In this age of technology, with screens dominating our lives however, the attraction of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or just adding the personal touch to your home, printables for free have proven to be a valuable resource. The following article is a take a dive deep into the realm of "What Is The Circuit Breaker Tax Credit For Seniors," exploring the different types of printables, where to find them and how they can enrich various aspects of your lives.

Get Latest What Is The Circuit Breaker Tax Credit For Seniors Below

What Is The Circuit Breaker Tax Credit For Seniors

What Is The Circuit Breaker Tax Credit For Seniors -

To qualify for the Senior Tax Credit you must be 65 years of age or older by the end of the tax year If they are younger you must Be a retiree on permanent and total disability Have taxable disability income Not yet reached

As a person aged 65 or older you may be eligible to claim a refundable credit on your personal state income tax return The Circuit Breaker tax credit is based on the actual real estate taxes paid on the

What Is The Circuit Breaker Tax Credit For Seniors encompass a wide variety of printable, downloadable materials available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and many more. The great thing about What Is The Circuit Breaker Tax Credit For Seniors is their flexibility and accessibility.

More of What Is The Circuit Breaker Tax Credit For Seniors

Massachusetts Seniors May Be Eligible For Circuit Breaker Tax Credit

Massachusetts Seniors May Be Eligible For Circuit Breaker Tax Credit

3 What is the Senior Circuit Breaker Tax Credit 4 Who is eligible for this credit 5 What are the income limits for 2021 6 How to calculate your credits 7 Example for a Homeowner 8

MA residents who are 65 or older by Dec 31 of the tax year who meet income eligibility guidelines may be able to receive a maximum of 2 590 for the 2023 tax year

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: We can customize printed materials to meet your requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge are designed to appeal to students from all ages, making them a vital resource for educators and parents.

-

Easy to use: Quick access to numerous designs and templates helps save time and effort.

Where to Find more What Is The Circuit Breaker Tax Credit For Seniors

Circuit Breaker Tax Credit Increase Being Proposed In The Missouri

Circuit Breaker Tax Credit Increase Being Proposed In The Missouri

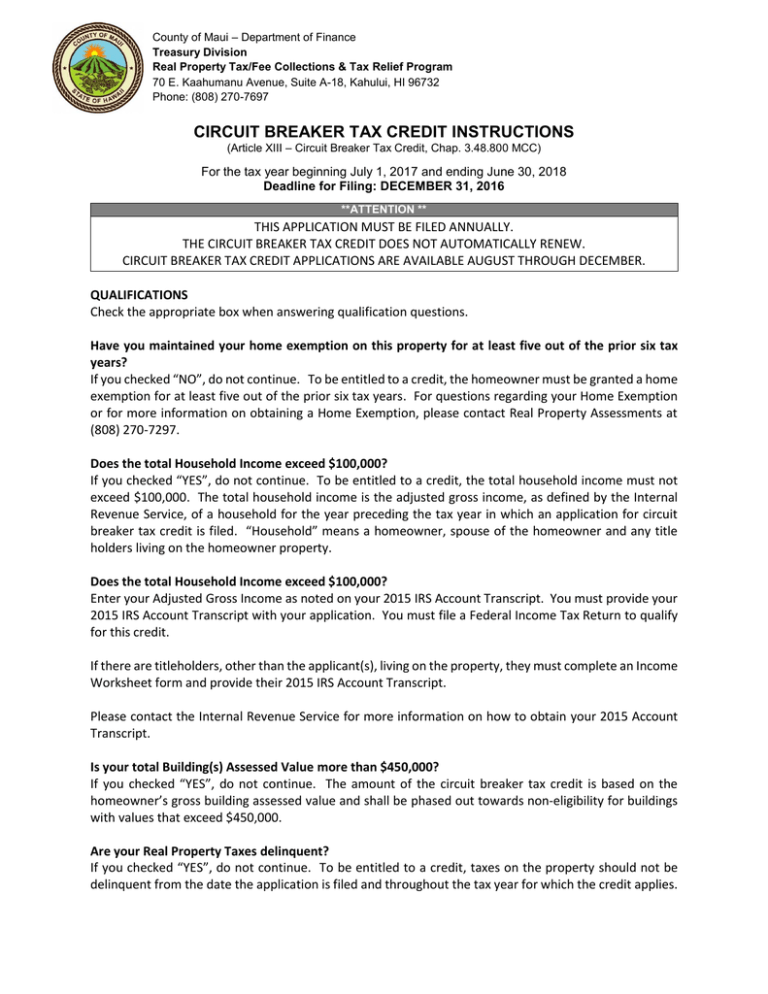

The Massachusetts Senior Circuit Breaker Tax Credit was designed by the Legislature to help provide tax relief for older adults This brochure contains information on

It is called the Circuit Breaker Tax Credit because your eligibility is triggered like an electrical circuit breaker when property tax payments exceed 10 of a senior citizen s annual

Now that we've piqued your interest in What Is The Circuit Breaker Tax Credit For Seniors We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of objectives.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing What Is The Circuit Breaker Tax Credit For Seniors

Here are some ideas of making the most use of What Is The Circuit Breaker Tax Credit For Seniors:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Is The Circuit Breaker Tax Credit For Seniors are a treasure trove filled with creative and practical information designed to meet a range of needs and needs and. Their access and versatility makes them a great addition to both professional and personal lives. Explore the vast array of What Is The Circuit Breaker Tax Credit For Seniors today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printing templates for commercial purposes?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright violations with What Is The Circuit Breaker Tax Credit For Seniors?

- Some printables may come with restrictions on use. Be sure to review the terms of service and conditions provided by the designer.

-

How do I print What Is The Circuit Breaker Tax Credit For Seniors?

- You can print them at home with printing equipment or visit a local print shop for premium prints.

-

What software do I need in order to open printables that are free?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

Spahealthy

Circuit Breaker Tax Exemption Archives California Property Tax

Check more sample of What Is The Circuit Breaker Tax Credit For Seniors below

Circuit Breaker 2020 Tax Credit For Seniors Citizens YouTube

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

Elder Affairs Kate Lipper Garabedian For State Representative

A Break For Low income Seniors In MA The Circuit Breaker Tax Credit

Tarr Talk Council On Aging Visit

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

https://lifepathma.org › stories › do-you-q…

As a person aged 65 or older you may be eligible to claim a refundable credit on your personal state income tax return The Circuit Breaker tax credit is based on the actual real estate taxes paid on the

https://eldercare.org

You must meet the following guidelines to qualify for this refundable tax credit Be 65 or older by the end of the tax year for which you are filing Have income below the

As a person aged 65 or older you may be eligible to claim a refundable credit on your personal state income tax return The Circuit Breaker tax credit is based on the actual real estate taxes paid on the

You must meet the following guidelines to qualify for this refundable tax credit Be 65 or older by the end of the tax year for which you are filing Have income below the

A Break For Low income Seniors In MA The Circuit Breaker Tax Credit

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

Tarr Talk Council On Aging Visit

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

Tax Credit For Seniors Who Volunteer YouTube

Massachusetts Circuit Breaker Tax Credit 2023

Massachusetts Circuit Breaker Tax Credit 2023

Circuit Breaker Tax Credit Instructions