In the digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or simply adding an extra personal touch to your home, printables for free have become an invaluable source. This article will take a dive deep into the realm of "What Is The Circuit Breaker Tax Credit," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your life.

Get Latest What Is The Circuit Breaker Tax Credit Below

What Is The Circuit Breaker Tax Credit

What Is The Circuit Breaker Tax Credit -

To claim the Circuit Breaker Credit you must file a Massachusetts state income tax return even if you typically don t file a return and include Schedule CB the Circuit Breaker Credit form You can file your tax return for FREE using one of our free filing options at mass gov efile

A tax circuit breaker is any property tax relief that limits or reduces taxes for certain individuals Circuit breaker programs are often specifically enacted for property owners who have disabilities or low income or those who are older

What Is The Circuit Breaker Tax Credit cover a large assortment of printable items that are available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and many more. The attraction of printables that are free is their versatility and accessibility.

More of What Is The Circuit Breaker Tax Credit

Circuit Breaker Tax Credit Increase Being Proposed In The Missouri

Circuit Breaker Tax Credit Increase Being Proposed In The Missouri

3 What is the Senior Circuit Breaker Tax Credit 4 Who is eligible for this credit 5 What are the income limits for 2021 6 How to calculate your credits 7 Example for a Homeowner 8 Example for a Renter 9 How do you apply 10 How do I apply for previous years 11 To Get the Proper Forms 12 Course Credit Next Steps

MA residents who are 65 or older by Dec 31 of the tax year who meet income eligibility guidelines may be able to receive a maximum of 2 590 for the 2023 tax year through this state level program Both homeowners and renters who are MA residents may apply

What Is The Circuit Breaker Tax Credit have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization They can make designs to suit your personal needs such as designing invitations or arranging your schedule or even decorating your home.

-

Educational Value Printing educational materials for no cost cater to learners of all ages, which makes the perfect device for teachers and parents.

-

Convenience: Access to a variety of designs and templates is time-saving and saves effort.

Where to Find more What Is The Circuit Breaker Tax Credit

In The Know Senior Circuit Breaker Tax Credit YouTube

In The Know Senior Circuit Breaker Tax Credit YouTube

The Massachusetts Senior Circuit Breaker Tax Credit was designed by the Legislature to help provide tax relief for older adults This brochure contains information on the Circuit Breaker Tax Credit including eligibility requirements

The Massachusetts Circuit Breaker tax credit program is a program for adults age 65 whose property taxes and half of the water and sewer bills are more than 10 of their annual gross income or for renters if their rent is greater than 25 of their income and who meet a

We hope we've stimulated your interest in What Is The Circuit Breaker Tax Credit Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of applications.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning tools.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad range of topics, all the way from DIY projects to party planning.

Maximizing What Is The Circuit Breaker Tax Credit

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

What Is The Circuit Breaker Tax Credit are an abundance of practical and imaginative resources that cater to various needs and pursuits. Their access and versatility makes them a wonderful addition to each day life. Explore the vast world of What Is The Circuit Breaker Tax Credit right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes, they are! You can download and print these files for free.

-

Are there any free printouts for commercial usage?

- It's based on the usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in use. You should read the conditions and terms of use provided by the designer.

-

How can I print What Is The Circuit Breaker Tax Credit?

- You can print them at home using any printer or head to the local print shop for more high-quality prints.

-

What program do I require to open printables free of charge?

- The majority of PDF documents are provided in the PDF format, and can be opened using free programs like Adobe Reader.

Massachusetts Seniors May Be Eligible For Circuit Breaker Tax Credit

Square D Homeline 2 20 Amp Single Pole Tandem Circuit Breaker

Check more sample of What Is The Circuit Breaker Tax Credit below

Are You Eligible For The 65 Circuit Breaker Tax Credit Somerville

All About The Circuit Breaker Income Tax Credit For Massachusetts

Circuit Breaker Tax Exemption Archives California Property Tax

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

Elder Affairs Kate Lipper Garabedian For State Representative

A Break For Low income Seniors In MA The Circuit Breaker Tax Credit

https://www.thebalancemoney.com/what-is-a-property...

A tax circuit breaker is any property tax relief that limits or reduces taxes for certain individuals Circuit breaker programs are often specifically enacted for property owners who have disabilities or low income or those who are older

https://www.mass.gov/technical-information-release...

A Massachusetts taxpayer age 65 or older who owns his or her principal residence is eligible for the circuit breaker credit if the following conditions are met 1 The taxpayer must own residential property in Massachusetts and occupy the property as his or her principal residence

A tax circuit breaker is any property tax relief that limits or reduces taxes for certain individuals Circuit breaker programs are often specifically enacted for property owners who have disabilities or low income or those who are older

A Massachusetts taxpayer age 65 or older who owns his or her principal residence is eligible for the circuit breaker credit if the following conditions are met 1 The taxpayer must own residential property in Massachusetts and occupy the property as his or her principal residence

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

All About The Circuit Breaker Income Tax Credit For Massachusetts

Elder Affairs Kate Lipper Garabedian For State Representative

A Break For Low income Seniors In MA The Circuit Breaker Tax Credit

Tarr Talk Council On Aging Visit

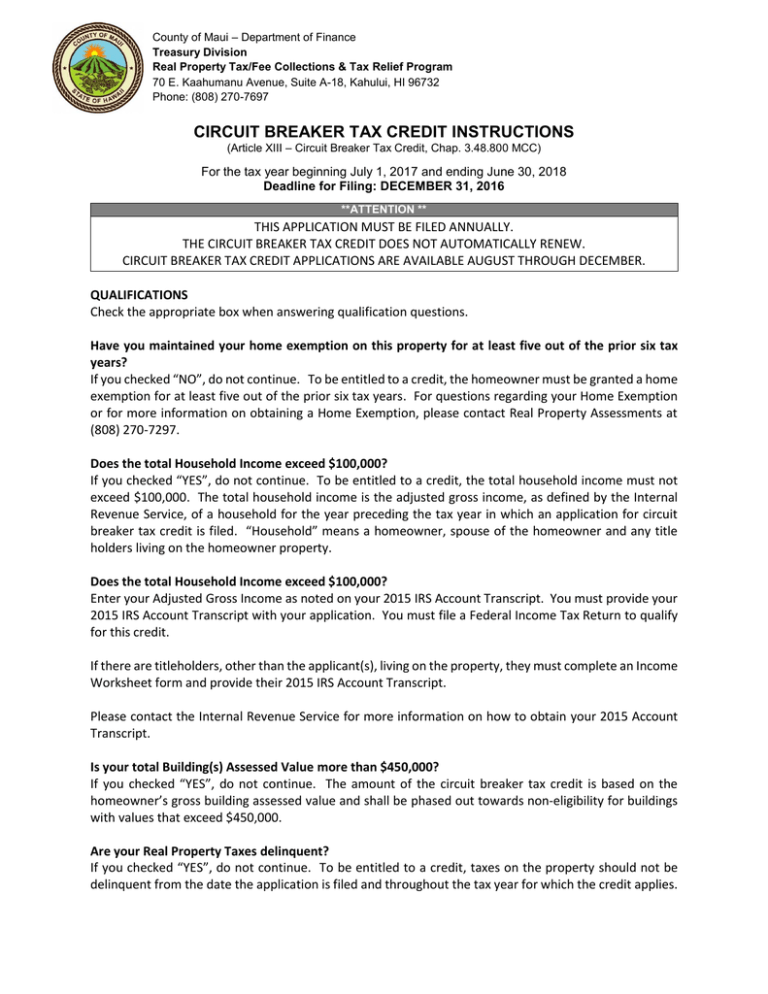

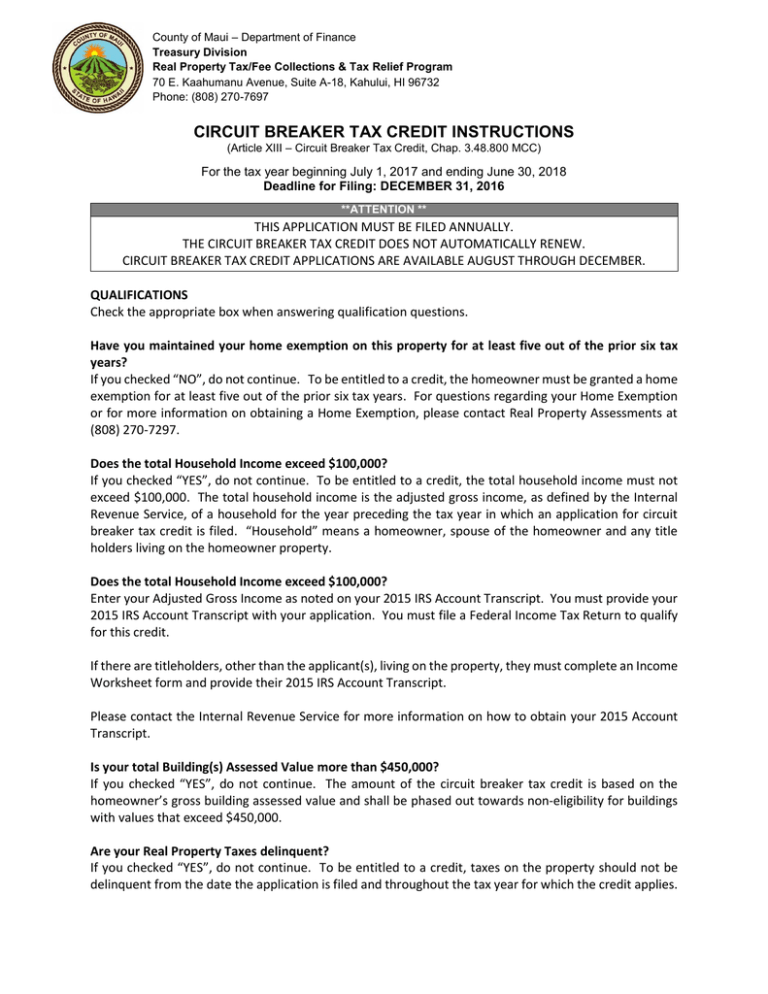

Circuit Breaker Tax Credit Instructions

Circuit Breaker Tax Credit Instructions

Massachusetts Circuit Breaker Tax Credit 2023