In the age of digital, in which screens are the norm, the charm of tangible printed materials isn't diminishing. Whatever the reason, whether for education in creative or artistic projects, or simply to add an element of personalization to your space, What Is Rebate In New Tax Regime are now a vital resource. For this piece, we'll dive into the sphere of "What Is Rebate In New Tax Regime," exploring the different types of printables, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest What Is Rebate In New Tax Regime Below

What Is Rebate In New Tax Regime

What Is Rebate In New Tax Regime -

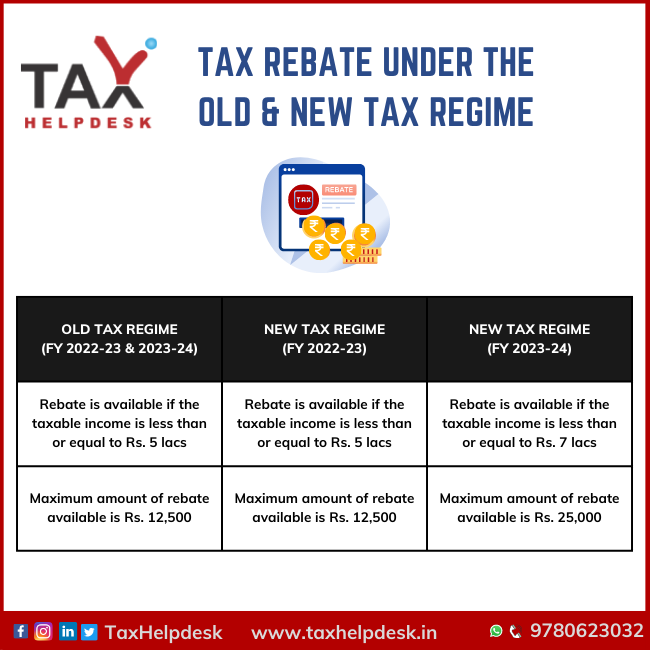

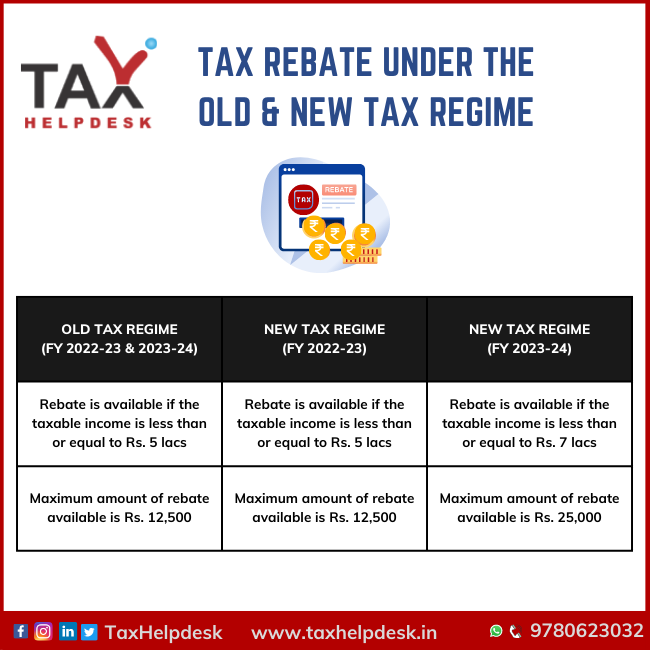

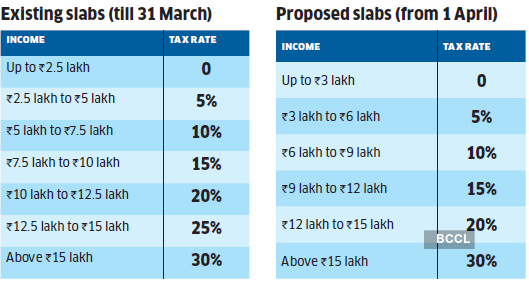

Following are the changes made in the new tax regime for FY2023 24 and onwards a Income tax slabs reduced from six to five b Basic exemption limit hiked to Rs 3 lakh from Rs 2 5 lakh an increase of Rs 50 000 c Income tax rebate hiked Zero tax payable under new tax regime if taxable income does not exceed Rs 7 lakh in a financial

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh in a financial year

The What Is Rebate In New Tax Regime are a huge array of printable resources available online for download at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of What Is Rebate In New Tax Regime

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000 HRA Exemption X X

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year

The What Is Rebate In New Tax Regime have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: We can customize printing templates to your own specific requirements whether you're designing invitations planning your schedule or decorating your home.

-

Educational Impact: Printables for education that are free offer a wide range of educational content for learners of all ages, making them an essential instrument for parents and teachers.

-

Easy to use: Access to the vast array of design and templates will save you time and effort.

Where to Find more What Is Rebate In New Tax Regime

Choosing The New Tax Regime You Can t Claim Tax Rebate For THESE 7

Choosing The New Tax Regime You Can t Claim Tax Rebate For THESE 7

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of

Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with incomes over Rs 7 lakh will have to pay tax as per the slabs of the new tax regime

We hope we've stimulated your interest in What Is Rebate In New Tax Regime, let's explore where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in What Is Rebate In New Tax Regime for different needs.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing What Is Rebate In New Tax Regime

Here are some innovative ways that you can make use use of What Is Rebate In New Tax Regime:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is Rebate In New Tax Regime are a treasure trove of useful and creative resources for a variety of needs and desires. Their accessibility and flexibility make them a wonderful addition to each day life. Explore the many options that is What Is Rebate In New Tax Regime today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Rebate In New Tax Regime really completely free?

- Yes they are! You can print and download the resources for free.

-

Are there any free printables for commercial use?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download What Is Rebate In New Tax Regime?

- Certain printables could be restricted regarding usage. Always read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit the local print shops for higher quality prints.

-

What program do I need to run printables at no cost?

- Most printables come as PDF files, which can be opened using free software, such as Adobe Reader.

What Is 87 A Rebate Free Tax Filer Blog

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

Check more sample of What Is Rebate In New Tax Regime below

Is 80C And NPS Finished What Is New Tax Rebate Of 7lakh In New Tax

Changes In New Tax Regime All You Need To Know

Sop For Option To New Tax Regime Has Been Introduced Union Budget 2023

Tax Rebate Under The Old New Tax Regime

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Exemptions Still Available In New Tax Regime with English Subtitles

https://cleartax.in/s/income-tax-rebate-us-87a

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh in a financial year

https://taxguru.in/income-tax/income-tax-regime-salaried-employees.html

Tax Rebate The Rebate U S 87A provides benefit on tax payment to a Resident Individual The condition to avail of the benefit is that total taxable income shall not exceed the threshold limit of Rs 7 00 000 The rebate is hiked to Rs 7 lakh from Rs 5 lakh under the new tax regime

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh in a financial year

Tax Rebate The Rebate U S 87A provides benefit on tax payment to a Resident Individual The condition to avail of the benefit is that total taxable income shall not exceed the threshold limit of Rs 7 00 000 The rebate is hiked to Rs 7 lakh from Rs 5 lakh under the new tax regime

Tax Rebate Under The Old New Tax Regime

Changes In New Tax Regime All You Need To Know

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Exemptions Still Available In New Tax Regime with English Subtitles

The New Tax Regime Offers A Higher Tax Exemption Raises The Threshold

What Is Rebate GETBATS Blog

What Is Rebate GETBATS Blog

Rebate What Is It Example Vs Discount Types Regulations