In this age of technology, when screens dominate our lives, the charm of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add a personal touch to your home, printables for free have become an invaluable source. Through this post, we'll take a dive deeper into "What Is Input Tax Credit In Gst," exploring what they are, how to get them, as well as ways they can help you improve many aspects of your lives.

Get Latest What Is Input Tax Credit In Gst Below

What Is Input Tax Credit In Gst

What Is Input Tax Credit In Gst -

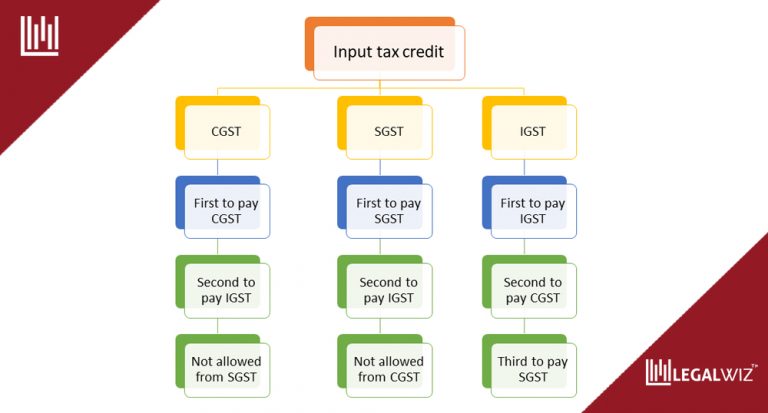

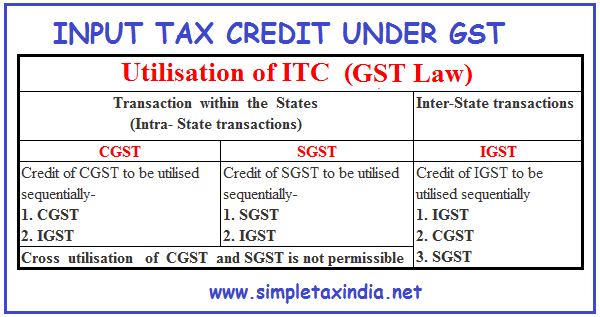

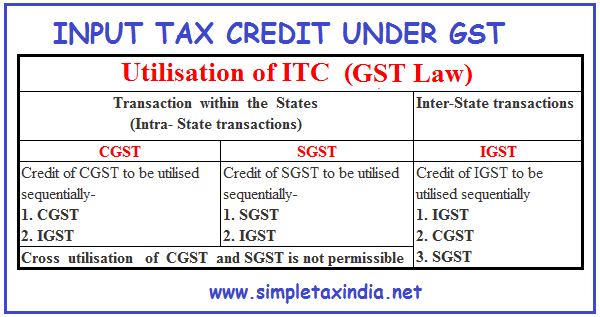

Input tax credit ITC is an integral and essential part of the GST that ensures tax is levied only on the incremental value addition done by the businesses at each stage of the overall supply

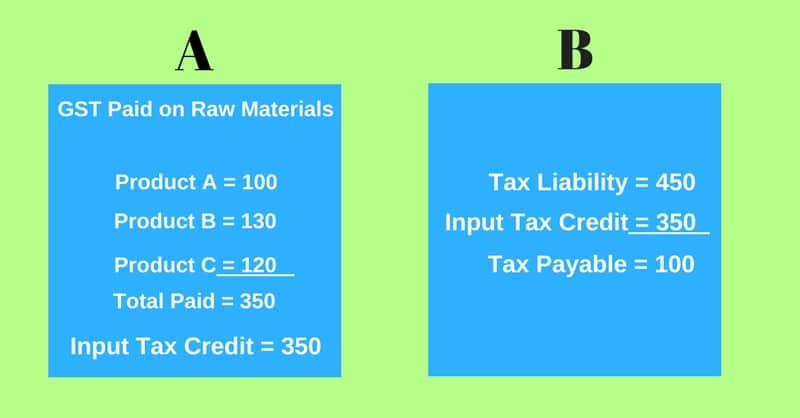

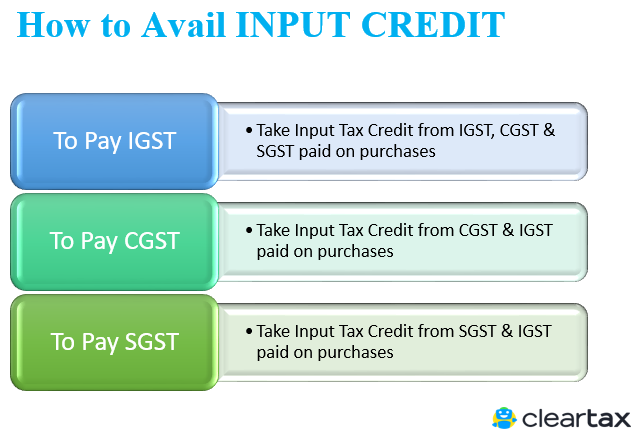

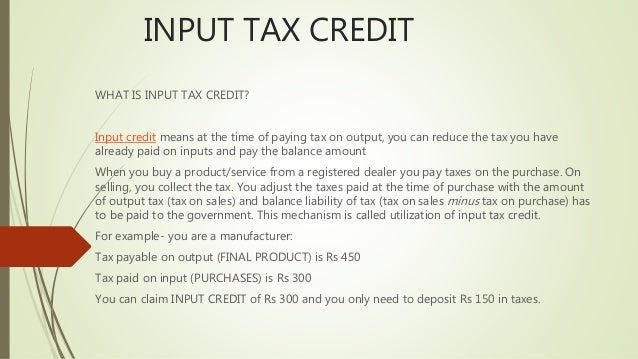

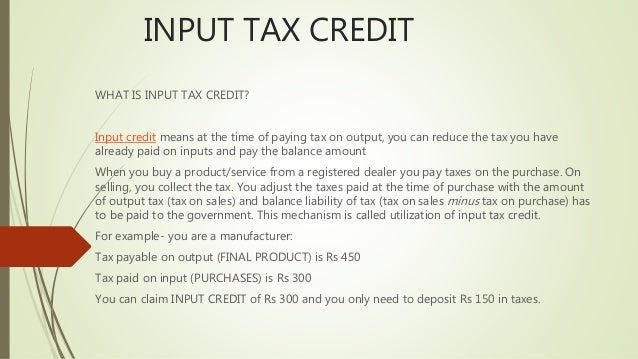

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount

What Is Input Tax Credit In Gst include a broad selection of printable and downloadable items that are available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of What Is Input Tax Credit In Gst

Gst Input Tax Credit Carolyn Brown

Gst Input Tax Credit Carolyn Brown

Input Tax Credit ITC is a crucial mechanism in GST allowing businesses to offset taxes paid on purchases against their GST liability on sales This article explores the definition of ITC its types eligibility criteria and recent updates under GST law

Input tax credit or ITC enables businesses to reduce the tax liability as it makes a sale by claiming the credit depending on how much GST was paid on the business s purchases

What Is Input Tax Credit In Gst have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make designs to suit your personal needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Use: Education-related printables at no charge provide for students of all ages, making them a great instrument for parents and teachers.

-

The convenience of Fast access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more What Is Input Tax Credit In Gst

Input Tax Credit Under GST All You Want To Know

Input Tax Credit Under GST All You Want To Know

What is an Input Tax Credit Input Tax Credit ITC in the GST framework is a mechanism that allows registered businesses to claim a credit for the taxes paid on their purchases This credit can then be used to offset the GST they owe on their sales This effectively lowers their overall tax burden and prevents double taxation

What is Input Tax Credit in GST Input Tax Credit ITC is one of the fundamental features of the Goods and Services Tax GST regime It is a mechanism that enables businesses to claim a credit for the taxes paid on their purchases which can be set off against the tax payable on their sales

We've now piqued your curiosity about What Is Input Tax Credit In Gst Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and What Is Input Tax Credit In Gst for a variety applications.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing What Is Input Tax Credit In Gst

Here are some fresh ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is Input Tax Credit In Gst are a treasure trove of useful and creative resources for a variety of needs and interests. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the many options of What Is Input Tax Credit In Gst to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Input Tax Credit In Gst truly absolutely free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printables in commercial projects?

- It depends on the specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted on use. Be sure to check the terms of service and conditions provided by the designer.

-

How do I print What Is Input Tax Credit In Gst?

- Print them at home using any printer or head to an in-store print shop to get more high-quality prints.

-

What software do I need in order to open printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened with free software such as Adobe Reader.

What Is Input Tax Credit Or ITC Under GST ExcelDataPro

What Is Input Credit Under GST And How To Claim It

Check more sample of What Is Input Tax Credit In Gst below

What Is Input Credit Under GST And How To Claim It

Input Tax Credit Under GST How To Claim Calculation Method

What Is Input Tax Credit In Gst And How To Calculate It Parasuraman

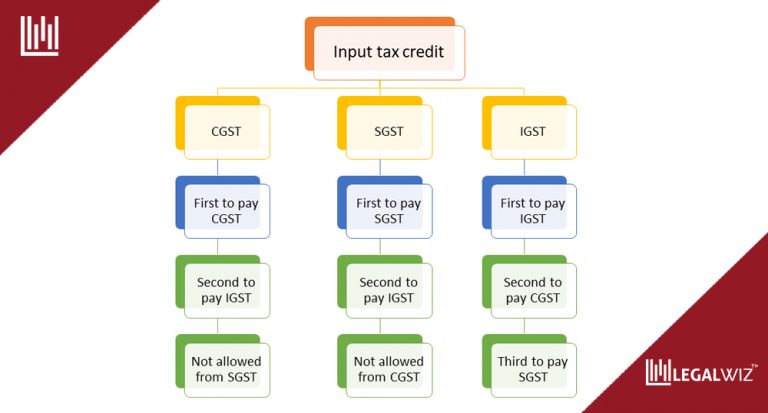

Input Tax Credit Under GST Input Tax Credit Under SGST IGST CGST

Gst Input Tax Credit Ppt

What Is Input Tax Credit In GST YourSelfQuotes

https://cleartax.in/s/gst-input-tax-credit

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount

https://cleartax.in/s/input-tax-credit-under-gst

Input Tax Credit or ITC means the Goods and Services Tax GST paid by a taxable person on any purchase of goods and or services that are used or will be used for business Input ITC can be reduced from the GST payable on the sales by the taxable person only after fulfilling some conditions

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount

Input Tax Credit or ITC means the Goods and Services Tax GST paid by a taxable person on any purchase of goods and or services that are used or will be used for business Input ITC can be reduced from the GST payable on the sales by the taxable person only after fulfilling some conditions

Input Tax Credit Under GST Input Tax Credit Under SGST IGST CGST

Input Tax Credit Under GST How To Claim Calculation Method

Gst Input Tax Credit Ppt

What Is Input Tax Credit In GST YourSelfQuotes

What Is Input Tax Credit Under GST Corpbiz Advisers

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

What Is Input Tax Credit In GST How To Get GST Refund Goods