In this digital age, where screens rule our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or just adding a personal touch to your home, printables for free are now a vital source. We'll take a dive into the world of "Under Construction Property Tax Benefit," exploring the different types of printables, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Under Construction Property Tax Benefit Below

Under Construction Property Tax Benefit

Under Construction Property Tax Benefit -

Under Construction Property Tax Benefit Section 80C Once the pre construction period ends homeowners can claim the tax benefit on under construction property under Section 80C of up to Rs 1 5 lakh per financial year This deduction is available for the paid home loan principal amount

The Bottom Line on Under Construction Property Tax Benefits Planning to buy an under construction property Learn about under construction property tax benefits based on different sections of the IT Act 1961 along with the capped amount and applicable conditions

Under Construction Property Tax Benefit encompass a wide array of printable documents that can be downloaded online at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and much more. The benefit of Under Construction Property Tax Benefit lies in their versatility and accessibility.

More of Under Construction Property Tax Benefit

177 Bothwell Street Gardiner Theobald

177 Bothwell Street Gardiner Theobald

Section 80EEA of the Income Tax Act introduces an additional tax benefit for individuals investing in under construction properties This benefit allows for a deduction of up to 1 50 000 per financial year on the interest paid on home loans provided that the limit of 1 5 lakh under Section 80C has already been exhausted

What are the Under Construction House Tax Benefits under Sec 24 and under Sec 80C How to calculate the interest and principal for claiming the benefit Whether one can claim the benefit under Sec 80C during the under construction period

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor the templates to meet your individual needs be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: Education-related printables at no charge can be used by students of all ages, which makes them an invaluable source for educators and parents.

-

Affordability: The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more Under Construction Property Tax Benefit

Know About The Property Tax Benefit Finkelstein Partners

Know About The Property Tax Benefit Finkelstein Partners

If you took a Home Loan to buy an under construction property and are currently paying EMIs for the same Section 80C of the Income Tax Act allows you to claim deductions up to Rs 1 5 Lakh on payments made towards principal repayment

A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section 80C of the Income Tax Act

Now that we've piqued your curiosity about Under Construction Property Tax Benefit We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Under Construction Property Tax Benefit for a variety reasons.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad range of interests, from DIY projects to planning a party.

Maximizing Under Construction Property Tax Benefit

Here are some ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Under Construction Property Tax Benefit are an abundance of practical and imaginative resources that can meet the needs of a variety of people and preferences. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the vast world of Under Construction Property Tax Benefit right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can download and print these materials for free.

-

Can I utilize free printouts for commercial usage?

- It is contingent on the specific rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with Under Construction Property Tax Benefit?

- Certain printables might have limitations on usage. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase high-quality prints.

-

What software will I need to access Under Construction Property Tax Benefit?

- Most PDF-based printables are available with PDF formats, which can be opened using free software, such as Adobe Reader.

Greyfriars Charteris Centre Thomson Gray

Will N J Treat My ANCHOR Payment As Income Nj

Check more sample of Under Construction Property Tax Benefit below

Disbursement In Under construction Property HomeCapital Blog

You Have Until Feb 28 To Apply For Anchor Property tax Benefit

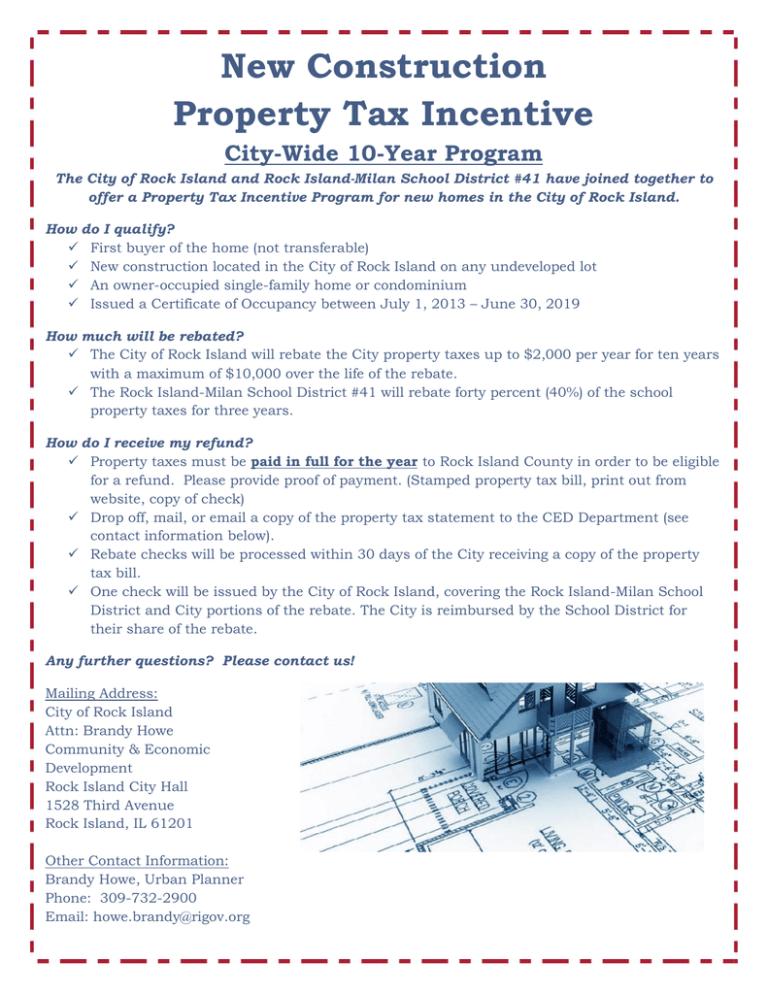

New Construction Property Tax Incentive

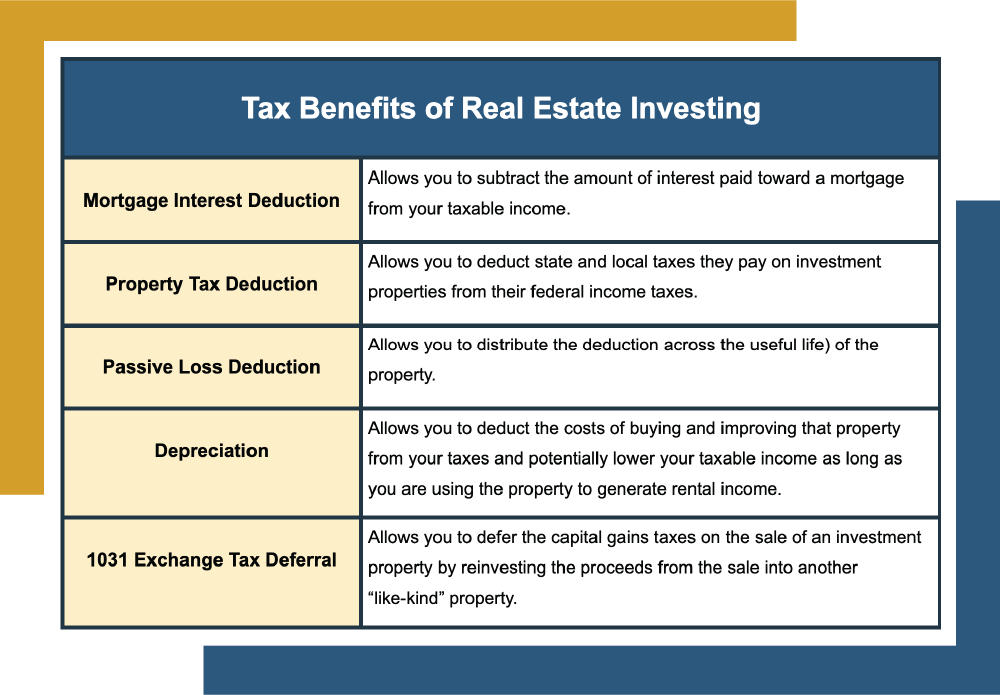

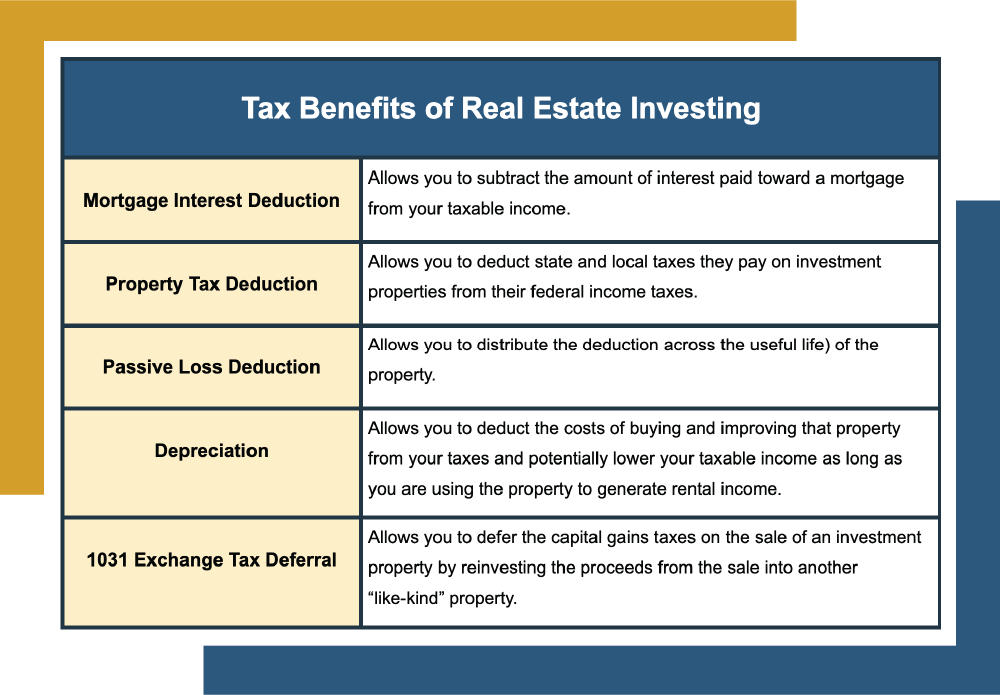

What Are The Tax Benefits Of Investing In Real Estate A Guide For

PERSONAL TAX Under construction Property Can Get Capital Gains Benefit

7 Things To Check Before Buying An Under construction Property

https://www.magicbricks.com/blog/avail-tax...

The Bottom Line on Under Construction Property Tax Benefits Planning to buy an under construction property Learn about under construction property tax benefits based on different sections of the IT Act 1961 along with the capped amount and applicable conditions

https://cleartax.in/s/case-study-deduction-for-pre-construction-interest

Pre construction interest is allowed to be claimed for under construction residential property under section 24 of the Income tax act This can be claimed only after the construction is complete over a period of 5 years

The Bottom Line on Under Construction Property Tax Benefits Planning to buy an under construction property Learn about under construction property tax benefits based on different sections of the IT Act 1961 along with the capped amount and applicable conditions

Pre construction interest is allowed to be claimed for under construction residential property under section 24 of the Income tax act This can be claimed only after the construction is complete over a period of 5 years

What Are The Tax Benefits Of Investing In Real Estate A Guide For

You Have Until Feb 28 To Apply For Anchor Property tax Benefit

PERSONAL TAX Under construction Property Can Get Capital Gains Benefit

7 Things To Check Before Buying An Under construction Property

Under Construction Vs Ready To Move Property Pros Cons TimesProperty

GST On Under Construction Property Quick Guide InstaFiling

GST On Under Construction Property Quick Guide InstaFiling

You Have Until Feb 28 To Apply For Anchor Property tax Benefit