In this age of electronic devices, where screens rule our lives and the appeal of physical printed objects hasn't waned. In the case of educational materials as well as creative projects or simply adding a personal touch to your home, printables for free have become a valuable resource. We'll take a dive into the sphere of "What Is Fringe Benefit Tax In South Africa," exploring their purpose, where they are available, and how they can enhance various aspects of your life.

Get Latest What Is Fringe Benefit Tax In South Africa Below

What Is Fringe Benefit Tax In South Africa

What Is Fringe Benefit Tax In South Africa -

The following categories of fringe benefit are identified in the Guide for employers in respect of fringe benefits 2018 tax year When receiving an asset or gift at less than its value This is best explained with an example such as an employee who receives an award for bravery or long service

With effect from 1 March 2013 the value of the fringe benefit for vehicles under operating leases as defined in section 23A 1 is in terms of paragraph 7 4 a ii is the actual cost to the employer incurred under that operating lease and

What Is Fringe Benefit Tax In South Africa include a broad selection of printable and downloadable material that is available online at no cost. They come in many types, like worksheets, templates, coloring pages, and much more. The appeal of printables for free lies in their versatility and accessibility.

More of What Is Fringe Benefit Tax In South Africa

What Is Fringe Benefits Tax FBT LDB Group

What Is Fringe Benefits Tax FBT LDB Group

Fringe benefits MEDICAL SCHEME CONTRIBUTIONS PAID BY AN EMPLOYER Reference to the Act Sections 6A and 18 5 and paragraphs 2 i and 12A of the 7th Schedule Meaning A taxable benefit shall be deemed to have been granted where the employer contributes directly or indirectly to a medical scheme on behalf of an

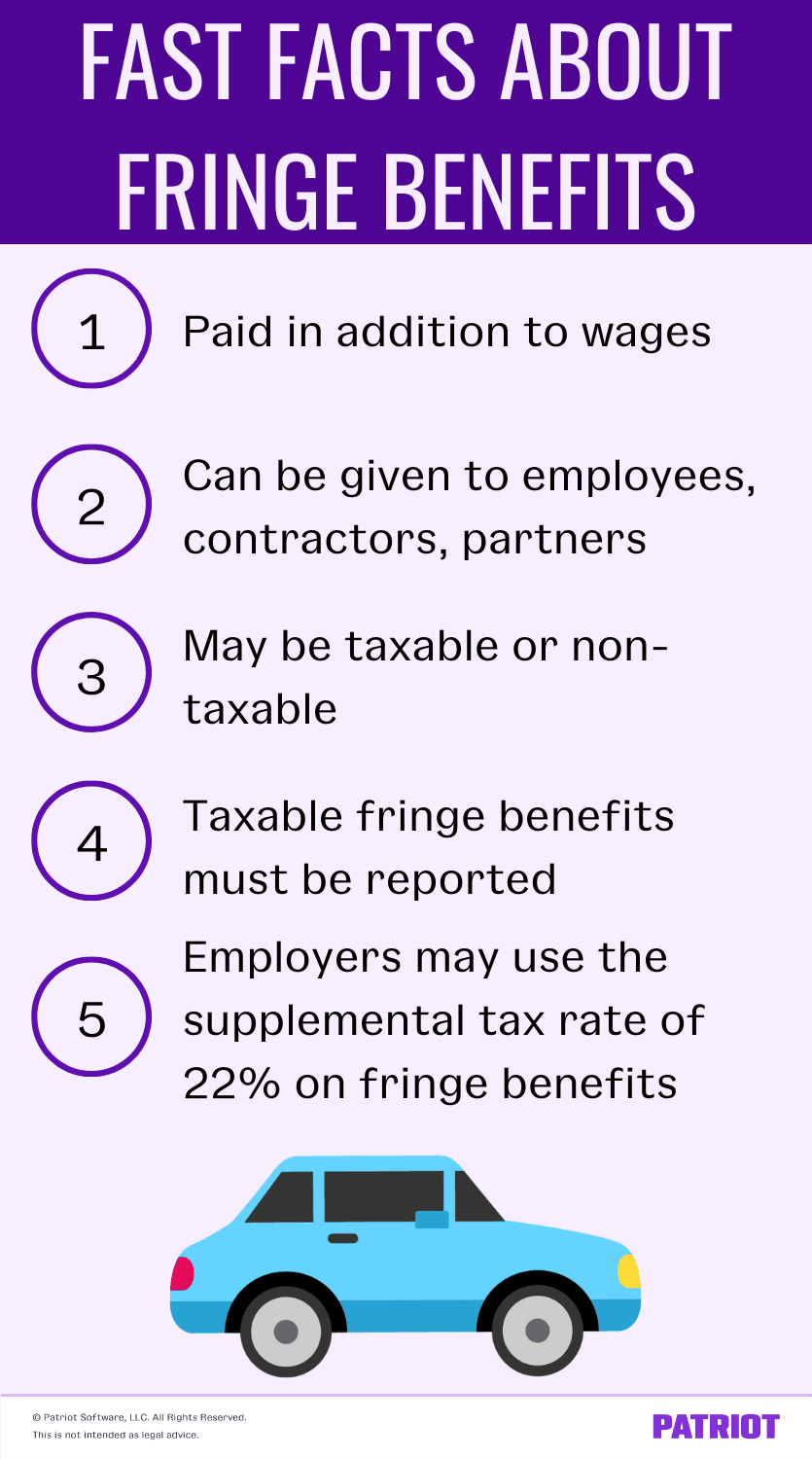

FBT is calculated on the taxable value of the benefit and is separate to income tax Examples of fringe benefits are work car and computer gym membership a discounted loan entertainment such as concert tickets meals or drinks providing accommodation either rent free or at a reduced rate

What Is Fringe Benefit Tax In South Africa have garnered immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: This allows you to modify the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value These What Is Fringe Benefit Tax In South Africa offer a wide range of educational content for learners of all ages, which makes them an essential resource for educators and parents.

-

Affordability: Quick access to an array of designs and templates is time-saving and saves effort.

Where to Find more What Is Fringe Benefit Tax In South Africa

What Is Fringe Benefit Tax Teletrac Navman AU

What Is Fringe Benefit Tax Teletrac Navman AU

The South African Revenue Service recently published four draft interpretation notes dealing with the taxation of allowances and fringe benefits Issue 3 of Interpretation Note No 14 on allowances advances and reimbursements A draft interpretation note on the right of use of a motor vehicle

Fringe benefits Low interest or interest free loans Paragraph 2 f of the 7th Schedule prescribes that a taxable benefit shall be deemed to have been granted if a loan other than a loan for purposes of paying any consideration by the employer in respect of a qualifying equity share the payment of any stamp duties or uncertified

If we've already piqued your interest in What Is Fringe Benefit Tax In South Africa Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of What Is Fringe Benefit Tax In South Africa suitable for many uses.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad range of topics, from DIY projects to party planning.

Maximizing What Is Fringe Benefit Tax In South Africa

Here are some unique ways in order to maximize the use use of What Is Fringe Benefit Tax In South Africa:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

What Is Fringe Benefit Tax In South Africa are a treasure trove filled with creative and practical information that can meet the needs of a variety of people and passions. Their access and versatility makes these printables a useful addition to any professional or personal life. Explore the wide world of What Is Fringe Benefit Tax In South Africa now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print these materials for free.

-

Are there any free templates for commercial use?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in What Is Fringe Benefit Tax In South Africa?

- Some printables may contain restrictions regarding their use. Always read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to the local print shop for the highest quality prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in PDF format. These can be opened with free programs like Adobe Reader.

What Is Fringe Benefit Tax FBT Giles Liew Chartered Accountants

Is My Company Christmas Party Subject To Fringe Benefit Tax Avesol

Check more sample of What Is Fringe Benefit Tax In South Africa below

Tax In South Africa Intertax Tax Services Tax Advisory Poland

Fringe Benefit Tax Tax Accountant On Track Chartered Accountants

What Is The Tax Rate For Fringe Benefits

What Is Fringe Benefit Tax

What Is Fringe Benefit Tax FBT And How Does It Work In NZ Afirmo NZ

Fringe Benefits

https://www.sars.gov.za/wp-content/uploads/Ops/...

With effect from 1 March 2013 the value of the fringe benefit for vehicles under operating leases as defined in section 23A 1 is in terms of paragraph 7 4 a ii is the actual cost to the employer incurred under that operating lease and

https://fincor.co.za/fringe-benefits-and-tax

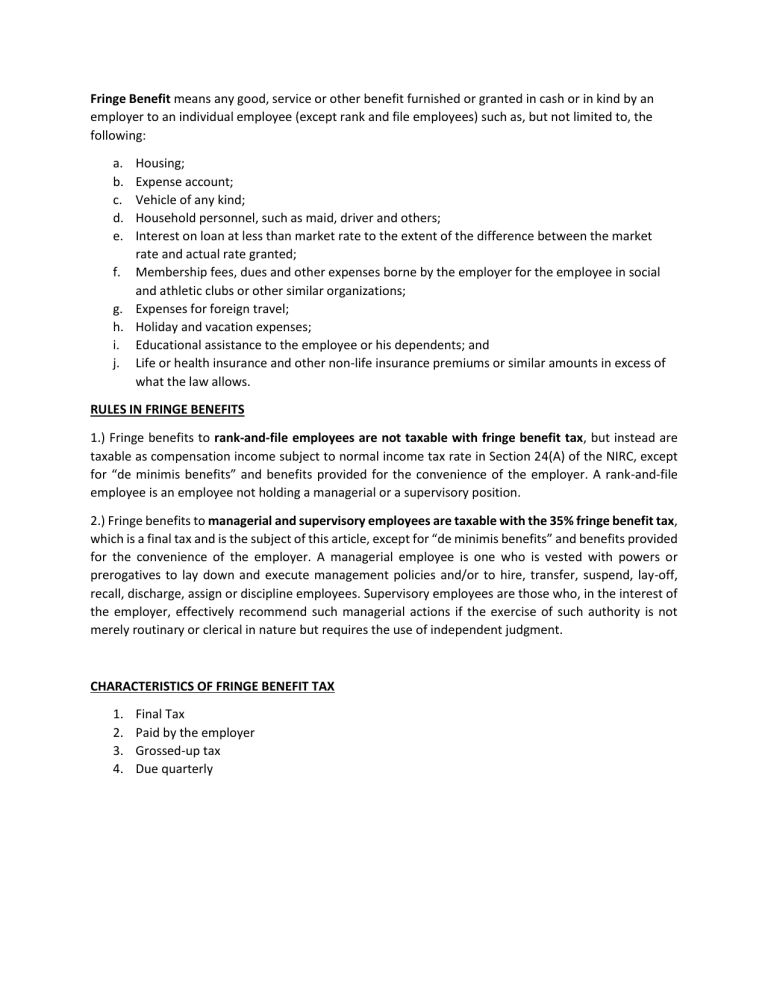

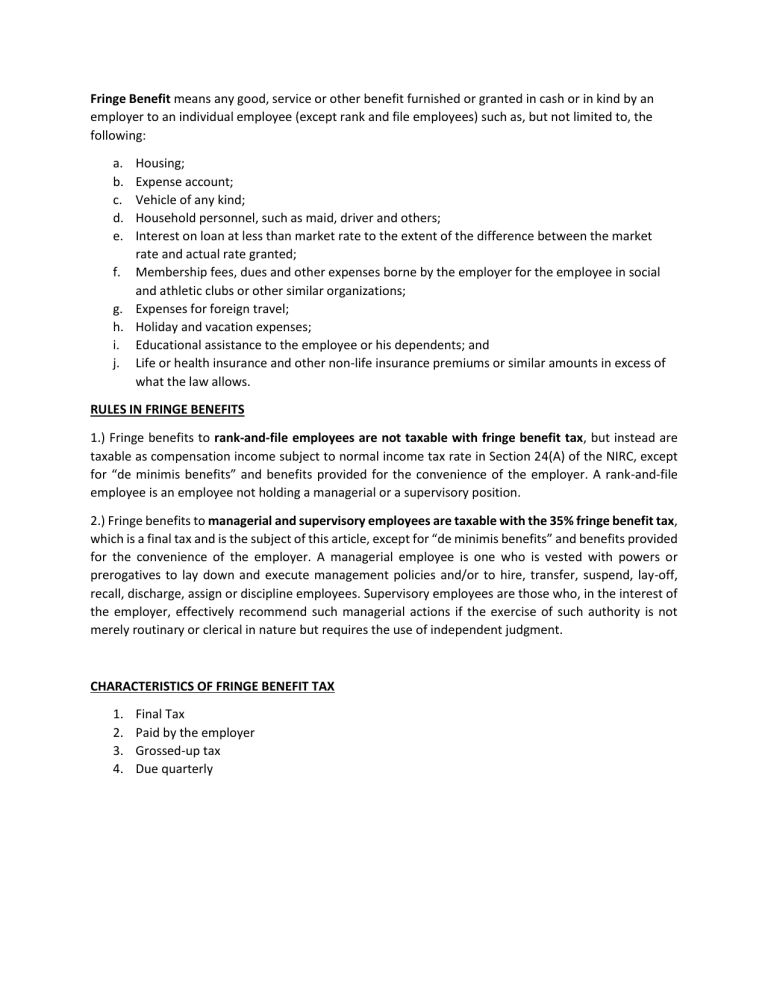

Tax Administration Act What is a fringe benefit Fringe benefits usually refer to non cash benefits granted to employees but do not constitute cash payments made These fringe benefits will be reflected on your tax certificate by source codes starting with the numbers 38 followed by two more numbers

With effect from 1 March 2013 the value of the fringe benefit for vehicles under operating leases as defined in section 23A 1 is in terms of paragraph 7 4 a ii is the actual cost to the employer incurred under that operating lease and

Tax Administration Act What is a fringe benefit Fringe benefits usually refer to non cash benefits granted to employees but do not constitute cash payments made These fringe benefits will be reflected on your tax certificate by source codes starting with the numbers 38 followed by two more numbers

What Is Fringe Benefit Tax

Fringe Benefit Tax Tax Accountant On Track Chartered Accountants

What Is Fringe Benefit Tax FBT And How Does It Work In NZ Afirmo NZ

Fringe Benefits

Fringe Benefit Tax Bartleby

Sharell Ferrara

Sharell Ferrara

What Is A Fringe Benefit