In the age of digital, with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes for creative projects, simply to add some personal flair to your area, What Is Property Tax Exemption Texas have become a valuable source. Here, we'll dive into the world of "What Is Property Tax Exemption Texas," exploring the different types of printables, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest What Is Property Tax Exemption Texas Below

What Is Property Tax Exemption Texas

What Is Property Tax Exemption Texas -

Property taxes in Texas are the seventh highest in the U S as the average effective property tax rate in the Lone Star State is 1 60 Compare that to the national average which currently stands at 0 99 The typical Texas homeowner pays 3 797 annually in property taxes

The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption The school district taxes on your residence homestead may go below but not above the ceiling amount

The What Is Property Tax Exemption Texas are a huge variety of printable, downloadable materials online, at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and much more. The benefit of What Is Property Tax Exemption Texas lies in their versatility and accessibility.

More of What Is Property Tax Exemption Texas

Property Tax What Is Property Tax And How It Is Calculated

Property Tax What Is Property Tax And How It Is Calculated

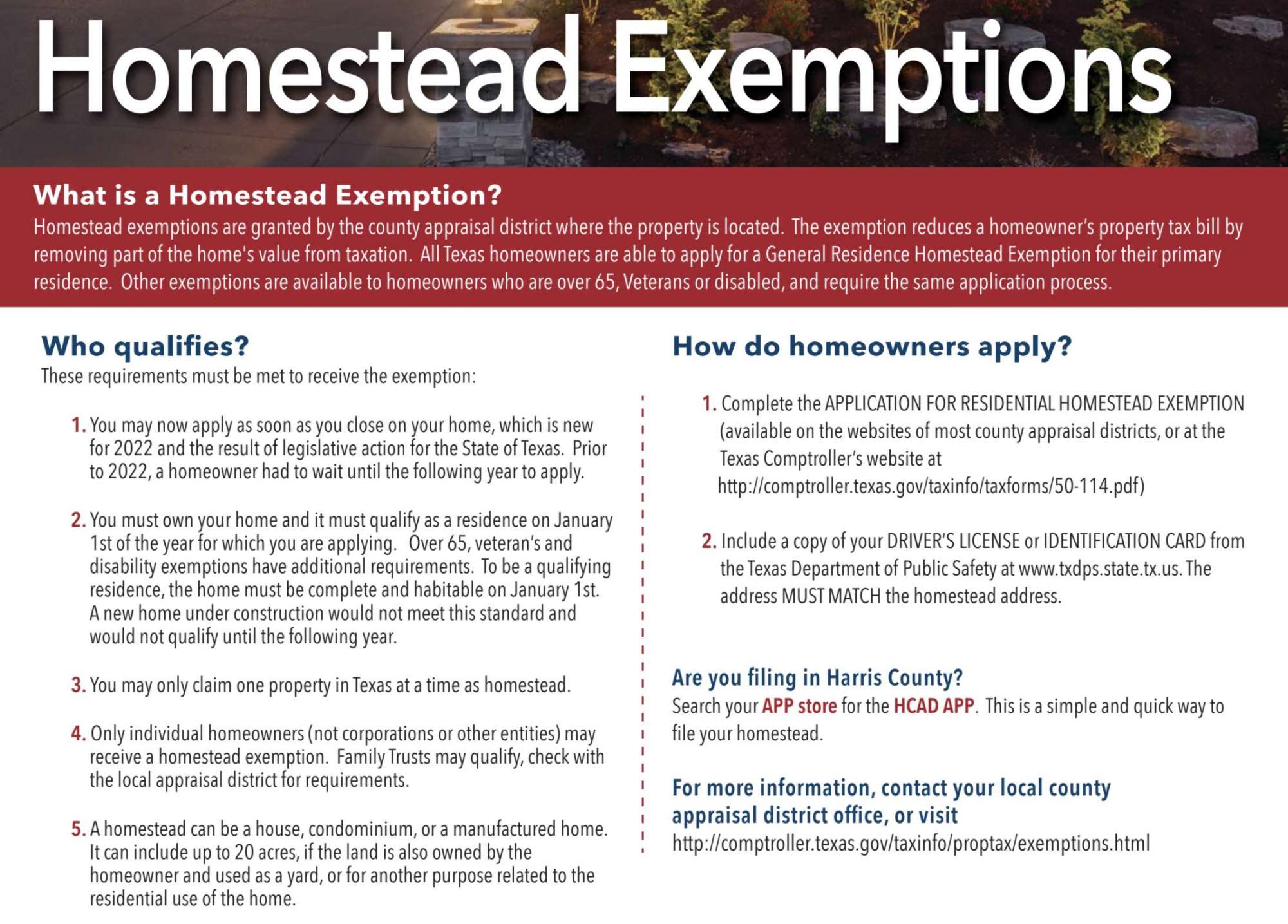

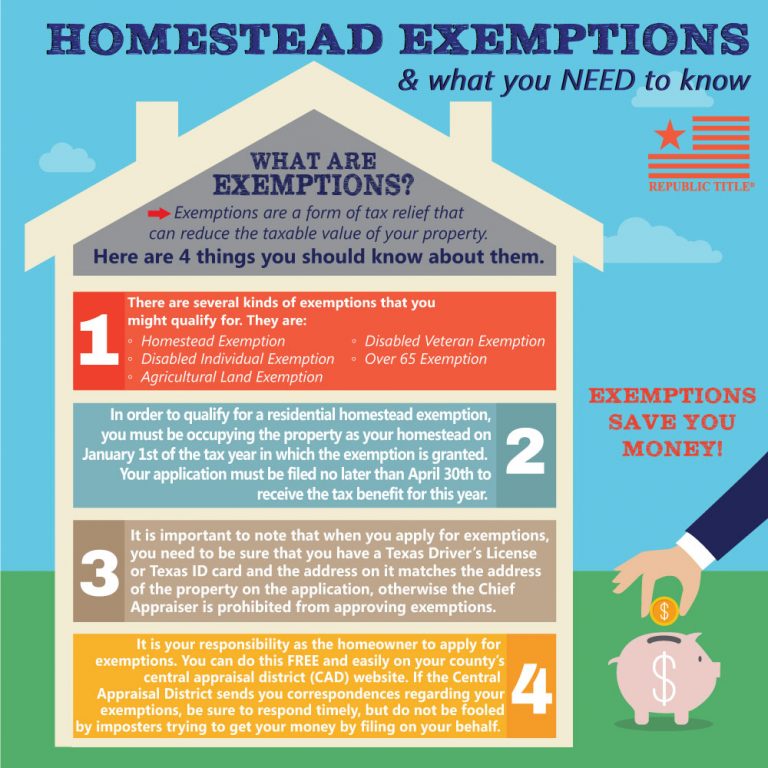

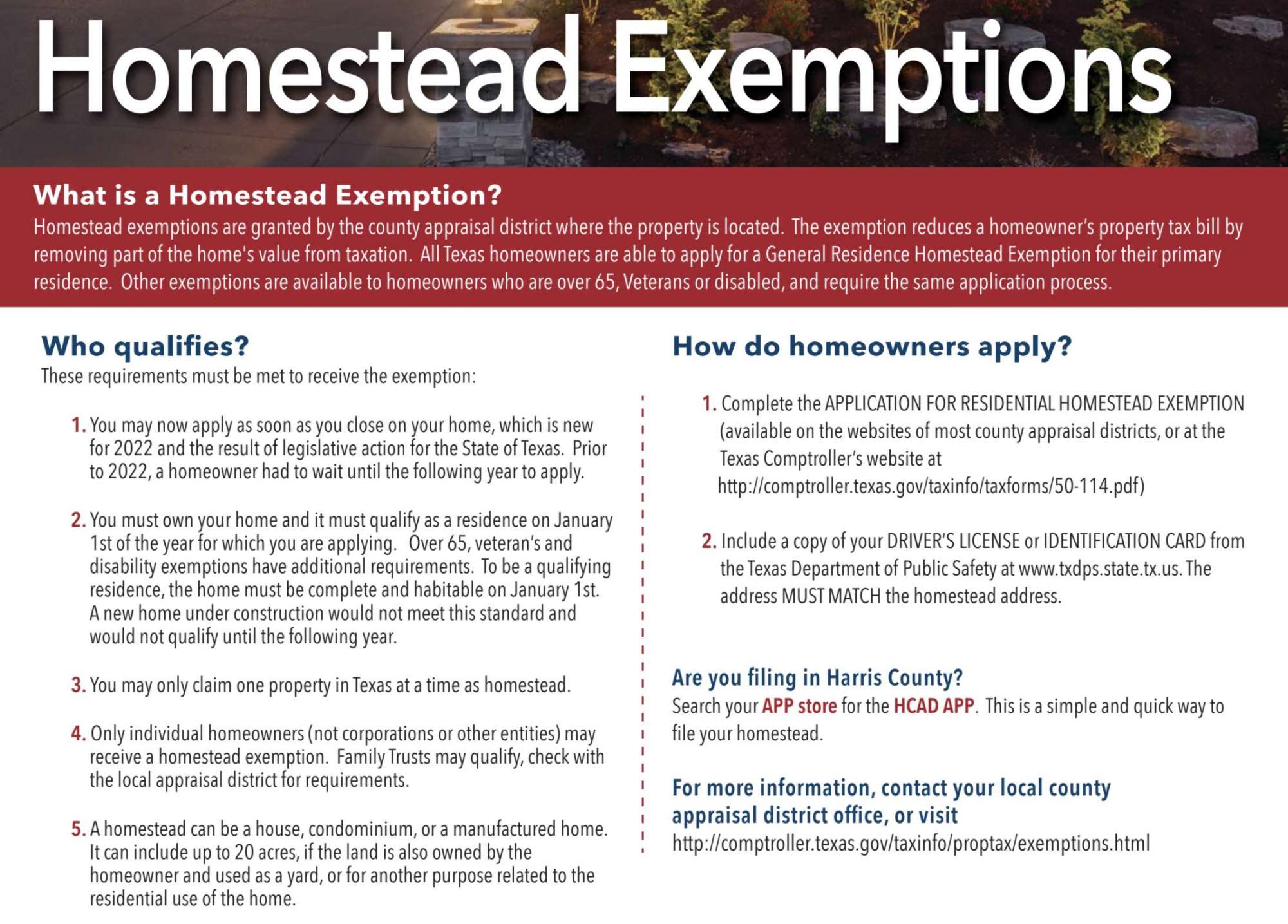

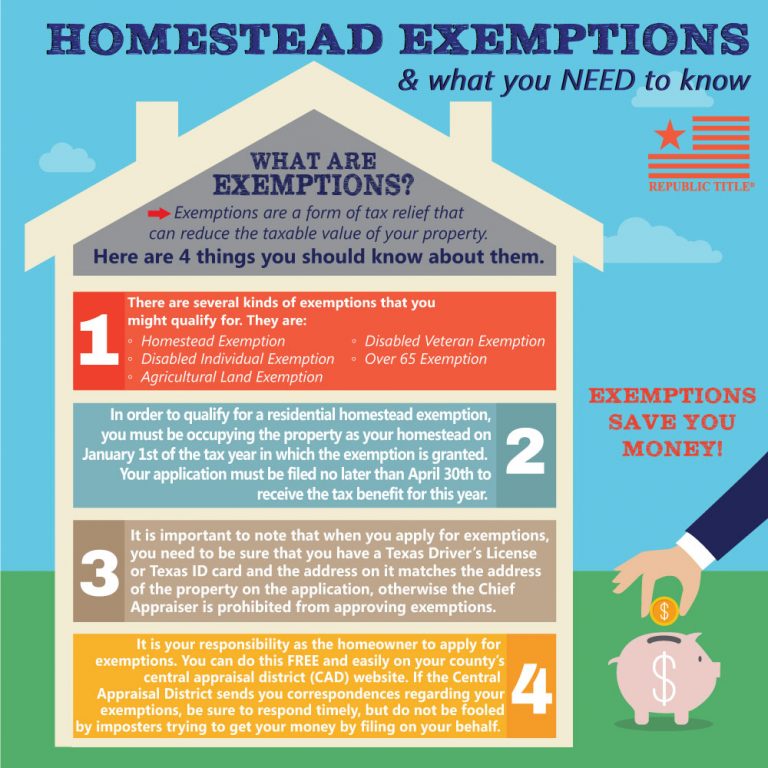

Homestead exemptions can help lower the property taxes on your home Here learn how to claim a homestead exemption You might be able to claim a homestead exemption based on whether you are 65 or older have a disability or are a veteran of the military

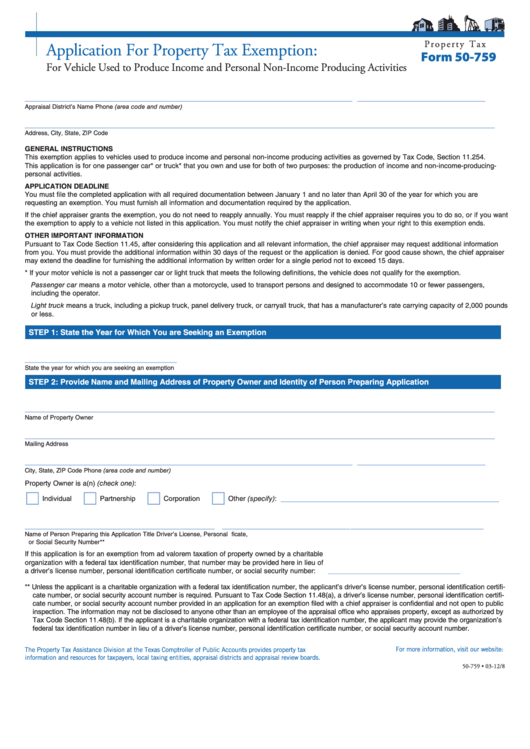

As a Texas property owner you might qualify for a reduction in the taxable appraised value of your property thereby reducing the amount of your tax bill These deductions are referred to as property tax exemptions and in Texas they are the most common way property owners reduce their tax burden In Texas one of the few states that does not

What Is Property Tax Exemption Texas have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Printables for education that are free cater to learners of all ages, making the perfect tool for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to many designs and templates reduces time and effort.

Where to Find more What Is Property Tax Exemption Texas

A Complete Guide On Property Tax Exemption Cut My Taxes

A Complete Guide On Property Tax Exemption Cut My Taxes

The Texas Homestead Exemption is a tax break that allows you to exclude up to 100 000 of your home s value from your property taxes Seniors or disabled homeowners are eligible for an additional 10 000 deduction

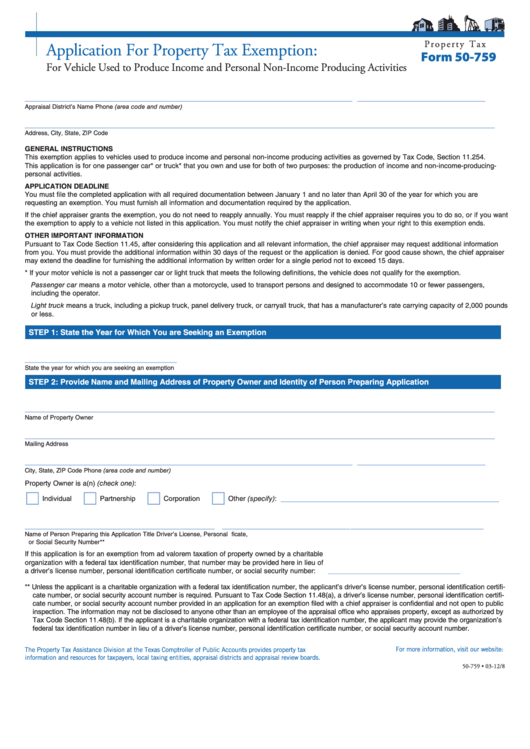

All real property and tangible personal property located in the state is taxable unless an exemption is required or permit ted by the Texas Constitution 1 Texas provides for a variety of exemptions from property tax for property and property owners that qualify for the exemption

If we've already piqued your interest in What Is Property Tax Exemption Texas Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of What Is Property Tax Exemption Texas suitable for many uses.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a broad variety of topics, all the way from DIY projects to party planning.

Maximizing What Is Property Tax Exemption Texas

Here are some new ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

What Is Property Tax Exemption Texas are an abundance of useful and creative resources that meet a variety of needs and interest. Their availability and versatility make them a wonderful addition to any professional or personal life. Explore the endless world of What Is Property Tax Exemption Texas now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables in commercial projects?

- It's based on specific usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright concerns with What Is Property Tax Exemption Texas?

- Certain printables may be subject to restrictions on use. Be sure to check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with an printer, or go to any local print store for high-quality prints.

-

What program will I need to access printables for free?

- The majority are printed in PDF format. These is open with no cost software like Adobe Reader.

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption

Check more sample of What Is Property Tax Exemption Texas below

How Much Is The Homestead Exemption In Houston Square Deal Blog

Life Estate Texas Homestead Exemption Inspire Ideas 2022

Texas Exemption Certificate TUTORE ORG Master Of Documents

Here s What Seniors Need To Know About Property Tax Breaks

Texas Property Tax Exemption Form ExemptForm

Homestead Exemption Mojgan JJ Panah

https://comptroller.texas.gov › taxes › property-tax › exemptions

The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption The school district taxes on your residence homestead may go below but not above the ceiling amount

https://www.texasrealestatesource.com › blog › ...

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions

The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption The school district taxes on your residence homestead may go below but not above the ceiling amount

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions

Here s What Seniors Need To Know About Property Tax Breaks

Life Estate Texas Homestead Exemption Inspire Ideas 2022

Texas Property Tax Exemption Form ExemptForm

Homestead Exemption Mojgan JJ Panah

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Hecht Group Texas Veterans Now Eligible For Property Tax Exemption

Hecht Group Texas Veterans Now Eligible For Property Tax Exemption

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue