Today, where screens dominate our lives The appeal of tangible printed objects isn't diminished. If it's to aid in education such as creative projects or just adding an individual touch to your home, printables for free are now an essential resource. The following article is a dive deep into the realm of "What Is Property Tax Exemption In California," exploring their purpose, where you can find them, and how they can add value to various aspects of your lives.

Get Latest What Is Property Tax Exemption In California Below

What Is Property Tax Exemption In California

What Is Property Tax Exemption In California -

A Homeowners Exemption will save you at least 70 per year in property taxes by exempting 7 000 of your property s value from taxation You may qualify for the Homeowners Exemption if You own the property You don t already have a Homeowners Exemption on any other property

Homeowners Exemption The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on the lien date January 1st

Printables for free include a vast variety of printable, downloadable materials that are accessible online for free cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and many more. The value of What Is Property Tax Exemption In California lies in their versatility as well as accessibility.

More of What Is Property Tax Exemption In California

Computer Professional Exemption The Law In California

Computer Professional Exemption The Law In California

Property taxes in California are limited by Proposition 13 a law approved by California voters in 1978 The law has two important features First it limits general property taxes not including those collected for special purposes to 1 of a property s market value

What is an Exemption As provided by the California Constitution certain qualified properties are exempt from paying property taxes Examples include properties used exclusively for religious scientific hospital or charitable purposes

The What Is Property Tax Exemption In California have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: They can make printables to your specific needs whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Value: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more What Is Property Tax Exemption In California

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption Cedar Park Texas Living

Beyond reducing the taxable value of your home California allows for exemptions from property taxes if you meet certain requirements Unlike most states which have exemptions governed by statutes or local rules California s exemptions are articulated in the State Constitution Article XIII

Contents hide 1 What is a Homestead Exemption 2 What Does a Homestead Exemption Do in California 3 What California s New Homestead Exemption in AB 1885 Means for Homeowners 4 California Code of Civil Procedure Section 704 730 California s Homestead Exemption Statute 5 How Will the New California Homestead Exemption Protect Homeowners

We hope we've stimulated your curiosity about What Is Property Tax Exemption In California Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Is Property Tax Exemption In California designed for a variety needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad variety of topics, that includes DIY projects to planning a party.

Maximizing What Is Property Tax Exemption In California

Here are some fresh ways to make the most use of What Is Property Tax Exemption In California:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

What Is Property Tax Exemption In California are a treasure trove of innovative and useful resources that meet a variety of needs and interests. Their access and versatility makes them a fantastic addition to your professional and personal life. Explore the vast collection of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Can I utilize free printables to make commercial products?

- It's based on specific conditions of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may have restrictions in their usage. Check these terms and conditions as set out by the author.

-

How do I print What Is Property Tax Exemption In California?

- Print them at home with either a printer or go to a print shop in your area for top quality prints.

-

What software must I use to open printables for free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software like Adobe Reader.

Senior Citizen Property Tax Exemption California Form Riverside County

How Much Is The Homestead Exemption In Houston Square Deal Blog

Check more sample of What Is Property Tax Exemption In California below

Sales Tax Exemption Certificate Wisconsin

Jefferson County Property Tax Exemption Form ExemptForm

Colorado Resale Certificate Dresses Images 2022

The Administrative Exemption In California Labor Law

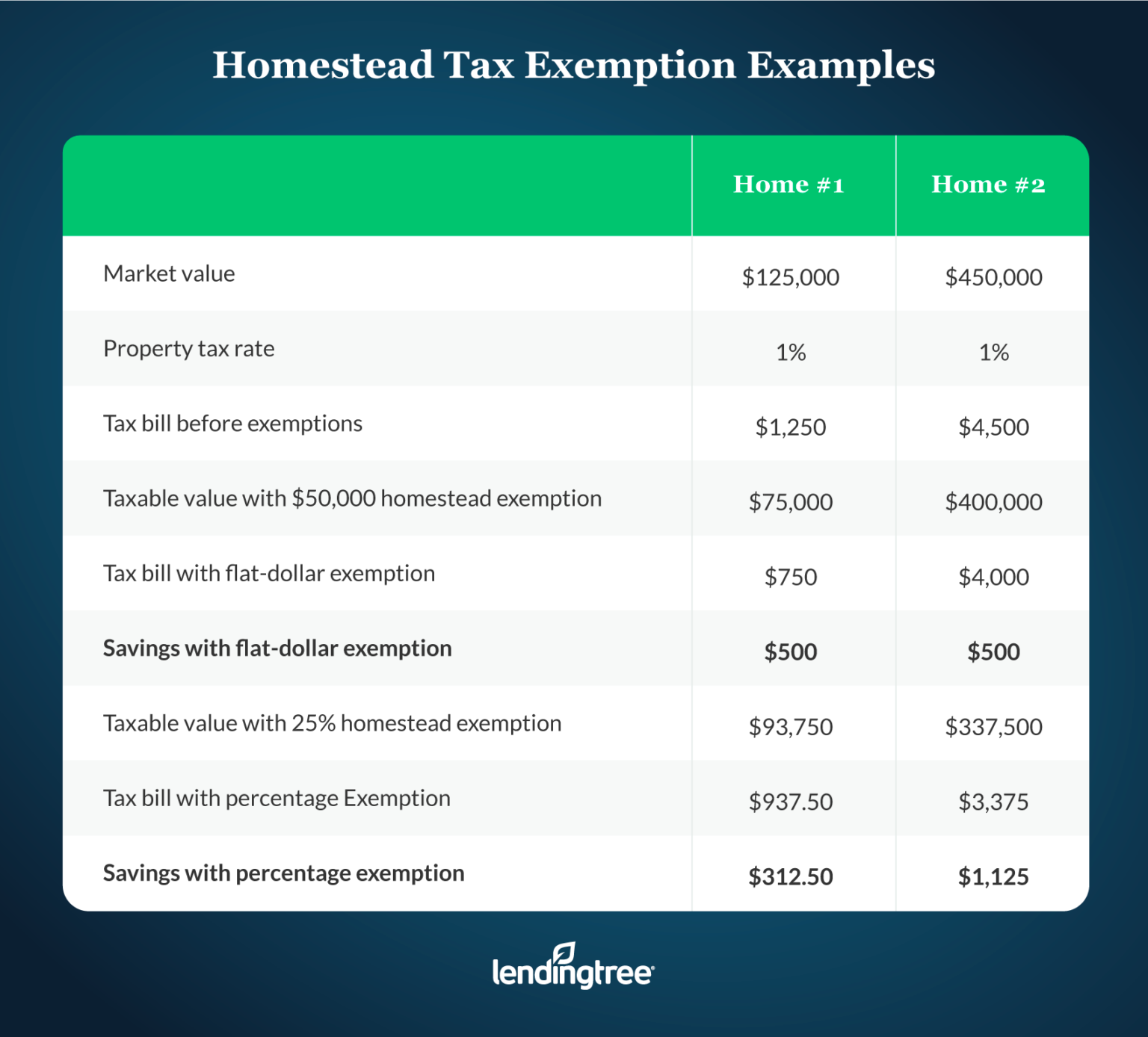

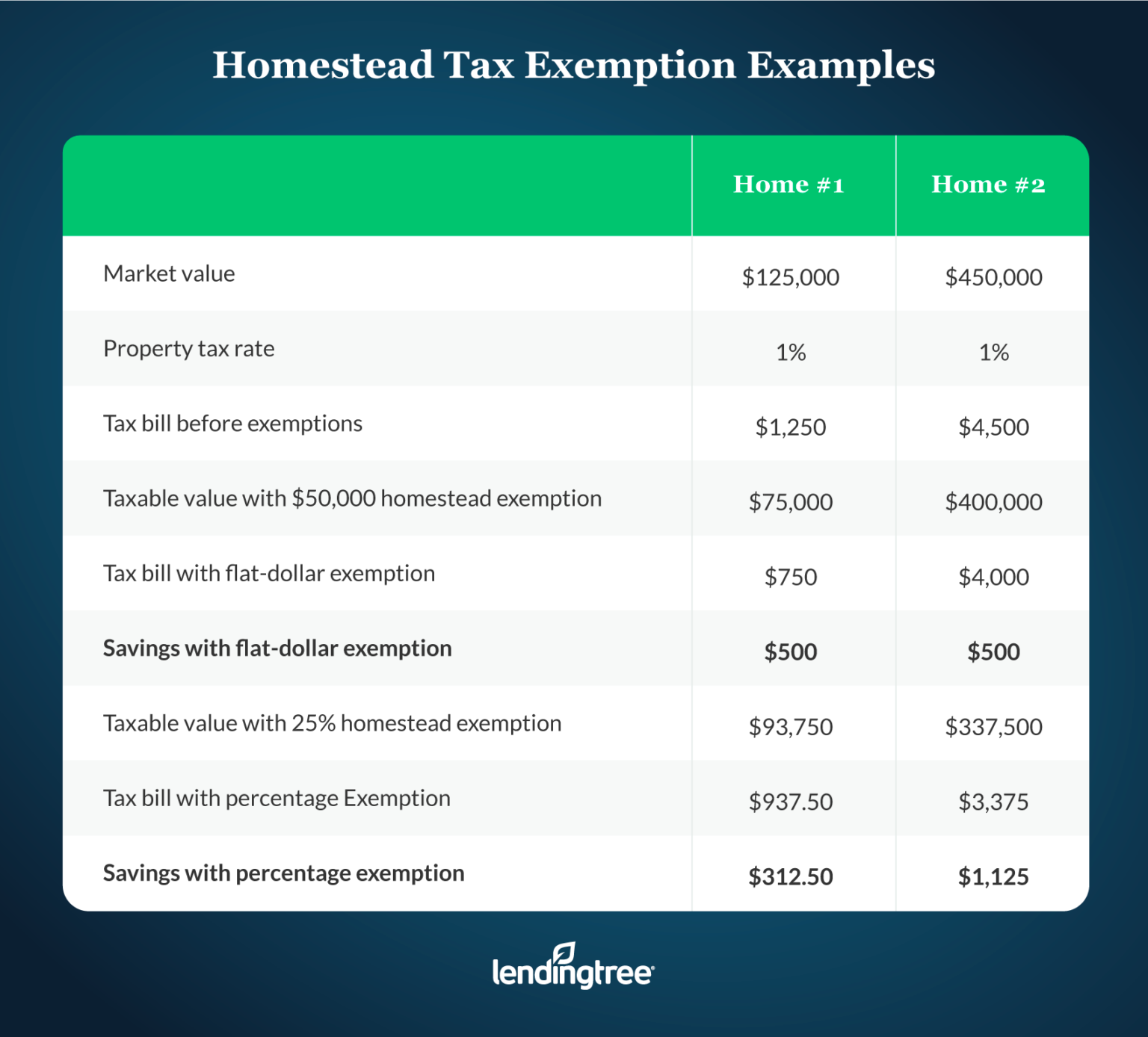

What Is A Homestead Exemption And How Does It Work LendingTree

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

https://www.boe.ca.gov › proptaxes › homeowners_exemption.htm

Homeowners Exemption The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on the lien date January 1st

https://www.boe.ca.gov › proptaxes › homeexem.htm

The homeowners exemption allows an owner to reduce property tax liability on a dwelling which is occupied as the owner s principal place of residence as of 12 01 a m on the lien date January 1 The maximum exemption is 7 000 of the full value of the property

Homeowners Exemption The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on the lien date January 1st

The homeowners exemption allows an owner to reduce property tax liability on a dwelling which is occupied as the owner s principal place of residence as of 12 01 a m on the lien date January 1 The maximum exemption is 7 000 of the full value of the property

The Administrative Exemption In California Labor Law

Jefferson County Property Tax Exemption Form ExemptForm

What Is A Homestead Exemption And How Does It Work LendingTree

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Printable Exemption Form From Garnishment Printable Forms Free Online

RCC Property Tax Exemption

RCC Property Tax Exemption

Hecht Group Texas Veterans Now Eligible For Property Tax Exemption