In this age of electronic devices, where screens rule our lives, the charm of tangible printed materials isn't diminishing. Be it for educational use as well as creative projects or simply to add a personal touch to your area, What Is A Federal Tax Credit For Energy Efficiency are now a vital source. Through this post, we'll dive deep into the realm of "What Is A Federal Tax Credit For Energy Efficiency," exploring what they are, how to find them and how they can add value to various aspects of your lives.

Get Latest What Is A Federal Tax Credit For Energy Efficiency Below

What Is A Federal Tax Credit For Energy Efficiency

What Is A Federal Tax Credit For Energy Efficiency -

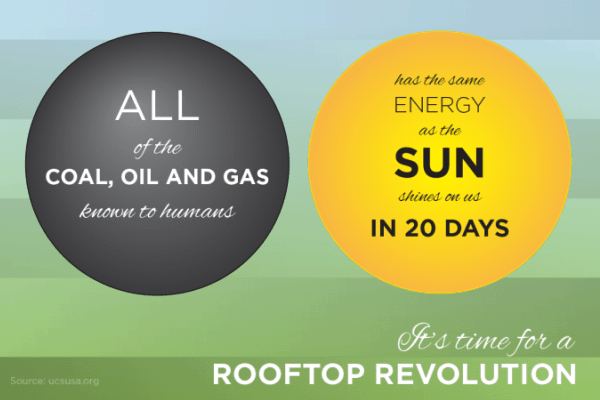

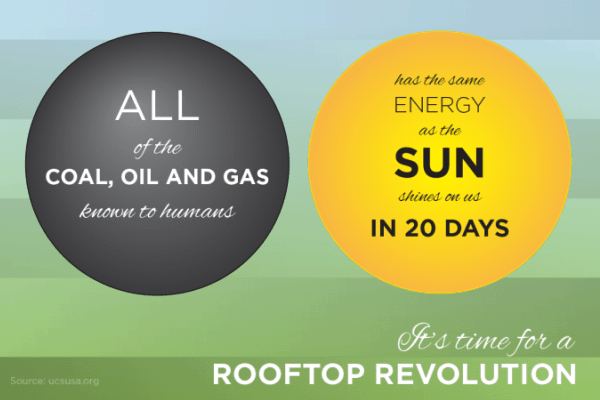

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

The What Is A Federal Tax Credit For Energy Efficiency are a huge array of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and much more. The appealingness of What Is A Federal Tax Credit For Energy Efficiency lies in their versatility as well as accessibility.

More of What Is A Federal Tax Credit For Energy Efficiency

Can I Receive A Federal Tax Credit For Replacing My Windows

Can I Receive A Federal Tax Credit For Replacing My Windows

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize the templates to meet your individual needs whether it's making invitations making your schedule, or even decorating your house.

-

Education Value The free educational worksheets are designed to appeal to students of all ages, which makes these printables a powerful resource for educators and parents.

-

The convenience of Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more What Is A Federal Tax Credit For Energy Efficiency

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage

We hope we've stimulated your interest in printables for free Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning tools.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast range of interests, including DIY projects to planning a party.

Maximizing What Is A Federal Tax Credit For Energy Efficiency

Here are some fresh ways in order to maximize the use of What Is A Federal Tax Credit For Energy Efficiency:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

What Is A Federal Tax Credit For Energy Efficiency are a treasure trove of useful and creative resources catering to different needs and preferences. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the plethora of What Is A Federal Tax Credit For Energy Efficiency now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is A Federal Tax Credit For Energy Efficiency really for free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I utilize free printing templates for commercial purposes?

- It's based on the usage guidelines. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with What Is A Federal Tax Credit For Energy Efficiency?

- Certain printables could be restricted regarding usage. Check these terms and conditions as set out by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to any local print store for top quality prints.

-

What program do I require to view What Is A Federal Tax Credit For Energy Efficiency?

- A majority of printed materials are in the PDF format, and can be opened with free software like Adobe Reader.

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

Electric Cars Lowest Prices 2013 Top 10 Electric Cars Clean Fleet Report

Check more sample of What Is A Federal Tax Credit For Energy Efficiency below

Federal Solar Energy Tax Credit Sapling

Earn Up To A 500 Federal Tax Credit With Purchase Of Energy Efficient

Ev Tax Credit 2022 Cap Clement Wesley

The Federal Solar Tax Credit Extension Can We Win If We Lose

Federal Tax Credit For Solar Installation Local Pro Solar

Arizona Solar Tax Credit Form Donny Somers

https://www.energystar.gov › about › fe…

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

https://www.investopedia.com › ... › en…

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum

The Federal Solar Tax Credit Extension Can We Win If We Lose

Earn Up To A 500 Federal Tax Credit With Purchase Of Energy Efficient

Federal Tax Credit For Solar Installation Local Pro Solar

Arizona Solar Tax Credit Form Donny Somers

The 2018 Electric Vehicle Tax Credit OsVehicle

Energy Efficiency Tax Credit Extended Boothbay Register

Energy Efficiency Tax Credit Extended Boothbay Register

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy