In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. For educational purposes in creative or artistic projects, or simply to add a personal touch to your area, Used Ev Tax Credit Federal are a great source. This article will dive into the world "Used Ev Tax Credit Federal," exploring their purpose, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Used Ev Tax Credit Federal Below

Used Ev Tax Credit Federal

Used Ev Tax Credit Federal -

Used EV Tax Credit Here are all the used EVs that qualify for a 4 000 tax credit Scooter Doll Mar 18 2024 12 50 pm PT 80 Comments January 1 2023 kicked off a fresh start of new

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a Previously Owned Clean Vehicle Credit The credit equals 30 of the sale price up to a maximum credit of 4 000

Used Ev Tax Credit Federal offer a wide range of printable, free material that is available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and more. The appeal of printables for free is in their variety and accessibility.

More of Used Ev Tax Credit Federal

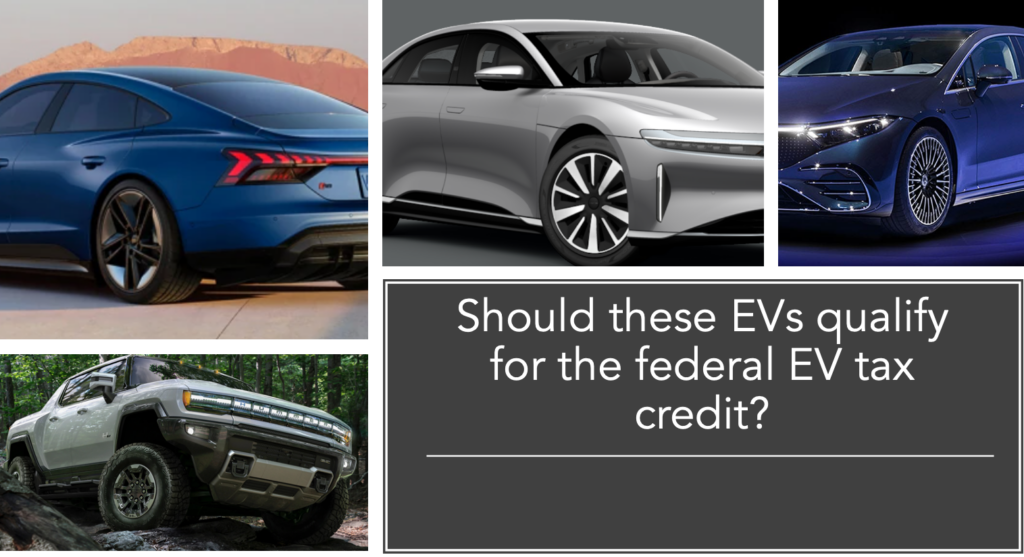

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

The tax credit for a used EV or PHEV is either 4 000 or 30 percent of the sale price of the vehicle whichever is lower That means if you re spending less than 13 333 you re not going to

Used EV tax credit qualifications Qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization They can make printing templates to your own specific requirements such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: These Used Ev Tax Credit Federal provide for students of all ages, which makes them a valuable tool for teachers and parents.

-

Affordability: Fast access a myriad of designs as well as templates helps save time and effort.

Where to Find more Used Ev Tax Credit Federal

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

As part of the phasing in of the new tax and climate law Section 25E of the tax code was amended to include an allowance of a credit for a qualified buyer purchasing a used EV from a dealer to be eligible for a credit equal to

Per the IRS Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible

We hope we've stimulated your interest in printables for free Let's look into where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Used Ev Tax Credit Federal for all applications.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Used Ev Tax Credit Federal

Here are some ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Used Ev Tax Credit Federal are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and pursuits. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the endless world of Used Ev Tax Credit Federal today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can download and print these items for free.

-

Do I have the right to use free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright problems with Used Ev Tax Credit Federal?

- Some printables may come with restrictions regarding usage. Be sure to review the terms of service and conditions provided by the designer.

-

How can I print Used Ev Tax Credit Federal?

- You can print them at home with your printer or visit the local print shop for top quality prints.

-

What software is required to open printables that are free?

- Most printables come as PDF files, which can be opened using free software such as Adobe Reader.

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

IRS Officially Updates Its EV Tax Credit Rules Cutting Out Even More

Check more sample of Used Ev Tax Credit Federal below

Attempt At Raising Ceiling For Federal EV Tax Credit By Tesla And GM

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

The Federal Electric Car Tax Credit OsVehicle

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Ev Tax Credit 2022 Cap Clement Wesley

Federal Tax Credit For Electric Cars 2021 Form Wcarsj

![]()

https://www. irs.gov /newsroom/taxpayers-may-qualify...

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a Previously Owned Clean Vehicle Credit The credit equals 30 of the sale price up to a maximum credit of 4 000

https://www. irs.gov /newsroom/topic-a-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a Previously Owned Clean Vehicle Credit The credit equals 30 of the sale price up to a maximum credit of 4 000

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Ev Tax Credit 2022 Cap Clement Wesley

Federal Tax Credit For Electric Cars 2021 Form Wcarsj

4 Ways How Does The Federal Ev Tax Credit Work Alproject

Federal EV Tax Credit News And Reviews InsideEVs

Federal EV Tax Credit News And Reviews InsideEVs

A Complete Guide To The New EV Tax Credit