In this digital age, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, just adding personal touches to your area, What Ev Qualify For Tax Credit are now a useful resource. With this guide, you'll dive to the depths of "What Ev Qualify For Tax Credit," exploring what they are, how to find them and how they can improve various aspects of your daily life.

Get Latest What Ev Qualify For Tax Credit Below

What Ev Qualify For Tax Credit

What Ev Qualify For Tax Credit -

The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in previous years but some of the

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Printables for free cover a broad assortment of printable, downloadable materials that are accessible online for free cost. These printables come in different styles, from worksheets to templates, coloring pages, and many more. The appeal of printables for free is their versatility and accessibility.

More of What Ev Qualify For Tax Credit

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Here Is the EPA s List of EVs Eligible for the Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax

The What Ev Qualify For Tax Credit have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: We can customize print-ready templates to your specific requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational value: Education-related printables at no charge can be used by students from all ages, making the perfect resource for educators and parents.

-

Easy to use: instant access a plethora of designs and templates helps save time and effort.

Where to Find more What Ev Qualify For Tax Credit

These EVs Qualify For A 7 500 Tax Credit Under The Inflation

These EVs Qualify For A 7 500 Tax Credit Under The Inflation

By Kelley R Taylor last updated 6 March 2024 A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

In the event that we've stirred your interest in printables for free Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of What Ev Qualify For Tax Credit for various uses.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast spectrum of interests, from DIY projects to planning a party.

Maximizing What Ev Qualify For Tax Credit

Here are some creative ways of making the most of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Ev Qualify For Tax Credit are a treasure trove of useful and creative resources for a variety of needs and passions. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the endless world of What Ev Qualify For Tax Credit today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Ev Qualify For Tax Credit really completely free?

- Yes you can! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial use?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright problems with What Ev Qualify For Tax Credit?

- Certain printables may be subject to restrictions in use. Be sure to check the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer or go to a local print shop for more high-quality prints.

-

What software do I need to open printables at no cost?

- The majority of printed documents are in PDF format. These can be opened using free software like Adobe Reader.

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500

Which Electric Vehicles Qualify For Federal Tax Credits The New York

Check more sample of What Ev Qualify For Tax Credit below

Tax Credit 2023 2023

Is The 2022 Hyundai Ioniq 5 Eligible For The Federal EV Tax Credit

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

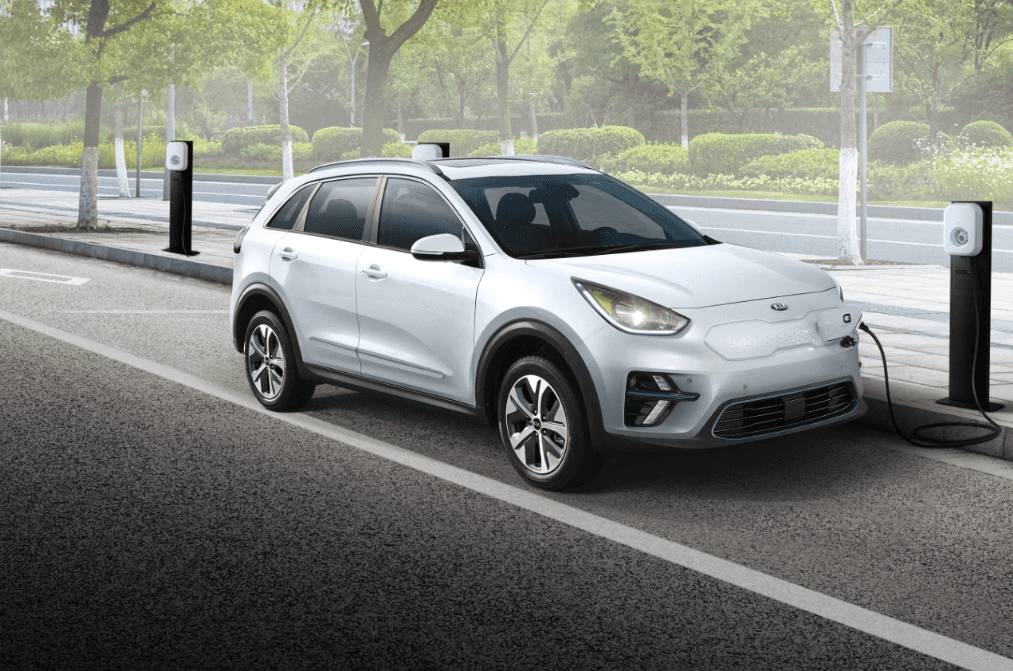

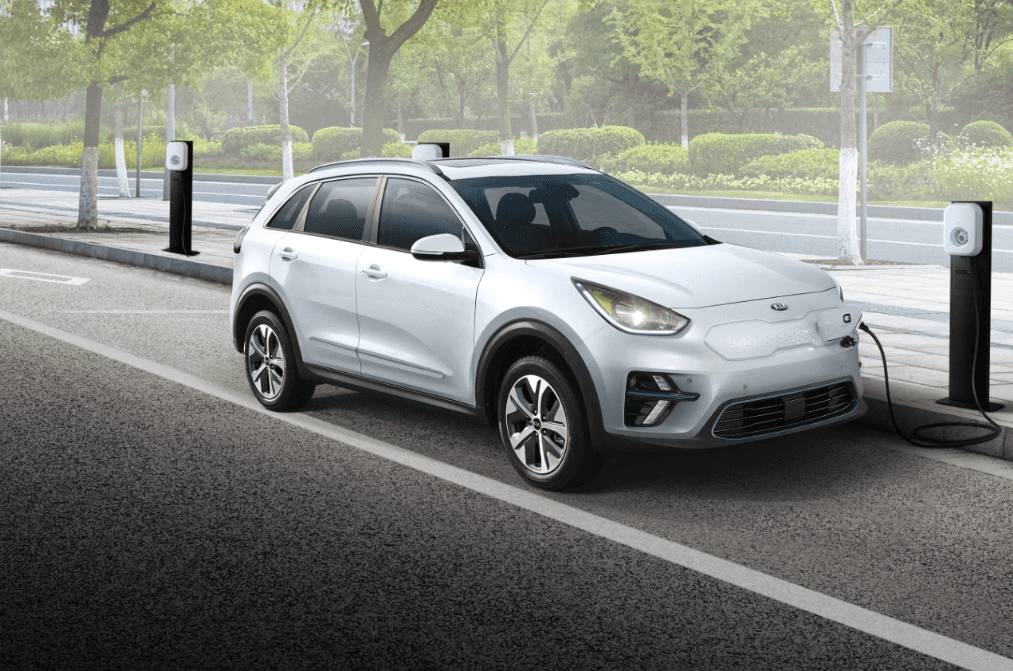

Does The Kia Niro EV Qualify For Tax Credit Electric Vehicle

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Tesla Model Y And Other Electric Vehicles Will Now Qualify For 7 500

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.consumerreports.org/cars/hybrids-evs/...

Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 for 2023 and 2024

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 for 2023 and 2024

Does The Kia Niro EV Qualify For Tax Credit Electric Vehicle

Is The 2022 Hyundai Ioniq 5 Eligible For The Federal EV Tax Credit

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Tesla Model Y And Other Electric Vehicles Will Now Qualify For 7 500

IRS EV Tax Credit 2023 Who Can Qualify Qualified Vehicles

These Electric Cars Qualify For The EV Tax Credits

These Electric Cars Qualify For The EV Tax Credits

.jpg)

The Tesla EV Tax Credit 2023