In this day and age with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes or creative projects, or just adding personal touches to your area, Uti Mutual Fund Income Tax Deduction are now an essential resource. Here, we'll dive deep into the realm of "Uti Mutual Fund Income Tax Deduction," exploring what they are, where to locate them, and how they can be used to enhance different aspects of your daily life.

What Are Uti Mutual Fund Income Tax Deduction?

Uti Mutual Fund Income Tax Deduction encompass a wide assortment of printable, downloadable documents that can be downloaded online at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and more. The great thing about Uti Mutual Fund Income Tax Deduction is in their versatility and accessibility.

Uti Mutual Fund Income Tax Deduction

Uti Mutual Fund Income Tax Deduction

Uti Mutual Fund Income Tax Deduction -

[desc-5]

[desc-1]

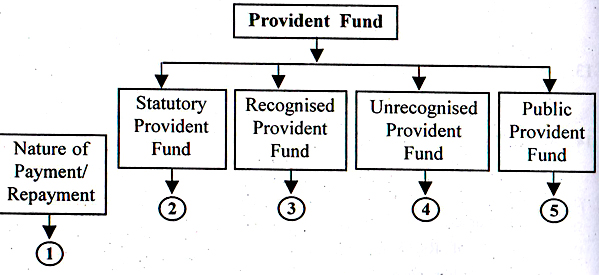

Graphical Chat Presentation Of Provident Fund Tax Treatement

Graphical Chat Presentation Of Provident Fund Tax Treatement

[desc-4]

[desc-6]

UTI Smart Plan Smart Tax Saving Schemes UTI Mutual Funds

UTI Smart Plan Smart Tax Saving Schemes UTI Mutual Funds

[desc-9]

[desc-7]

Section 194K Tax Deduction On Income From Mutual Fund Units

UTI Mutual Fund UTI Long Term Equity Fund Tax Saving Ad Advert Gallery

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

How To Manage Income Tax On Income From Mutual Funds TaxClue

What Is Tax Saving Mutual Fund Invest In ELSS UTI Mutual Fund

Income Tax Return How To Disclose Your Earnings From Mutual Fund

Income Tax Return How To Disclose Your Earnings From Mutual Fund

4 Types Of Provident Fund And Tax Treatment Of Provident Fund