In the digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. In the case of educational materials, creative projects, or simply adding an individual touch to your space, What Is Housing Loan Principal In 80c have become an invaluable source. For this piece, we'll dive in the world of "What Is Housing Loan Principal In 80c," exploring what they are, how to find them and ways they can help you improve many aspects of your lives.

Get Latest What Is Housing Loan Principal In 80c Below

What Is Housing Loan Principal In 80c

What Is Housing Loan Principal In 80c -

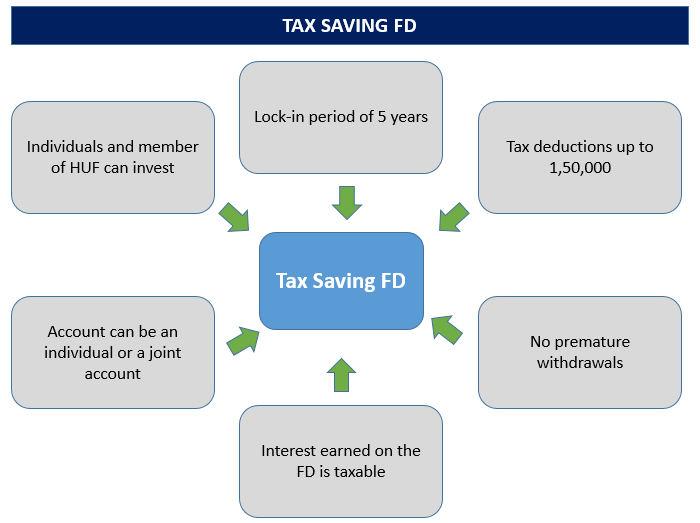

Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax Act Under this an individual is entitled to tax deduction on the amount paid as repayment of the principal component on the housing loan

The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this section is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession

What Is Housing Loan Principal In 80c provide a diverse range of printable, free material that is available online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages, and much more. The value of What Is Housing Loan Principal In 80c is in their variety and accessibility.

More of What Is Housing Loan Principal In 80c

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

The deduction under section 80EE is available only to home owners individuals having only one house property on the date of sanction of the loan The value of the property must be less than Rs 50 lakh and the

Is the Home Loan principal part of Section 80C Yes the home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of the

The What Is Housing Loan Principal In 80c have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring the templates to meet your individual needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge provide for students from all ages, making them a valuable aid for parents as well as educators.

-

Convenience: instant access a myriad of designs as well as templates reduces time and effort.

Where to Find more What Is Housing Loan Principal In 80c

Tax Benefits Of Home Loan Section 24 Section 80C Section 80EEA

Tax Benefits Of Home Loan Section 24 Section 80C Section 80EEA

The principal portion of your EMIs repaid during a year are allowed to be taken as deduction under the Section 80C of the Income tax act Under Section 80C you can claim a deduction of Rs 1 5 lakh against the principal repaid during the year This is the upper limit of the deduction you can claim

If you have made a principal repayment during the year check your loan instalment details principal repayments can be claimed as a deduction under Section 80C However the total amount allowed to be claimed under section 80C

Since we've got your curiosity about What Is Housing Loan Principal In 80c, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of What Is Housing Loan Principal In 80c to suit a variety of objectives.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing What Is Housing Loan Principal In 80c

Here are some new ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

What Is Housing Loan Principal In 80c are a treasure trove of practical and innovative resources designed to meet a range of needs and desires. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the world of What Is Housing Loan Principal In 80c today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I use free printables for commercial use?

- It depends on the specific rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright concerns with What Is Housing Loan Principal In 80c?

- Certain printables may be subject to restrictions in their usage. Be sure to review these terms and conditions as set out by the creator.

-

How can I print What Is Housing Loan Principal In 80c?

- Print them at home using any printer or head to any local print store for premium prints.

-

What software do I need to run printables at no cost?

- Most PDF-based printables are available in PDF format, which is open with no cost software, such as Adobe Reader.

80C Deduction

Top Tax Saving Investments Under Section 80C PPF NPS 5 year FD ELSS

Check more sample of What Is Housing Loan Principal In 80c below

TERMOTATO Y HOUSING 80C VW NEW BEETLE 2 5 GOLF MK6 JETTA MK5 MK6

7 Ways To Improve Your Chances Of Getting A Housing Loan Approval

Tuition Fees Deduction Under Section 80C School Fees Deduction In 80C

SSS Offers Housing Loan Penalty Condonation Program Until June 30 2022

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

What Is Home Extension Loans Know About The Benefit And Eligibility

https://cleartax.in/s/home-loan-tax-benefit

The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this section is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession

https://blog.bankbazaar.com/home-loan-tax-benefits...

Section 80C Home Loan principal For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax Act You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000

The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this section is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession

Section 80C Home Loan principal For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax Act You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000

SSS Offers Housing Loan Penalty Condonation Program Until June 30 2022

7 Ways To Improve Your Chances Of Getting A Housing Loan Approval

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

What Is Home Extension Loans Know About The Benefit And Eligibility

Home Loan Principal Repayment 4 Expenses To Help You In Tax saving

5 Tips For Getting A Housing Loan Sudduth Realty

5 Tips For Getting A Housing Loan Sudduth Realty

Ramanathapuram District District Cooperative Bank HOUSING LOAN