In this age of electronic devices, with screens dominating our lives but the value of tangible printed objects hasn't waned. No matter whether it's for educational uses or creative projects, or simply to add an individual touch to the space, What Is 80c And 80ccc In Income Tax can be an excellent source. In this article, we'll take a dive deeper into "What Is 80c And 80ccc In Income Tax," exploring their purpose, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest What Is 80c And 80ccc In Income Tax Below

What Is 80c And 80ccc In Income Tax

What Is 80c And 80ccc In Income Tax -

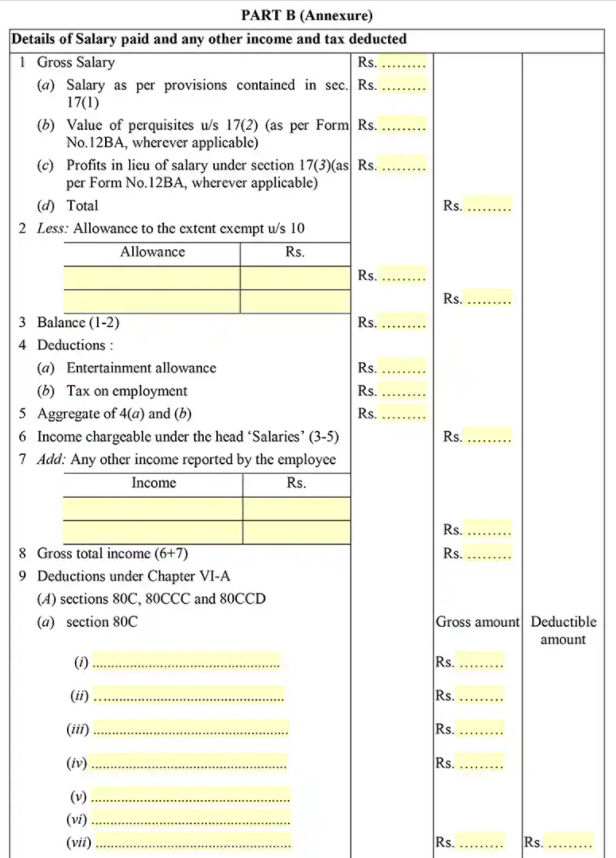

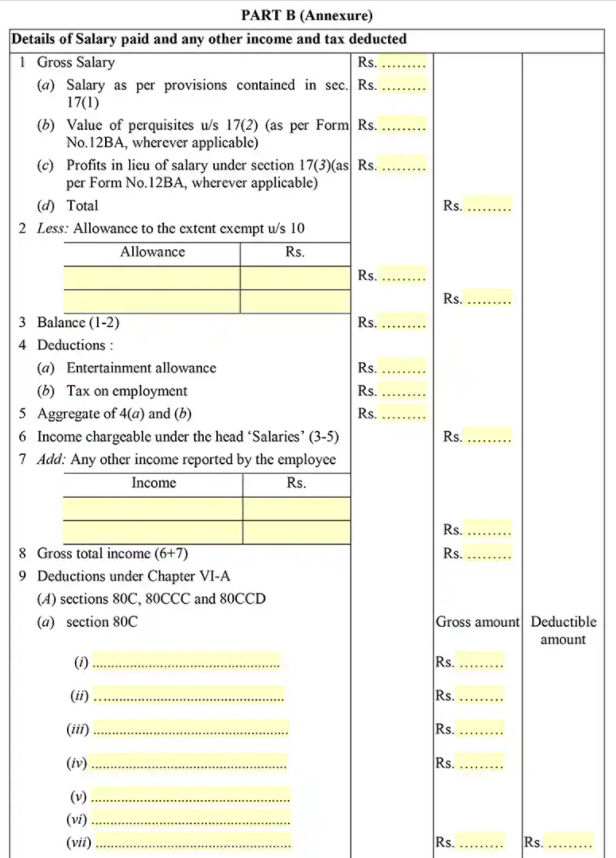

Section 80C helps you to save tax up to Rs 46 800 annually by deductions on investments up to 1 5 lakh year from your taxable income Whereas in comparison Section 80CCC also provides deductions of up to 1 5 lakh year for

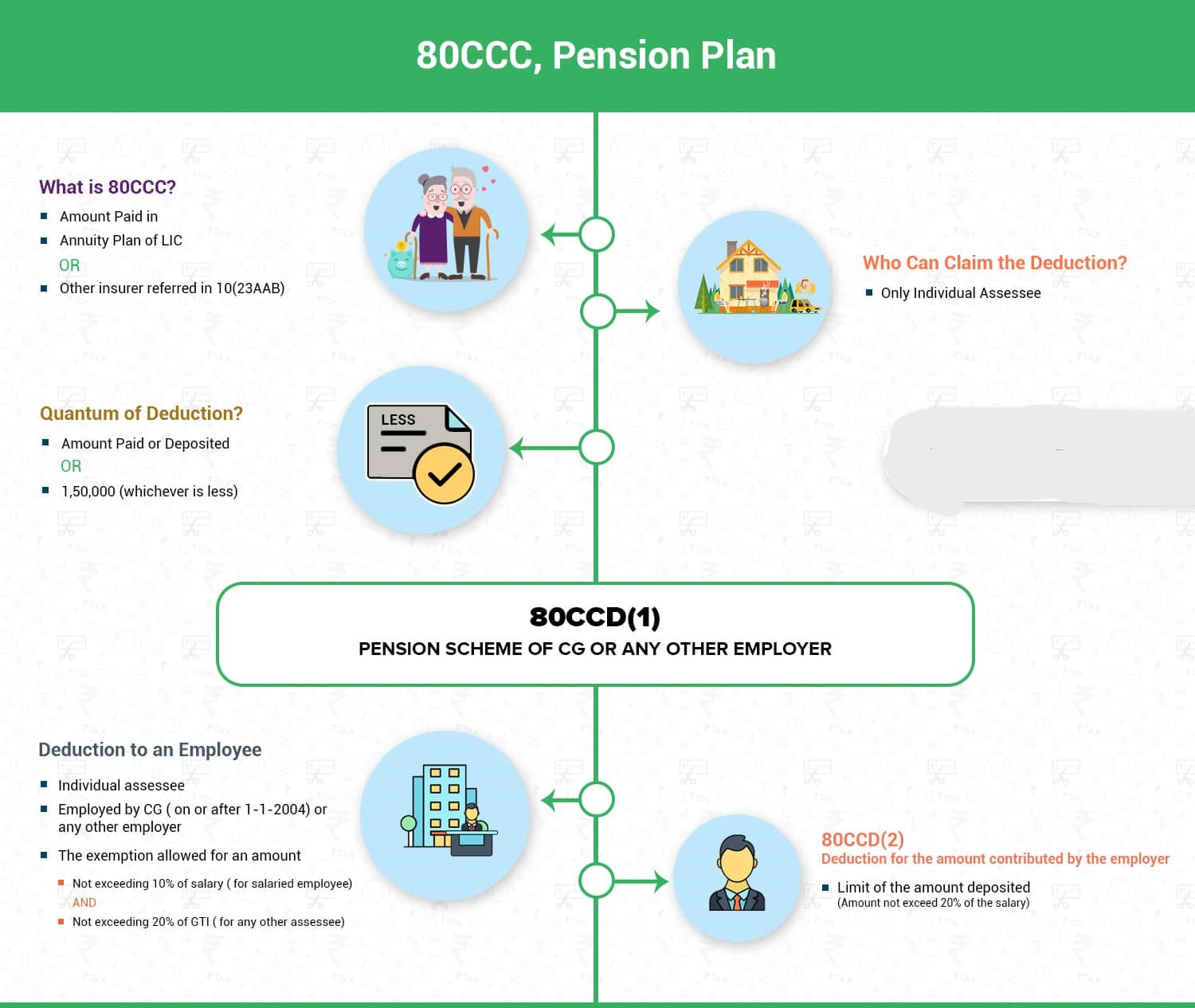

Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is within the combined limit along with deductions under Section 80C and Section 80CCD 1

The What Is 80c And 80ccc In Income Tax are a huge assortment of printable documents that can be downloaded online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and much more. The beauty of What Is 80c And 80ccc In Income Tax is their versatility and accessibility.

More of What Is 80c And 80ccc In Income Tax

Income Tax Section 80C 80CCC Latest Update 2023

Income Tax Section 80C 80CCC Latest Update 2023

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

Sections 80C and 80CCC of the Income tax Act 1961 allow tax deductions of up to Rs 1 5 lakh in a financial year for contributions towards small savings schemes pension plans life

What Is 80c And 80ccc In Income Tax have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: We can customize printed materials to meet your requirements whether it's making invitations, organizing your schedule, or decorating your home.

-

Education Value These What Is 80c And 80ccc In Income Tax can be used by students of all ages. This makes the perfect instrument for parents and teachers.

-

The convenience of The instant accessibility to a plethora of designs and templates reduces time and effort.

Where to Find more What Is 80c And 80ccc In Income Tax

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Section 80C provides tax deductions for individuals and Hindu Undivided Families HUFs through certain investments and expenses The maximum deduction is Rs 1 5 lakh per year Companies partnership firms and LLPs cannot use this deduction

Section 80CCC pertains to deductions for premiums paid towards certain pension funds Section 80CCD allows deductions for contributions to the National Pension Scheme NPS or Atal

Now that we've ignited your interest in What Is 80c And 80ccc In Income Tax we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in What Is 80c And 80ccc In Income Tax for different objectives.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing What Is 80c And 80ccc In Income Tax

Here are some unique ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

What Is 80c And 80ccc In Income Tax are a treasure trove of useful and creative resources that cater to various needs and pursuits. Their availability and versatility make them a wonderful addition to each day life. Explore the wide world of What Is 80c And 80ccc In Income Tax right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is 80c And 80ccc In Income Tax truly gratis?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial use?

- It's based on specific rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright problems with What Is 80c And 80ccc In Income Tax?

- Some printables may have restrictions regarding their use. You should read the conditions and terms of use provided by the creator.

-

How do I print What Is 80c And 80ccc In Income Tax?

- You can print them at home with printing equipment or visit a local print shop for higher quality prints.

-

What program will I need to access printables for free?

- The majority of printed documents are in PDF format, which can be opened using free software, such as Adobe Reader.

Exemptions Under Sections 80C 80CCC 80CCD And 80D For A Y 2022 23

Deduction Under Section 80C A Complete List BasuNivesh

Check more sample of What Is 80c And 80ccc In Income Tax below

What Is Section 80c In Hindi 80c Be

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Income Tax 80c Deduction Fy 2021 22 TAX

What Is 80c All You Need To Know About Section 80C Tata Capital Blog

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Form 16 How To Download Form 16 Types Eligibility

https://cleartax.in

Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is within the combined limit along with deductions under Section 80C and Section 80CCD 1

https://cleartax.in

Under section 80C a deduction of Rs 1 50 000 can be claimed from your total income In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1 50 000 can be claimed for the FY 2021 22 2020 21 and FY 2019 20 each

Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is within the combined limit along with deductions under Section 80C and Section 80CCD 1

Under section 80C a deduction of Rs 1 50 000 can be claimed from your total income In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1 50 000 can be claimed for the FY 2021 22 2020 21 and FY 2019 20 each

What Is 80c All You Need To Know About Section 80C Tata Capital Blog

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Form 16 How To Download Form 16 Types Eligibility

NRI Deductions Are Allowed Deduction Not Allowed RJA

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through