In this age of technology, where screens rule our lives and the appeal of physical printed material hasn't diminished. If it's to aid in education as well as creative projects or just adding an individual touch to the area, What Is Corporate Tax In India have proven to be a valuable resource. Here, we'll take a dive into the world "What Is Corporate Tax In India," exploring what they are, how they can be found, and ways they can help you improve many aspects of your lives.

Get Latest What Is Corporate Tax In India Below

What Is Corporate Tax In India

What Is Corporate Tax In India -

Corporate Tax in India It is the tax imposed on the net income of the company Learn more about corporate tax working definition and all updates

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

What Is Corporate Tax In India provide a diverse range of printable, free items that are available online at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of What Is Corporate Tax In India

Meaning Of Corporate Tax In India And Corporate Tax Rate For Companies

Meaning Of Corporate Tax In India And Corporate Tax Rate For Companies

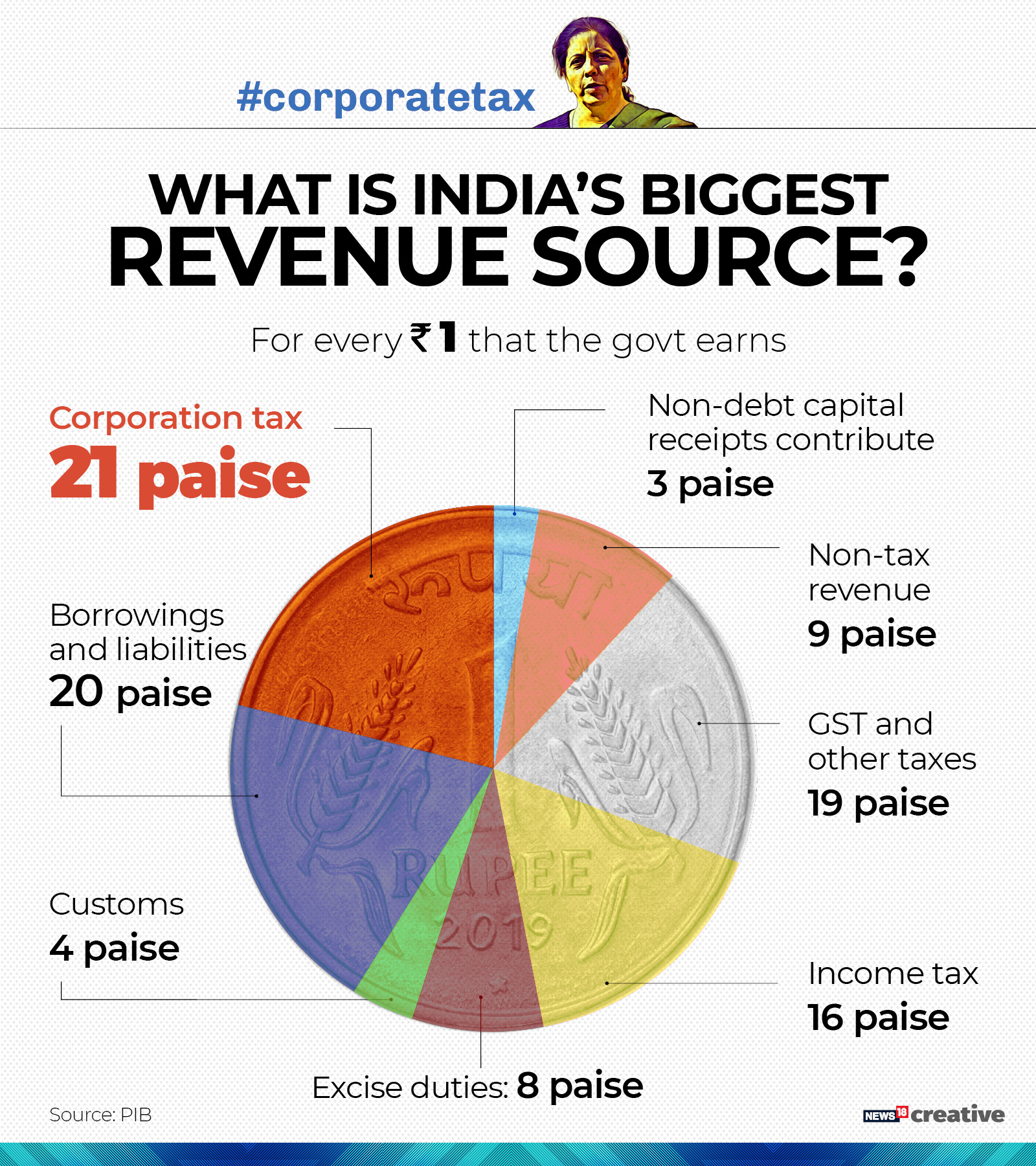

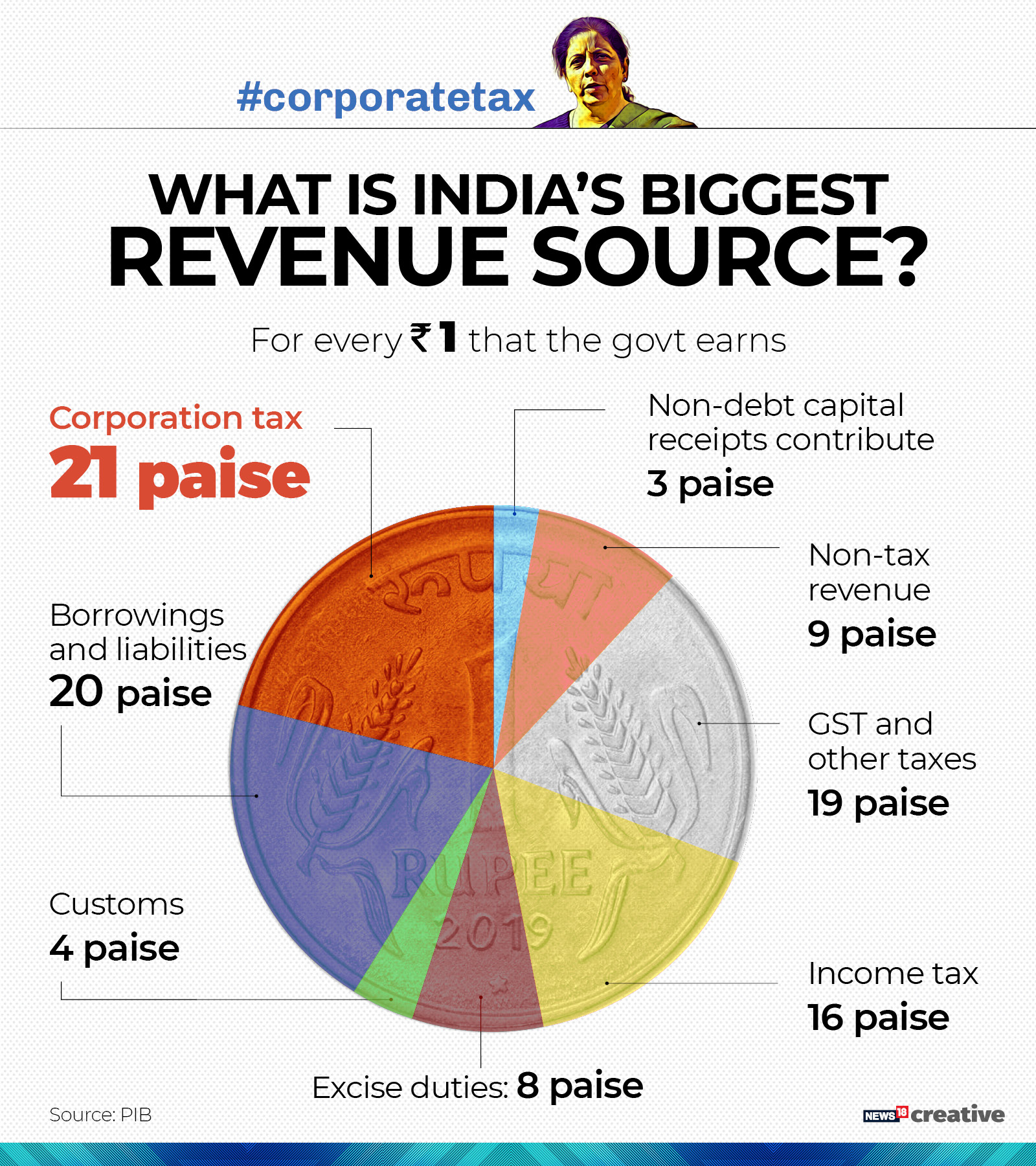

Corporate Tax in India Indian government levies corporate taxes on enterprises as a source of income The calculation of this tax is premised upon the net income of a company

Corporation Tax or Corporate Tax is a direct tax levied on the net income or profit of a corporate entity from their business foreign or domestic The rate at which the tax is imposed as per the provisions of the Income Tax Act

What Is Corporate Tax In India have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: We can customize printables to your specific needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Impact: Free educational printables cater to learners from all ages, making them a great instrument for parents and teachers.

-

Simple: The instant accessibility to an array of designs and templates cuts down on time and efforts.

Where to Find more What Is Corporate Tax In India

Corporate Tax What Is Corporate Tax In India Tax2win

Corporate Tax What Is Corporate Tax In India Tax2win

The key features of the new corporate tax regime introduced in 2019 included 1 Reduced Corporate Tax Rates The corporate tax rate for existing domestic companies was reduced to 22 subject to the condition that they do not avail any specified exemptions or incentives

Corporate tax rate in India Corporate tax rebates Basics of corporation tax planning Dividend Distribution Tax DDT This guide will walk you through corporate tax in India with the latest rates for domestic companies and foreign companies rebates and calculating taxable income

In the event that we've stirred your curiosity about What Is Corporate Tax In India and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with What Is Corporate Tax In India for all goals.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide spectrum of interests, that range from DIY projects to planning a party.

Maximizing What Is Corporate Tax In India

Here are some innovative ways of making the most use of What Is Corporate Tax In India:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

What Is Corporate Tax In India are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and preferences. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the vast array of What Is Corporate Tax In India now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions on their use. Be sure to read these terms and conditions as set out by the designer.

-

How can I print What Is Corporate Tax In India?

- You can print them at home with a printer or visit a local print shop for higher quality prints.

-

What program will I need to access What Is Corporate Tax In India?

- Most PDF-based printables are available in the format PDF. This can be opened with free programs like Adobe Reader.

Corporate Tax In India Calculate Corporate Tax Corporate Tax Rates

Corporate Tax In India The Ultimate Guide Razorpay Learn

Check more sample of What Is Corporate Tax In India below

All About Corporate Tax In India Paytm Business Blog

Corporate Tax In India Rates Calculation Types Slabs

Corporate Tax In India Overview Meaning Types Rates

What Is Corporate Tax YouTube

All You Need To Know About Corporate Tax In The UAE Pledge Times

What Is Corporate Tax In UAE Corporate Tax Rate In UAE Corporate

https://taxsummaries.pwc.com/india/corporate/taxes...

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

https://cleartax.in/glossary/corporate-tax

A corporate tax is a levy which the government imposes on the income of a company The money collected from corporate taxes is used as the source of revenue for a country Operating earnings of a company are determined by deducting costs from the cost of the product sold COGS and income depreciation

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

A corporate tax is a levy which the government imposes on the income of a company The money collected from corporate taxes is used as the source of revenue for a country Operating earnings of a company are determined by deducting costs from the cost of the product sold COGS and income depreciation

What Is Corporate Tax YouTube

Corporate Tax In India Rates Calculation Types Slabs

All You Need To Know About Corporate Tax In The UAE Pledge Times

What Is Corporate Tax In UAE Corporate Tax Rate In UAE Corporate

Zero Corporation Tax Rate Countries Forecast 2023 YouYaa

UAE Corporate Tax Be Applicable To Businesses In Each Emirate

UAE Corporate Tax Be Applicable To Businesses In Each Emirate

How UAE Corporate Tax Effects GCC Countries