In the digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. In the case of educational materials as well as creative projects or simply to add a personal touch to your area, What Is 80dd Deduction In Income Tax are now a useful source. Here, we'll take a dive deep into the realm of "What Is 80dd Deduction In Income Tax," exploring what they are, how to locate them, and how they can enrich various aspects of your lives.

Get Latest What Is 80dd Deduction In Income Tax Below

What Is 80dd Deduction In Income Tax

What Is 80dd Deduction In Income Tax -

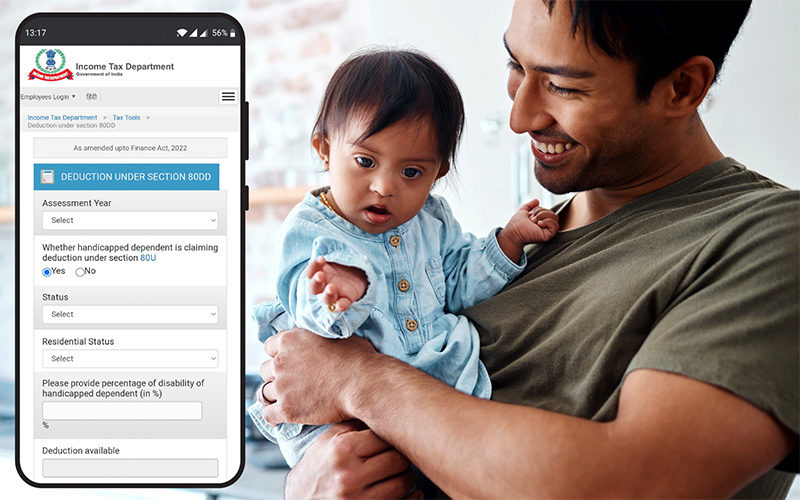

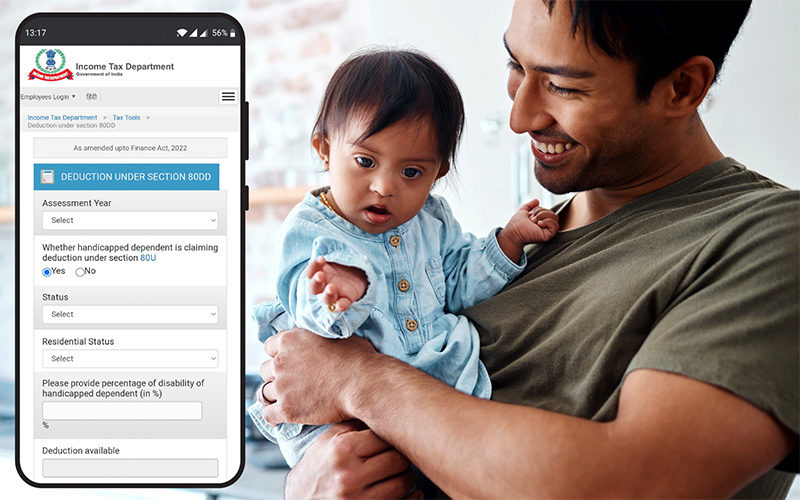

Last Updated November 18 2022 What Exactly is Section 80DD of the Income Tax Act Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely reliant on them for support and maintenance

Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include The deduction is allowed only to the dependants of the taxpayer and not the taxpayer himself

What Is 80dd Deduction In Income Tax cover a large variety of printable, downloadable materials available online at no cost. These resources come in many types, like worksheets, coloring pages, templates and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of What Is 80dd Deduction In Income Tax

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

What is Section 80DD in Income Tax Residents Individuals or HUFs can claim a deduction under section 80DD of the Income Tax Act for a dependent who is differently abled and relies on the individual or HUF for assistance and maintenance

All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family member To claim an individual must submit medical certificates and other essential documents as mentioned under the provision

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization We can customize the templates to meet your individual needs in designing invitations or arranging your schedule or even decorating your home.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages, which makes them a vital tool for parents and teachers.

-

Convenience: The instant accessibility to many designs and templates will save you time and effort.

Where to Find more What Is 80dd Deduction In Income Tax

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Tax deduction under Section 80DD of the Income Tax Act can be claimed by individuals who are residents of India and HUFs for the medical treatment of a dependant with disability ies or differently abled The deduction amount will also cover insurance premium paid towards specific insurance plans designed for a disabled dependant

Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax

After we've peaked your interest in What Is 80dd Deduction In Income Tax Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Is 80dd Deduction In Income Tax to suit a variety of objectives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to planning a party.

Maximizing What Is 80dd Deduction In Income Tax

Here are some new ways of making the most of What Is 80dd Deduction In Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

What Is 80dd Deduction In Income Tax are a treasure trove filled with creative and practical information for a variety of needs and passions. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast array of What Is 80dd Deduction In Income Tax today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can print and download the resources for free.

-

Can I use the free printables for commercial use?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations on use. Check the terms and conditions provided by the author.

-

How do I print What Is 80dd Deduction In Income Tax?

- Print them at home with any printer or head to a local print shop for high-quality prints.

-

What software will I need to access What Is 80dd Deduction In Income Tax?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

Section 80DD Deductions Under Section 80DD Of Income Tax Act

Check more sample of What Is 80dd Deduction In Income Tax below

Claim Deduction Under Section 80DD Learn By Quicko

Income Tax Sec 80DD Deduction In Relation To Disable Autism Etc

Deduction Under Section 80DD 80DDB And 80U

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

Standard Deduction In Income Tax 2022

Anything To Everything Income Tax Guide For Individuals Including

https://tax2win.in/guide/section-80dd

Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include The deduction is allowed only to the dependants of the taxpayer and not the taxpayer himself

https://taxguru.in/income-tax/deduction-section...

Q 1 What is 80DD in income tax Ans 80DD provides deduction towards the medical treatment training and rehabilitation of a disabled dependant or towards the amount of insurance premium paid for specified insurance plan for the disabled dependant Q 2 How do I claim a section 80DD

Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include The deduction is allowed only to the dependants of the taxpayer and not the taxpayer himself

Q 1 What is 80DD in income tax Ans 80DD provides deduction towards the medical treatment training and rehabilitation of a disabled dependant or towards the amount of insurance premium paid for specified insurance plan for the disabled dependant Q 2 How do I claim a section 80DD

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

Income Tax Sec 80DD Deduction In Relation To Disable Autism Etc

Standard Deduction In Income Tax 2022

Anything To Everything Income Tax Guide For Individuals Including

Section 80DD 80U Of Income Tax II Deduction For Disabled II How 80DD

Preventive Check Up 80d Wkcn

Preventive Check Up 80d Wkcn

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates