In the age of digital, in which screens are the norm yet the appeal of tangible printed objects isn't diminished. Be it for educational use for creative projects, simply to add some personal flair to your home, printables for free have proven to be a valuable source. This article will dive into the sphere of "What Is Input Tax Credit," exploring their purpose, where they are, and how they can be used to enhance different aspects of your daily life.

Get Latest What Is Input Tax Credit Below

What Is Input Tax Credit

What Is Input Tax Credit -

By its nature Value Added Tax is incurred by the final person in the chain of supply who is not registered for VAT Persons registered for VAT will claim back through the return the input VAT incurred in the course of their business and remit to Zambia Revenue Authority the Output VAT collected in excess of their input VAT

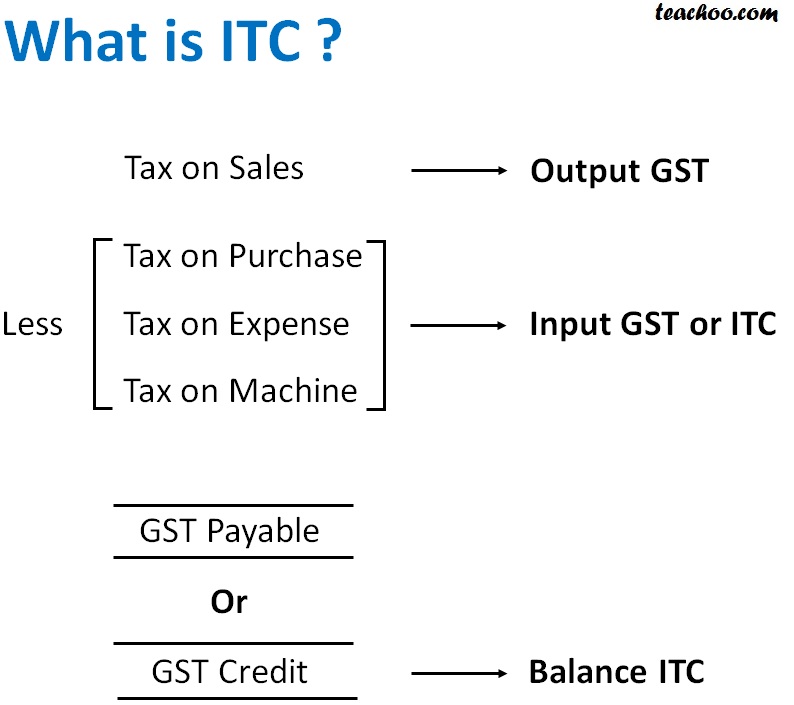

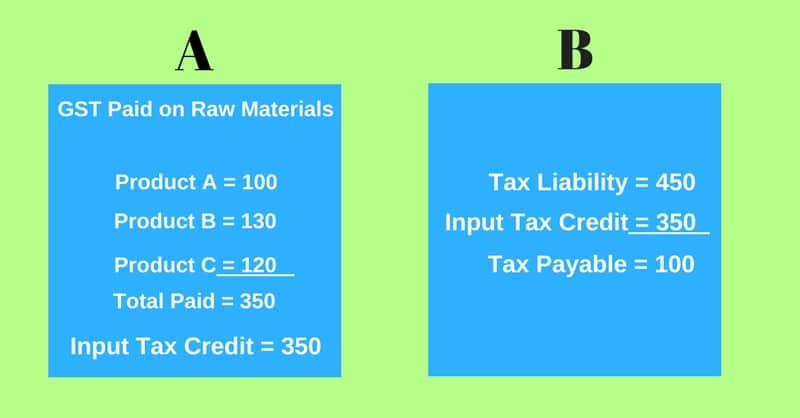

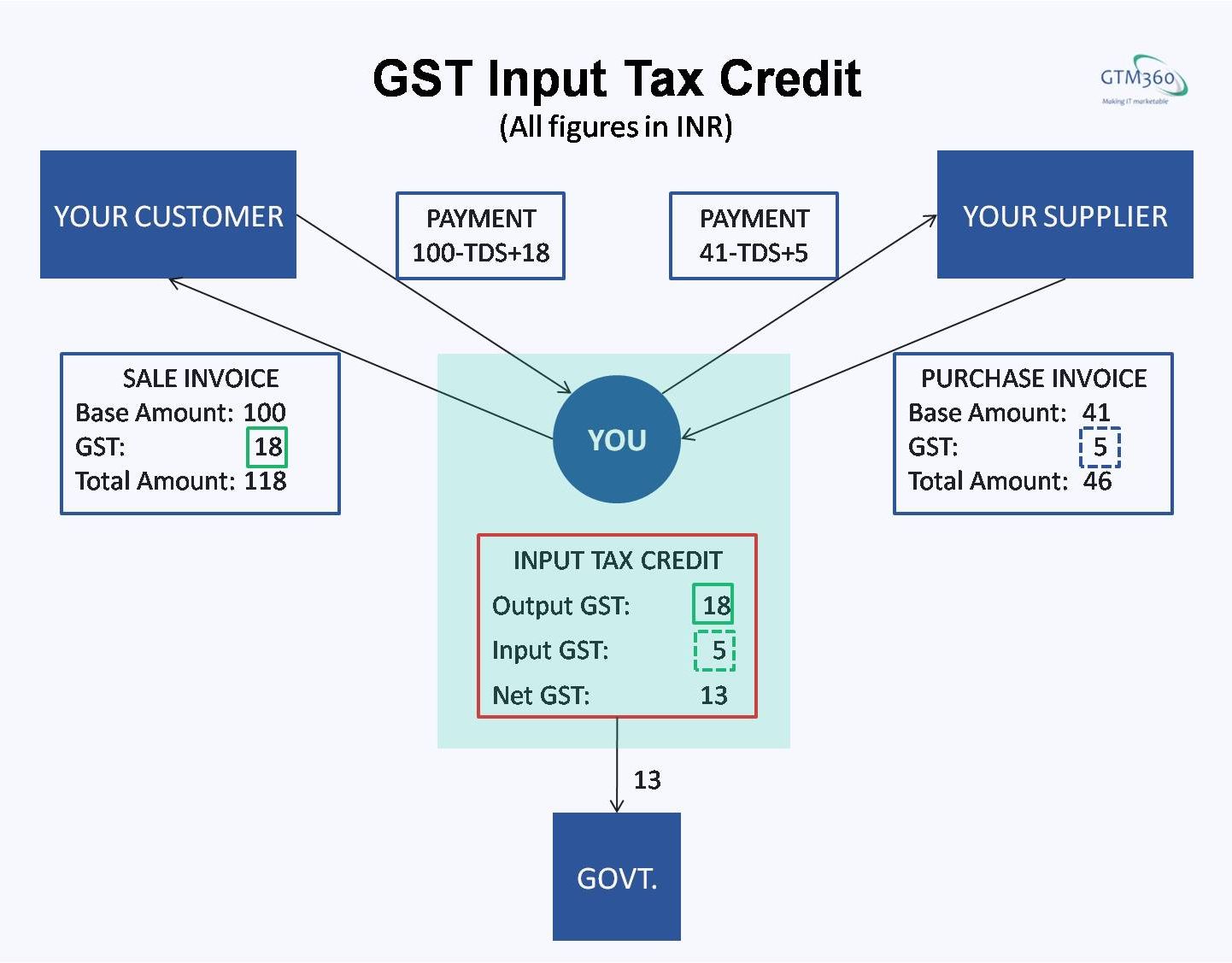

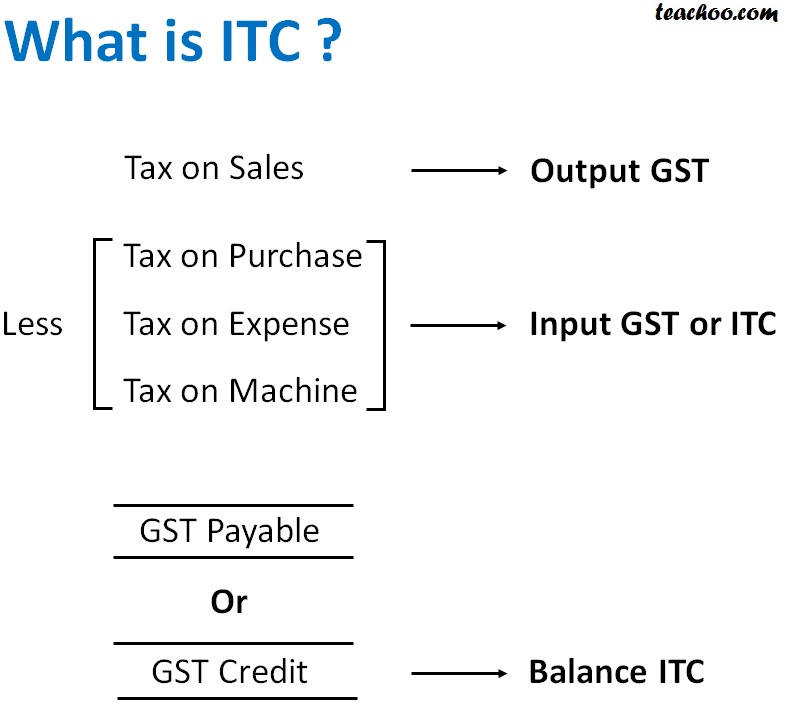

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

What Is Input Tax Credit offer a wide selection of printable and downloadable materials online, at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The beauty of What Is Input Tax Credit is their flexibility and accessibility.

More of What Is Input Tax Credit

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

What is input tax credit Ever since GST has been discussed across the country the input tax credit has been spoken about in the same breath In essence ITC is the heart and soul of GST

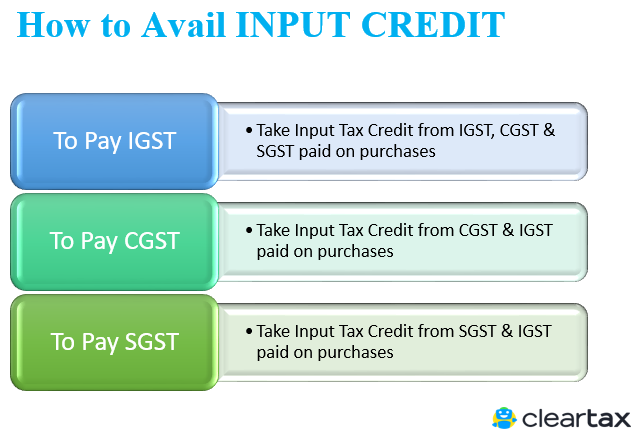

Input Tax Credit ITC means claiming the credit of the GST paid on the purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST Businesses can reduce their tax liability by claiming

What Is Input Tax Credit have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize the design to meet your needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Printing educational materials for no cost can be used by students of all ages. This makes them an invaluable resource for educators and parents.

-

Easy to use: Quick access to a variety of designs and templates cuts down on time and efforts.

Where to Find more What Is Input Tax Credit

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

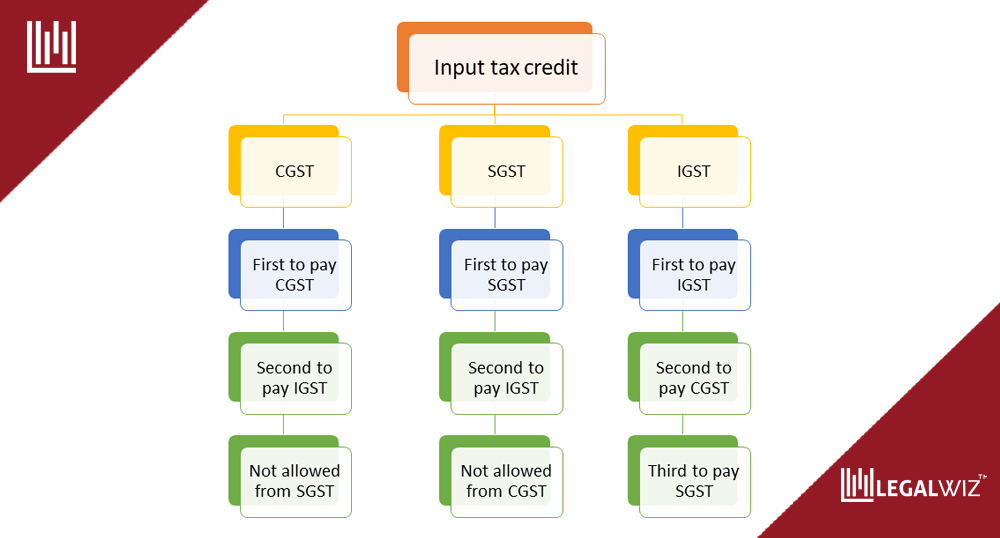

The inputs for a business can be divided into three parts GST Input Tax Credit provides complete guidance on Input Tax Credit Refund of Input Tax Credit Export issues relating to Input Tax Credit It also incorporates various issues related to Input Tax Credit such as availment reversal refund etc

Input Tax Credit ITC is a kind of tax that businesses pay on a purchase ITC can be used to reduce tax liability when businesses make a sale It means that businesses can be able to reduce their tax by claiming credit to the extent of ITC paid on purchases

Now that we've piqued your curiosity about What Is Input Tax Credit, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Is Input Tax Credit designed for a variety goals.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing What Is Input Tax Credit

Here are some fresh ways of making the most of What Is Input Tax Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

What Is Input Tax Credit are a treasure trove of useful and creative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of What Is Input Tax Credit to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these files for free.

-

Can I utilize free printables in commercial projects?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with What Is Input Tax Credit?

- Certain printables might have limitations on usage. Be sure to review these terms and conditions as set out by the designer.

-

How do I print printables for free?

- Print them at home using either a printer at home or in an in-store print shop to get more high-quality prints.

-

What program do I need to open printables free of charge?

- The majority of printables are in PDF format. They can be opened using free software such as Adobe Reader.

What Is Input Tax Credit Or ITC Under GST ExcelDataPro

GST For Normies Part 2 Talk Of Many Things

Check more sample of What Is Input Tax Credit below

What Is Input Credit Under GST And How To Claim It

Input Tax Credit ITC Under GST TaxAdda

Conditions Made To Claim Input Tax Credit Authoritative Blog

GST Input Tax Credit On Supply Of Goods Or Services

Gst Input Tax Credit Tax Credits Pie Chart Chart

Input Tax Credit Under GST How To Claim Calculation Method

https://www.embibe.com/exams/input-tax-credit

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

https://gsthero.com/input-tax-credit-itc-under-gst-with-examples

Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable on outward supplies is known as input tax credit In other words input tax credit is tax reduced from output tax payable on account of sales

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable on outward supplies is known as input tax credit In other words input tax credit is tax reduced from output tax payable on account of sales

GST Input Tax Credit On Supply Of Goods Or Services

Input Tax Credit ITC Under GST TaxAdda

Gst Input Tax Credit Tax Credits Pie Chart Chart

Input Tax Credit Under GST How To Claim Calculation Method

What Is Input Tax Credit ITC Under GST Accoxi

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

GST Archives LegalWiz in