In this day and age when screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. If it's to aid in education such as creative projects or simply to add an extra personal touch to your area, What Is Section 80ccd 2 Of Income Tax Act have proven to be a valuable resource. For this piece, we'll take a dive to the depths of "What Is Section 80ccd 2 Of Income Tax Act," exploring what they are, where to get them, as well as how they can enhance various aspects of your life.

Get Latest What Is Section 80ccd 2 Of Income Tax Act Below

What Is Section 80ccd 2 Of Income Tax Act

What Is Section 80ccd 2 Of Income Tax Act -

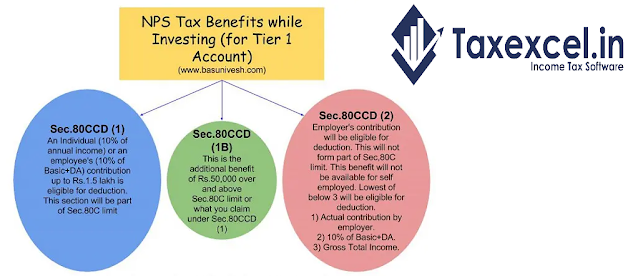

Section 80CCD 2 of the Income Tax Act 1961 is a provision that allows individuals to claim an additional deduction on contributions made towards the

Section 80CCD 2 of the Income Tax Act gives employed individuals the benefit of claiming income tax deductions for contributions made by their employer It

Printables for free cover a broad range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and much more. The benefit of What Is Section 80ccd 2 Of Income Tax Act lies in their versatility and accessibility.

More of What Is Section 80ccd 2 Of Income Tax Act

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deduction Under Section 80CCD 2 For Employer s Contribution To

Section No Section 80CCE Limit on deductions under sections 80C 80CCC and 80CCD Section 7 Income deemed to be received Section 115BAC Tax on

Frequently Asked Questions What is Section 80CCD Section 80CCD of the Income Tax Act 1961 provides deductions for contributions to the National Pension

What Is Section 80ccd 2 Of Income Tax Act have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: We can customize printing templates to your own specific requirements whether you're designing invitations to organize your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge are designed to appeal to students of all ages, making them an essential instrument for parents and teachers.

-

Easy to use: immediate access numerous designs and templates will save you time and effort.

Where to Find more What Is Section 80ccd 2 Of Income Tax Act

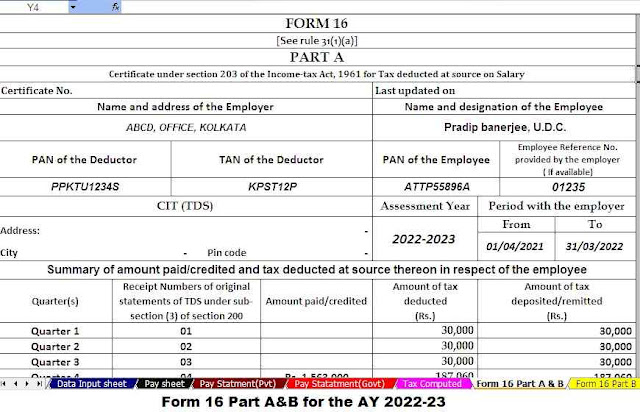

Income Tax Section 80CCD With Auto Fill Income Tax Form 16 For The F Y

Income Tax Section 80CCD With Auto Fill Income Tax Form 16 For The F Y

A No not all Section 80CCD tax benefits are included in the Section 80C annual cumulative limit of 1 5 lakh While Section 80CCD 1 tax

Section 80CCD 2 This section deals with the employer s contribution toward an employee s NPS funds Employees can claim this amount as deductions u s Section

Since we've got your interest in printables for free Let's find out where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of What Is Section 80ccd 2 Of Income Tax Act suitable for many needs.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing What Is Section 80ccd 2 Of Income Tax Act

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home and in class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is Section 80ccd 2 Of Income Tax Act are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the plethora of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Section 80ccd 2 Of Income Tax Act truly available for download?

- Yes they are! You can download and print these materials for free.

-

Does it allow me to use free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions on use. Make sure you read these terms and conditions as set out by the author.

-

How can I print What Is Section 80ccd 2 Of Income Tax Act?

- Print them at home with any printer or head to an in-store print shop to get premium prints.

-

What program do I need to run printables at no cost?

- Many printables are offered as PDF files, which can be opened with free programs like Adobe Reader.

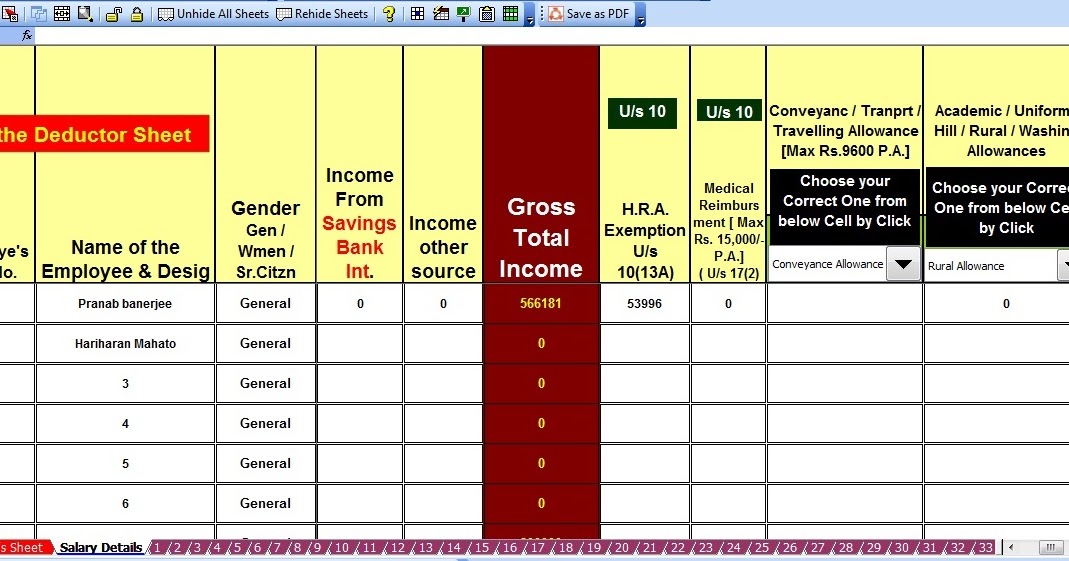

Income Tax Arrears Relief Calculator U s 89 1 With Form 10 E For The F

How To Claim Section 80CCD 1B TaxHelpdesk

Check more sample of What Is Section 80ccd 2 Of Income Tax Act below

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80C Deduction Under Section 80C In India Paisabazaar

How To Claim Section 80CCD 1B TaxHelpdesk

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deductions Under Section 80CCD Of Income Tax Act YouTube

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Section 80CCD 2 of the Income Tax Act gives employed individuals the benefit of claiming income tax deductions for contributions made by their employer It

https://www.goodreturns.in/section-80ccd-2-of-income-tax-act-s5.html

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2023 24 AY 2024 25 from Goodreturns

Section 80CCD 2 of the Income Tax Act gives employed individuals the benefit of claiming income tax deductions for contributions made by their employer It

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2023 24 AY 2024 25 from Goodreturns

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deduction Under Section 80C In India Paisabazaar

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deductions Under Section 80CCD Of Income Tax Act YouTube

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

80CCD Income Tax Deduction Under Section 80CCD 1 2

80CCD Income Tax Deduction Under Section 80CCD 1 2

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund