In the digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. In the case of educational materials as well as creative projects or simply to add an individual touch to your home, printables for free have proven to be a valuable resource. In this article, we'll take a dive deep into the realm of "What Is 80ccc In Income Tax," exploring the benefits of them, where to find them, and how they can improve various aspects of your daily life.

Get Latest What Is 80ccc In Income Tax Below

What Is 80ccc In Income Tax

What Is 80ccc In Income Tax -

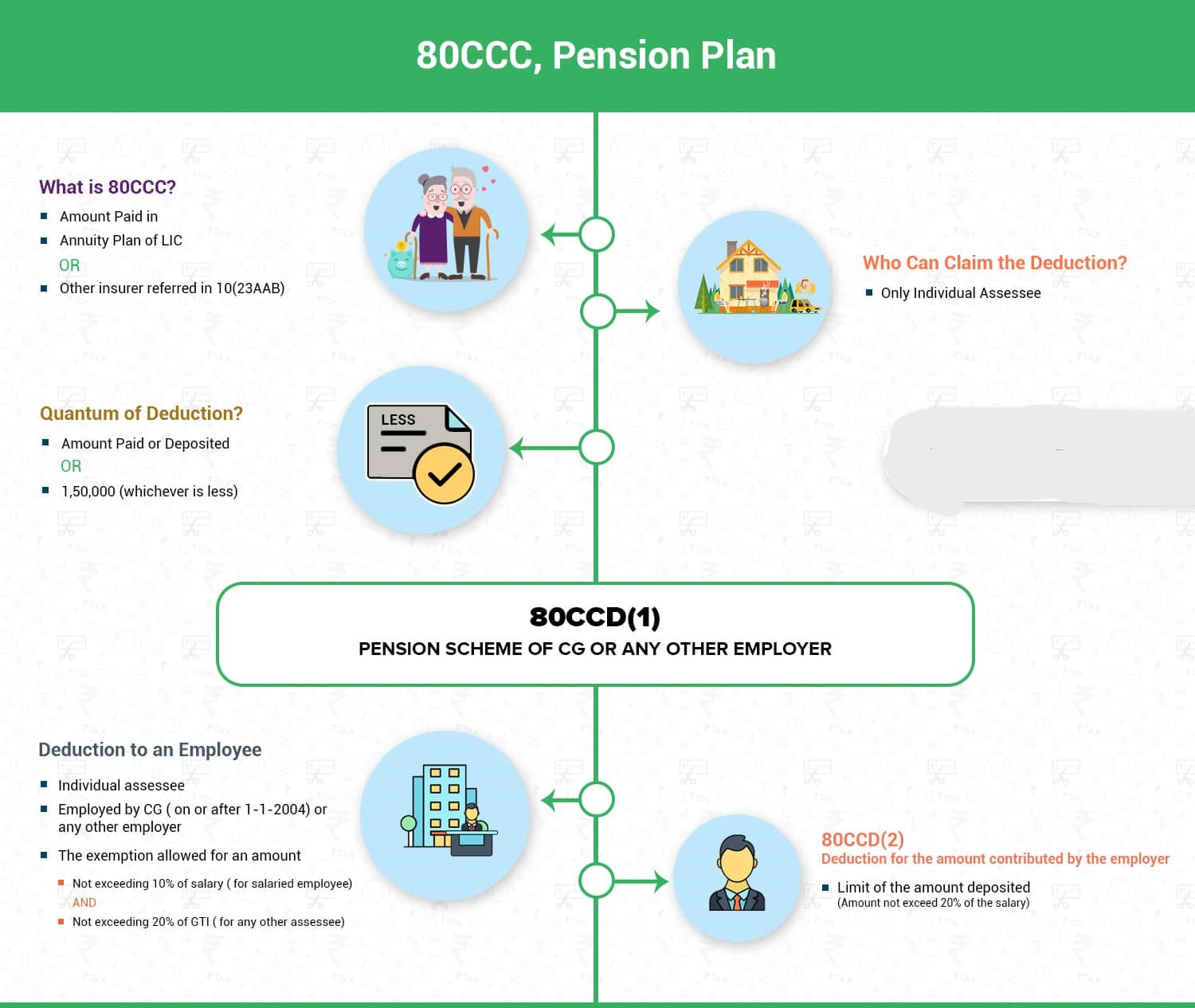

Section 80CCC of the Income Tax Act of 1961 is part of the larger 80C category which offers a cumulative tax deduction of up to Rs 1 5 lakh per year for investments in PPF EPF VPF life insurance recognized

Section 80CCC of the Income Tax Act 1961 is part of the broader 80 C category which allows cumulative tax deduction up to Rs 1 5 lakh annually for investments made into PPF EPF VPF life insurance notified pension funds etc Section 80CCC specifically allows investors to claim tax deductions in lieu of contributions made to

What Is 80ccc In Income Tax cover a large range of downloadable, printable material that is available online at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and many more. The beauty of What Is 80ccc In Income Tax is their versatility and accessibility.

More of What Is 80ccc In Income Tax

Section 80CCC Deductions Under Section 80CCC Of Income Tax Act

Section 80CCC Deductions Under Section 80CCC Of Income Tax Act

Deduction under Section 80CCC According to this section deduction is allowable to only individual whether resident or non resident for contributions made to certain pension funds However whenever the amount received from such pension funds along with interest then it will taxable in such period

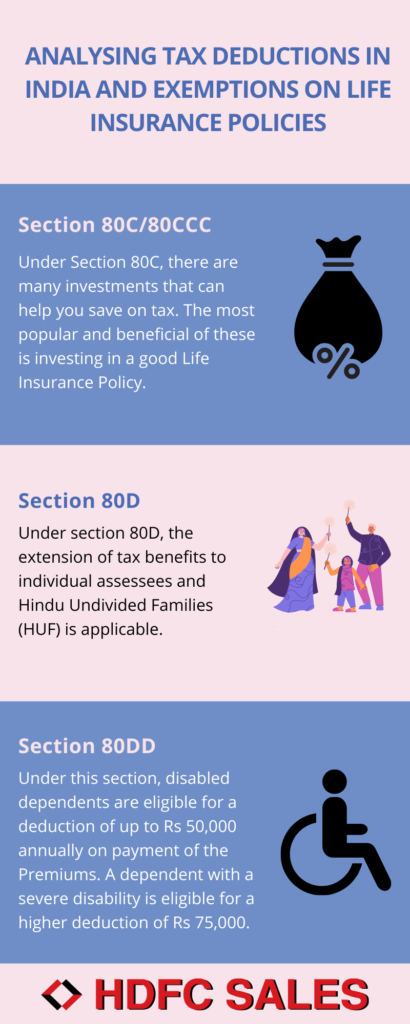

Simply put 80C is the section of the Income Tax Act that allows deductions for life insurance plans other investments crucial expenditures etc by any individual or a Hindu Undivided Family HUF Under the provision of section 80C tax exemptions are available for annual investments up to Rs 1 5 lakh

What Is 80ccc In Income Tax have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Customization: There is the possibility of tailoring printing templates to your own specific requirements such as designing invitations planning your schedule or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them a useful source for educators and parents.

-

An easy way to access HTML0: Instant access to the vast array of design and templates reduces time and effort.

Where to Find more What Is 80ccc In Income Tax

Income Tax Section 80C 80CCC Latest Update 2023

Income Tax Section 80C 80CCC Latest Update 2023

Section 80CCC of the Income Tax Act provides tax deductions when you invest in certain types of pension funds Read the article to understand why it is important features eligibility criteria for section 80ccc deductions

Section 80CCC of the Income Tax Act 1961 offers tax deductions up to Rs 1 5 Lakhs per year for contributions made by a person towards certain pension funds offered by a life insurance policy The 80CCC deduction is within the limit of section 80C

If we've already piqued your interest in printables for free Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of What Is 80ccc In Income Tax for various goals.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to party planning.

Maximizing What Is 80ccc In Income Tax

Here are some fresh ways in order to maximize the use of What Is 80ccc In Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is 80ccc In Income Tax are a treasure trove of fun and practical tools that satisfy a wide range of requirements and preferences. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the many options of What Is 80ccc In Income Tax and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printouts for commercial usage?

- It's all dependent on the rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may have restrictions in their usage. Be sure to review these terms and conditions as set out by the creator.

-

How do I print What Is 80ccc In Income Tax?

- Print them at home with the printer, or go to an area print shop for top quality prints.

-

What program do I need to run printables for free?

- Most PDF-based printables are available in PDF format. They is open with no cost software like Adobe Reader.

NRI Deductions Are Allowed Deduction Not Allowed RJA

Section 80CCC Deduction Of Income Tax IndiaFilings

Check more sample of What Is 80ccc In Income Tax below

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80CCC Deduction Income Tax IndiaFilings

Deduction Under Section 80CCC Tutorial In Tamil YouTube

Analysing Tax Deductions In India And Exemptions On Life Insurance

Section 4 Income Tax Act Malaysia Deduction In Income Tax Section

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

https://www.paisabazaar.com/tax/section-80ccc

Section 80CCC of the Income Tax Act 1961 is part of the broader 80 C category which allows cumulative tax deduction up to Rs 1 5 lakh annually for investments made into PPF EPF VPF life insurance notified pension funds etc Section 80CCC specifically allows investors to claim tax deductions in lieu of contributions made to

https://cleartax.in/s/80c-80-deductions

Section 80C Deductions on Investments Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments or incurring eligible expenses

Section 80CCC of the Income Tax Act 1961 is part of the broader 80 C category which allows cumulative tax deduction up to Rs 1 5 lakh annually for investments made into PPF EPF VPF life insurance notified pension funds etc Section 80CCC specifically allows investors to claim tax deductions in lieu of contributions made to

Section 80C Deductions on Investments Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments or incurring eligible expenses

Analysing Tax Deductions In India And Exemptions On Life Insurance

Section 80CCC Deduction Income Tax IndiaFilings

Section 4 Income Tax Act Malaysia Deduction In Income Tax Section

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Section 80CCC 80CCD 1 80CCD 2 80CCE Deductions Of Chapter VIA