In a world where screens have become the dominant feature of our lives however, the attraction of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or simply to add a personal touch to your space, Virginia Tax Credit For Energy Efficient Appliances are a great source. The following article is a dive to the depths of "Virginia Tax Credit For Energy Efficient Appliances," exploring what they are, how to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Virginia Tax Credit For Energy Efficient Appliances Below

Virginia Tax Credit For Energy Efficient Appliances

Virginia Tax Credit For Energy Efficient Appliances -

Rebates covering 50 100 of the cost of installing new electric appliances including super efficient heat pumps water heaters clothes dryers stoves and ovens In Virginia millions

June 2023 The Inflation Reduction Act of 2022 H R 5376 extends the Energy Efficient Home Improvement Credit 25C 1 through the end of 2032 and expands the credit to allow households to deduct 30 of the costs of eligible upgrades from their taxes while adding new qualified products and larger dollar maximums

Virginia Tax Credit For Energy Efficient Appliances cover a large range of printable, free content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and many more. The benefit of Virginia Tax Credit For Energy Efficient Appliances lies in their versatility and accessibility.

More of Virginia Tax Credit For Energy Efficient Appliances

Tax Credit For Energy Efficient Appliances HomeSelfe

Tax Credit For Energy Efficient Appliances HomeSelfe

Home Electrification and Appliance Rebates will provide up to 14 000 per household in up front rebates to support households in purchasing certain types of high efficiency electric appliances The rebate can support upgrades in single family and multi family dwellings

Taxpayers in Virginia may deduct from their taxable personal income an amount equal to 20 of the sales taxes paid for certain energy efficient equipment The incentive is capped at 500 This incentive is available for the following equipment types clothes washers room air conditioners dishwashers standard size refrigerators

Virginia Tax Credit For Energy Efficient Appliances have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: The Customization feature lets you tailor printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational value: These Virginia Tax Credit For Energy Efficient Appliances offer a wide range of educational content for learners of all ages, making them a valuable aid for parents as well as educators.

-

Easy to use: instant access various designs and templates reduces time and effort.

Where to Find more Virginia Tax Credit For Energy Efficient Appliances

Tax Credits For Energy Efficient Replacement Windows What You Should

Tax Credits For Energy Efficient Replacement Windows What You Should

This legislation includes 10 years of tax credits and rebates to install all kinds of clean residential and vehicle technologies from rooftop solar to heat pumps to high efficiency appliances and electric

You can save money and energy while protecting the environment by purchasing ENERGY STAR certified appliances Any Appalachian Power residential electric customer residing in Virginia who purchases a certain

Now that we've ignited your curiosity about Virginia Tax Credit For Energy Efficient Appliances We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Virginia Tax Credit For Energy Efficient Appliances for a variety reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets or flashcards as well as learning tools.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Virginia Tax Credit For Energy Efficient Appliances

Here are some fresh ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Virginia Tax Credit For Energy Efficient Appliances are a treasure trove of creative and practical resources for a variety of needs and passions. Their access and versatility makes them a fantastic addition to your professional and personal life. Explore the vast collection of Virginia Tax Credit For Energy Efficient Appliances to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Virginia Tax Credit For Energy Efficient Appliances really absolutely free?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables for commercial use?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns with Virginia Tax Credit For Energy Efficient Appliances?

- Some printables may come with restrictions regarding their use. Always read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home using a printer or visit a local print shop to purchase top quality prints.

-

What software do I require to view printables that are free?

- Most printables come in PDF format. They can be opened with free software, such as Adobe Reader.

Federal Solar Energy Tax Credit Sapling

West Virginia New Markets Tax Credit Coalition

Check more sample of Virginia Tax Credit For Energy Efficient Appliances below

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Is There A Tax Credit For Energy Efficient Appliances

Is There A Tax Credit For Energy Efficient Appliances

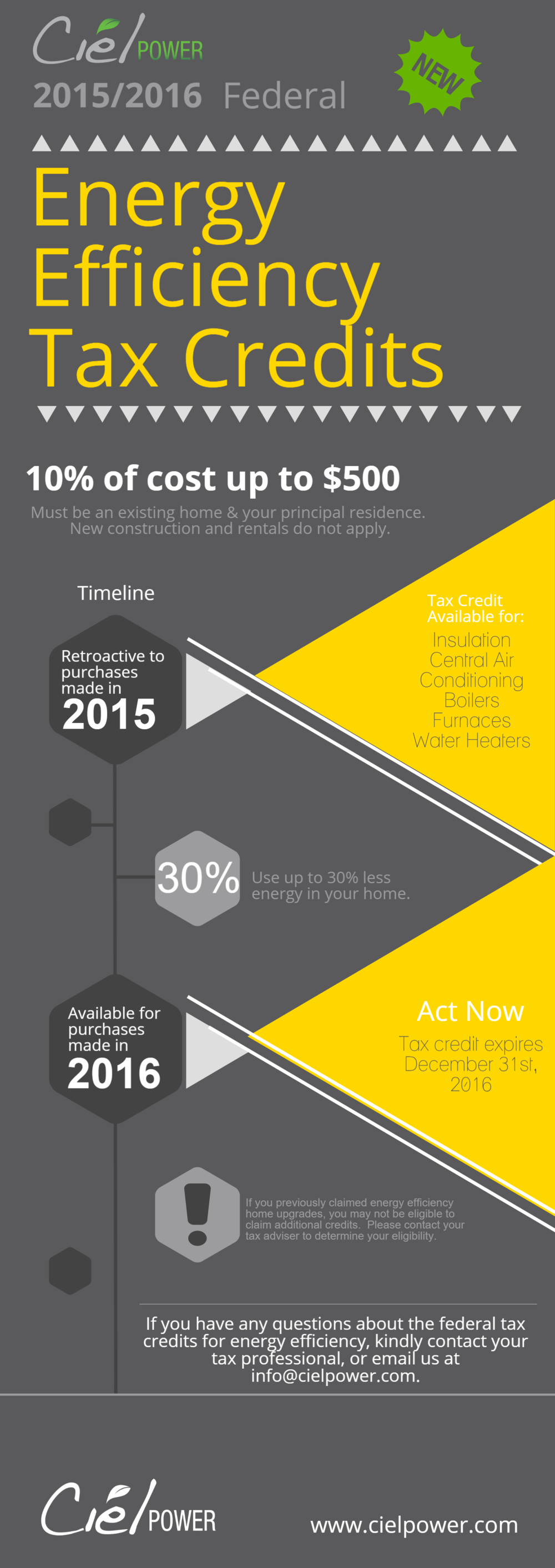

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Update House Passes Historic Rehab Tax Credit Increase Revitalizing

Can I Claim My Energy Efficient Appliances For Tax Credit

https://www.energy.virginia.gov/energy-efficiency/...

June 2023 The Inflation Reduction Act of 2022 H R 5376 extends the Energy Efficient Home Improvement Credit 25C 1 through the end of 2032 and expands the credit to allow households to deduct 30 of the costs of eligible upgrades from their taxes while adding new qualified products and larger dollar maximums

https://www.deq.virginia.gov/our-programs/...

This page lists grants rebates tax credits tax deductions and utility incentives available to encourage the adoption of energy efficiency measures and renewable or alternative energy The incentives may vary by sector but in general there are programs for all types residential customers small and large businesses and government agencies

June 2023 The Inflation Reduction Act of 2022 H R 5376 extends the Energy Efficient Home Improvement Credit 25C 1 through the end of 2032 and expands the credit to allow households to deduct 30 of the costs of eligible upgrades from their taxes while adding new qualified products and larger dollar maximums

This page lists grants rebates tax credits tax deductions and utility incentives available to encourage the adoption of energy efficiency measures and renewable or alternative energy The incentives may vary by sector but in general there are programs for all types residential customers small and large businesses and government agencies

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Is There A Tax Credit For Energy Efficient Appliances

Update House Passes Historic Rehab Tax Credit Increase Revitalizing

Can I Claim My Energy Efficient Appliances For Tax Credit

45L Tax Credit Tax Credit For Energy Efficient Homes Bit Rebels

Energy Efficient Appliance Cost Benefits

Energy Efficient Appliance Cost Benefits

How To Access The 179d Tax Credit For Energy Efficient Construction