In this age of electronic devices, in which screens are the norm and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or simply to add a personal touch to your space, Vehicle Tax Deduction Uk have proven to be a valuable resource. Here, we'll dive through the vast world of "Vehicle Tax Deduction Uk," exploring their purpose, where you can find them, and how they can improve various aspects of your lives.

Get Latest Vehicle Tax Deduction Uk Below

Vehicle Tax Deduction Uk

Vehicle Tax Deduction Uk -

Over 255g km 2 595 for alternative fuel 2 605 for petrol and RDE2 standard diesel 2 605 for non RDE2 standard diesel 170 for alternative fuel 180 for petrol or diesel 390 In the tax year beginning April 2025

Recovery vehicles The rates are for vehicles that have been registered You can check tax rates for new unregistered cars online Tax your vehicle Get an

Vehicle Tax Deduction Uk encompass a wide assortment of printable, downloadable materials available online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and much more. The beauty of Vehicle Tax Deduction Uk is their flexibility and accessibility.

More of Vehicle Tax Deduction Uk

Best Ways To Use The Heavy Vehicle Tax Deduction Financequickie

Best Ways To Use The Heavy Vehicle Tax Deduction Financequickie

What are tax deductible expenses On certain job related expenses known as a tax deductible expense you can claim tax relief for the amounts you ve paid out This applies both where you have paid the

Advice about how to tax a vehicle Please select an option below A vehicle tax reminder Advice about taxing on line or by phone Changing the taxation class of a vehicle

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: There is the possibility of tailoring the templates to meet your individual needs when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge are designed to appeal to students from all ages, making them a great tool for parents and educators.

-

The convenience of You have instant access many designs and templates is time-saving and saves effort.

Where to Find more Vehicle Tax Deduction Uk

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

As with all motoring expenses make sure you track your mileage accurately throughout the year Claim for Business mileage allowance at HMRC rate 45p mile up to 10 000

Is leasing a car tax deductible By Mike Parkes GoSimpleTax Date 7 March 2022 Reportedly there are more than five million leased vehicles being driven on UK

We hope we've stimulated your curiosity about Vehicle Tax Deduction Uk, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of uses.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad range of topics, starting from DIY projects to planning a party.

Maximizing Vehicle Tax Deduction Uk

Here are some new ways of making the most of Vehicle Tax Deduction Uk:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Vehicle Tax Deduction Uk are an abundance of fun and practical tools that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them an essential part of both professional and personal life. Explore the vast world of Vehicle Tax Deduction Uk and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can download and print these files for free.

-

Can I use the free templates for commercial use?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright issues in Vehicle Tax Deduction Uk?

- Some printables may contain restrictions in their usage. Be sure to read the terms and conditions provided by the creator.

-

How do I print Vehicle Tax Deduction Uk?

- You can print them at home using any printer or head to the local print shop for superior prints.

-

What program do I need to run printables for free?

- The majority of printables are in PDF format. These can be opened with free software, such as Adobe Reader.

Rules For Business Vehicle Tax Deductions Podcast 131 Do You Know

Double Tax Relief Saffery Champness

Check more sample of Vehicle Tax Deduction Uk below

Section 179 The Heavy Vehicle Tax Deduction You Don t Want To Miss

Claiming A Tax Deduction For Motor Vehicle Expenses Pro TAX SOLUTIONS

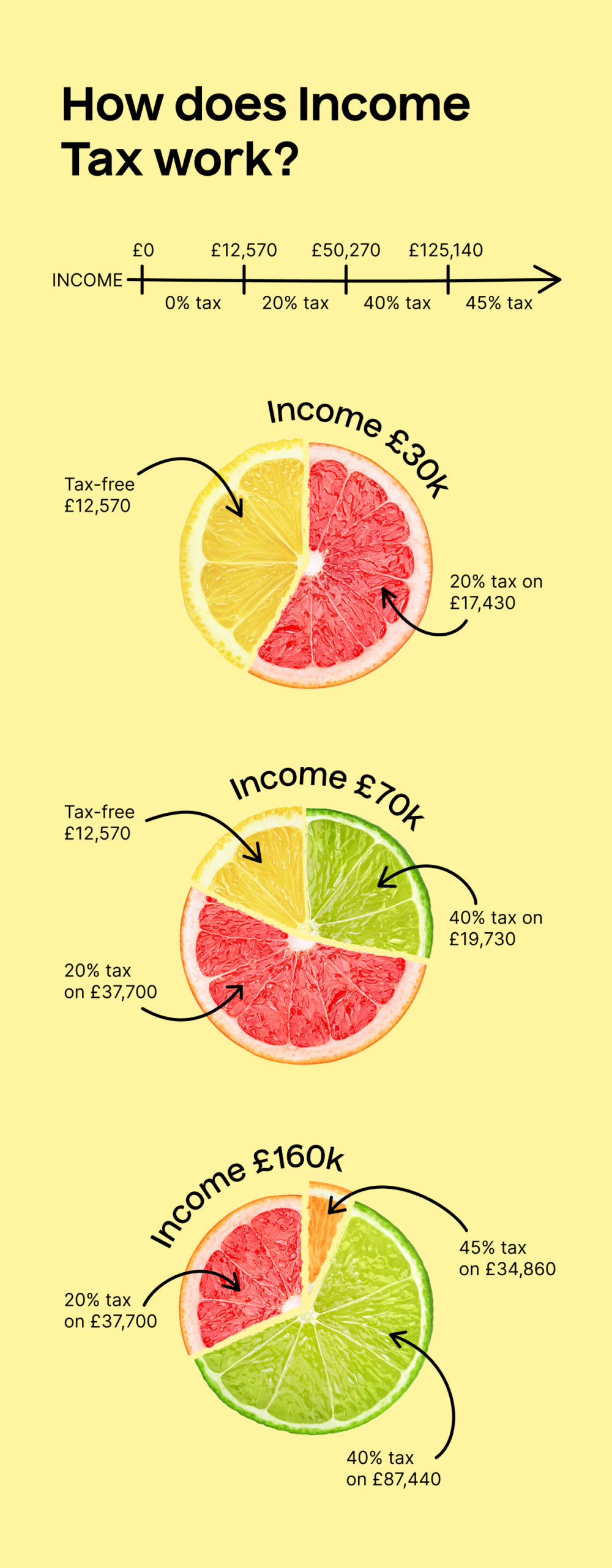

Income Tax Rates In The UK TaxScouts

How To Get Vehicle Tax Deduction Over 6 000 Lb GVWR Auto SUV

Vehicle Tax Deduction 8 Cars You Can Get Basically For Free

What Is The 6 000 Pound Vehicle Tax Deduction Bizfluent

https://www.gov.uk/government/publications/rates-of-vehicle-tax-v149

Recovery vehicles The rates are for vehicles that have been registered You can check tax rates for new unregistered cars online Tax your vehicle Get an

https://www.gov.uk/capital-allowances/business-cars

Cars do not qualify for annual investment allowance Sole traders and partnerships You can claim simplified mileage expenses on business vehicles instead if you re either a

Recovery vehicles The rates are for vehicles that have been registered You can check tax rates for new unregistered cars online Tax your vehicle Get an

Cars do not qualify for annual investment allowance Sole traders and partnerships You can claim simplified mileage expenses on business vehicles instead if you re either a

How To Get Vehicle Tax Deduction Over 6 000 Lb GVWR Auto SUV

Claiming A Tax Deduction For Motor Vehicle Expenses Pro TAX SOLUTIONS

Vehicle Tax Deduction 8 Cars You Can Get Basically For Free

What Is The 6 000 Pound Vehicle Tax Deduction Bizfluent

Section 179 Vehicle Calculator ZubairKellsey

Vehicle Tax Deduction 8 Cars You Can Get Basically For Free

Vehicle Tax Deduction 8 Cars You Can Get Basically For Free

UK Super deduction Learn How You Can Save With Capital Allowance