In this day and age where screens rule our lives and the appeal of physical printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply to add an individual touch to your space, What Is Deduction Under Section 80d have become a valuable source. Through this post, we'll dive deeper into "What Is Deduction Under Section 80d," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your lives.

Get Latest What Is Deduction Under Section 80d Below

What Is Deduction Under Section 80d

What Is Deduction Under Section 80d -

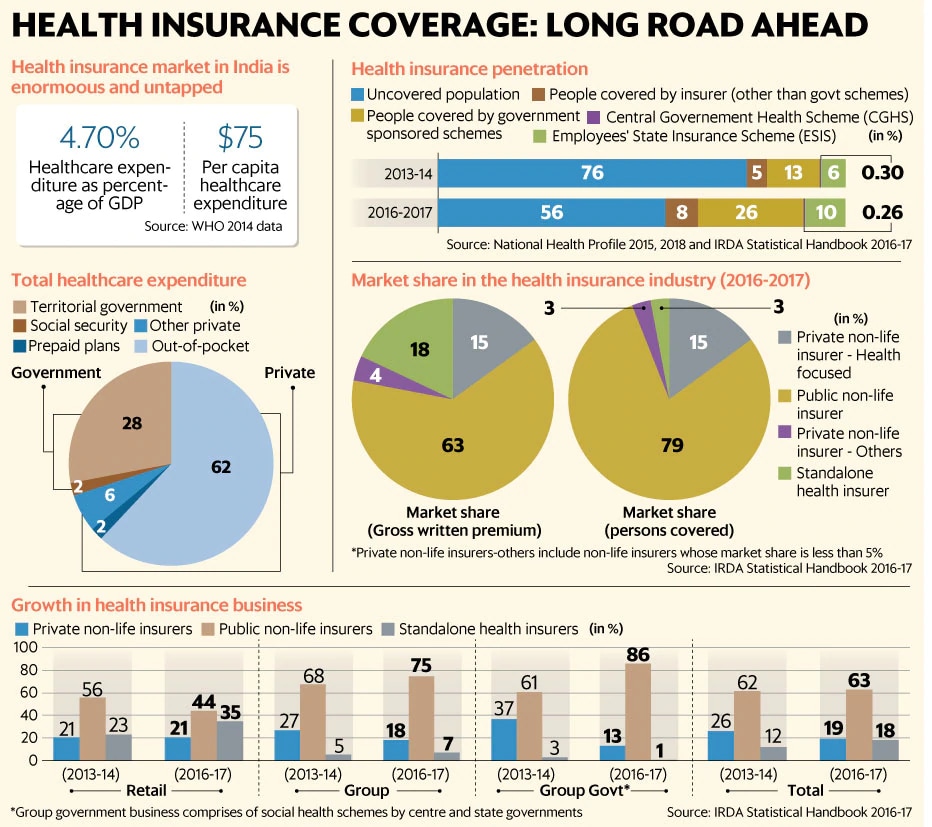

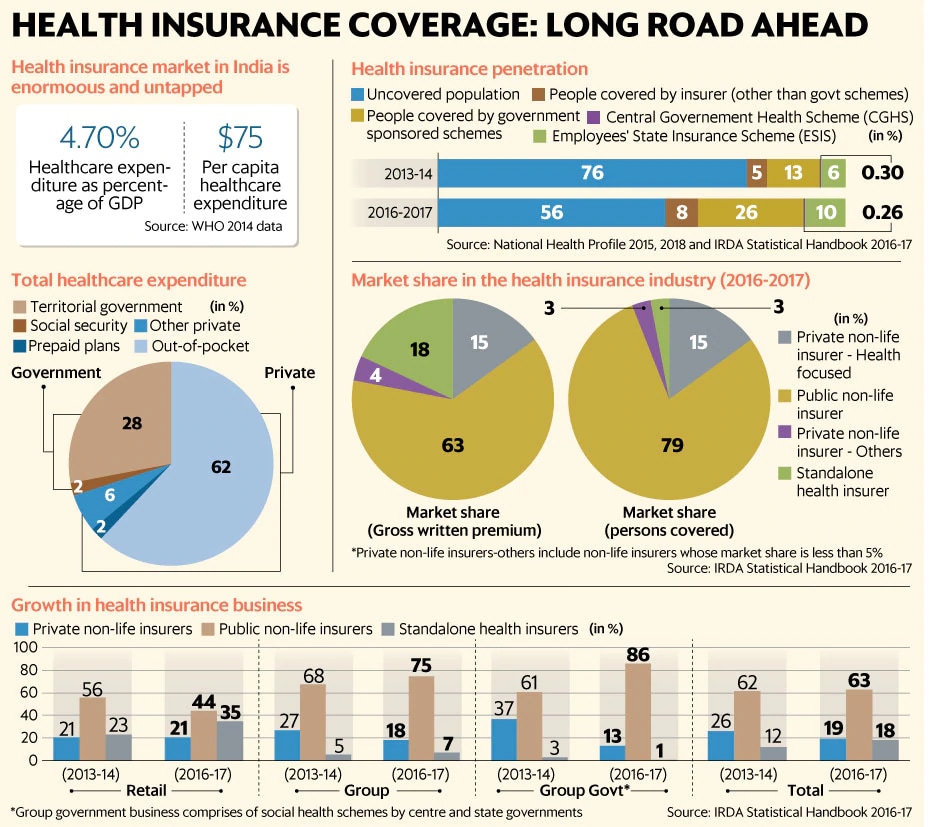

Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

What Is Deduction Under Section 80d cover a large assortment of printable content that can be downloaded from the internet at no cost. These resources come in various forms, like worksheets templates, coloring pages and much more. The attraction of printables that are free is their flexibility and accessibility.

More of What Is Deduction Under Section 80d

80D Tax Deduction Under Section 80D On Medical Insurance

80D Tax Deduction Under Section 80D On Medical Insurance

Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and dependent who are under 60 years of age

Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up and 2 Medical expenditure Categories of persons qualifying for deduction under section 80D Deduction under section 80D is available to the following categories of persons An

What Is Deduction Under Section 80d have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization: You can tailor the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: The free educational worksheets can be used by students of all ages, making the perfect tool for parents and educators.

-

Accessibility: The instant accessibility to many designs and templates is time-saving and saves effort.

Where to Find more What Is Deduction Under Section 80d

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

Under Section 80D of the Income Tax Act an individual can claim a deduction for the following medical expenses incurred during the financial year Medical insurance premium paid by the taxpayer through any mode of payment other than cash

How can you claim deduction under section 80D The maximum deduction to be claimed under section 80D depends on how many people are covered under the insurance cover Depending on the taxpayer s family situation and the respective people covered under the policy the limit could be Rs 25 000 Rs 50 000 Rs 75 000 or Rs 1 lakh

We hope we've stimulated your interest in What Is Deduction Under Section 80d Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of What Is Deduction Under Section 80d to suit a variety of purposes.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to planning a party.

Maximizing What Is Deduction Under Section 80d

Here are some inventive ways create the maximum value use of What Is Deduction Under Section 80d:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home and in class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is Deduction Under Section 80d are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and preferences. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the many options of What Is Deduction Under Section 80d and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Deduction Under Section 80d really gratis?

- Yes you can! You can download and print these files for free.

-

Can I use the free printables for commercial use?

- It's based on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using What Is Deduction Under Section 80d?

- Certain printables may be subject to restrictions regarding their use. Check the terms and conditions set forth by the designer.

-

How can I print What Is Deduction Under Section 80d?

- Print them at home using your printer or visit a local print shop to purchase top quality prints.

-

What program do I need to open printables at no cost?

- The majority are printed in PDF format. They can be opened using free programs like Adobe Reader.

Tax Deductions Section 80D How To Claim Tax Deduction Under Section

Section 80D Deduction For Medical Insurance Health Checkups 2019

Check more sample of What Is Deduction Under Section 80d below

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80D Guide Tax Deductions For Health Insurance Medical

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

All About Section 80D Deduction On Medical Insurance

https://tax2win.in/guide/section-80d-deduction...

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

https://economictimes.indiatimes.com/wealth/tax/...

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Section 80D Guide Tax Deductions For Health Insurance Medical

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

All About Section 80D Deduction On Medical Insurance

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Tax Saving On Health Insurance Section 80D Detailed Guide For FY