In this digital age, with screens dominating our lives The appeal of tangible printed objects isn't diminished. If it's to aid in education or creative projects, or simply to add a personal touch to your space, What Date Does Hmrc Take Vat Payment can be an excellent resource. Here, we'll take a dive deeper into "What Date Does Hmrc Take Vat Payment," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest What Date Does Hmrc Take Vat Payment Below

What Date Does Hmrc Take Vat Payment

What Date Does Hmrc Take Vat Payment -

Payments are typically taken from your business bank account 3 working days after the payment deadline on your VAT return and take a further 3 working days to process

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day

The What Date Does Hmrc Take Vat Payment are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and more. The beauty of What Date Does Hmrc Take Vat Payment is in their versatility and accessibility.

More of What Date Does Hmrc Take Vat Payment

Does Hmrc Check Whether Someone Is A Director Who Is My Filipino Vrogue

Does Hmrc Check Whether Someone Is A Director Who Is My Filipino Vrogue

For example a VAT period ending on 31 March will require payment of the VAT liability by the 7 May However if the business registered for paying by direct debit payments are

As a UK business owner you ll know you must make VAT payments to HMRC These payments align with your VAT return which you can calculate by deducting the input

What Date Does Hmrc Take Vat Payment have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Worth: Downloads of educational content for free cater to learners of all ages, which makes them an essential resource for educators and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates helps save time and effort.

Where to Find more What Date Does Hmrc Take Vat Payment

What Is HMRC Mileage Allowance And How Does It Work FuelGenie

What Is HMRC Mileage Allowance And How Does It Work FuelGenie

On What Date Does HMRC Take the VAT Payment Payments for monthly and quarterly VAT returns are due on the same day as the submission deadline Therefore one month

The VAT payment date when you need to make payment for any VAT you owe to HMRC In most cases these dates are the same But can be different depending on the VAT

Now that we've piqued your interest in printables for free Let's find out where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of What Date Does Hmrc Take Vat Payment to suit a variety of needs.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching materials.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing What Date Does Hmrc Take Vat Payment

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Date Does Hmrc Take Vat Payment are an abundance of creative and practical resources that meet a variety of needs and pursuits. Their accessibility and versatility make them a wonderful addition to each day life. Explore the plethora of What Date Does Hmrc Take Vat Payment to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download these materials for free.

-

Does it allow me to use free printables for commercial use?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables could be restricted on their use. Be sure to review the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What software do I need to open printables free of charge?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software, such as Adobe Reader.

What Does The HMRC Let Property Campaign Letter Look Like YouTube

How Long Does It Take For HMRC To Pay My VAT Refund

Check more sample of What Date Does Hmrc Take Vat Payment below

When Does HMRC Investigate Self Employed AccountingFirms

Hmrc Take Home Pay OnePronic

How Long Does It Take To Get A Tax Refund From HMRC UK Salary Tax

HMRC KevynSteffan

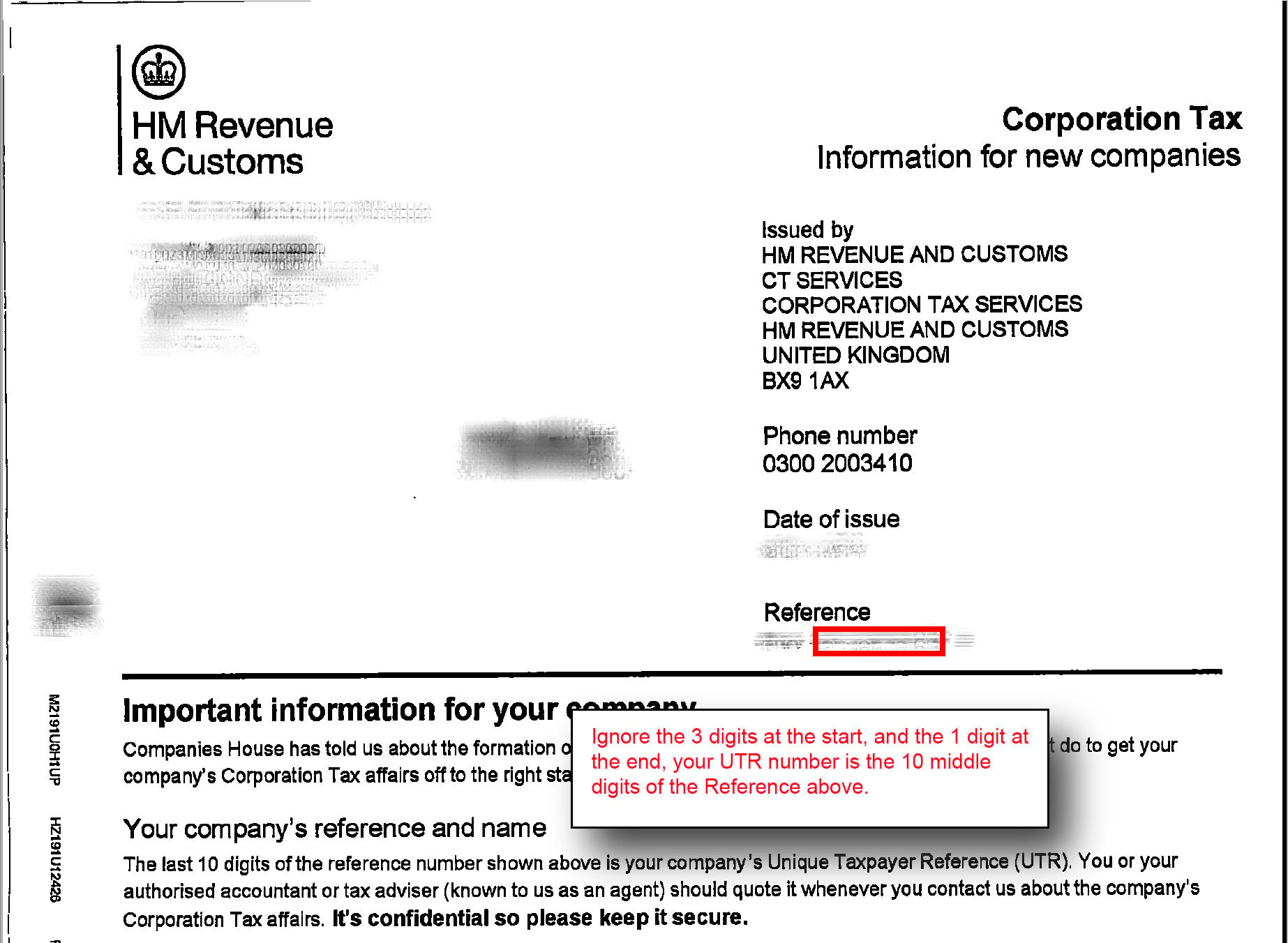

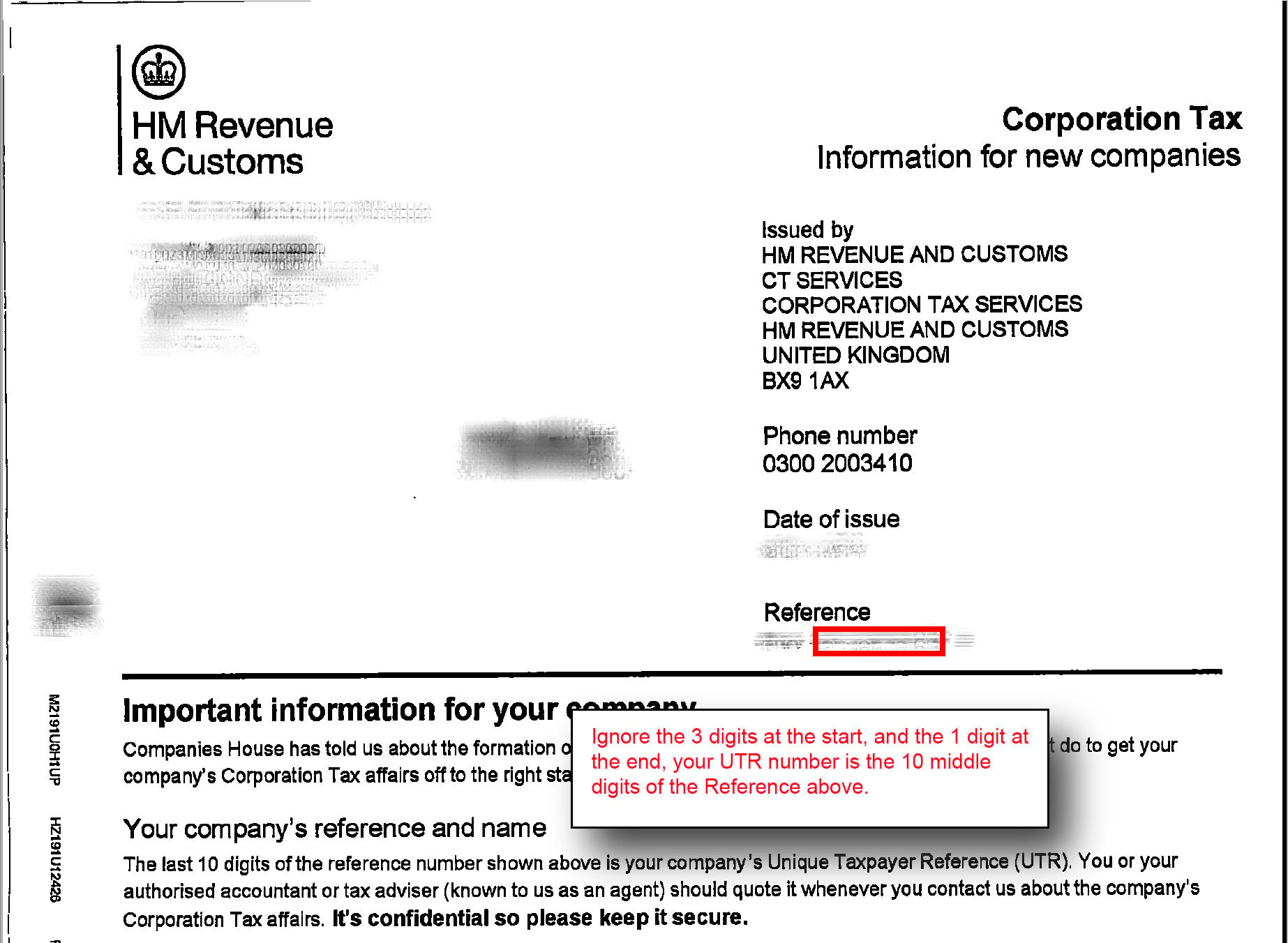

Where Can I Find My UTR Number

What Does HMRC Mean By Gifts From surplus Income Investors Chronicle

https://www. gov.uk /guidance/vat-payments-on-account

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day

https://www. aabrs.com /services/advice/dates...

July 11th 2023 Importantly the deadlines for submitting your VAT return online and paying HMRC any VAT you owe are the same If you re not sure when your VAT return and

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day

July 11th 2023 Importantly the deadlines for submitting your VAT return online and paying HMRC any VAT you owe are the same If you re not sure when your VAT return and

HMRC KevynSteffan

Hmrc Take Home Pay OnePronic

Where Can I Find My UTR Number

What Does HMRC Mean By Gifts From surplus Income Investors Chronicle

HMRC Have Asked Me To Make Payments On Account What Does It Mean

HMRC Take Possession Of Atlantic Square UK Government Hub June 2021

HMRC Take Possession Of Atlantic Square UK Government Hub June 2021

How Does HMRC Know I Sold My House Huuti