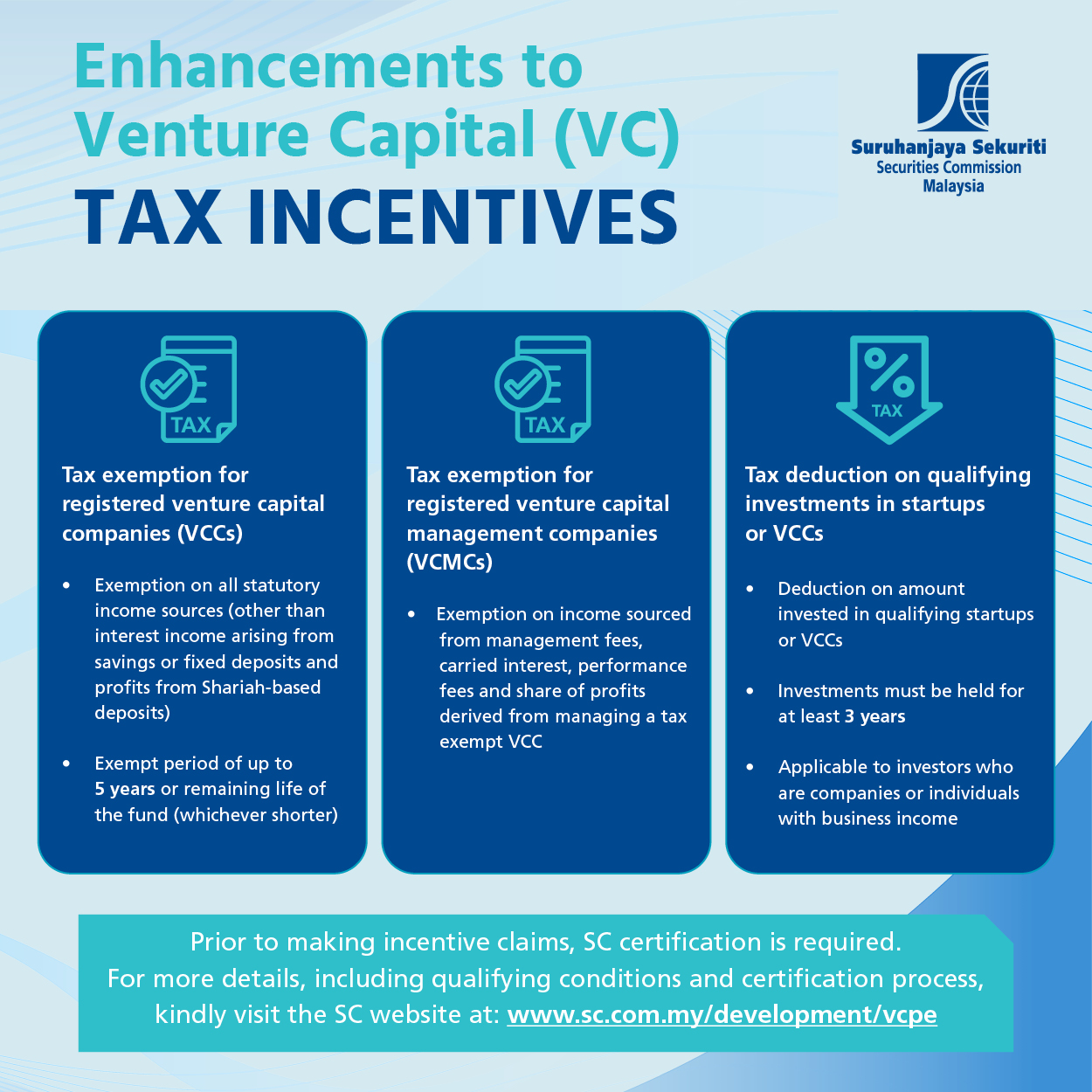

SC Malaysia On Twitter The Enhancements To Venture Capital VC Tax

Get To Know Vietnam Tax Credits And Incentives

Incentives Definition Types Function Examples And Benefits 2023

What Does It Take The Role Of Incentives In Forest Plantation

Tax Incentives Tax Reliefs In Malaysia Paul Hype Page

https://www.mida.gov.my/setting-up-content/incentives

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and

https://www.3ecpa.com.my/resources/malaysia-taxation/tax-incentives

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax

Incentives Definition Types Function Examples And Benefits 2023

SC Malaysia On Twitter The Enhancements To Venture Capital VC Tax

What Does It Take The Role Of Incentives In Forest Plantation

Tax Incentives Tax Reliefs In Malaysia Paul Hype Page

Film Industry Tax Incentives State by State 2022 Wrapbook

Film Industry Tax Incentives State by State 2022 Wrapbook

Tax Incentives In Malaysia 2017 Alexander Lawrence