In a world where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or just adding an element of personalization to your space, What Is The Investment Tax Credit For Renewable Energy are now a vital source. Here, we'll take a dive into the sphere of "What Is The Investment Tax Credit For Renewable Energy," exploring what they are, how to find them, and how they can enrich various aspects of your daily life.

Get Latest What Is The Investment Tax Credit For Renewable Energy Below

What Is The Investment Tax Credit For Renewable Energy

What Is The Investment Tax Credit For Renewable Energy -

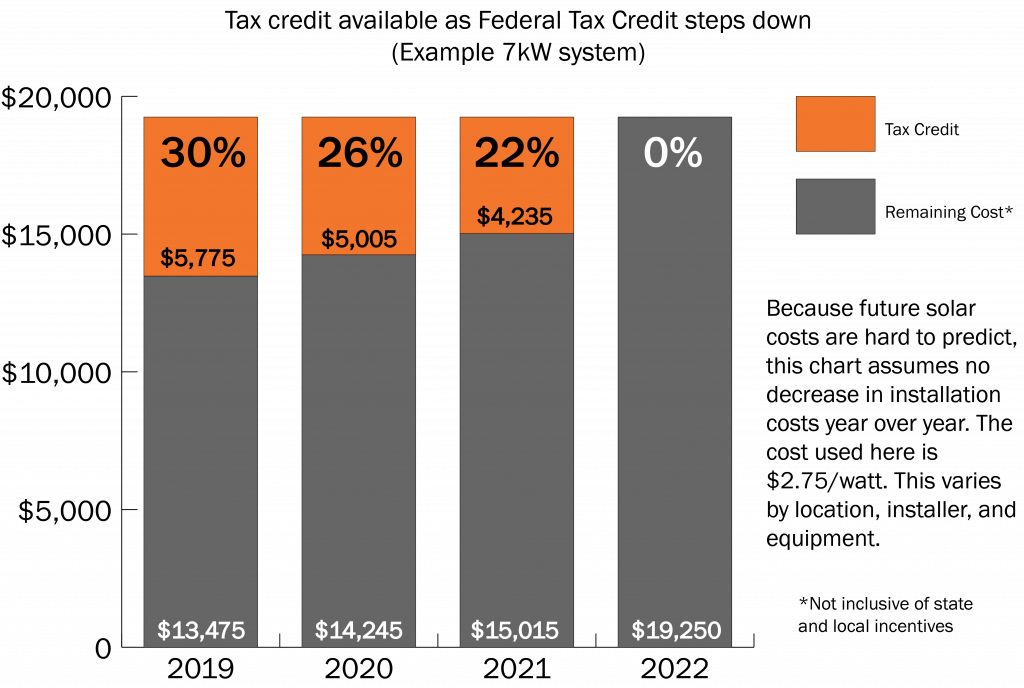

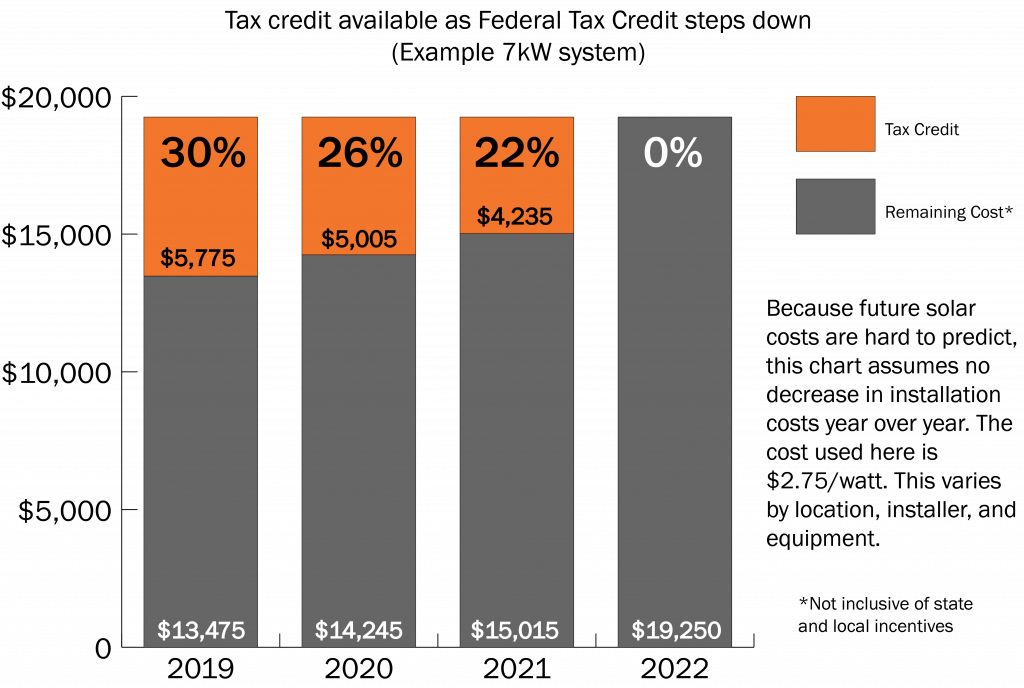

The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1

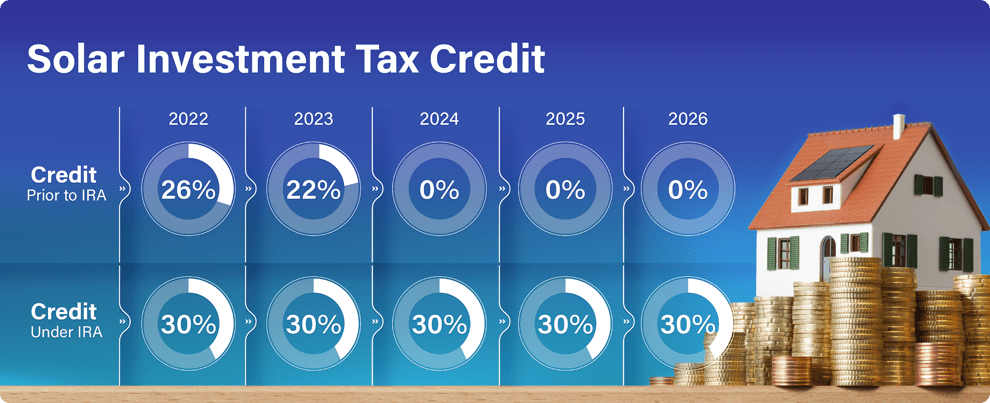

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already

What Is The Investment Tax Credit For Renewable Energy cover a large range of downloadable, printable material that is available online at no cost. These printables come in different types, like worksheets, templates, coloring pages and much more. The appealingness of What Is The Investment Tax Credit For Renewable Energy is in their versatility and accessibility.

More of What Is The Investment Tax Credit For Renewable Energy

Tax Credit For Renewable Energy Yes The Abundant Energy

Tax Credit For Renewable Energy Yes The Abundant Energy

Investment Tax Credit ITC The ITC is a dollar for dollar credit for expenses invested in renewable energy properties most often solar developments

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize designs to suit your personal needs when it comes to designing invitations to organize your schedule or decorating your home.

-

Educational Value These What Is The Investment Tax Credit For Renewable Energy offer a wide range of educational content for learners of all ages, making them a useful instrument for parents and teachers.

-

The convenience of Fast access a plethora of designs and templates helps save time and effort.

Where to Find more What Is The Investment Tax Credit For Renewable Energy

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

When the Inflation Reduction Act IRA of 2022 was passed one of the cornerstones of the 369 billion set aside for climate and energy spending is the

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind

Since we've got your interest in printables for free We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of What Is The Investment Tax Credit For Renewable Energy designed for a variety reasons.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing What Is The Investment Tax Credit For Renewable Energy

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is The Investment Tax Credit For Renewable Energy are an abundance filled with creative and practical information for a variety of needs and interest. Their accessibility and versatility make these printables a useful addition to each day life. Explore the vast array of What Is The Investment Tax Credit For Renewable Energy today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may come with restrictions in use. Make sure to read the terms and condition of use as provided by the author.

-

How can I print printables for free?

- Print them at home using any printer or head to any local print store for superior prints.

-

What software do I need to run printables free of charge?

- A majority of printed materials are in the format of PDF, which can be opened with free software, such as Adobe Reader.

Extension Of Solar Investment Tax Credit What Does Mean For Homeowners

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Check more sample of What Is The Investment Tax Credit For Renewable Energy below

Summary Of Inflation Reduction Act Changes To Production Tax Credit And

The Investment Tax Credit For Solar Energy SUNSOLAR

An Explanation Of The Investment Tax Credit ITC And The Role Of CHP

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

Renewable Electricity Production Inflation Factors KPMG United States

IRS Form 3468 Guide To Claiming The Investment Tax Credit

https://www.energy.gov/eere/solar/articl…

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already

https://home.treasury.gov/news/press-releases/jy1920

Press Releases U S Department of the Treasury IRS Propose New Rules to Drive Clean Energy Investments November 17 2023 Guidance to clarify underlying

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already

Press Releases U S Department of the Treasury IRS Propose New Rules to Drive Clean Energy Investments November 17 2023 Guidance to clarify underlying

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

The Investment Tax Credit For Solar Energy SUNSOLAR

Renewable Electricity Production Inflation Factors KPMG United States

IRS Form 3468 Guide To Claiming The Investment Tax Credit

The Federal Solar Tax Credit Extension Can We Win If We Lose

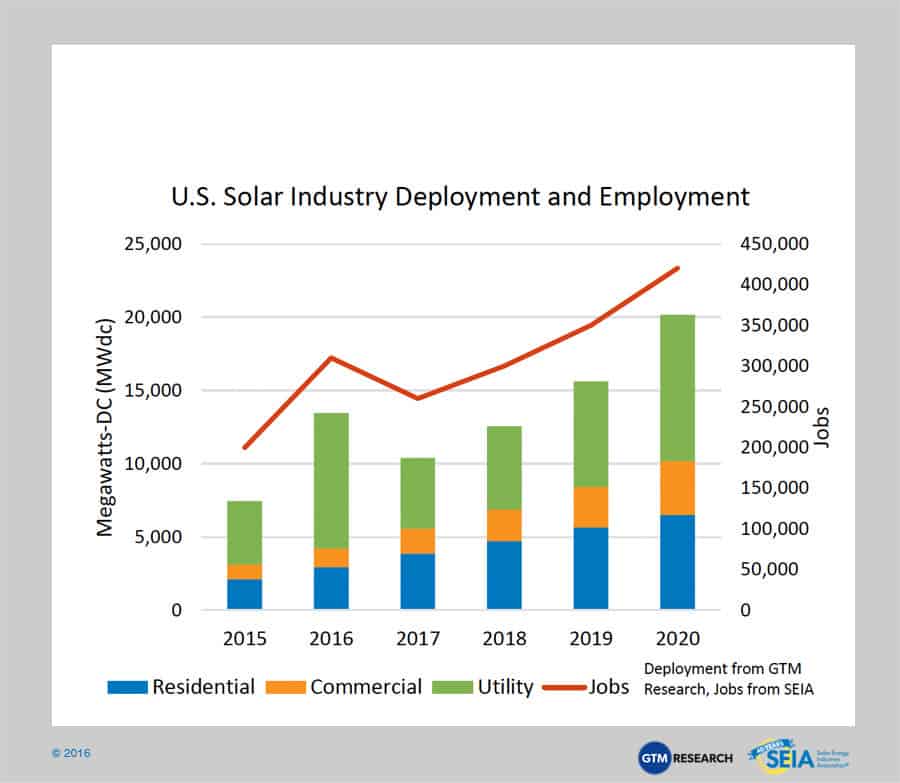

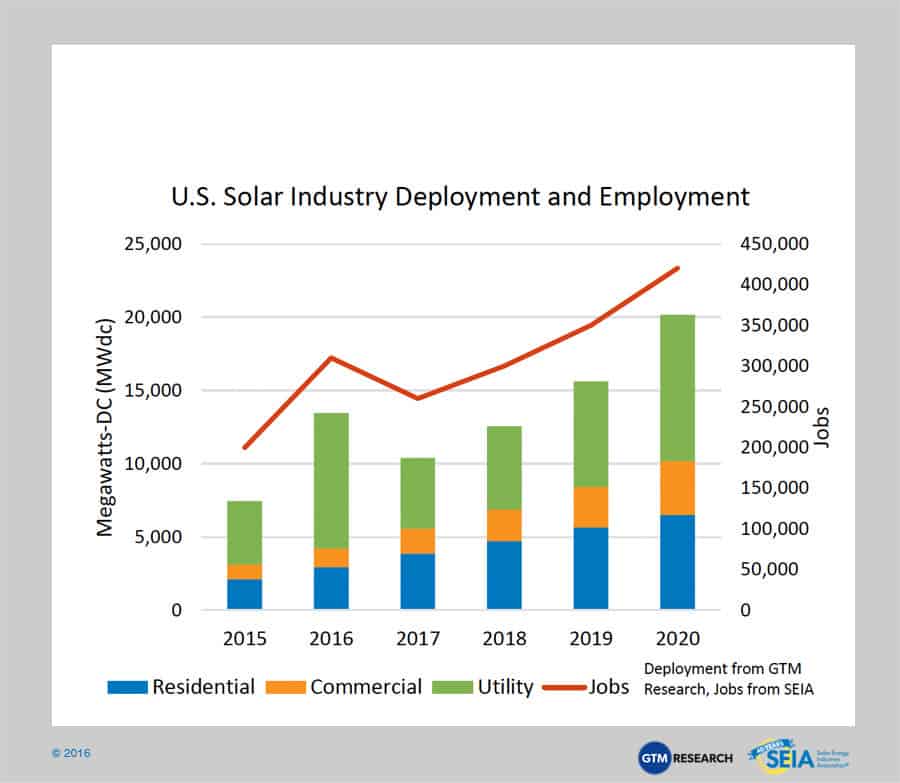

Impacts Of Solar Investment Tax Credit Extension SEIA

Impacts Of Solar Investment Tax Credit Extension SEIA

Clean Energy Tax Credit Resources Positive Change Purchasing Cooperative